How to buy Dogecoin? A beginners guide to investing in DOGE

With thousands of coins available, it can be difficult for those interested in buying cryptocurrencies to know what they are looking at. This is especially true when you go outside the big names such as Bitcoin (BTC) and Ether (ETH).

Dogecoin (DOGE), meanwhile, has become somewhat of a darling in the cryptocurrency community. Due to a rally that took place in 2021, it entered the top 10 cryptocurrencies by market capitalization. Many saw the price surge in 2021 and became interested in buying Dogecoin.

So, where and how can you buy Dogecoin? Below is a guide to what is DOGE and tips on how to buy it.

What is Dogecoin?

Dogecoin is one of the many cryptocurrencies currently available. Like many cryptocurrencies, it is peer-to-peer and open-source. The coin is also recognizable for its Shiba Inu logo.

Back in 2013, Jackson Palmer, an Adobe product manager from Sydney, Australia, came up with the idea of Dogecoin. It was a bit of a tongue-in-cheek joke about all of the hype that new cryptocurrencies were seeing. Palmer started tweeting about Dogecoin and, to his surprise, got positive feedback. Billy Markus, a developer at IBM, thought Dogecoin was a fun idea. Markus contacted Palmer to see if he could build the software to support the coin. With that, the two came together to found Dogecoin.

Dogecoin was launched in December 2013. With the hype created before the coin even existed, it gained a community rather quickly. Much of its attraction was the loose and laidback concept of a coin based on a popular internet meme. Most notably, it gained a large and passionate following on Reddit.

The Dogecoin community is known to be rather unique in the world of cryptocurrency. As is commonly true in the world of internet culture, things that start for fun or as a joke commonly develop devoted communities. Moreover, the Dogecoin crowd is known for coming together for organized action, for example, supporting individual athletes and sports teams.

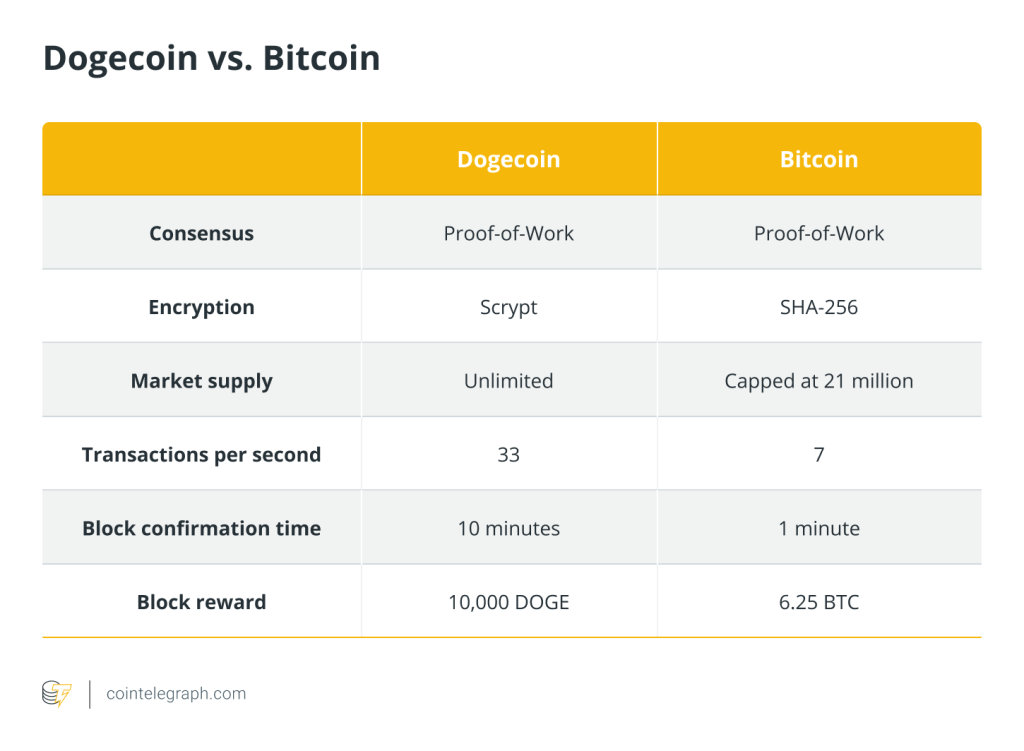

Aside from that, Dogecoin is a cryptocurrency much like many others. It’s a coin mined through a proof-of-work (PoW) consensus algorithm, and miners receive it as a reward for solving blocks. It uses blockchain technology, however, unlike Bitcoin, there is no cap on the amount of Dogecoin that can be mined. That makes it an inflationary coin instead of a deflationary coin like Bitcoin.

