Who is Brian Armstrong: Profile and biography

Who is Brian Armstrong?

Brian Armstrong is the founder and CEO of Coinbase, the largest cryptocurrency exchange in the United States. Often quoted as one of the most influential people in crypto, Brian Armstrong is credited with taking public the first crypto exchange in U.S. history. He has also played a significant role in accelerating mass adoption of cryptocurrencies, utilizing blockchain technology for financial services and advocating for a pro-cryptocurrency regulatory environment in the United States.

Brian Armstrong founded Coinbase, a centralized cryptocurrency exchange (CEX), in 2012, and it has grown to become one of the most prominent and widely used platforms for buying, selling and storing cryptocurrencies such as Bitcoin (BTC), Ether (ETH) and others.

Under Armstrong’s leadership, Coinbase has played a significant role in popularizing cryptocurrencies and making them more accessible to the public at large. The company has expanded its crypto and digital asset services, including the introduction of Coinbase Wallet and Coinbase Pro (formerly GDAX), a platform catering to more experienced cryptocurrency traders.

Coinbase became the first cryptocurrency platform in the U.S. to go public through a direct listing on the NASDAQ stock exchange in April 2021.

This article will explore Brian Armstrong’s entrepreneurial journey of creating America’s most popular CEX, Coinbase; his early life; leading Coinbase through many crypto market turbulences; his struggles with the Securities and Exchange Commission (SEC); and more.

Educational and professional background

Brian Armstrong was born on Jan. 25, 1983 near San Jose, California to engineer parents. He studied computer science and economics and earned a master’s degree in computer science from Rice University in 2006. He interned for IBM when he was a student at Rice and then went on to work in enterprise risk management for Deloitte & Touche.

During his time at Rice, he co-founded his first venture, UniversityTutor.com, in 2003. It was a website that connected parents, students and independent instructors worldwide. Brian Armstrong served as CEO of UniversityTutor.com until 2012. Johnson Educational Technologies LLC acquired the business in 2014.

As a serial entrepreneur, he then co-founded GiveCrypto, a philanthropic platform that aims to provide cryptocurrency to the underprivileged and improve financial inclusion. Brian Armstrong honed his entrepreneurial skills while working alongside his regular job as a developer, consultant and in other roles with firms including Airbnb, IBM and Deloitte.

In 2012, Armstrong quit his job at Airbnb and co-founded Coinbase with Fred Ehrsam, bringing crypto trading access to millions of Americans and global crypto enthusiasts.

Continuing his entrepreneurial journey, Brian Armstrong will be recognized in 2023 as the co-founder of NewLimit, a bioengineering startup specializing in the field of epigenetic cell reprogramming.

How was Coinbase founded by Brian Armstrong?

Armstrong applied for Y Combinator incubation but was told to find a co-founder to proceed and had only three days to find one. He posted on Hacker News for a co-founder explaining his mission, which went viral and garnered massive interest on Reddit as well.

This is when Armstrong met Ehrsam, a Goldman Sachs trader, on a subreddit where Armstrong often posted his views on crypto, and they shared a bullish view on Bitcoin and the cryptocurrency space as a whole. The duo joined hands and obtained a $150,000 funding infusion from the startup incubator program at Y Combinator.

Ben Reeves, a British programmer and co-founder of Blockchain.com, was initially also interested and was in discussions to be a member of the Coinbase founding team. However, Reeves and Armstrong split up soon before the Y Combinator funding due to their divergent opinions on how Coinbase Wallet should function.

Coinbase launched out of a two-bedroom shared apartment by introducing its services for buying and selling BTC using bank transfers in October 2012.

Coinbase funding and valuation

Armstrong and Ehram started raising funds to build Coinbase and, in May 2013, raised a $5 million Series A investment from New-York based venture capital firm Union Square Ventures, with Fred Wilson serving as the lead investor.

Wilson, co-founder of Union Square Ventures, is well known for his earlier investments in successful companies including Twitter, Tumblr, Zynga, Foursquare, Etsy and more.

In December 2013, Coinbase raised another $25 million from Andreessen Horowitz, Ribbit Capital and other investors. Presently, Coinbase has 76 investors and has raised a total of $498.7 million in funding over 18 rounds. Ehrsam left the company in 2017 with a 6% stake but still serves on the board of directors and was part of the company’s audit committee before its April 2021 public offering.

Coinbase, under Brian Armstrong’s leadership, has been active in investing in other companies and has made 23 investments. The most recent investment was on Feb. 15, 2023 in crypto market index fund Alongside, which raised $11 million total in the round.

