What is Pepecoin (PEPE)? The trending new memecoin

Pepecoin, explained

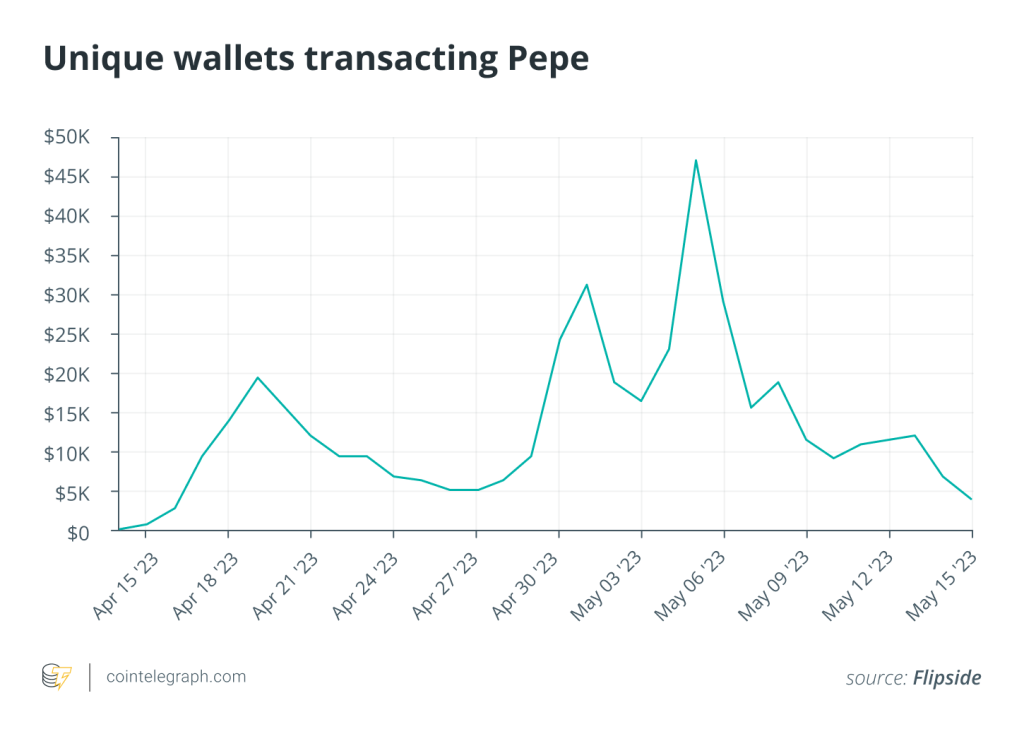

The crypto world is full of surprises. The rise and fall of new trends and seasons keeps its users and followers on their toes. The memecoin season began with the rise of Pepecoin (PEPE), an ERC-20 token, in late April 2023. After hitting a massive $1.5 billion in market capitalization, Pepecoin has suffered from profit taking by investors.

Memecoins are born from meme themes, and Pepecoin is no different. Pepecoin was inspired by the “Pepe the Frog” meme created by Matt Furie in his cartoon “Boy’s Club.” The price action of Pepecoin in the initial days was driven by frog-themed memes that the founding team and its followers used on social media.

Pepecoin is one instance of how cryptocurrency communities can rally behind a culture and not really look at the fundamental economics of an asset. The predecessors of Pepecoin are the dog-themed memecoins Dogecoin (DOGE) and Shiba Inu (SHIB).

Dogecoin rose to popularity through billionaire Elon Musk’s support and enjoys a $10 billion market capitalization, and Shiba Inu’s market capitalization is above $5 billion. In comparison, Pepecoin is still around a modest $700 million market cap, less than half its $1.5 billion top in May 2023.

How do memecoins create and retain value

Pepecoin’s increase in popularity within a few weeks is an interesting case study to understand how memecoins create and retain value. The team behind the memecoin stuck to the meme culture on social media, helping those who loved the culture “ape” into it. That said, active community members also helped to raise awareness and increase interest in the memecoin, which drew in new users and investors. However, beyond the cultural aspects, memecoins lack a fundamental reason to retain value.

