STO 101: A beginner’s guide on launching a security token offering

What is a security token?

A security token usually represents a stake in an asset or external enterprise. Technically, a token is categorized as a security token when subjected to rules and regulations under federal law and deriving its value from external tradable assets or enterprises.

Governments or businesses can issue security tokens. As such, these tokens serve similar purposes as stocks or bonds. Security tokens are different from utility tokens, for example, because they represent the right of ownership to an asset.

Simply put, they are liquid contracts in digital format that represent shares in valuable assets like corporate stock, real estate, or a vehicle. By using security tokens, ownership stakes are preserved on a public ledger (blockchain).

By tokenizing securities, startups launching initial coin offerings (ICOs) and initial exchange offerings (IEOs) can improve their asset liquidity and attract more investors. There are other benefits, too, like lower issuance fees, high market efficiency, fractional ownership and improved access to real-world assets that are digitized.

Uses of security tokens

Startups and companies wishing to distribute shares to their investors can now do so in the form of security tokens.

Because security tokens are issued on blockchains, they are also transparent, divisible, quick to settle and have no downtime whatsoever.

Transparent

Public ledgers allow for transparency of transactions despite participant anonymity. As such, everything can be accessed on the public ledger and audited at any time. Smart contracts that manage tokens, as well as holdings and issuances, can be viewed by anyone.

Divisible

Extremely valuable assets like art and real estate can be offered to investors who find the tokenized scheme more appealing and affordable. For example, a sculpture worth $8 million can be tokenized into 8,000 pieces and then sold at $1,000 a piece. Tokenizing assets increases accessibility by making them divisible.

Quick to settle

Settlement and clearing usually take a long time when transferring assets. On a blockchain, however, processes are automated. This means that reassigning ownership can be done almost instantly.

No downtime

Financial markets typically have a fixed period for doing business. They’re usually open on weekdays and closed on weekends. Digital asset markets, however, have no downtime and can offer access 24/7.

Types of security tokens

Below, we briefly explain the various types of security tokens available on the market:

Equity tokens

An equity token represents ownership of an underlying asset such as company stock. An equity token holder may be entitled to dividends, voting rights, or both. Similar to shares, a contract dictates the applicable terms and conditions of such.

Debt tokens

Debt tokens are tokens that accrue interest. They are equivalent to the interest rate or short-term loan on the amount loaned to a person or company. They represent the debt owed by the token holder. There are two types of debt tokens: stable debt tokens that represent a debt with a stable interest rate and variable debt tokens represent a debt with a variable interest rate.

Asset-backed tokens

Tokens built on the blockchain and considered real-world assets are called asset-backed tokens. These assets can be anything from real estate to company shares, commodities, or even diamonds. They give users ownership rights over valuable tangible or intangible objects, and in digital form.

Utility tokens

A utility token helps companies, startups and project development groups raise funds and capital to develop blockchain projects. These tokens can be used later on to purchase goods or services from the cryptocurrency’s issuer.

What is a security token offering or STO?

In a security token offering, or STO, security tokens are sold in security token exchanges. STOs are a type of public offering that facilitates the trading of financial assets via tokenized digital securities. Token transactions are stored and validated through a public ledger or blockchain.

