On-chain volume vs. Trading volume: Differences explained

Given the volatility of trading assets, fundamental and technical analyses are crucial skills for traders. These analyses provide an insight into the trading volume and trends of various cryptocurrencies, enabling you to make the right decisions. Though associated with legacy financial markets, these techniques in analysis serve immensely well in crypto markets as well.

On-chain volume vs. trading volume is a key metric for traders when they are deciding if a certain cryptocurrency is worth putting their money in. Regardless of the asset being traded, tools such as relative strength index (RSI), (moving average convergence divergence (MACD) and Bollinger Bands have proven to be quite helpful in gauging market behavior. However, one of the first things any experienced trader will set out to find is stuff like on-chain volume, trading volume, support and resistance indicators.

Before diving into these metrics, it is important to understand what fundamental analysis and technical analyses are, the problems with using these approaches in crypto and how certain other metrics can help.

Related: How to trade cryptocurrencies: A beginner’s guide to buy and sell digital currencies

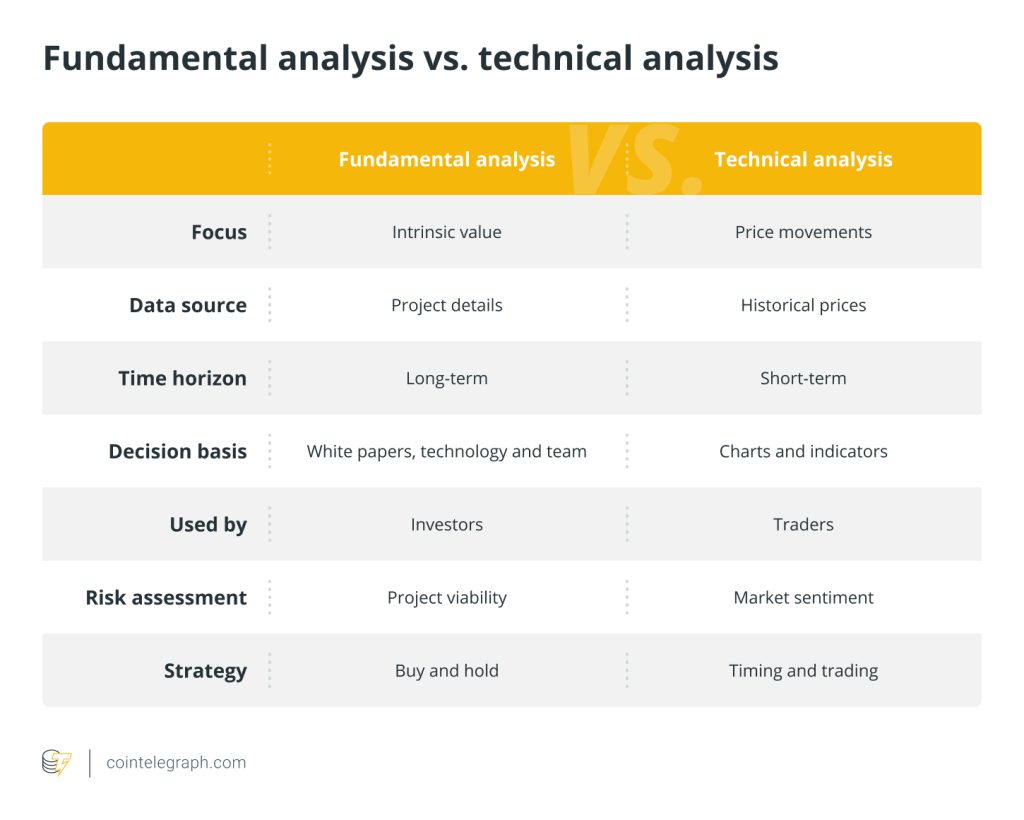

Understanding fundamental and technical analyses

Fundamental analysis involves an array of internal and external factors to discover the intrinsic value of an asset. It helps determine whether the asset in question is overvalued or undervalued and whether a trader should enter or exit a position.

