Grayscale’s GBTC bleeding drives down AUM by $5B

Heavy outflows and the decline in Bitcoin’s price are driving down the value of GBTC’s portfolio despite solid demand for other Bitcoin ETFs.

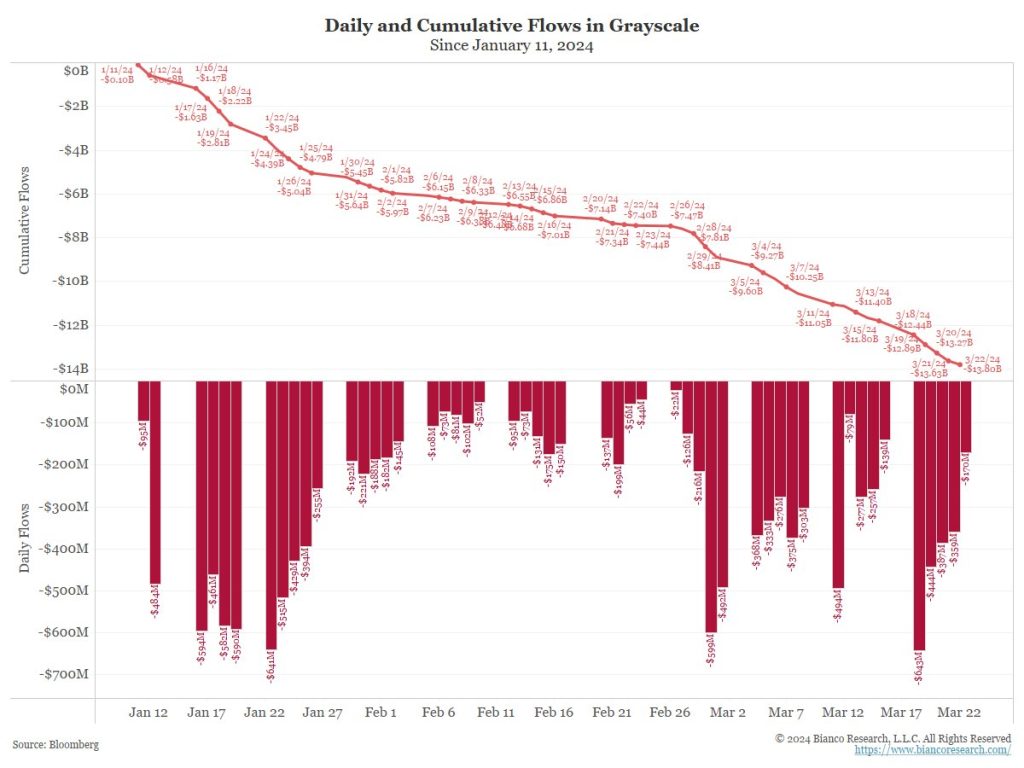

Outflows from the Grayscale Bitcoin Trust (GBTC) have intensified in its first days of trading as a spot Bitcoin exchange-traded fund (ETF), contributing to a nearly $5 billion decline in assets under management (AUM).

According to data from YChart and Grayscale, the ETF’s total assets dropped from $28.5 billion on Jan. 10 to $23.7 billion on Jan. 18.

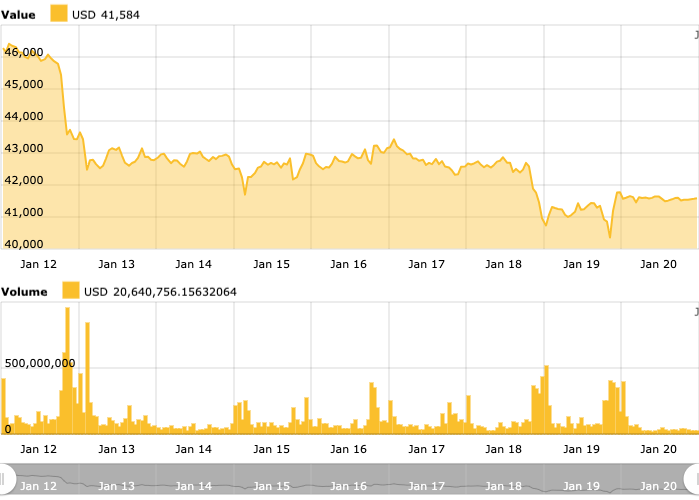

Bitcoin’s (BTC) price decline also explains the drop in AUM. As the underlying asset of the ETF, Bitcoin’s market value has a direct impact on the value of the fund. At the time of writing, Bitcoin’s price is down 4% over the past week, trading at $40,582, per Cointelegraph data.

WHEN WILL THE BLEEDING STOP? I don’t know, but this this is some serious daily outflows for The Nine to have to battle every single day.. they’ve done a great job so far but damn its a lot to ask.. pic.twitter.com/LqwPRETrQf

— Eric Balchunas (@EricBalchunas) January 19, 2024

Outflows from GBTC were anticipated. The ETF’s approval by the Securities and Exchange Commission on Jan. 10 allowed GBTC holders to convert and redeem their shares for Bitcoin. Prior to that, investors would have to sell shares on the secondary market to exit positions.

Approximately $1.1 billion flowed out of Grayscale’s ETF in a three-day period as holders sought lower fees from its competitors and took advantage of a narrow discount on the shares. Anthony Scaramucci, the founder of SkyBridge Capital, told Bloomberg that certain GBTC investors were realizing losses and switching to cheaper ETF options. To illustrate the cost gap, GBTC has a fee of 1.5%, while other ETFs have fees as low as 0.20% plus six months of free investing.

CoinRoutes CEO Dave Weisberger noted on X that GBTC holders’ composition may be playing a significant role in the wave of outflows. Along with hedgers seeking discounts and other investors jumping to lower fees, panic selling could be contributing to recent market movements. According to Weisberger:

“Taxable accounts taking profit or panic selling to preserve them are THE issue. We have no idea what the % of these are, OR the average price of entry for the holders.”

While GBTC faces its first storm as a spot ETF, other Bitcoin funds are moving in a different direction. Issuers added another net 10,667 BTC to their portfolios on the fifth trading day amid increased activity.

According to data from CC15Capital, there has been a net addition of approximately $440 million in the Bitcoin holdings of issuers. A significant portion of this increase was attributed to BlackRock’s ETF, which acquired about 8,700 BTC, valued at nearly $358 million. Since their inception, nine ETFs (excluding Grayscale) have collectively purchased close to 68,500 BTC.

Magazine: 10 best long reads about crypto in 2023

… [Trackback]

[…] There you will find 83916 additional Information on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Here you will find 41140 additional Info to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Here you will find 71417 more Info on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] There you can find 12312 additional Information to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Here you can find 20918 additional Information to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] There you can find 24372 more Information on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] There you can find 4352 additional Info on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] There you can find 95585 additional Information to that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/3086/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/3086/ […]