Ethereum’s (ETH) 14% price drop overshadows improvements in investor interest: Report

ETH price is revisiting cycle lows, but data from Glassnode highlights a notable improvement in investor sentiment.

The price of Ether (ETH) rallied 77% in the lead-up to the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States, setting a year-to-date high at $2,715. But in the weeks since, ETH price has turned soft alongside the rest of the market.

The latest data from on-chain analytics firm Glassnode shows that despite the current downturn, Ether has outperformed Bitcoin (BTC) in multiple areas.

ETH eclipses BTC

Glassnode’s latest “The Week Onchain” report highlights ETH’s outperformance of Bitcoin “on a quarterly, monthly, and weekly basis.”

Analyst Alice Kohn points to a significant surge of over 20% in Ether’s value against Bitcoin, a trend that aligns with similar activity in the ETH derivatives market.

Glassnode notes that this performance coincides with a rebound in ETH’s market dominance. According to the chart below, ETH has gained 2.9% in market cap dominance compared with Bitcoin since the spot BTC ETF approval.

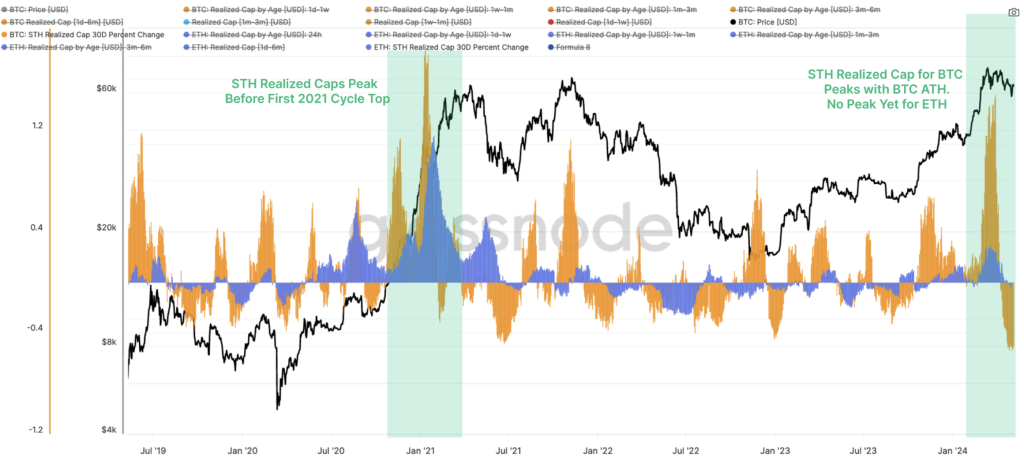

Positive market sentiment reflected in ETH’s net unrealized profit/loss metric

Ether may be trading 14% lower over the last week, but market sentiment around the cryptocurrency remains positive. This is evidenced by the volume of net profits locked in by ETH investors, which has reached a new multiyear high, signaling significant changes in investor profitability.

Kohn said:

“While profits taking has increased since mid-October, the peak on 13-Jan reached over $900M/day, aligned with investors capitalising on the ‘sell-the-news’ momentum.”

Perhaps the most significant indicator supporting Ether’s positive sentiment is the net unrealized profit/loss (NUPL) metric for short-term tokenholders.

NUPL gauges the potential profit or loss of investors holding an asset based on the price at which they acquired their coins.

This metric has crossed above 0.25 for the first time since the November 2021 all-time high, indicating increasing optimism among holders.

According to Kohn, this could mean either a level of positive market sentiment is “creeping in for ETH” or that “markets tend to take a pause and digest profit taking distribution pressure.”

Related: Socket protocol recovers two-thirds of stolen ETH from hack

Expressing this optimism, trader Ken spotted a “manual stop,” saying that the ETH/BTC confluence was nearing a breakout with Ether’s price above $2,240.

$ETH

long from 2240 retest, aiming for the liquidity at 2500

ETH/BTC confluence as it's nearing breakout retest

manual stop for now, same as BTC pic.twitter.com/DxWt4aYxZa

— Ken (@KenCharts) January 24, 2024

ETH displays dominance in the derivatives market

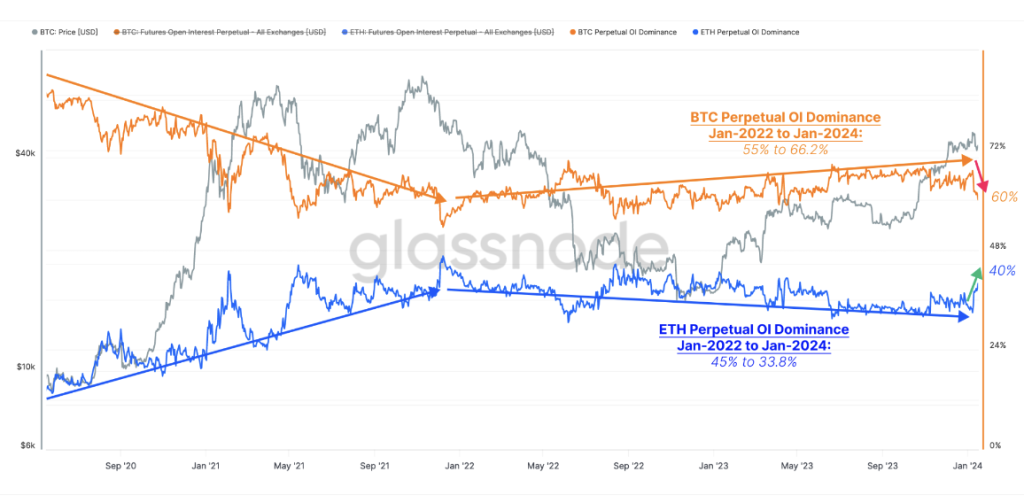

The recent resurgence in Ether’s market performance, as highlighted in Glassnode’s report, suggests a potential shift in capital flows within the crypto market. A closer look at derivatives data reveals that Bitcoin’s perpetual swaps accounted for 55% of open interest in January 2022, which has since risen to 66.2%.

In comparison, “ETH open interest dominance decreased from 45% to 33.8% between 2022 and 2024,” according to Glassnode.

However, ETH regained some market share, with its dominance rebounding to approximately 40% by this metric following the ETF approval.

Ether’s recent market performance has sparked increased speculation among investors about the possible introduction of a spot Ether ETF.

According to Yield App chief investment officer Lucas Kiely, now that there is clarity after the Bitcoin ETFs — along with seven deadlines between May and August — Ether ETFs may come sooner than expected.

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Here you will find 15086 more Info to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] There you will find 66112 additional Info on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] There you can find 72099 additional Info to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] There you can find 44701 more Information to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Here you can find 35834 more Information on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] There you can find 94447 more Info to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3521/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3521/ […]