BNB bull flag and blockchain DApp activity hint at price recovery

BNB eyes new year-to-date highs as BNB Chain DApp activity increases and a new Binance incentive program launches.

BNB (BNB), the native token of BNB Chain, began a recovery on Jan. 26, rising by 3% to reclaim the $300 level. Although BNB remains weak, the ongoing recovery is backed by increasing network activity.

New Binance launchpad product and a surge in DApp activity

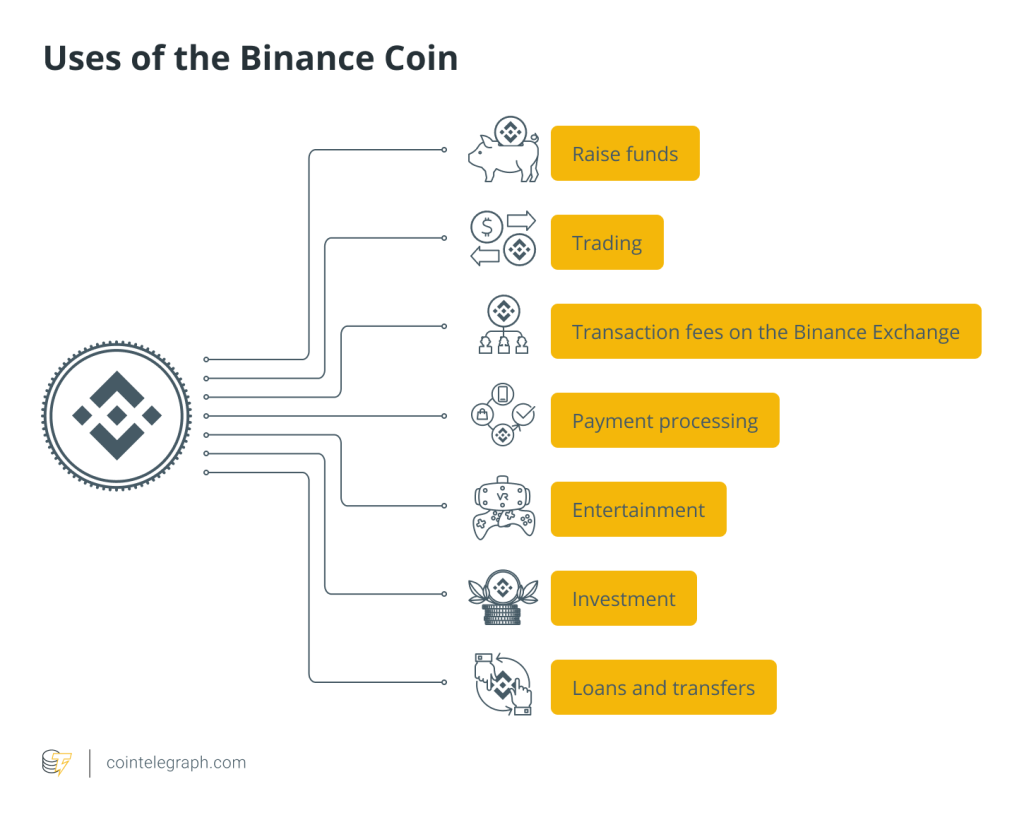

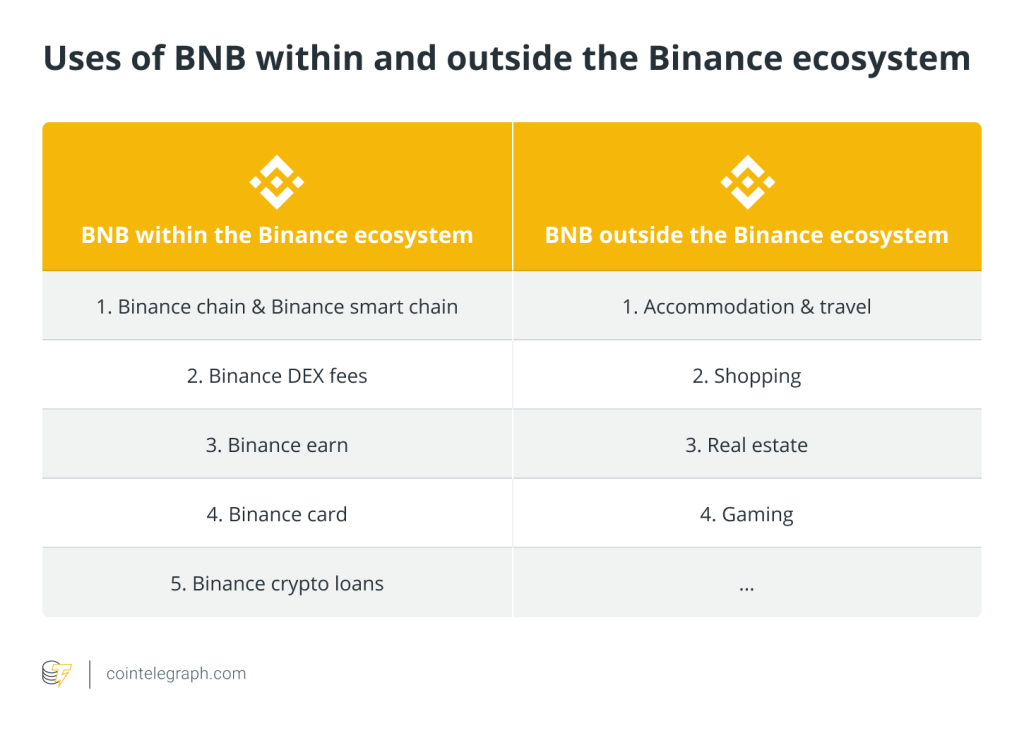

A significant portion of the BNB token’s value comes from reduced trading fees and exclusive launchpad offers and services from Binance.

A recently launched “dual investment” product from Binance could add to BNB’s volumes, which have exceeded $998 million over the last 24 hours.

One way to determine the health of a blockchain ecosystem is to compare how the network performs against competing chains.

Notice that Ethereum and its layer-2 scaling solutions remain unchallenged in terms of DApp volumes, accumulating over $31.73 billion in the past seven days, with Ethereum’s nonfungible token (NFT) volume at $226 million. In contrast, BNB Chain amassed $3.82 billion in DApp volumes, but its NFT volume surged 11% over the same period to $864.93 million.

However, when accounting for active unique addresses (UAW), BNB Chain leads the way, with 2 million UAWs against Ethereum’s 359,380.

Related: Price analysis 1/24: BTC, ETH, BNB, SOL, XRP, ADA, AVAX, DOGE, DOT, LINK

From a relative standpoint, BNB Chain’s 6.4% growth in the number of addresses engaging with DApps in seven days and the growing transaction volume could explain the increasing total value locked (TVL).

Data from DefiLlama shows that BNB Chain’s TVL increased steadily from mid-December 2023, when the price began rising to reach a peak of $3.73 billion on Jan. 18. Although this metric fell slightly over the last few days, it began picking up again on Jan. 25, suggesting increasing user trust in the blockchain.

Is BNB’s bull flag a sign of things to come?