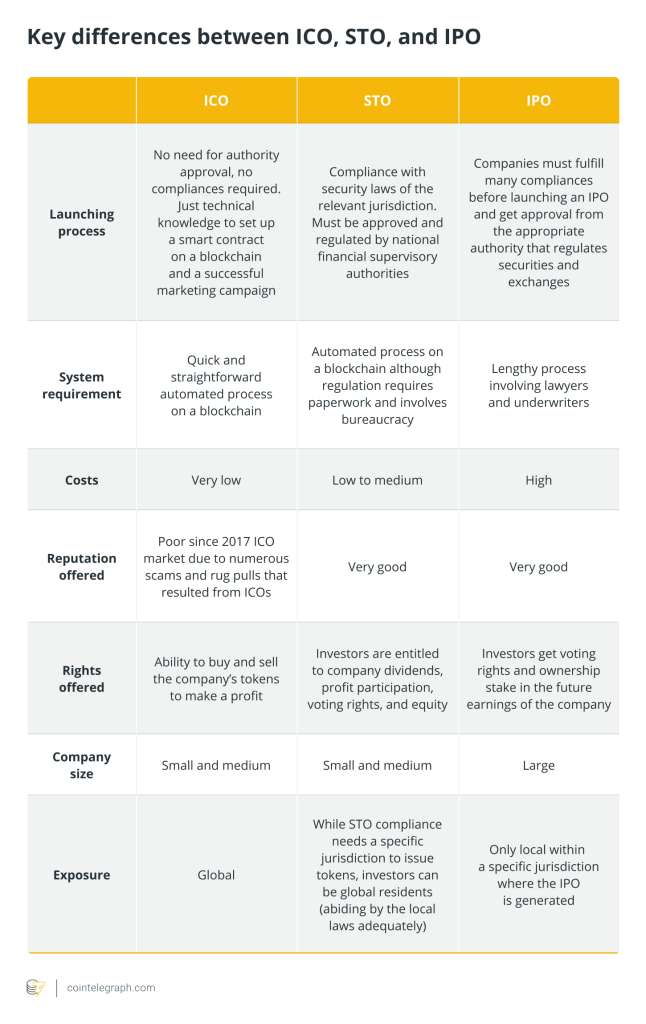

STOs are considered to be a more secure alternative to initial coin offerings that are susceptible to fraud. Since tokens are classified as securities, STOs are also subject to rules and regulations, offering token holders safe and legitimate investment opportunities.

For context, ICOs were all the rage in 2017, as they became a popular method for fundraising crypto projects. ICOs allowed startups to raise capital while providing investors with coins or tokens in return. However, ICOs were not subject to regulations and were thus vulnerable to scams, fraudulent crowd sales and airdrops.

How does an STO work?

Similar to ICOs, security tokens allow startups to raise capital for crypto projects and new business ventures. The difficulties and limitations associated with securing funding through traditional venture capitalists made other ways of sourcing capital like STOs quickly popular. STOs are legal and regulated, making them a safe way for companies to acquire much-needed funding.

Another function of security tokens is crypto-fractionalization, where existing assets in the real world are secured via tokenization or securitization. Global real estate assets are worth approximately $326.5 trillion in total while the world’s total market capitalization is estimated at $91 trillion, and technically, these assets can be tokenized.

Tokenization facilitates easier trading of securities, not to mention the lower cost of administration. Paperwork will likewise be significantly reduced or eliminated once securitization is adopted in equity markets.

Security tokens typically represent the following security assets:

-

Real estate: Similar to real estate investment trusts (REITs), real estate equity can also be converted into security tokens.

-

Capital markets: Organizations can tokenize their shares, offering token holders the benefit of voting rights, earning dividends, or both.

-

Commodities: Commodities can likewise be split into tokens that can later be offered during an STO.

-

Equity Funds: Equity funds can also tokenize their shares, with token holders entitled to a portion of the equity fund’s earned profits.

It’s important to note that security token offerings technically offer the same securities available on traditional investment platforms. Tokenization does not in any way change these underlying securities. Rather, STOs just provide a new way of approaching investments.

Factors to consider before launching an STO

Here are some things to consider before launching an STO:

What is being tokenized?

As we’ve mentioned before, security tokens represent a variety of assets and interests like physical assets, equity interest, or debt, among others. As such, the type of asset being tokenized will not only require various legal attachments but will also hold varying levels of appeal among investors. Hence, it’s important to consider the type of interest before launching an STO.

The jurisdiction of the token

A token’s area of incorporation has a significant impact on its STO structure. As such, the right jurisdiction has to be taken into consideration, depending on the following:

-

The physical asset’s location

-

Security regulations and other laws specific to the area

-

The classification of the interest being tokenized

-

The founders’ countries of origin, for tax purposes

-

Marketing strategy and efforts that will work in said location

A proper corporate structure and governance

This is a very important consideration before launching an STO. For example, if the tokens resemble traditional equity securities, their issuance should also be authorized in the issuer’s corporate documents.

Other limitations and rules might apply, as mandated by the law. The number of token holders, for instance, might be subject to limitations. In the United States, most tokenized securities are limited to 99 investors residing in the U.S.

AML, KYC

A majority of the countries today have Anti-Money Laundering (AML) Know Your Customer (KYC) requirements. These apply to financial businesses including issuers of security tokens. AML and KYC stand to ensure that the investment money was acquired legally.

Tokenization platform

Various online tokenization platforms are available, like Securitize, Tokensoft and Token IQ, among others. It’s important to consider which platform to use, as each one has a different approach. You’ll also want to look into the partnering price and support post-launch, as well as the percentage of commission on the funds raised.

Some things to check before committing to a platform are its track record of launching tokens successfully, whether or not it provides resources for KYC and AML checks and how it handles secondary trading.

