Bitcoin Halving: How it works and Why it matters

What is Bitcoin halving?

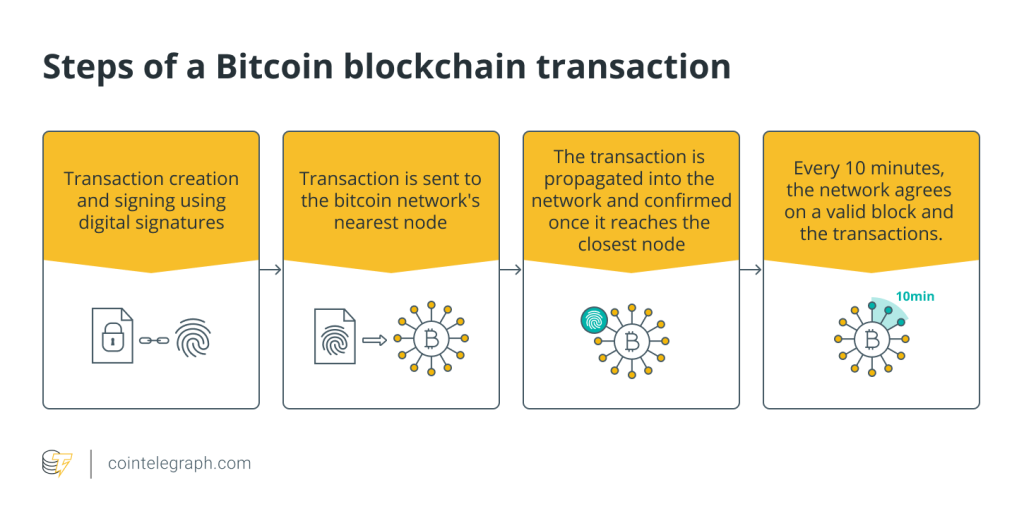

A “block” is a file containing 1 megabyte (MB) of Bitcoin (BTC) transaction records on the Bitcoin blockchain. “Miners” compete to add the next block by solving a complex mathematical problem using specialized hardware, producing a random 64-character output known as a “hash,” finishing the process and locking the block so it can’t be changed. By completing these blocks, miners receive Bitcoin.

So, how does the Bitcoin halving cycle work? Miners were paid 50 BTC per block when the cryptocurrency was originally established. Early users could be enticed to mine the network in this fashion, even before it was evident how successful it would be. The rate at which new Bitcoin is created decreases by half for every 210,000 blocks mined — roughly every four years.

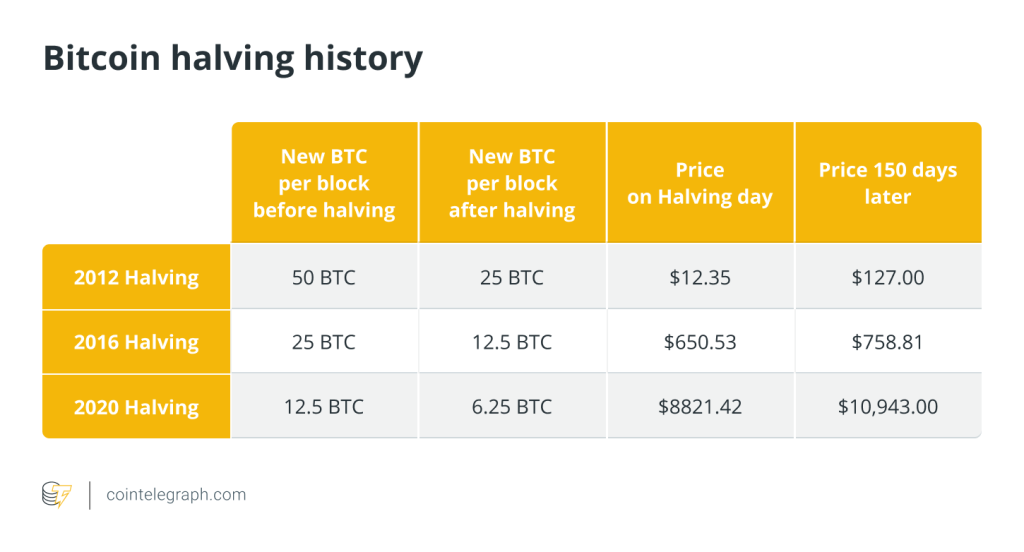

As per Bitcoin halving dates history, the last three halvings occurred in 2012, 2016 and 2020. The first Bitcoin halving, or Bitcoin split, occurred in 2012 when the reward for mining a block was reduced from 50 to 25 BTC.

