What are decentralized derivatives: A beginner’s guide

Decentralized derivatives, explained

Decentralized derivatives are financial contracts that are exchanged on decentralized platforms, often based on blockchain technology, and derive their value from an underlying asset, such as a cryptocurrency, commodity, stock or even another derivative. These platforms eliminate the need for intermediaries such as traditional financial institutions or exchanges, enabling peer-to-peer trading and settlement.

The essential concepts involved in decentralized derivatives are explained as follows:

Underlying asset

The asset on which the derivative contract is based is known as the underlying asset. It might be a stock index; a commodity, such as gold or oil; a cryptocurrency, such as Bitcoin (BTC) or Ether (ETH); a derivative, or anything else of value.

Derivative contract

Financial contracts known as derivatives derive their value from an underlying asset. Derivatives come in a variety of forms, including options, futures, swaps and others. With the help of these contracts, traders can make predictions about the underlying asset’s price movement without really holding it.

Decentralized platform

Decentralized derivatives are traded on platforms built on blockchain technology that function without the involvement of intermediaries. These platforms make use of smart contracts, self-executing contracts whose conditions are encoded directly into program code. Due to its support for smart contracts, Ethereum is one of the most often-used blockchains for these applications.

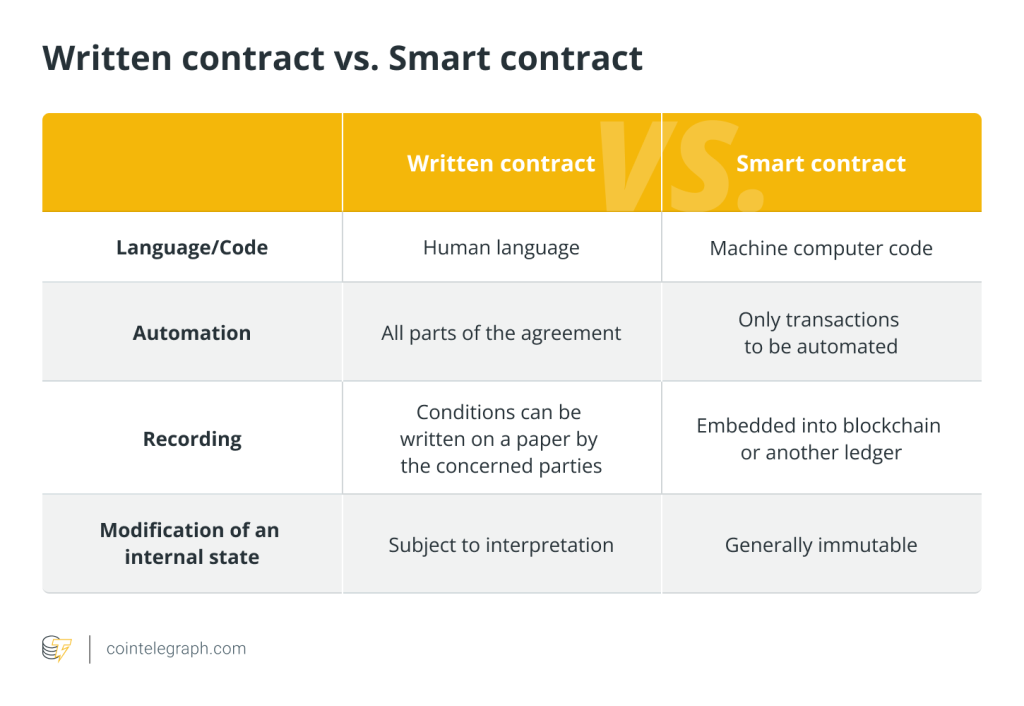

Smart contracts

Smart contracts automate the trading, settlement and clearing procedures in relation to decentralized derivatives. When specific criteria are satisfied, these digital contracts automatically carry out predetermined tasks. For instance, a contract for options might be configured to automatically exercise or expire in accordance with the value of the underlying asset.

Peer-to-peer trading

Decentralized derivatives make it possible for participants to trade directly with one another, eliminating the need for intermediaries, such as brokers or exchanges. Direct trader-to-smart contract communication ensures transparency and lowers counterparty risk.