How to launch an STO

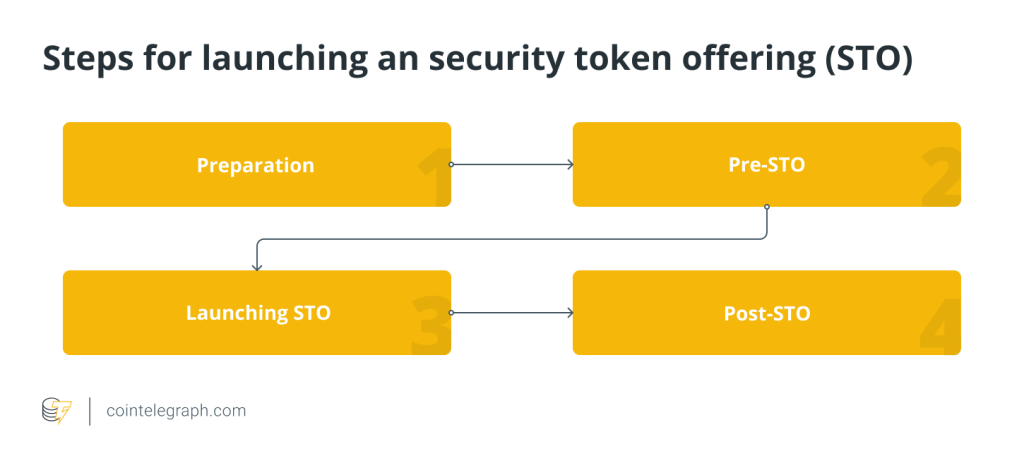

Phase 1: Preparation

Before launching an STO, you need to have a solid foolproof idea to engage potential investors. During this step, it’s best to take legal advice to sort out regulations and consult experts on how the token can gain value.

Generally, a token’s value is decided based on its role, purpose and feature. The role that you define for your token will generate a corresponding purpose. In turn, its features can be decided and tailored to fit business goals.

It’s important to sort these things out and fine-tune the details before you dive into launching your STO.

Phase 2: Pre-STO

Remember that even before launching your STO, you should already have introduced it to the market. This is where your marketing strategy will come into play. You also have to maximize crypto community forums and websites that list STOs and ICOs. Make sure to get the right information out there, such as:

-

Your white paper

-

Token structure

-

Your team’s credentials

-

Milestones

It would be best if you also choose a credible cryptocurrency exchange as your partner. Choose one that practices high levels of due diligence, as this will eliminate fraudsters from the mix and save you a lot of time and grief down the line. Ensure that the exchange likewise allows investors to comply with KYC and AML regulations in their country.

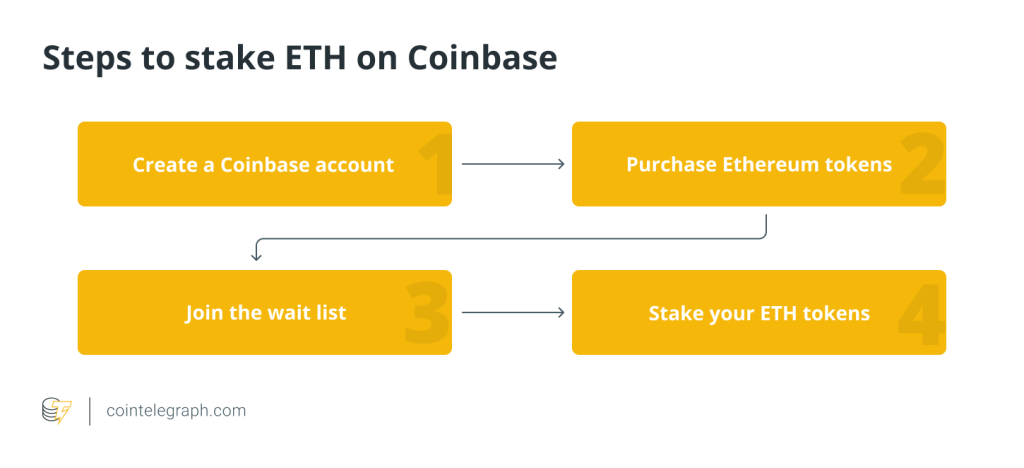

The collateral assets for security tokens must also have custodians. Typically, third parties that have Special Purpose Vehicles or Trust Companies can do this. Popular custodian organizations include Coinbase and Prime Trust, among others.

