Grayscale CEO's warning: Only two or three spot Bitcoin ETFs are here to stay

The spot Bitcoin ETF fee war will not save the funds from being eventually pulled from the market, Grayscale CEO believes.

Most of the spot Bitcoin (BTC) exchange-traded funds (ETF) approved by the United States Securities and Exchange Commission (SEC) won’t survive, Grayscale Investment CEO Michael Sonnenshein says.

Sonnenshein predicted in an interview with CNBC at the World Economic Forum on Jan. 18 that the majority of the 11 approved spot Bitcoin ETFs are likely to fail.

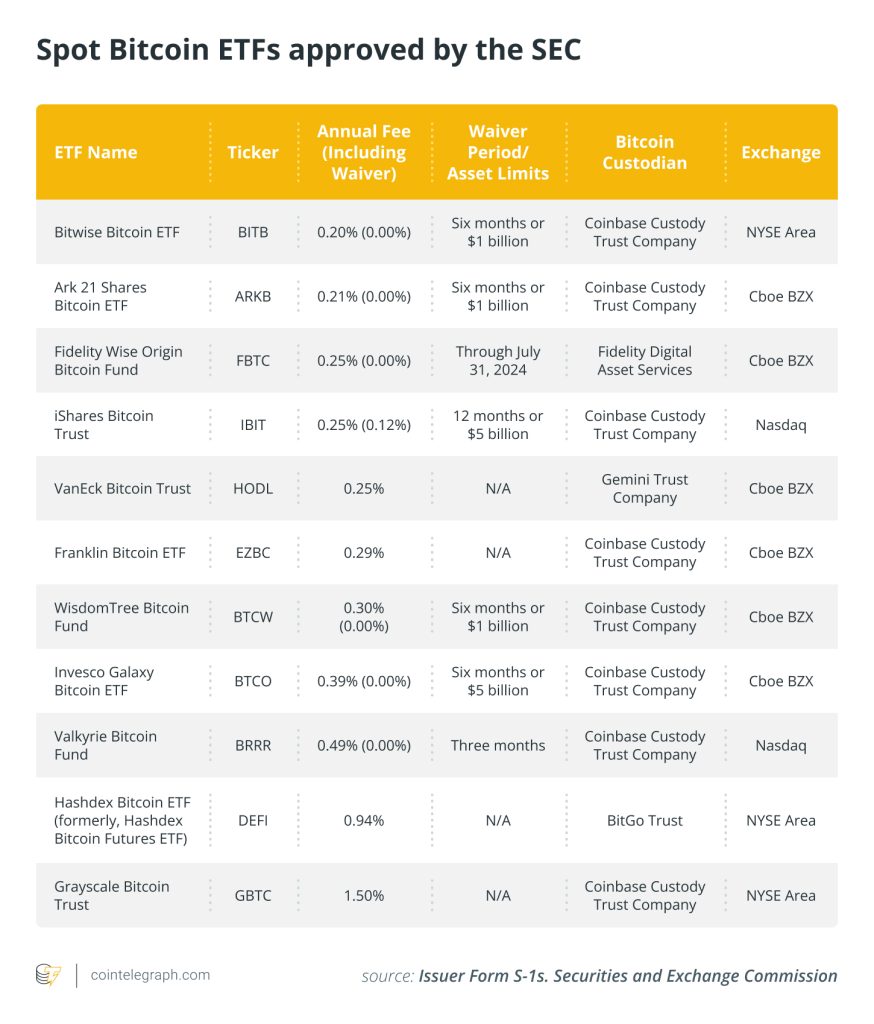

The U.S. SEC officially approved 11 spot Bitcoin ETFs on Jan. 10, with 10 of them beginning trading the next day. Many ETF issuers were actively lowering their trading fees to raise competitiveness with other ETF sponsors, with most of the approved ETFs setting fees between 0.2% and 0.4%. Multiple spot Bitcoin ETF providers also offered temporary fee waivers.

On the other hand, Grayscale — the largest Bitcoin holder among spot Bitcoin ETF issuers — charges as much as 1.5% without any waivers.

Grayscale CEO Sonnenshein defended the highest fees in the market for its spot Bitcoin ETF product, stating that only two or three of the spot Bitcoin ETFs are here to stay, while the rest will be pulled from the market. He said:

“I think from our standpoint, it may at times call into question their long-term commitment to the asset class […] I don’t ultimately think that the marketplace will have ultimately these 11 spot products we find ourselves having.”

Sonnenshein’s remarks came on the fifth day of spot Bitcoin ETF trading in the United States. Since the trading launch, Grayscale has become the only issuer aggressively dumping Bitcoin, offloading as much as 37,947 BTC by Jan. 18. In contrast, the other nine issuers have added at least 40,000 BTC to their products since the start of trading.

Quantum Economics founder Mati Greenspan doesn’t rule out the possibility that most ETF issuers are likely to fail in the long term because most investors will prefer to hold their assets, or opt for self-custody.

Related: Spot Bitcoin ETFs scoop up another 10,600 BTC on day 5

“For now, having spot ETFs is a good way for some portfolio managers to gain exposure who wouldn’t otherwise be able to,” Greenspan told Cointelegraph, adding:

“But having 11 of them is pretty ridiculous. There will have to be a consolidation and they all know it, which is why fees are on the floor.”

Some executives at spot Bitcoin ETF issuers believe that there’s no conflict between self-custody and spot Bitcoin ETFs. “Self-custody and an ETF are not mutually exclusive,” ARK Invest CEO Cathie Wood said during X Spaces on Jan. 10. She also noted that ARK’s Bitcoin ETF — which charges a fee of 0.21% — doesn’t aim to maximize profits.

“We are looking at Bitcoin as a public good. And one of the ways to do that is this low-fee product. We have other actively managed strategies where we can do more on the profitability side. That is not our objective here,” Wood stated.

… [Trackback]

[…] Here you will find 71839 more Information on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] There you will find 74058 more Info to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] There you can find 21436 more Info to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] There you can find 91421 additional Info on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Here you will find 57161 additional Information to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/news/bitcoin/3064/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/3064/ […]