On April 14, 2021, Coinbase went public via a direct stock listing and was listed on the NASDAQ as COIN. Coinbase opened at $381 per share, valuing the company at $99.6 billion, and briefly touched a market capitalization of $100 billion, which was 10 times higher than Coinbase’s last private valuation. The valuation rivaled the likes of Facebook and Airbnb when they went public.

Brian Armstrong owns 19% of Coinbase shares. According to Forbes, as of May 2022, Armstrong’s net worth hovers close to $2.4 billion, making him a crypto billionaire American CEO.

Coinbase growth trajectory under Brian Armstrong’s leadership

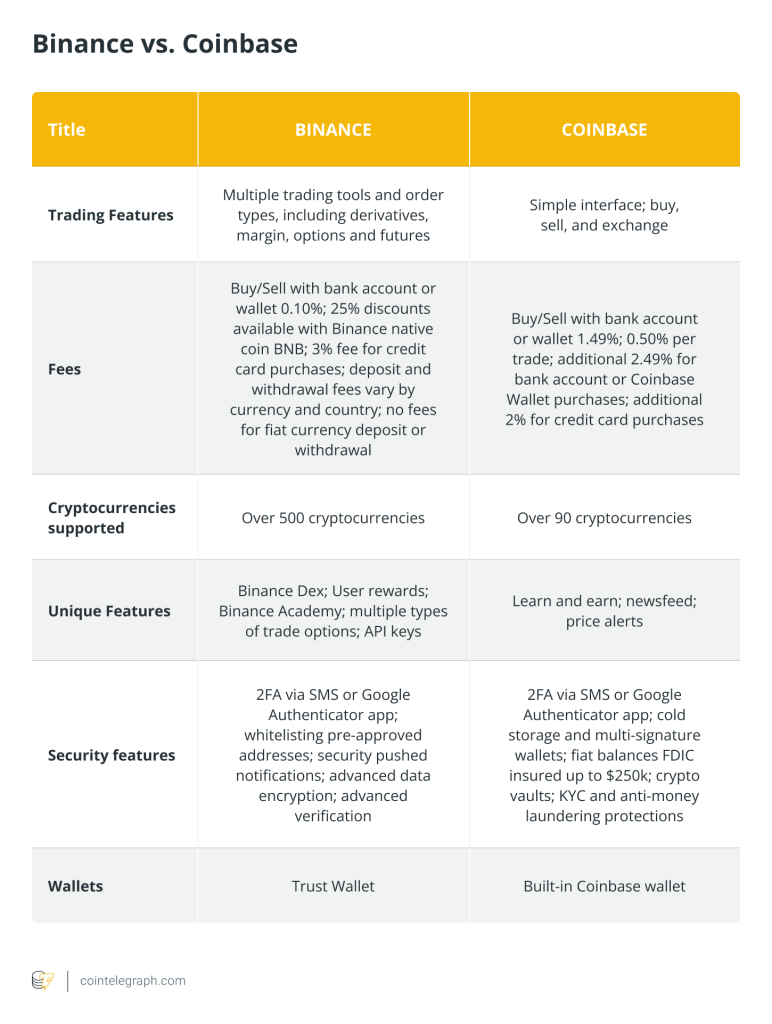

From a simple platform for buying and selling Bitcoin, Coinbase grew in scale and now operates in over 100 countries, providing a range of products catering to retail traders, institutional investors, developers and businesses in the cryptocurrency market. Its product offerings can be divided into three primary lines of business designed for:

Retail traders

Coinbase offers its app for purchasing, storing and trading various cryptocurrencies, and it has the Coinbase Wallet for enabling access to decentralized cryptocurrency applications (DApps). These have accelerated mass adoption due to their ease of use. Additionally, Coinbase Pro, launched in 2015, serves as a crypto exchange for high-volume professional crypto traders with advanced charting and trading options, giving superior control over trading.

Institutional investors

A trading platform called Coinbase Prime offers multiple exchanges, financing options and secure storage for the custody of digital assets using Coinbase Custody services. It was created specifically for institutional customers and corporate entities.

Developers

Coinbase Cloud helps DApp developers by providing them with fiat-to-crypto and wallet software development kits and wallet infrastructure APIs to create their DApps for accepting payments in digital currencies.

