Bitcoin vs. satoshi: Key differences explained

What is a satoshi?

There is some confusion surrounding the term “Satoshi Nakamoto,” who is the creator of Bitcoin. Some people believe that Satoshi is one individual, while others think it may be a group of individuals. The truth remains unknown, but here are some possible definite answers about the term satoshi when used in the context of Bitcoin (BTC).

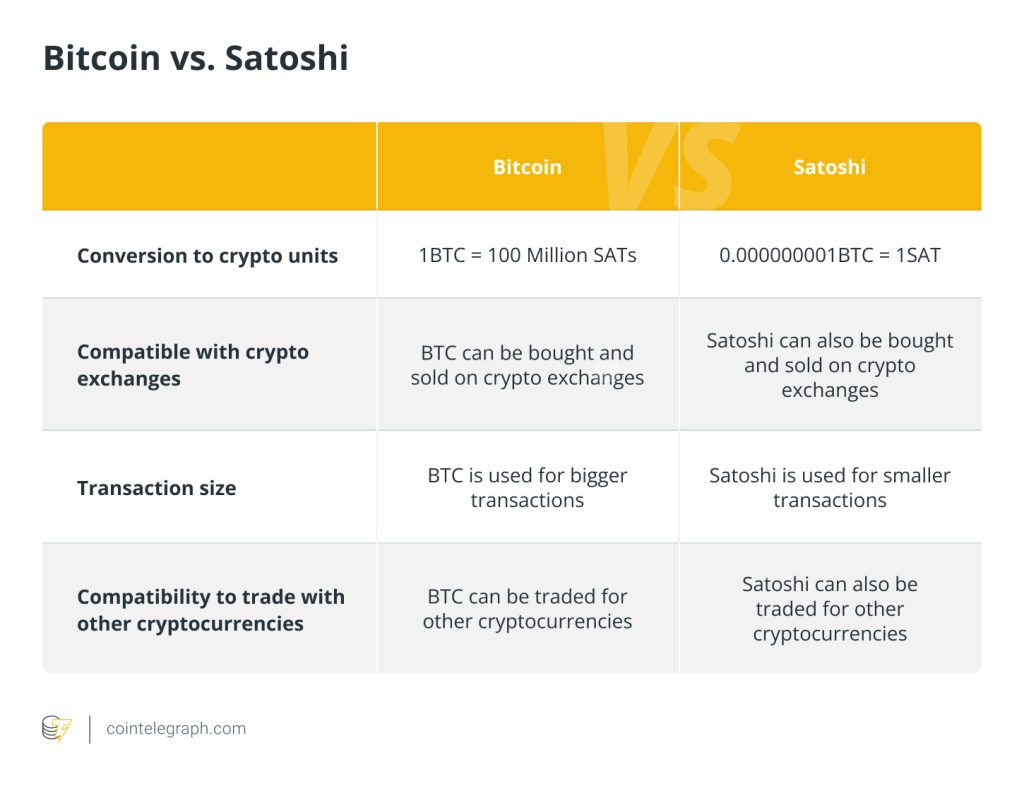

Bitcoin is the world’s first cryptocurrency and a satoshi, or sat, is the smallest unit of BTC. A satoshi-to-Bitcoin conversion equates to 1 sat to 0.00000001 BTC. It is not just a unit of BTC but also a tribute to the anonymous Bitcoin founder and creator, Satoshi Nakamoto.

A satoshi is 100 millionth of a BTC. Satoshis are relevant because BTC has increased in value exponentially; therefore, smaller denominations are needed for microtransactions. Furthermore, these small denominations make prospective investors purchase Bitcoin worth $1 rather than having to invest in 1 BTC. That said, when people refer to “buying Bitcoin,” they are actually buying units of BTC, or sats. When someone talks about amounts less than 1 whole Bitcoin, they represent it using a term called satoshi.

While satoshis are used to simplify BTC transactions, there’s a lot of confusion surrounding the term “satoshi.” Is it real Bitcoin? What is its value? And how do you calculate sats? In this article, we will clear up these questions and, more importantly, understand the difference between a satoshi and BTC.

Bitcoin measurement units

BTC measurement units are essential to increasing mainstream adoption of the crypto industry. For different tiers of transactions, different levels of currency measurement are also necessary. Cryptocurrencies can become a handy payment method for daily expenses if measurement units are categorized accordingly.

BTC is already divided into four measurement units:

- 1 BTC = 1,000 miliBitcoin (mBTC): It represents an amount of 0.001 BTC (one-thousandth of a Bitcoin) or 100,000 satoshis (100,000 sats).