Liquidity pools

Users who have secured their assets in smart contracts provide liquidity on decentralized finance (DeFi) networks. These assets combine to create liquidity pools, which make trading easier. These pools can be used by traders to enter and exit positions.

Automated market makers (AMMs)

On decentralized exchanges (DEXs), AMMs are algorithms used to calculate asset prices depending on the pool’s available liquidity. They enable continuous trading and eliminate the requirement for conventional order books.

Risk and regulation

Decentralized derivatives include advantages such as improved accessibility and less reliance on intermediaries, but they also come with risks. Regulatory challenges, weak points in smart contracts and pricing manipulation are possible problems to take into account.

Decentralized oracle networks

Decentralized oracle networks provide smart contracts with access to external data that they can use to precisely predict actual events. To ensure that contracts are settled properly for derivatives, oracles are employed to supply information on the price of the underlying asset.

Types of decentralized derivatives

Decentralized derivatives in the realm of DeFi encompass various types that mimic traditional financial instruments.

Decentralized options contracts are a typical type that allow users to opine on the price development of an underlying asset over a predetermined period of time. Decentralized futures contracts are another common type that let users agree to buy or sell an item at a defined price at a later time, facilitating risk management and hedging methods.

Decentralized synthetic assets also play a role, giving users access to different assets without actually owning them. Decentralized swaps and swap options additionally enable users to trade assets according to pre-established conditions, increasing liquidity and facilitating unique trading methods.

How do derivatives work in decentralized finance?

Derivatives function similarly to traditional financial instruments in DeFi, but they are executed using smart contracts on blockchain platforms like Ethereum. Financial contracts known as derivatives get their value from underlying assets, indexes or reference rates. Without really owning the assets, they let participants speculate on their price alterations. Let’s understand how derivatives operate in DeFi with an example:

Suppose Alice wants to make hypothetical predictions about ETH’s price without actually buying any. She predicts that ETH’s price, which is currently $3,000, will rise in the upcoming month. Bob is willing to take the opposing stance since he believes that the price will either decrease or remain the same. To enter into a derivative contract, they both use a decentralized options marketplace.

Contract creation

For this particular options contract, a smart contract is established on the DeFi platform. The following hypothetical parameters are stated in the contract:

The predetermined price at which the underlying asset may be purchased or sold when exercising an options contract is referred to as the strike price, also known as the exercise price. It is the reference point that determines the potential profitability.

The right to purchase the underlying asset at the strike price before or on the expiration date is granted to the holder of a call option, but not the responsibility to do so. On the other hand, the right to sell the asset at the strike price is offered by a put option. Depending on the trader’s prognosis for the market, a call or put is chosen.

The price that the option buyer must pay the option seller is known as the premium. It represents the cost of obtaining the rights included in the options contract. The value of the premium is influenced by variables, such as market volatility, remaining time before expiration, and the spread between the strike price and the current asset price.

Premium payment

Alice pays Bob a premium for the option contract in the amount of, say, 0.1 ETH. If the circumstances are favorable, the option may be exercised later in exchange for this premium.

Contract execution

There are two possible outcomes at the end of the month:

a) Increased ETH price (Alice’s scenario):

Alice decides to activate her option if the cost of ETH has risen to, say, $3,500. Even though the market price is higher, she can now purchase ETH at the negotiated strike price of $3,000. As a result, she is able to sell the ETH she bought for a profit right away.

b) The price of ETH remained the same or fell (Bob’s scenario):

Alice decides not to activate her option in the event that the price of ETH stays at $3,000 or drops. As payment for taking the other side of the trade in this instance, Bob keeps the premium.

It’s crucial to remember that while DeFi derivatives have intriguing potential, they also carry risks, such as smart contract vulnerabilities, erratic market conditions and regulatory uncertainty. When trading DeFi derivatives, participants should take precautions and fully comprehend the contracts and systems they are using.

