US GAO recommendations to SEC before spot Bitcoin ETF approval revealed

In its assessment, the GAO found that although the SEC has a dedicated wing toward emerging technologies, it’s not well equipped to deal with the current challenges and needs specific improvements.

The United States Government Accountability Office (GAO) recommended three key execution plans to the Securities and Exchange Commission (SEC) before its spot Bitcoin (BTC) exchange-traded fund (ETF) approval on Jan. 10. The recommendations were focused on workforce management for the digital asset market and how the regulator would deal with the nascent industry in the coming years.

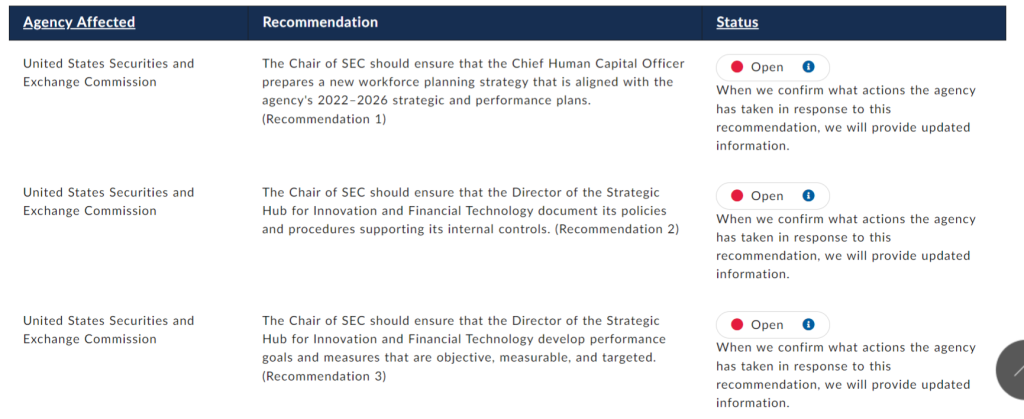

The GAO recommendations were put forward to the SEC on Dec. 15 and made public on Jan. 16. The GAO report recommends that the SEC prepare a new workforce plan, document policies and procedures for its Strategic Hub for Innovation and Financial Technology (FinHub) internal controls, as well as developing performance goals and measures for the hub.

GAO is an independent, nonpartisan audit institution of the U.S. federal government within the legislative branch that offers auditing, evaluative and investigative services for the U.S. Congress.

In assessing the SEC and its ability to deal with the rising crypto market, the GAO found that the agency employs 116 people who work primarily on matters related to crypto assets. However, the SEC has not prepared a new workforce planning strategy to update its fiscal years 2019–2022 strategy. GAO recommended that doing so would better position the SEC to meet its future workforce needs and to carry out its oversight and policymaking duties related to crypto assets.

GAO also found that the SEC’s FinHub helps coordinate SEC oversight of emerging technology but does not have documented policies, procedures, or performance goals. While FinHub has operating processes in place, such as meeting with market participants, it has not established policies and procedures to support internal controls.

Related: SEC did not ‘approve or endorse Bitcoin’ with spot BTC ETF nod — Gary Gensler

Following the assessment, the GAO made three recommendations:

1. The SEC chief should ensure that the chief human capital officer prepares a new workforce planning strategy aligned with the agency’s 2022–2026 strategic and performance plans.

2. The SEC chief should ensure the FinHub director documents the policies and procedures supporting its internal controls.

3. The chair of the SEC should ensure that the FinHub director develops performance goals and measures that are objective, measurable and targeted.

The GAO has also put a live status section against each recommendation to indicate whether the SEC has taken appropriate action on the recommendations.

In a historical judgment, the SEC approved 11 spot Bitcoin ETF applications on Jan. 10. The internal document shared by the SEC revealed the proposal received three votes in favor and two against. To many people’s surprise, SEC chief Gary Gensler cast the deciding vote to approve the first spot BTC ETFs in the U.S. after nearly a decade of rejections.

Gold bug and a known Bitcoin critic, Peter Schiff, said that the SEC chief was backed into a corner on spot Bitcoin ETF approval. At the same time, he warned Gensler may “soon introduce new onerous crypto regulations that will substantially increase the cost of Bitcoin transactions, further undermining its ‘use’ case, resulting in a sharp decline in price.”

Since @GaryGensler was backed into a corner on spot #BitcoinETFs approval, I think he will soon introduce new onerous #crypto regulations that will substantially increase the cost of #Bitcoin transactions, further undermining its "use" case, resulting in a sharp decline in price.

— Peter Schiff (@PeterSchiff) January 17, 2024

All approved spot BTC ETFs started publicly trading the next day, reaching record volumes of over $2 billion on the first day of trading.

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Here you will find 95638 additional Information to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] There you can find 49874 more Information to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] There you can find 51956 additional Info to that Topic: x.superex.com/news/bitcoin/2800/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2800/ […]