Technical analysis examines the past performance of assets to predict future price movements. The analysis generates valuable trading data which offers insights. Users of technical analysis identify candlestick patterns and study essential indicators to guess which way future price movements will move.

Conventional financial analysis uses indicators like earnings-per-share (profit a company makes for each share) or price-to-book ratio (investors’ valuation of the enterprise vs. its book value) to figure out how a particular metric might perform.

Related: Crypto charts 101: How to read cryptocurrency charts

Problems in analyzing crypto projects

As crypto projects are uniquely different, they can’t fit into any existing norm in the financial ecosystem. More than a regular stock or bond, cryptocurrencies are closer to commodities. Some specific crypto projects are modeled on derivatives. This is why it is difficult to use existing tools of analysis in crypto; rather, we have to tweak them a bit to fit in better with the way digital coins work.

When evaluating a project, the first step is to identify strong metrics. The strength means that the metric should provide some real insight into the project. For instance, you can’t use metrics like the number of Twitter or Telegram followers when determining the worth of a crypto project. These metrics aren’t reliable, as project promoters can game them by creating fake accounts or buying engagement.

No metric is good enough to get all the ticks. Crypto is complex and there are so many factors that you need to care about. So, to reach a reasonable conclusion, you may need to use a string of metrics in tandem. When analyzing a crypto project, it will be better to use metrics that have been developed specifically for blockchain-based activities.

For instance, you may check the number of active addresses on a blockchain to determine if there has been a spike in its use. But, even this metric cannot be crystal clear. Some self-serving actors may be sending and receiving money in new addresses each time to create an impression of the sharp rise. Using a set of metrics helps you tide over such scrupulous activities and get better at the game. Two key metrics that will be part of any such analysis are on-chain volume and trading volume.

What does on-chain volume mean?

You might be eager to know how on-chain analysis helps crypto traders. On-chain volume refers to the volume of digital coins transferred to exchange from external venues. As these transactions are written on the blockchain, instances of fake transactions come down.

A blockchain explorer enables you to view the transactions on the distributed ledger. All these transactions are not just authenticated and validated by a pre-defined number of participants but are irreversible as well.

On-chain transactions take up some time to complete as it has to go through a series of steps before it is deemed successful. Transactions occurring on a blockchain must undergo validation by a pre-set number of the network’s participants termed miners. A transaction is considered valid only after consensus is reached among miners. The transaction details then become a part of the blockchain.

What does trading volume mean?

Trading volume, on the other hand, indicates the volume of intra-exchange trading. Occurring off-chain, these exchanges are recorded in order books of exchanges are reported via application programming interfaces (APIs). Dealing with the values lying outside the blockchain, off-chain transactions can be performed using several methods such as a transfer agreement between two parties, a guarantee of a third party regarding the transaction, a code based payment mechanism or any other.

Off-chain transactions entail no change in the blockchain. The absence of validation leads to faster transaction processes and lower fees. Transactions entailing trading volume are self-reported by exchanges, making them prone to manipulation. Since off-chain transactions aren’t written on the blockchain, there is no network record of the transaction’s financial details, leaving it open to dispute.

On-chain volume vs. trade volume: Role of exchanges

Crypto exchanges, like stock exchanges, have a key role to play in the crypto ecosystem. For traders as well as other stakeholders in the crypto industry, exchanges work as an interface. They serve as an on-ramp to cryptocurrency and a platform for currency swap, thus performing two critical functions.

In this light, it is not a surprise to note that most blockchain transactions entail the exchanges where the digital coins move to and fro. Invariably, on-chain volume and trading volume are two key metrics designed to get an insight into the trading an exchange is engaged in.

The ratio between on-chain volumes and trade volumes at various exchanges indicates the difference between the flow of funds in these exchanges. Viewing the data, you get interesting insights regarding the volume of trading in these exchanges. In absence of these metrics, you will have no way to determine the truth behind the claims. Between exchanges with similar user bases, it will be difficult to figure out the leader in terms of trading.

