What is Terra (LUNA)? A beginner's guide

What is Terra LUNA Classic (LUNC)?

LUNA Classic (LUNC) is the original Terra LUNA coin left behind after the recent UST/Luna collapse and the establishment of a new Terra chain. Kwon's plan for recovery included the creation of a whole new chain on which future transactions would be conducted. The old chain was split into the LUNA Classic and the Terra chains. Terra will be the name of the new chain (known as LUNA 2.0), and LUNA Classic (LUNC) is the original Terra LUNA blockchain's native token.

The term “classic” is most likely a reference to the hard fork of Ethereum and Ethereum Classic that occurred after Ethereum's 2017 decentralized automated organization (DAO) breach. This appears to be another ploy to promote the UST crash as “Terra's DAO hack moment,” as Kwon stated.

The old version of the Terra protocol was expanded to offer support for stablecoin developers to build Terra decentralized finance (DeFi) projects. The project consisted of two cryptocurrencies: Terra and LUNA. Terra was the stablecoin standard pegged to fiat and other currencies. For example, TerraUSD (UST) is tied to the United States dollar, while TerraKRW (KRT) is tied to the South Korean won.

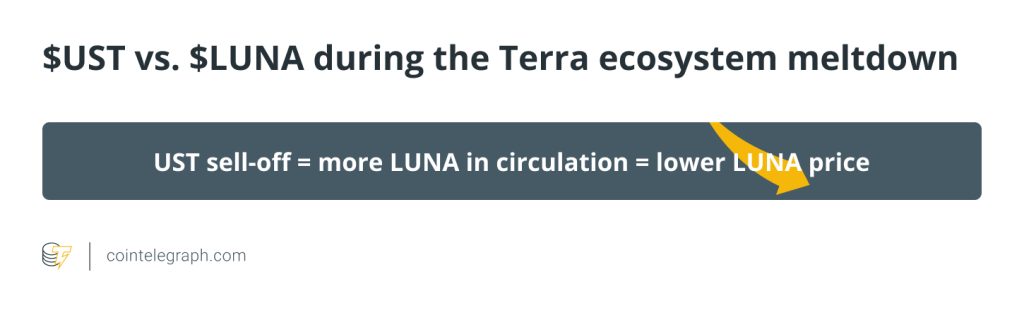

The native token, Terra (LUNA) was the network’s staking and governance asset. Users stake LUNA to earn a place in governance and become validators and obtain rewards. Users can also burn LUNA to mint Terra’s UST token or one tied to their local fiat. However, it’s important to note that while these stablecoins are tied to the value of fiat, they’re not backed by fiat. Instead, the LUNA token was considered an algorithmic stablecoin.

An algorithmic stablecoin is an asset that derives value through a set of rules rather than being tied to an asset, itself. This method enabled Terra users to invest in the price of these coins linked without needing to hold their physical counterparts.

However, the so-called stablecoin UST was unpegged on May 9, after nearly 18 months of retaining its value against the US dollar. The uncoupling created a chain reaction that resulted in the crash of UST and the Terra (LUNA) cryptocurrency and Bitcoin and the more significant crypto sector, which has yet to recover fully.

This article will discuss the history of Terra blockchain, Terra LUNA 2.0, and the difference between LUNA 2.0 and LUNA Classic.

What is Terra Luna 2.0?

Terra 2.0 is the most recent version of Terra (LUNA), which is what Do Kwon has devised as a regeneration strategy. The goal is to propose a fork of the Terra blockchain and an airdrop to crypto investors whom the recent market downturn has impacted. The main goal is to restore trust in this stablecoin through the Terra ecosystem's new venture.

Terra 2.0's policy occasionally issues additional LUNA tokens to crypto investors who purchased more than 10,000 LUNA before the catastrophic harm to this stablecoin. It will help to keep Terra 2.0 from being sold right away. More than 300% of crypto investors' LUNA tokens will be unlocked at once, with the remaining 70% issued over two years. These crypto investors will receive the new Terra 2.0 tokens after six months.

How does LUNA 2.0 work?