- 1 BTC = 1,000,000 microBitcoin (μBTC): It is pronounced as “you-bit” and is equal to 0.000001 BTC (one-millionth of a Bitcoin) or 100 satoshis (100 sats).

- 1 BTC = 100 million sats: It represents 100 millionths of 1 BTC. 1 sat is equal to 0.000000001BTC

- 1 BTC = 100 billion millisatoshis: This is Bitcoin’s smallest unit. The millisatoshi unit is only used on the Lightning Network. 1 msat amounts to 0.00000000001 (100 billionth of a Bitcoin) or 0.001 satoshis (one-thousandth of a sat).

How to use satoshis?

Investors can buy satoshis on any platform that sells BTC. The only difference between using BTC and satoshis is the calculation. In order to use satoshis, the first step is to buy a fraction of a Bitcoin.

This is similar to how investors purchase any other type of cryptocurrency — by buying a portion of it with fiat currency. Now, when an investor has bought a fraction of BTC, they can refer to this purchase using either term, BTC or satoshis. The only difference will lie in the calculation of the sum bought.

Nevertheless, the term satoshi is just another way of referring to Bitcoin. There isn’t a huge difference between them other than which term people involved in transactions prefer. Merchants could provide prices in Bitcoin or satoshis, and customers could also refer to the transactions with either term.

Just as people use cents to measure payments worth less than a dollar, satoshis are used for payments that value less than one Bitcoin. For instance, to pay for food in Bitcoin, it will be easier to use satoshi units to calculate the total amount owed.

That said, if someone wants to pay for pizza at an outlet that accepts BTC, it will be easier to use satoshis to calculate the amount. Assuming the pizza is worth $10, and 1 BTC is worth $17,000, the pizza merchant may either ask the customer to pay 0.000059 BTC or 59,368.93 sats.

Additionally, crypto gift card portals like Bitrefill also offer a sats-back customer rewards program. Bitrefill account holders have the opportunity to earn a minimum of 1% of the total purchasing price back in satoshis. Customers can redeem these rewards every time they use Bitrefill to purchase gift cards and mobile refills.

Customers may accumulate and use their satoshi reward toward future purchases. These include using the collected sats to purchase gift cards and mobile refills directly with a rewards balance. Furthermore, the sats can also be combined with the users’ existing BTC or USD/EUR balance to purchase gift cards or mobile refills.

How to use a satoshi converter?

A satoshi BTC/USD converter is a handy tool to have when users want to quickly and easily exchange Bitcoin or Ether (ETH) for other currencies. These tools allow investors to enter the amount of BTC, ETH or any other cryptocurrency that they may want to convert into dollars or euros, and the calculator provides an approximate conversion rate.

There is a number of satoshi BTC/USD converters available online, so it can be hard to decide which one to use. Here are a few considerations while using a crypto converter:

- Choose a converter that has been tested and is known to be reliable.

- Based on users’ requirements, they can choose if they want a paid or unpaid version of the converter.

- In order to choose the right version, users may consider certain features of the converter. These include support for multiple currencies, live updates and a history of conversion rates.

- Make sure the converter has a user-friendly interface. This can be ascertained by looking out for things like clearly labeled buttons, concisely located features on the same page, etc.

There are several websites that offer both paid and unpaid versions of currency converters. While popular crypto exchanges like Kraken, Coinbase and Crypto.com have these options, there are platforms that are solely dedicated to satoshi conversions, such as 99Bitcoins and Walletinvestor.

