Bitcoin nears key weekly close as analyst says 20% BTC price dip 'over'

Bitcoin may be clear to attack resistance higher up, but the odds of sweeping recent lows later on remain convincing among BTC price pundits.

Bitcoin (BTC) held near $42,000 on Jan. 27 as late-week BTC price gains made traders confident about fresh upside.

Bitcoin seen rechallenging $48,000

Data from Cointelegraph Markets Pro and TradingView showed classic cool weekend price action entering, with $41,800 as a focus.

The day prior saw 5% upside, with Cointelegraph reporting on improving market conditions relative to past weeks.

The same topics were on the radar — outflows from exchange-traded funds (ETFs), sell pressure from defunct exchanges FTX and Mt. Gox and the incoming block subsidy halving.

In his latest YouTube update, Michaël van de Poppe, founder and CEO of MN Trading, nonetheless told viewers that he believed the current BTC price correction to be over.

Between now and April’s halving, he foresaw a trip to long-term range highs, but did not discount the possibility of taking liquidity in the mid to low-$30,000 zone.

“Perhaps we’re going to have one more run to $48,000 prior to it, then a final correction,” he summarized.

Van de Poppe argued that the negative influence of FTX, Mt. Gox and GBTC maneuvers would become less noticeable in time.

“Bitcoin is likely consolidating from here, between $37-48K for the coming months,” he added in a subsequent post on X (formerly Twitter).

“In this period, Altcoins will have their time. The real impact on the ETF is going to come in the next few years, resulting into a price of Bitcoin going to $300,000-500,000.”

As Cointelegraph noted, not everyone believes that Bitcoin is out of the woods — some continue to see a return to $30,000 or even lower in the coming months.

$41,300 becomes crunch BTC price reclaim level

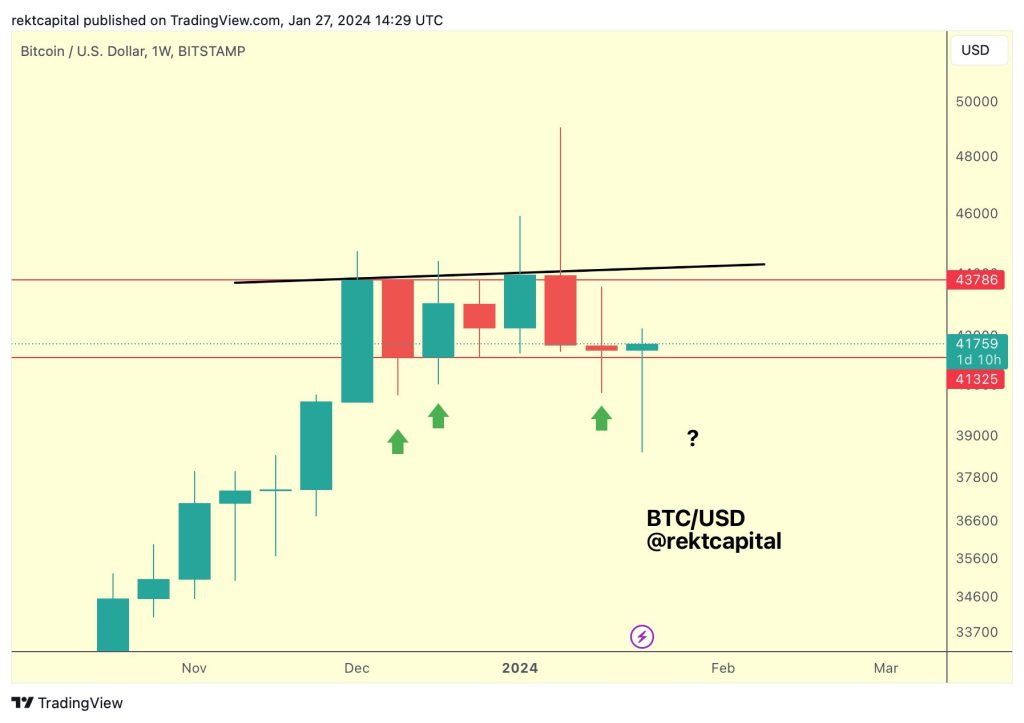

Continuing on shorter timeframes, popular trader and analyst Rekt Capital drew attention to the significance of the upcoming weekly close.

Related: 3 reasons why Bitcoin hitting $38.5K marked the ‘ETF dip’

#BTC

BTC has performed a Daily Candle Close above the Range Low

If $BTC is able to successfully retest the Range Low as support over this weekend…

It would enable a Weekly Close that would confirm a return to this range BTC lost earlier this week#Crypto #Bitcoin https://t.co/3kWyjop7l5 pic.twitter.com/T8vSMBbYa0

— Rekt Capital (@rektcapital) January 27, 2024

“Great reaction from Bitcoin this week as it slowly positions itself to reclaim the range it had lost earlier this week,” he continued.

“Weekly Close above the Range Low of ~$41300 could be enough to rescue the range.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] There you will find 95650 additional Information on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Here you can find 35037 more Information to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] There you can find 2566 more Information on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] There you will find 93297 more Info to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] There you will find 37592 additional Info to that Topic: x.superex.com/news/bitcoin/3765/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3765/ […]