Here’s why Bitcoin bulls are failing to shift the $42K BTC price range

Bitcoin is caught in a liquidity stalemate, and BTC price volatility catalysts are so far lacking, says new research.

Bitcoin (BTC) remains stuck below $43,000 this week as even institutional buying has little impact on markets.

Liquidity keeps Bitcoin bulls bound

Data from Cointelegraph Markets Pro and TradingView confirms that BTC price action is focused on a narrow range — for the seventh day in a row.

Since dropping 15% in two days last week after the launch of the first United States spot exchange-traded funds (ETFs), Bitcoin has underwhelmed traders.

While so far not delivering further downside, bulls likewise lack the momentum to bring BTC/USD back to even the top of its broader trading range with $48,000 as its ceiling.

Examining which hurdles lie in the way, however, trading resource Material Indicators flagged a key problem: too much liquidity around spot price.

“Liquidity Dampens Volatility,” it told subscribers on X (formerly Twitter) on Jan. 18, repeating a classic mantra.

“That is precisely why BITCOIN has been trading sideways with price pinned between $41.5k – $44k since Saturday.”

Material Indicators presented a heatmap of BTC/USDT order book liquidity on the largest global exchange, Binance, showing a haze of bid support between $42,000 and spot at around $42,500.

“On the weekly view of the binance order book we can see that another $10M+ in BTC bids has moved above $42k, but resistance above $43.5k has been strengthening,” it continued.

Since Bitcoin fell below $44,000, significant seller interest has appeared both there and at $45,000, the heatmap additionally confirmed.

Material Indicators concluded that there were no clear candidates for shaking up the market in the short term.

Analyst: “No wonder” BTC price came off highs

Various other theories for why Bitcoin is not reacting to the ETF launch with snap gains, meanwhile, continue to surface.

Related: Did a $5B Bitcoin whale sale spark the post-ETF BTC price crash?

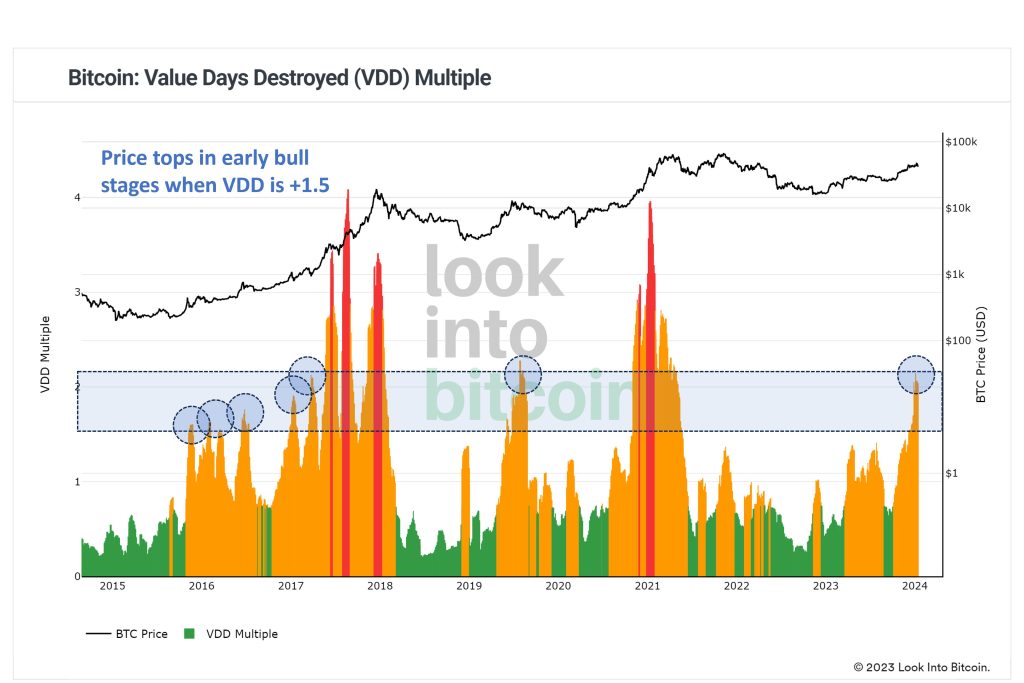

In his own X post on the day, Philip Swift, creator of statistics resource Look Into Bitcoin, flagged a classic signal on its Value Days Destroyed (VDD) Multiple metric.

VDD, which multiplies the existing Coin Days Destroyed metric by the current BTC price to compare spending velocity over time, typically marks a local top when it passes 1.5, Swift explaine.

“Value Days Destroyed Multiple reached frothy levels for this early stage of the cycle,” he wrote alongside a print of the indicator.

“No surprise that bitcoin price needed to cool down.”

As Cointelegraph reported, VDD suggested that Bitcoin was in an early-stage bull market in July last year.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] There you can find 55596 additional Information on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2959/ […]

cinemakick

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Here you can find 39144 additional Information to that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Here you can find 38208 additional Information on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Here you will find 39205 additional Info to that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] There you will find 48187 additional Info on that Topic: x.superex.com/news/bitcoin/2959/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2959/ […]