Pros and sons of satoshis

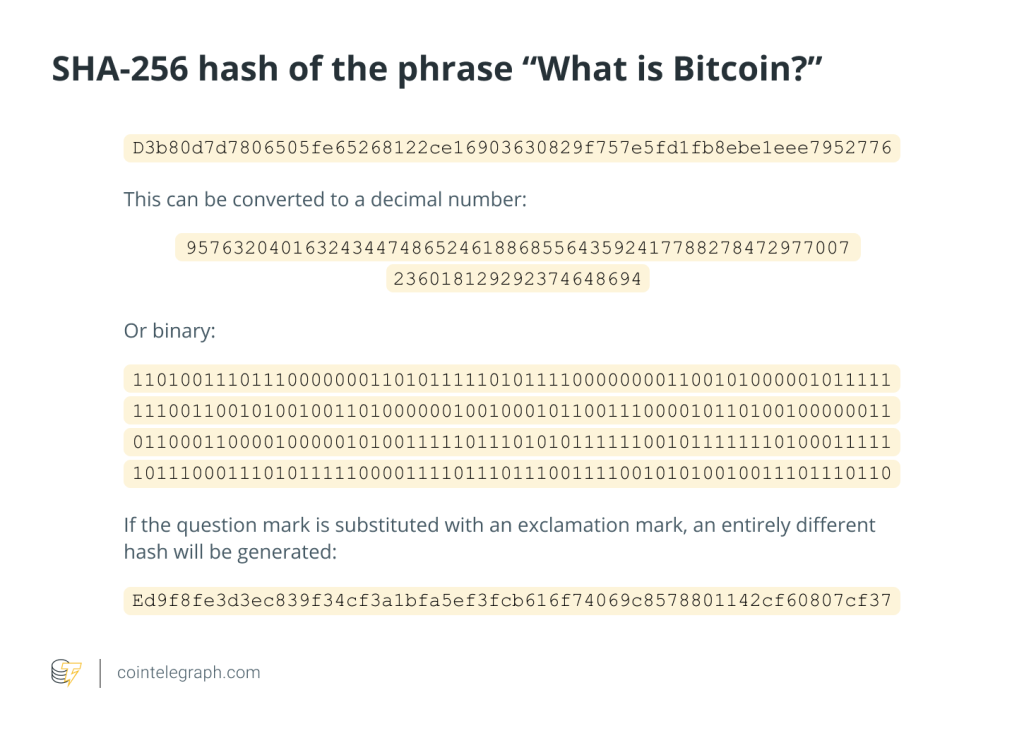

Satoshis were created in 2014, and as stated earlier, they are just smaller units of Bitcoin and use the same SHA-256 hashing algorithm as BTC. While a satoshi is a measuring unit for BTC, there are certain pros and cons associated with using it.

Pros of using satoshis:

- They are relatively easy to trade and transfer. In light of this, satoshis are an efficient way of using BTC for daily expenses.

- Satoshis are also used to pay Bitcoin transaction’s mining fee, which is necessary to ensure that the transaction is processed within a reasonable timeframe.

Cons of using satoshis:

- The biggest disadvantage is that satoshis can be a confusing concept for those not familiar with cryptocurrency.

- Since satoshis are units of BTC, they are also prone to high volatility. This makes their most prominent use case of a medium of exchange for daily expenses difficult to understand.

What does it mean to stack sats?

“Stacking” is used in the crypto industry to describe the practice of buying and holding cryptocurrencies in order to increase the chances of making a profit. When investors stack, they are accumulating cryptocurrencies not just for their current value but also for the future potential they have as well.

“Stacking sats” denotes the practice of regularly accumulating small amounts of Bitcoin over extended time frames by buying, earning or mining BTC. It began as a trend by the crypto community on Twitter; however, it later turned into an investment practice. Stacking sats was first tweeted on Dec. 20, 2017, by a community and took off from there.

In 2019, the movement became considerably prominent when Bitcoin advocate Matt Odell tweeted about staking sats. He highlighted the limited supply of BTC and encouraged his followers to keep accumulating amid the crypto winter.

He added that given Bitcoin’s supply cap of 21 million, the world will look back at 2019 and be “blown away” by how cheap the cryptocurrency was. Furthermore, former Twitter CEO Jack Dorsey also joined the trend and tweeted a snapshot of buying small units of BTC with the caption “stackingsats.”

The future of satoshis

The dominant cryptocurrency Bitcoin encompasses two major use cases — a store of value and a medium of exchange. While users can buy BTC to store as a long-term investment, using BTC to pay for routine expenses may seem tricky.

This is because of the asset’s volatility along with BTC’s high price. In light of this, to enable the mainstream adoption of cryptocurrencies, satoshis come into play. Sats streamline Bitcoin’s thousands of dollars worth of value into smaller units, allowing users to pay with BTC for daily expenses.

Therefore, the future of sats sits within the hands of both these use cases. If retail users can incorporate sats into daily payments along with the concept of stacking it as a long-term investment, the measuring unit of Bitcoin may just drive its adoption. Especially during a bear market, the small investment into BTC using sats for measurement could help create a hefty portfolio during the next bull run. However, as a cautionary practice, users must conduct due diligence before making any investments.

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Here you will find 40673 additional Info to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] There you can find 76450 additional Info to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] There you will find 16993 additional Information on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Here you will find 64931 additional Info to that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2842/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2842/ […]