ETH’s Classification As A Non-security Is Key To the ETF’s Ability To Pass Muster

Abstract

Abstract

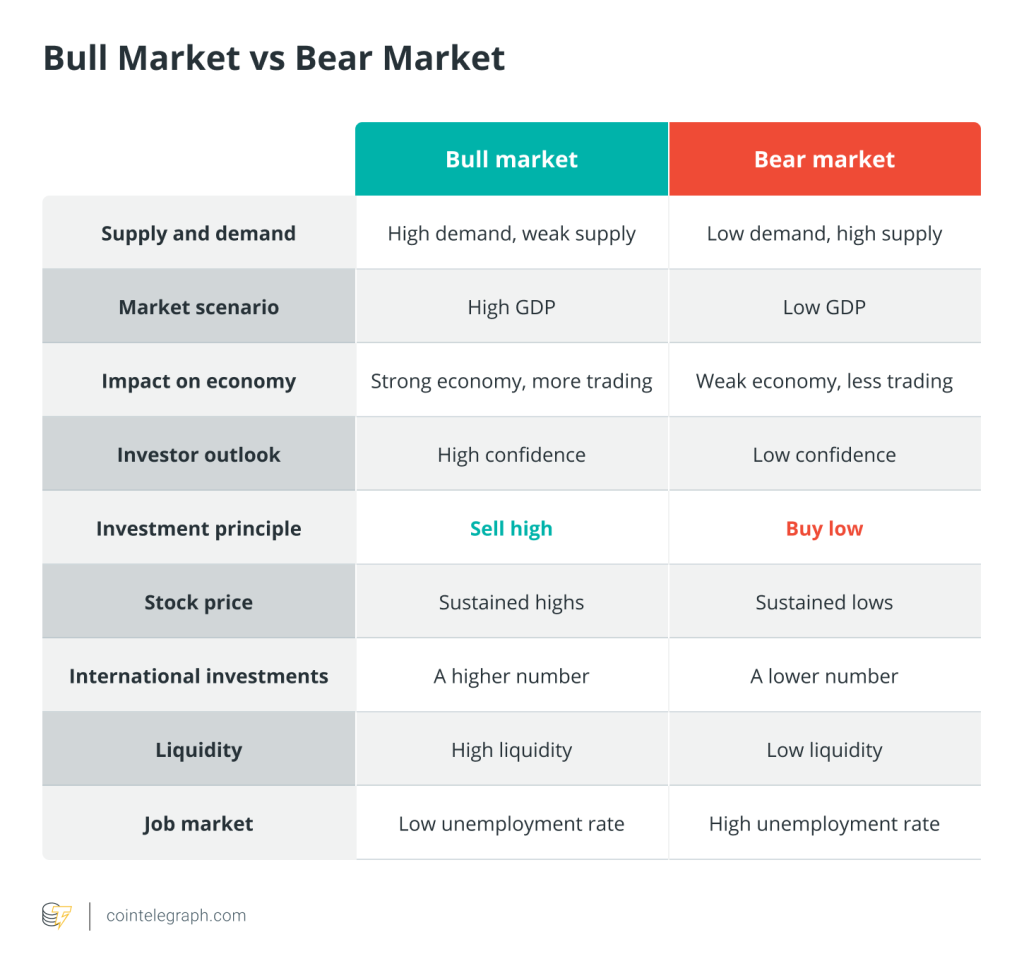

In the crypto space, there is a phenomenon where some of the headline coins drive the overall bull market, for example, BTC and ETH have brought a weathervane effect on the direction of the entire crypto market, and at the same time gathered most of the investors’ attention.

With the arrival of a spot bitcoin ETF, traders are now starting to focus on ethereum. Eric Balchunas, senior ETF analyst at Bloomberg, said the likelihood of a spot Bitcoin ETF being approved is only 70%, down from the 90% he believes it will be.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy

ETH in the Spotlight

After a decade of wrangling and twists and turns, the US Securities and Exchange Commission (SEC) finally compromised with the market and on 11 January 2024, US time, the SEC approved Bitcoin spot ETFs for the first time in its history, authorising 11 ETFs to begin trading on Thursday.

While this time Bitcoin didn’t see as much of a surge as some in the crypto industry had hoped, the inflows into these ETFs were in line with analysts’ expectations, bringing close to $19 billion in liquidity to BTC.

Data released by Bloomberg analyst James Seyffart shows that trading volumes in U.S. spot bitcoin ETFs remain very strong, with more than $2 billion traded on 23 January, with GBTC still accounting for more than half of the volume ($1.013 billion). Additionally, the ten spot Bitcoin ETFs’ total volume for the first seven trading days was marginally less than $19 billion, totalling more than $18,779.8 million.

And with the arrival of the spot Bitcoin ETF, traders are now starting to focus on Ethereum, and while it won’t be able to have a big impact on the approval of the spot ETF for Ethereum, the shift in the field’s focus back to Ethereum has led to the creation of a healthy buy that has sent ETH/BTC up 25% this week, shaking off 1.5 years of sustained declines since the merger.

Clearly, a large number of investors, both institutional and retail, are already preparing for the ETH Spot ETF! If the ETH Spot ETF passes with flying colours, then ETH and BTC may be able to bring about a crypto bull market opportunity together!

But will the ETH Spot ETF really be passed successfully

ETH Spot ETF Less Than 50% Likely to Pass by May!

Eric Balchunas, senior ETF analyst at Bloomberg, said the likelihood of a spot Bitcoin ETF being approved is only 70%, down from the 90% he believes it will be.

On a more pessimistic note, Nikolaos Panigirtzoglou, Director of Global Markets Strategy and Alternative Digital Assets at JPMorgan Chase, believes that the SEC will need to classify ethereum as a non-security, also known as a commodity, before a spot ETF can be approved. While he agrees with the idea of classifying ethereum as a commodity, he continues to believe that there is no more than a 50% chance that the SEC will take a classification certification before May.

Whether ETH is classified as a security or a commodity will have a decisive impact on whether an ETH spot ETF will pass muster! Worryingly, ETH’s proof of equity and gain in value approach is very close to that of a security, which certainly puts a bad spin on the determination that ETH is not a security.

Multiple cases provide evidence in favour of ETH non-securities certification!

· The SEC sued multiple cryptocurrency exchanges for listing crypto assets they consider securities, which does not include Ether.

· JPMorgan’s Panigirtzoglou’s vote in October 2023 to approve Ether ETFs holding commodity futures contracts has clarified Ethereum’s status as a non-security.

· SEC Chairman Gary Gensler, who was the deciding vote to approve the spot bitcoin ETF, has long argued that bitcoin is not a security under federal securities laws.

· A U.S. appeals court, which held that the ETH spot ETF should receive the same regulatory treatment as the BTC spot ETF, had a very critical impact on Gary Gensler’s decision.

Write at the end

Whether it’s a BTC spot ETF or an ETH spot ETF, the impact on the crypto market is a long-term positive, not a short-term up or down, and a healthy market must look towards the long term. Regularisation, legalisation is the key for cryptocurrencies to officially step into the global legal financial arena and a key catalyst for a long-term bull market.

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] There you can find 3783 more Info on that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Here you can find 47728 more Information to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Here you can find 81071 more Info to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] There you will find 67419 more Info on that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Here you can find 20896 more Info to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/3431/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/3431/ […]