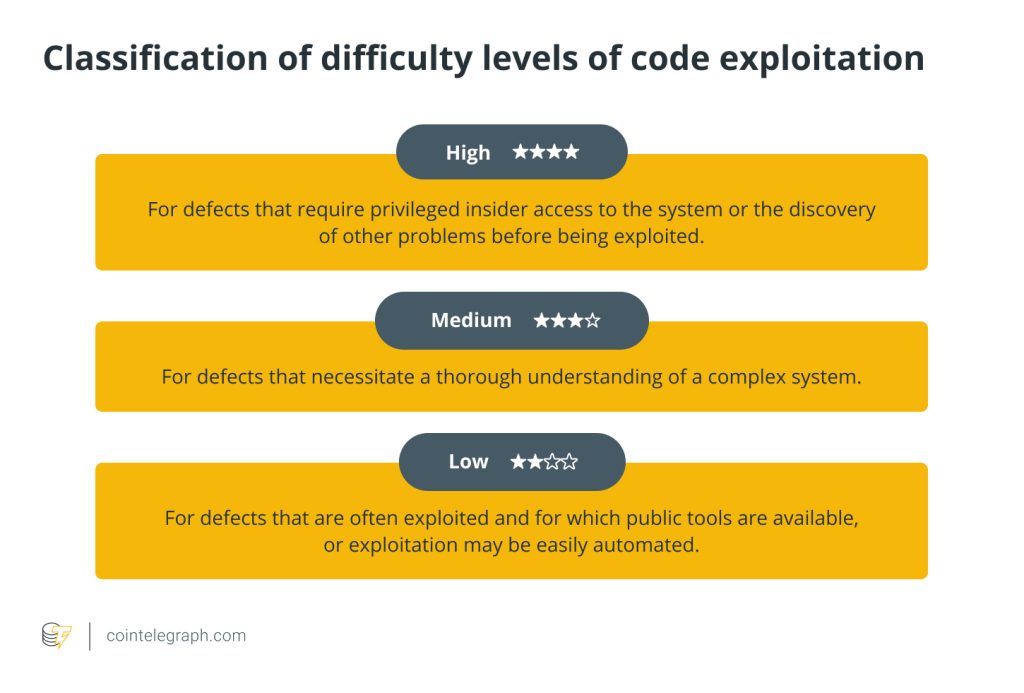

Limitations of decentralized derivatives

As mentioned, decentralized derivatives, while offering innovative solutions and opportunities in the realm of DeFi, are not without their limitations. The fact that the technology and ecosystem are still in their infancy is one important restriction. Decentralized derivatives powered by smart contracts are susceptible to errors, vulnerabilities and attacks, which could result in severe financial losses for consumers. DeFi differs from conventional financial markets in that it lacks investor protections and governmental control, which leaves participants more vulnerable to such risks.

Decentralized derivatives platforms also frequently struggle with scalability and efficiency issues. The speed and cost-effectiveness of executing derivative contracts can be impacted by congestion and high transaction costs on blockchain networks like Ethereum, where many DeFi operations take place. This might make price discovery less effective and prevent decentralized derivatives from being used more widely.

Moreover, DeFi’s accessibility and inclusivity may be constrained by the complexity of financial derivatives, which may dissuade less experienced users from engaging. Widespread adoption and institutional participation may also be hampered by a lack of standardized procedures and well-defined legal frameworks, as traditional financial institutions frequently want legal certainty and regulatory compliance.

Traditional derivatives vs. decentralized derivatives

Traditional derivatives and decentralized derivatives represent two distinct approaches to financial instruments within the broader financial landscape. Traditional derivatives have long been a feature of well-established financial markets, whereas decentralized derivatives are a result of blockchain technology and the DeFi movement.

Understanding their differences can help explain how market structures and financial instruments are changing. Here’s a comparison table between traditional and decentralized derivatives:

The future of DeFi derivatives

As innovation and rising demand for decentralized financial solutions converge, the future of DeFi derivatives seems bright. The effectiveness and accessibility of DeFi derivatives are expected to increase due to better smart contract capabilities, security safeguards and blockchain interoperability. Institutional involvement is likely to increase as regulatory clarity increases, thereby legitimizing the area.

The development of increasingly complex derivatives may be facilitated by the incorporation of real-world assets and cutting-edge risk management techniques. To fully realize their potential as a transformational force in the global financial environment, DeFi derivatives must overcome the obstacles of scalability, user education and regulatory adaptation.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Here you will find 84286 additional Info on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Here you can find 15562 additional Info on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3124/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3124/ […]