Brian Armstrong: Approach, thoughts and views

While individual beliefs can evolve, insights from Brian Armstrong’s interviews, public statements or articles reveal the following insights:

Cryptocurrency and financial system

“I wanted the world to have a global, open financial system that drove innovation and freedom.” — Brian Armstrong

Coinbase’s trajectory has followed the bulls and bears of the broader crypto world and has sailed steadily under Armstrong’s leadership. He often shares his views and opinions on Coinbase and cryptocurrencies through his Medium blogs published under his profile and under the banner of “The Coinbase Blog.”

Brian Armstrong was quoted as saying, “Coinbase’s mission is to increase economic freedom in the world.” He has aimed to do this by promoting crypto assets as an investment vehicle, creating a new financial system parallel to traditional finance and providing an app platform to fulfill this purpose.

Employees and work practice

Olaf Carlson-Wee, a Vassar College alum, was the company’s first employee in 2013. From a two-employee company out of a shared apartment, Coinbase grew rapidly under Brian Armstrong as CEO and employed over 1,000 employees within the first two years of its operations.

However, by 2017, the world assumed crypto was almost dead amid Bitcoin’s price crash, as it lost more than a third of its value and wiped out billions from the market. As a result, many Coinbase employees left.

Coinbase was initially headquartered in San Francisco, California, but during the Covid-19 pandemic, Brian Armstrong announced that Coinbase would be a full-remote organization and would no longer recognize a formal headquarters.

According to a December 2018 report by The New York Times, Coinbase paid its black and female workforce less compared to their white and male counterparts in similar roles.

However, the chief people officer of Coinbase announced in a blog post in May 2021 that the company would be removing salary and equity negotiations from the hiring process.

Brian Armstrong has been vocal about his commitment to creating an open and inclusive work environment, supporting employee autonomy and focusing on the company’s mission to enable economic freedom through cryptocurrencies.

Advertising

Coinbase emerged as a frontrunner in the industry, sustaining many booms, dips, crypto winters and bull runs while not just continuing to sustain but also expanding its extensive user base. Coinbase’s promotional and marketing strategies have often been unrivaled in the landscape of cryptocurrency services.

At the peak of the NFT boom in 2021, Coinbase planned a giveaway from one of the most valuable NFT collections, Bored Ape Yacht Club. During the 2022 Super Bowl, Coinbase unveiled a captivating commercial that showcased a dynamically bouncing QR code.

Upon scanning, people were directed to Coinbase’s promotional website, where they were offered $15 worth of Bitcoin just for creating an account with Coinbase. The influx of customers was so high that the Coinbase site crashed briefly.

Regulatory environment

Brian Armstrong has been a vocal advocate of crypto regulation to help drive economic growth and consumer protection. He has often emphasized the importance of regulatory clarity and a balanced approach to government oversight to foster innovation in the cryptocurrency industry.

However, the relationship between Coinbase and the SEC has been characterized by a notable level of turbulence and uncertainty.

In March 2023, the SEC issued a warning to Coinbase, indicating the potential for charges. Before this, the SEC had warned that Coinbase and other crypto exchanges had been disregarding securities laws by asserting that cryptocurrencies were not classified as securities, thereby asserting that registration as a broker was unnecessary.

Brian Armstrong had issued his clarification to the SEC multiple times and in public forums. However, on June 6, 2023, the SEC sued Coinbase, asserting that the company engaged in the trading of at least 13 cryptocurrency assets that qualify as securities and should have been registered accordingly.

Those assets included Solana (SOL), Cardano (ADA) and Polygon (MATIC), among others. Furthermore, the SEC stated that Coinbase was operating as an unregistered exchange, broker and clearing house.

The future of Coinbase amid the SEC’s allegations

The charges and lawsuit brought by the SEC have raised worries about the future of Coinbase. The outcome of the lawsuit might potentially affect Coinbase’s capacity to operate and extend its services within the U.S. (and internationally). An unfavorable outcome may result in large fines, penalties or even limits on its operations, harming its growth and reputation.

However, Coinbase has a history of handling regulatory difficulties successfully. The company has exhibited a commitment to compliance and has established strong partnerships with regulatory bodies. Nonetheless, the future of Coinbase depends on the outcome of the SEC’s charges.

Ultimately, the company’s ability to properly manage regulatory concerns, protect its reputation and adapt to shifting legislation will be essential in deciding its long-term viability and location within the dynamic crypto ecosystem.

Written by Shailey Singh

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] There you can find 7671 additional Information to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Here you can find 54168 additional Info to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] There you can find 88095 additional Info to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] There you will find 40743 additional Information on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Here you can find 79048 more Info to that Topic: x.superex.com/academys/beginner/2933/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2933/ […]