On-chain volume vs. trading volume: Why these metrics are important

The problem of faking data is huge. According to a study from Bitwise, 95% of spot Bitcoin (BTC) trading volume is a hoax. When Bitwise analyzed the top 81 cryptocurrency exchanges on CoinMarketCap, they found the exchanges had reported an aggregated $6 billion in average daily bitcoin volume. Astonishingly, only $273 million of the reported volume was real, which was just 5% of the reported trading.

It is this manipulation that has turned the cryptocurrency market into a mess. Exchanges fake data to hop on the rankings of public data aggregators like CoinMarketCap and gain greater visibility. More trading volume on exchanges creates an impression of greater liquidity and market activity, drawing in new users and new cryptocurrencies looking to list.

Though it might be bringing goods for the exchanges, it does bring a bad name for the whole industry as a whole. Once potential investors see the holes, they might be looking at the whole project with suspicion. This scenario makes the role of a metric like on-chain volume more important. Comparing the amounts of digital coins that move in exchanges through on-chain transactions with the off-chain volumes helps you separate chalk from the cheese.

Analysis of on-chain vs. trading volume graph

The below graph compares the volume of BTC traded on exchanges (green) with on-chain transactions (blue) at diverse price levels. Statistics of renowned crypto exchange Coinbase are used to represent on-chain trading volume. The graph merges three Bitcoin metrics: price across time, trading volume and on-chain transaction volume.

Please note that volume measurement has been done in relation to price, not time. BTC price is hooked to the x-axis along the bottom of the graph. Bitcoin on-chain volume measurement relates to the x-axes at the top of the graph. Different price points manifest themselves in the graph. The graph clubs the Bitcoin trading volume each time the cryptocurrency touches a particular price level.

You need to be a diligent analyst, though, to draw the right conclusion from the graphs, or you face the risk of falling somewhere between the lines, or in other words, getting to the wrong outcomes. You may have noticed both on-chain and off-chain volume create the same pattern, making it more difficult for anyone analyzing.

On-chain data enables you to determine if the transactions exchanges are showing actually materialized. As some exchanges manipulate data to fake volumes, examining trade volume along with on-chain volume enables you to verify volume at diverse price points. A careful analysis of the graphs ensures you are able to make your trading decisions on accurate data.

Metrics for crypto financial analysis

There are two ways to extract data from the blockchain. You could do it by running a node on the blockchain and exporting the data, but it would be needlessly expensive. A better option is to pull the information using APIs specifically designed for the purpose. Examples include CoinMarketCap’s on-chain analysis of Bitcoin and Coinmetrics’ Data Charts.

These APIs come in handy for finding information like on-chain volume and then comparing it with trade volume. For on-chain metrics like volume, you have to take into consideration metrics such as:

Liquidity and volume

An important consideration when investing in any cryptocurrency is liquidity, a measurement of ease regarding buying and selling an asset. An asset is termed liquid if it can be sold without a problem at its trading price. A liquid market has plenty of asks and bids, resulting in a tighter bid-ask spread. An illiquid market, on the other hand, is the one where asset holders are able to sell assets at a fair price.

Trading volume is a key indicator to determine liquidity. You are able to find traded value within a given time period. With a glance at the chart, you are able to gauge the market’s interest in a specific crypto project. Assets with higher trading volume are likely to be traded more frequently and rapidly compared to those with lower volume.

What is considered a good trading volume?

To have a hard and fast rule regarding trading volume is unfeasible. Every crypto project is different and you need to take into account various factors before arriving at a decision. While indicators like trading volume and on-chain volume are a given when it comes to an investment decision, any smart trader will touch up other metrics as well. These include a white paper to know about technical, business and management side of the project, tokenomics to understand the supply of tokens, coin burning mechanism, market capitalization, network value to transactions ratio (NVT) and others. Indicators from all these metrics are considered collectively to arrive at a sound and well-informed decision.

Related: Cryptocurrency investment: The ultimate indicators for crypto trading

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] There you can find 17760 additional Info on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Here you can find 53729 additional Information on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Here you will find 59883 more Information to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Here you can find 31860 more Information to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3138/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3138/ […]