Very much like Dogecoin and Shiba Inu, Pepecoin lacks an ecosystem with a commercial use case. An ecosystem with fundamentals would have a strong developer community, a number of applications for users to interact with and a few uses for institutional investors to participate in.

Despite the lack of these fundamental use cases, Dogecoin has still maintained a market cap of several billion dollars, dominating more mainstream cryptocurrencies like Solana (SOL) and Polygon (MATIC).

Following the rise of Pepecoin, there were several other memecoins that rose and subsequently fell. On the Ethereum blockchain, Turbo and Wojak were quick followers, whereas on the Solana blockchain, Guacamole (GUAC) and King rose to popularity. Turbo tapped into the theme of memecoins with an artificial intelligence (AI) overlay.

Turbo was founded by Rhett Mankind, who used GPT-4 to create the memecoin. Within a few days, the memecoin hit a market capitalization of over $80 million before settling around $50 million after profit taking took over. The AI-created meme “vibed” with many investors who had seen or profited from the Pepecoin run.

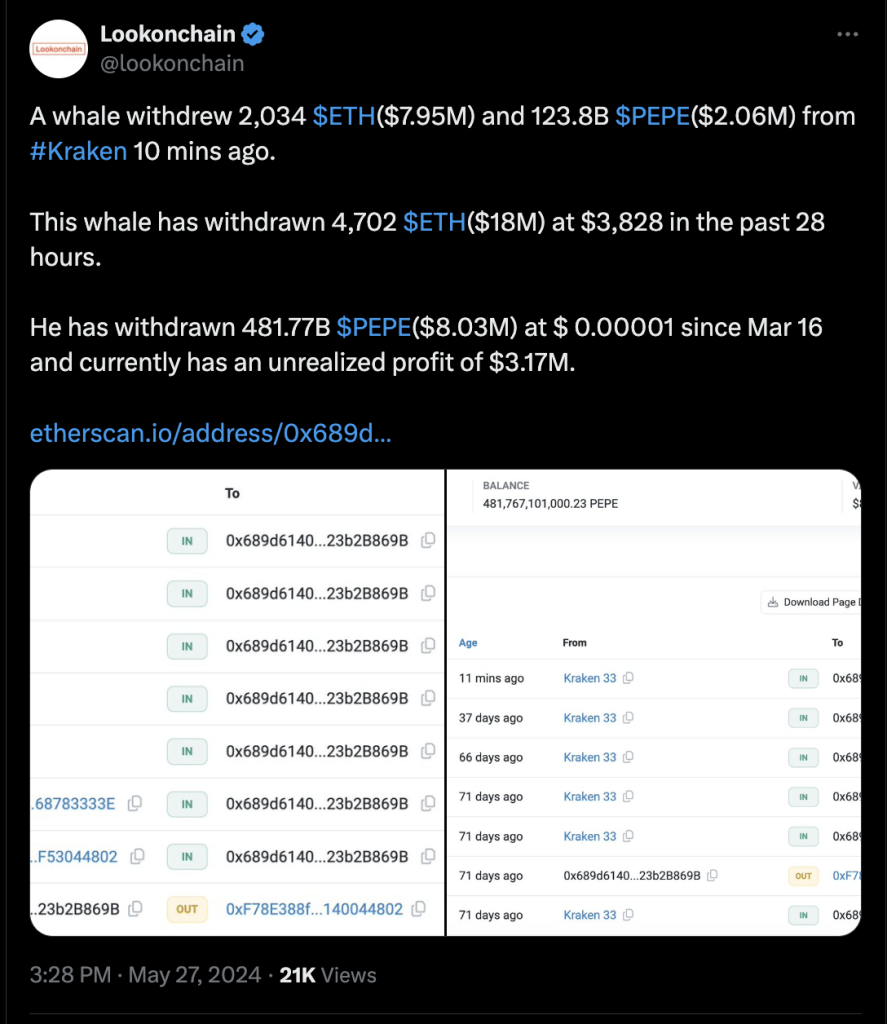

Several whales and investors who had made millions from a few thousand dollars in Pepecoin participated in Turbo, driving the increase in holders from just 56 wallets to over 4,000 wallets in under a day. Such rise in interest triggered alerts through on-chain activity that led to further investments into the memecoin.