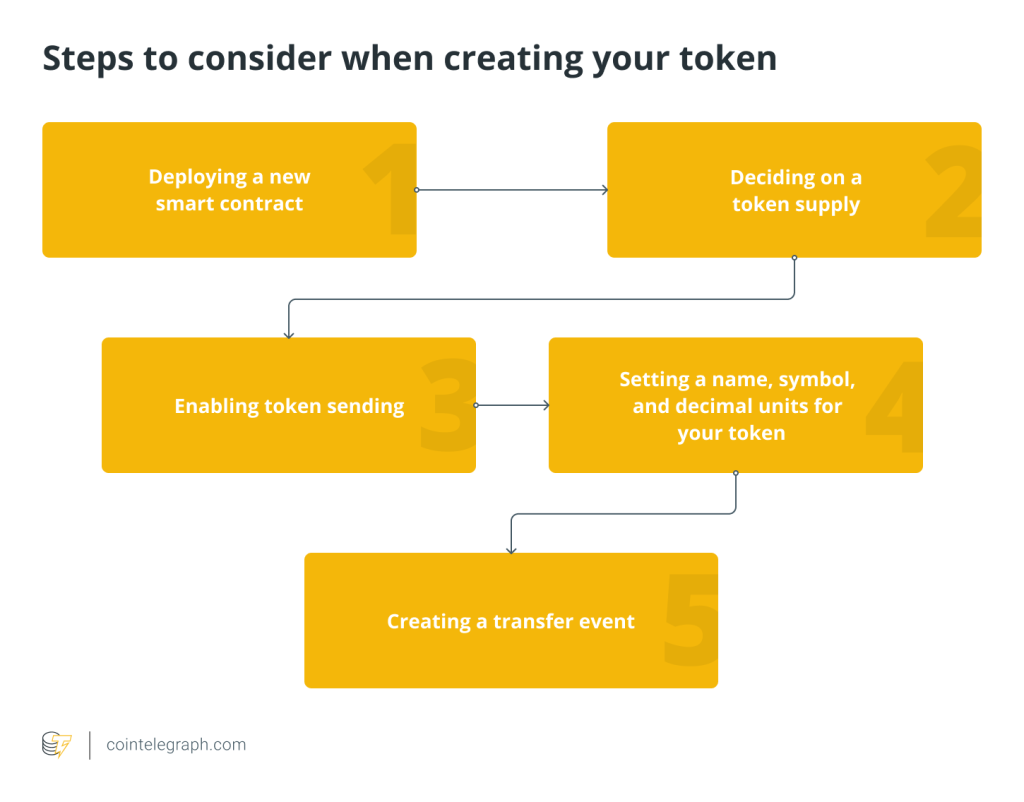

After ironing out these details, you can now proceed to token creation and marketing your STO. The token creation process will largely be dictated by the platform you choose, so make sure you have already researched a platform thoroughly.

Phase 3: Launching STO

The next phase in the security token offering process involves running a crowd sale, the most crucial part of an STO project. This is where your company will finally sell your tokens to the general public so that you can raise funds.

Now is the time to publish the selling portion of your website. Ensure that the section and buttons for token sales are highlighted on your site and easily accessible. From here, investors can register and go through KYC and AML checks and purchase tokens. You can also enlist the help of STO launch services in this step.

Ensure that your community support services are in place to offer timely assistance to investors as well. Your support team should be available to help investors and answer queries on crypto forums and social media platforms. Promptly responding to inquiries is crucial, as it can spell the difference between a fulfilled token sale and a missed one.

Have a hotline or ticket submission portal on your website so that clients can submit their queries or reach out to you whenever they need help with an issue.

Phase 4: Post-STO

Once the crowd sale is completed, it’s time to build your product. Now is the time to build an application on the blockchain. Ensure that your app is user-friendly, robust and, most importantly, secure.

It’s crucial to ensure that the product you build will support your newly-launched security token. During this stage, it’s important to hire developers with expertise in blockchain app development and STO development.

While you are building your product, you should also keep your investors updated. They will want to know that the business plan is being executed as intended and meets their expectations and needs.

After you have built your product and launched it to the public, the last thing to put in place is technical support to ensure that all issues raised by customers are addressed promptly and properly. Tech support should be available 24/7 via chat, social media, your website and other platforms that your customers use.

Advantages of STO

STOs are deemed more secure and carry lower risk compared to an ICO. This is because laws are heavily enforced on STOs. Since security tokens are also technically pegged to a real-world asset, it’s easier for a potential investor to assess whether it is priced fairly or not, compared to current market value.

STOs are also more cost-effective than, say, initial public offerings, or IPOs. Through the use of smart contracts, there’s no need for expensive legal counsel. Meanwhile, the blockchain also eliminates traditional paperwork and dependencies, reducing processing time drastically.

Furthermore, STOs open up the market to beginner investors who may not have access to investment opportunities if not for crypto-fractionalization. Trading can also be done 24/7, providing investors with both convenience and liquidity.

Disadvantages of STO

One of the advantages of STOs can also be considered one of its biggest challenges: regulation. STO platforms are subjected to increased regulation that makes processes more complicated on the administrative side. STO platforms have to constantly keep up with changing regulations concerning AML, KYC, exchange approvals, tracking ownership and the like to ensure compliance with existing laws.

Regulations in certain areas might also limit who can invest in STOs (e.g., as residents only or citizens only), thereby reducing the pool of investors and lowering investment opportunities for investors.

… [Trackback]

[…] There you can find 88880 more Information on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] There you can find 6481 additional Information to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Here you will find 65975 additional Information on that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2816/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2816/ […]