To validate transactions on the Terra 2.0 cryptocurrency blockchain, a typical proof-of-stake (PoS) consensus mechanism is used. A total of 130 validators engage in network consensus at any given moment, with voting privileges determined by the quantity of LUNA 2.0 connected to each node. Gas fees and a 7% fixed yearly LUNA 2.0 inflation rate are used to produce rewards.

By delegating LUNA 2.0 tokens to a validator of their choice, LUNA 2.0 token holders participate in consensus. Validators, like delegates, frequently put up their own stake. Therefore, before awarding prizes to delegators, the validation node keeps a commission in this scheme.

The incentives generated by Terra 2.0 coin delegators differ, depending on the voting power of the validators. That being said, those with more voting power naturally earn more rewards, but they must be dispersed among a wider pool of delegators.

Delegating can be done using the Terra Station interface, but be warned that it comes with a risk. For instance, validators can be penalized for misbehaving, resulting in staked LUNA 2.0 being sliced. Slashing can happen even if the validators are mistakenly turned off for a brief time.

History of the Terra blockchain

Terra was founded in 2018 by Do Kwon and Daniel Shin and launched its mainnet in 2019. Kwon and Shin built Terra to offer users the stability of fiat currencies while harnessing the power of blockchain technology for settlements that were faster and cheaper than traditional payment solutions. The two founders also believed that such options would increase blockchain adoption.

The Terra Alliance backs Terra. The Terra Alliance is a group of e-commerce businesses and platforms from around the world pushing for Terra adoption. Businesses within the Terra Alliance have a combined value worth tens of billions and more than 45 million customers across the companies.

What is the difference between LUNA 2.0 and LUNA Classic?

Despite their striking resemblance, LUNA Classic and LUNA 2.0 are not the same. The Terra network has been divided into two chains based on the new governance plan. Terra Classic with Luna Classic tokens (LUNC) will be the old chain, whereas Terra with LUNA tokens will be the new chain called LUNA 2.0.

The old LUNA will co-exist with LUNA 2.0 rather than being entirely replaced. Any decentralized applications (DApps) launched for Terra Luna will be favored for LUNA 2.0, and the development community will begin constructing DApps and providing utility for the new token. However, it does not include an algorithmic stablecoin.

However, this does not rule out the possibility of Terra Classic losing its community as many investors and traders oppose Do Kwon's restoration plan and the new chain. In truth, Terra Classic retains a sizable following, and the classic community has agreed to begin burning as many LUNC tokens as possible to reduce the coin supply and raise individual token prices.

Is Terra Luna 2.0 secure?

One hundred thirty active PoS validators protect Terra LUNA 2.0. Given the calamity that befell LUNA's prior iteration, investors in the crypto world have legitimate reservations about the coin's stability. Since its launch, there has been no evidence of hacking or scams, but investors should be aware of the risks before committing funds to LUNA 2.0.

The Crypto market is highly volatile, and a lack of regulation makes it riskier than the traditional stock market. Therefore, conduct your due diligence on blockchain-based projects before investing your hard-earned money.

Should you invest in Terra LUNA 2.0?

LUNA was a growing powerhouse within the DeFi space before the collapse of the Terra ecosystem. In December 2021, Terra overtook the BNB Smart Chain to become the second-largest DeFi protocol with more than $20 billion locked into the network across its applications.

However, the algorithmic stablecoin UST and its sister coin LUNA both failed during the Terra ecosystem crash, and their prices plummeted, leading the investors to lose trust in smart contracts and algorithm-based cryptocurrencies.

Should you invest in LUNA 2.0 based on the statistics or past performance? That’s up to the individual buyer. Every investor has their own goals and risk-return trade-offs concerning the project in which they are willing to invest. Hence, they should conduct their research before investing in digital assets.

How to buy Terra LUNA 2.0 tokens?

Those wondering where to buy Terra LUNA 2.0 tokens should understand that you'll need to use a crypto exchange to exchange your fiat cash for LUNA. Since LUNA is relaunched after UST's collapse, it was pulled out from many exchanges and hasn't yet returned to all of them.