Therefore, memecoins are an extreme category in crypto that largely runs on a culture-based speculative tribe. The culture excites an investor community that is not too shy to speculate. However, whether these memecoins will continue to hold value is yet to be seen. Going by the Doge and Shiba history, memecoins may become a major category of coins within cryptocurrencies.

Are memecoins sound investment instruments?

If history has taught investors something about cryptocurrencies and Web3, it is to keep an open mind and let the market decide. Investors have seen new subsectors within cryptocurrency and Web3 that have attracted several billions of dollars through cultural groups coming together. That behavior cannot be discounted when assessing memecoins.

For those who got into cryptocurrencies in the first half of the previous decade, even Bitcoin felt like a memecoin. For most retail audiences who do not understand the fundamentals of crypto assets, the entire asset class may look and feel like memecoins.

Yet, the crypto industry has a total market capitalization of over $1.1 trillion and is consolidating before the next Bitcoin halving. Investors in memecoins understand that the coins lack the fundamentals of a layer-1 protocol like Ethereum or Solana. These protocols have thousands of developers building hundreds of applications that can be used in a day-to-day context.

These L1s derive their value from the demand for their cryptocurrencies by developers, creators and users. They have several subsectors of applications — like decentralized finance, nonfungible tokens (NFTs), decentralized physical infrastructure, GameFi and so on — to drive demand for their coins. Therefore, even large institutions are open to investing in them.

Memecoins lack that utility narrative. Crypto Twitter has gotten excited several times by inferring that Elon Musk might have plans for Doge as a method of value exchange on the platform. However, any potential plans have yet to materialize. Therefore, as it stands, memecoins rely on meme culture rather than real-world utility.

Nonetheless, the influence of culture should not be underestimated. The NFT asset class in Web3 has shown that culture could bring communities together and help drive huge sums of capital toward it. Memecoins might just be a fungible and a more liquid equivalent of NFTs.

However, when the crypto bull market is not on, it must be noted that there is often limited liquidity within the system. During periods of increased liquidity flowing into memecoins, NFT floor prices may decline or established cryptocurrencies may decrease in value. Investors sell some of their holdings to tap into the memecoin run.

It is also worth noting that this movement of liquidity happens even within memecoins. For instance, there are just over 174k and 30k wallets that hold Pepecoin and Turbocoin, respectively, as of May 15, 2023. Yet, of the 30k Turbocoin holders, over 14k have held Pepecoin at some stage. That is nearly 50% of the investors going into a subsequent memecoin within the ERC-20 token ecosystem.

This trend was also noticeable on Solana, where the top two coins by the number of wallets, namely Guac and King, had several thousand wallets in common.

On both Ethereum and Solana, it was the same liquidity moving across memecoins. Speculators were picking up a coin, buying it for others to follow and then dumping it on the latecomers.

Needless to say, the memecoin space is perhaps too risky to even think about having regulators address it. Also, with only a few hundred thousand wallets involved in the memecoin space and the overall market cap of memecoins at less than $16 billion, it is still in the early days. Yet, it is a huge regulatory risk for the firms launching memecoins, as they are currently perceived as the most speculative bet within cryptos.

What is the future of Pepecoin (and memecoins)

Over the years, the crypto industry has created several “rags-to-riches'' stories based on culture. Memecoins are one of them. The industry has only seen two previous instances of such models holding value through a tough bear market and consistently performing well from an investment perspective — DOGE and SHIB.

Pepecoin is perhaps only the third significant example of this trend. Therefore, it is too early to know if memecoins have a future. If culture-based asset creation becomes a significant economy within cryptocurrencies, with a number of such ecosystems emerging with big market capitalizations, that would be one data point.

These culture-based ecosystems must also hold value across a number of Bitcoin cycles and hit respectable milestones, like a $1 trillion market capitalization. That would then become undeniable evidence that the crypto world has unearthed a new asset class that is here to stay. Until then, memecoins like Pepe remain at the extreme end of speculation within the crypto ecosystem.

Written by Arunkumar Krishnakumar

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Here you will find 76634 more Information on that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Here you will find 43991 more Info on that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3534/ […]

… [Trackback]

[…] Here you will find 41090 additional Information to that Topic: x.superex.com/academys/beginner/3534/ […]