TrueUSD deploys new reserve audit system in attempt to recover dollar peg

TrueUSD’s price fell to $0.97 on Jan. 18 despite its efforts to assure users of its fiat reserves.

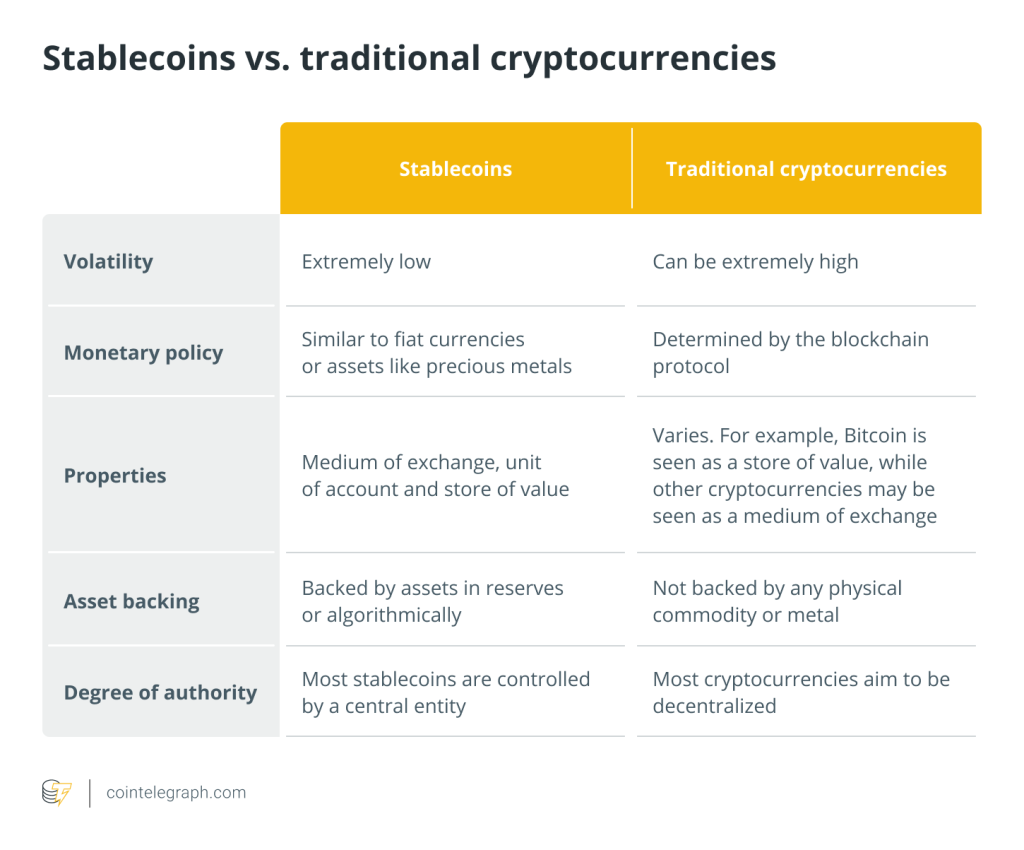

TrueUSD (TUSD), a stablecoin associated with Tron founder Justin Sun, has deployed daily attestation services from an accounting firm as it struggles to recover its dollar peg.

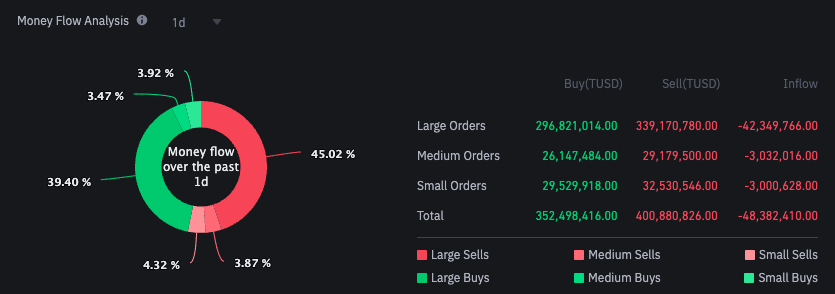

On Jan. 15, the TUSD stablecoin started to lose its dollar peg, dropping to $0.984 at 11:15 pm UTC. The depeg came as traders sold over $339 million in TUSD on the Binance exchange in 24 hours. This led to a total net outflow of $42.3 million in the exchange.

Users on X (formerly Twitter) have also speculated that the depeg may be related to the stablecoin not being included as an asset on the Manta (MANTA) launch pool initiative by Binance. In addition, reports saying that TUSD was struggling to post real-time attestations of its reserves also surfaced on social media on Jan. 10.

Big props to @binance for not supporting $TUSD in its latest pools.

Justin Sun’s scammy asset that he has mint keys for should never be treated as a first class stable asset.

A big step in cleaning up Binance for sake of the industry by @_RichardTeng.

— Adam Cochran (adamscochran.eth) (@adamscochran) January 15, 2024

Following the depeg event, the TrueUSD team announced that it had upgraded its fiat reserve audit system. The company employed the services of the accounting firm Moore Hong Kong to provide daily attestations of the stablecoin’s fiat reserves in addition to its current provider, The Network Firm.

With the new system, TrueUSD said that the report will include details on the reserve funds that are held by its financial partners. MooreHK executive Michelle Chu said that they will be collaborating with The Network Firm to allow TUSD users to monitor its reserves.

Related: Poloniex says hacker’s identity is confirmed, offers last bounty at $10M

Despite its efforts to deploy a new system for attesting its fiat reserves, the stablecoin’s price continued to drop. On Jan. 18, TUSD’s price went down to as low as $0.97, according to coin information tracker CoinMarketCap.

At the time of publication, TUSD’s price hovers at $0.99 on CoinMarketCap and Binance.

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] There you can find 91618 additional Info on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Here you will find 10362 additional Information on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] There you will find 94710 additional Info on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/blockchain/2939/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/blockchain/2939/ […]