After reaching an eight-month high of $340 on Dec. 28, 2023, BNB price pulled back as sellers booked profits and the wider crypto market corrected.

Despite the correction, a bull flag can be seen on the daily chart, which hints at the continuation of the uptrend.

BNB bulls face resistance from the flag’s upper boundary at $316. A daily candlestick close above this level would signal a possible breakout from the chart formation, projecting an uptick to $450. Such a move would represent a 48% ascent from the current price.

The 50-day exponential moving average (EMA), 100-day EMA, 200-day EMA and the relative strength index (RSI) were all facing upward, suggesting that the market conditions still favored the upside. The increase in price strength from 40 to 50 indicated that the bulls were buying on the dips.

On the other hand, the bears may pull the price lower with the flag’s lower limit at $282, providing the first line of defense. Additional support lines could emerge from the 100-day EMA at $271 and the major support level at $250.

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] There you will find 53540 more Info on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] There you will find 31899 more Information on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] There you can find 22297 additional Info on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] There you can find 23956 additional Info on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Here you can find 77056 additional Info on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Here you will find 42454 more Information to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] There you will find 55615 more Information on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] There you can find 55753 more Information to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Here you will find 89705 more Information on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Here you can find 88454 more Info on that Topic: x.superex.com/academys/markets/3707/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/3707/ […]