Overall, Dogecoin can be seen as a viable investment; however, those looking to buy DOGE as an investment should be aware of its incredibly volatile nature and the fact that the coin has very few use cases. Do your own research about Dogecoin and how to trade cryptocurrencies. Only buy and trade Dogecoin at your own risk.

How do I buy Dogecoin?

When it comes to buying Dogecoin, the process is simple. If you already have experience buying cryptocurrencies, buying Dogecoin will be similar. Despite being present on most of the biggest cryptocurrency exchanges, it’s not as widely available as some of the more established coins, and you might need to find a new exchange or a new wallet to accommodate Dogecoin.

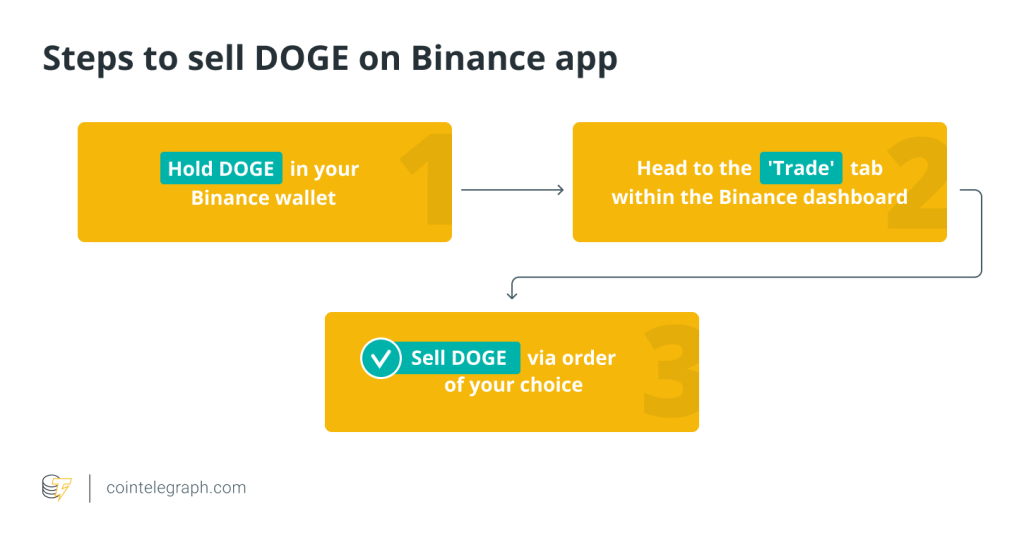

If you are looking to buy Dogecoin, you need to cover the following basics:

-

Find a wallet that supports Dogecoin.

-

Find an exchange that trades Dogecoin.

-

Complete your first Dogecoin transaction and transfer the coins to your wallet.

Finding a Dogecoin wallet

You need to find a wallet before buying Dogecoin. If you already trade cryptocurrencies, your current wallet might be suitable. But if you are new to cryptocurrency or your existing wallet does not support Dogecoin, you will need to find a crypto wallet to make the transactions.

A crypto wallet can be a software program or it can be a piece of hardware. You can even create paper wallets for storing and protecting your cryptocurrency. Regardless of the type of wallet you choose, the purpose is to store your private keys and facilitate transactions.

If you are looking for the basics of different types of cryptocurrency wallets, software wallets tend to be more convenient and are usually free. On the other hand, hardware wallets are seen as more secure, but they require an upfront purchase, and they are less convenient for people who engage in a lot of transactions.

There are a lot of wallets for people looking to buy Dogecoin as there are both software wallets and hardware wallets that support DOGE. However, it is important to note that different wallets may offer different features and levels of security. Whether you are going with a software wallet or a hardware wallet, you should do your research to make sure you are using a crypto wallet that is secure but that also offers the features you need.

How to choose an exchange to buy Dogecoin

Dogecoin might be growing in popularity, but it is still only available on a limited number of exchanges. If you are planning to invest in Dogecoin, you will need to find an exchange that offers the coin for trade and is legally operating within the jurisdiction where you reside.

While there are a number of exchanges that may offer Dogecoin for trading, finding the right one may take time. You do not want to simply go with the first Dogecoin exchange you find. Take the time to evaluate your needs and investigate exchanges to find the one that works best for you.

Make a list

The first step is to make a list of exchanges that offer Dogecoin. You can do this by searching for exchanges and seeing if they have the coin for trading.