However, many of these exchanges, such as Binance, KuCoin, Crypto.com and eToro, still feature the trading of LUNA 2.0 tokens. Almost all exchanges follow the same steps like registration, deciding how to deposit funds, choosing the investment amount and selecting the wallet to store your funds. The four simple steps outlined below will show you how to purchase LUNA 2.0 on the Crypto.com exchange in a matter of minutes.

Can you stake Terra LUNA 2.0?

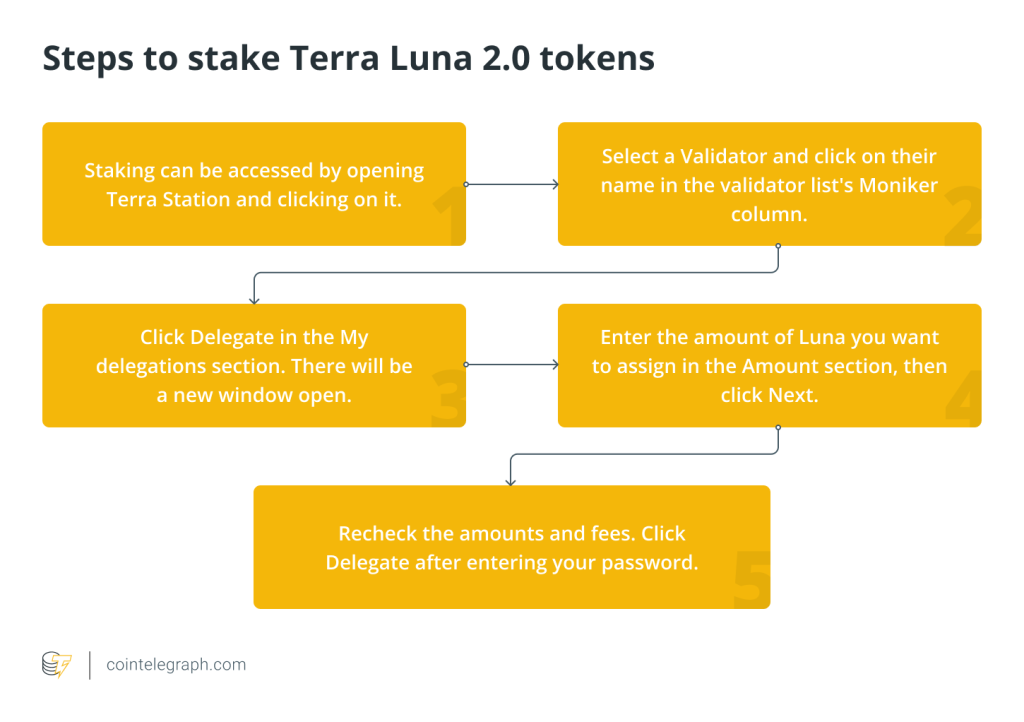

After purchasing LUNA, holders can stake it on the cryptocurrency exchanges like Binance. Make sure you have LUNA in your wallet before you stake. To accomplish this, follow the steps below:

All the above steps will help you stake your LUNA 2.0 tokens and earn staking rewards.

The Future of LUNA 2.0

The future of LUNA 2.0 is impossible to predict with complete accuracy, considering the collapse of its UST stablecoin. Previously, LUNA was home to some very popular DeFi projects, even if there aren’t very many to speak of at the moment. Terra’s overtaking of the Binance Smart Chain (now BNB Chain) to become the second most popular DeFi platform is nothing to ignore, either.

However, the future cannot be predicted based on past events. Terra LUNA 2.0's success depends upon the performance of the new chain and its efforts to regain investors' trust. Of course, it’s always possible that Ethereum’s eventual upgrade to PoS might overtake competitors like Terra, being that Ethereum has more mindshare than just about any project out there. But nothing is certain until Ethereum’s implementation is complete.

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Here you can find 4014 more Info to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] There you can find 19550 additional Information on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Here you will find 62820 additional Information on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] There you can find 33904 additional Information on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Here you will find 10330 more Information to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Here you can find 34072 additional Info to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3278/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3278/ […]