Once you have a list of Dogecoin exchanges, you then need to make sure they offer trading in your country, and if they do, make sure they are offering those services legally. There is no point in opening an account with an exchange that does not operate in your country, and you do not want to get caught using an exchange that does not have the proper licensing or certifications.

KYC and AML

Exchanges comply with different regulations depending on where they are located and the types of services they offer. Many exchanges will have requirements for Know Your Customer (KYC) or Anti-Money Laundering (AML) practices.

One of the more noticeable requirements of these laws is that account holders will need to verify their identities. This could include sending the exchange a picture of a government ID and providing things such as billing statements to prove your address.

Many crypto traders find these requirements to be a hassle, but they can be to the benefit of the consumer. If an exchange complies with these regulations, it can be a sign that it is reputable. Furthermore, these regulations might make it easier for law enforcement to catch perpetrators and recover the missing funds.

Reputation

Regardless of the cryptocurrency you plan to trade, you need to be careful when it comes to the exchanges you choose to use. Fake exchanges and scams are a perennial problem. Beyond that, there have been issues with exchanges being hacked or engaging in less-than-ethical behavior.

Before opening an account with any exchange, you should search the name of the exchange to see if there are any news stories about past issues. You should also check their website to see what they say about themselves and research their social media presence to see what other people might be saying about the exchange. You could also look for user reviews to get an idea of how the site operates and how it treats the people who use the platform.

You should also try to get a little information on what is behind the exchange. Look to see if you can find an address on record. Try to find information about the people who own and run the exchange. If you can’t identify people like the CEO or chief operating officer, that should be a reason to be wary. If you can find their names but no reliable information about them, that is another cause for concern.

Fees and prices

Most trading platforms charge fees for trading activity. Prices of different coins can vary from one exchange to the next, but most fees will be based on a percentage of each trade. It is also common for exchanges to offer lower fees for traders who have more volume. Therefore, research the fees of each platform to find which one offers the best rates.

Beyond fees, pricing can be an issue, as they can differ from one exchange to another. This phenomenon is called a price premium. It is worth looking for the exchange with the best DOGE prices. Prices will vary across different exchanges, but they should all be close. Traders should be careful of any exchange that is selling coins at prices well below the market value.

Trading volume

The number of users may vary across different exchanges. The activity in different coins can also vary from one exchange to the next. This is important for a trader because the trading volume can have a direct impact on your ability to enter and exit different trades at the required times. High trading volumes can also be another indicator of an exchange that has a good reputation.

If you are looking to trade Dogecoin, the volume and liquidity of the exchange is an important metric to take into account. It is worth checking the figures published by the exchange and any third-party sites that track volume data.

Should you store your Dogecoin on an exchange?

One feature of many cryptocurrency exchanges is that users can store their coins in the account they have on the exchange. This is convenient for traders who engage in a lot of transactions, but it is not the most secure option for storing your Dogecoin.

The problem with leaving coins in your account is that the exchange could have a security breach, or you could also compromise your own account. If this occurs, all of your coins could be stolen. Once the coins leave an account, it is next to impossible to recover stolen cryptocurrency.

For this reason, it is recommended to withdraw most of your Dogecoin after making a purchase. Online wallets offer some safety, but they may be exploited as well. But storing coins in a hardware wallet will be the safest way. However, with the hardware wallet, the custody of the DOGE you bought now lies solely on the owner, so one would need to do their research to find out how to operate such a device, as mistakes could lead to a loss of funds.

Should I invest in Dogecoin?

There is no simple yes or no answer to this question. Investing in Dogecoin will be right for some people, but it might not be a good idea for others. As is true with any form of investing, there is a risk. Cryptocurrency prices can experience significant swings in very short periods. If you have been paying attention to market news, you will have heard of people who became millionaires in a matter of days and others who lost significant sums of money just as fast.

Overall, Dogecoin could be seen as an investment because it has been around for a while; it has a devoted community; and the price has increased over the long term. With that said, you have to be able to withstand the price drops that occur from time to time. If you want to make money investing in Dogecoin, you need to be prepared for the risks and be ready to see the price go up and down in ways that might be hard to stomach.

Ultimately, do your own research to find the right wallet for your purposes and check out different exchanges to find one that meets your needs.

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] There you will find 45606 additional Info on that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] There you will find 47926 additional Info to that Topic: x.superex.com/academys/beginner/3635/ […]

… [Trackback]

[…] There you will find 14587 additional Information on that Topic: x.superex.com/academys/beginner/3635/ […]