The halving event in 2016 reduced incentives to 12.5 BTC for each block mined, and as of May 11, 2020, each new block mined only generates 6.25 new BTC. The next Bitcoin halving is expected to take place in April 2024, and the system will continue until roughly 2140 when all Bitcoin is mined.

In this guide, we will explain why Bitcoin halving occurs, how the Bitcoin halving cycle works, and why it matters.

Why does Bitcoin halving occur?

Bitcoin halving occurs as part of the protocol’s design and is a key mechanism to control the supply of new Bitcoin entering circulation. The primary reasons for Bitcoin’s halving are:

Scarcity and controlled supply

Satoshi Nakamoto, the person or group of people who invented Bitcoin, wanted to create a digital currency with a constrained and managed supply. Reducing the mining rewards by half decreases the rate at which new Bitcoin is generated. Due to its rising scarcity over time, Bitcoin has a valuable value proposition as a deflationary asset.

Inflation control

The Bitcoin halving contributes to limiting excessive inflation in the Bitcoin ecosystem. The rate at which new Bitcoin reaches the market is decreased by lowering the block reward. This restricted issuance process aims to keep the coin stable and valuable in the long term.

Market forces and economics

The halving event has economic repercussions for both Bitcoin miners and the broader market. Miners must modify their operations to be profitable with a lower block reward, which increases competition and drives away less productive miners. This, in turn, can impact the overall security and decentralization of the network.

Price impact

In the past, Bitcoin price rises have frequently been linked to halving events. Positive market sentiment and probable price appreciation have resulted from the expectation of decreased supply and rising demand. However, it is crucial to remember that past performance does not guarantee future results and that factors other than halving events affect Bitcoin’s price.

Why does Bitcoin halving matter?

Usually, there is an increase in volatility for Bitcoin following the halving. The supply of available Bitcoin decreases, which raises the value of Bitcoin yet to be mined, making it a more attractive asset to investors.

There are other elements to consider when analyzing Bitcoin’s post-halving booms:

- More press coverage of cryptocurrencies and Bitcoin.

- A fascination with the digital asset’s anonymity.

- A gradual increase in real-world use cases for the currency.

However, if you believe in the value of history, past Bitcoin halvings have been long-term bullish drivers for the cryptocurrency’s price. The next halving, on the other hand, is almost certain to impact the BTC ecosystem in various ways. Primarily, as the economic benefit of mining becomes less enticing and, for less effective miners, unprofitable, the number of Bitcoin miners is widely projected to decline.

Bitcoin halving history and dates

On Nov. 28, 2012, when the price of BTC was around $12, the first halving took place; one year later, Bitcoin had risen to nearly $1,000. The second halving occurred on July 9, 2016, and Bitcoin’s price plummeted to $670 at the time, but rose to $2,550 by July 2017. Bitcoin also reached a previous all-time high of about $19,700 in December 2017. Bitcoin’s price was $8,787 at the time of the most recent halving in May 2020, rising to its all-time high of nearly $69,000 by November 2021.

The Bitcoin halving symbolizes its deflationary characteristics regularly. Since Bitcoin’s inception, this has been one of the main arguments in favor of it. Because it is a decentralized cryptocurrency, governments or central banks can’t print more Bitcoin, and the total supply is fixed.

Implications of the Bitcoin halving event

In terms of the halving’s broader implications, a lower reward for mining Bitcoin will reduce the amount of money miners may make by adding new transactions to the blockchain. Miner rewards determine the flow of new Bitcoin into circulation.

As a result, halving these payments reduces the influx of new Bitcoin — bringing demand and supply economics into play. While supply drops, demand fluctuates and the price changes.

Bitcoin’s inflation rate is also reduced due to the halving event. In crypto, inflation relates to new coins being introduced to the circulating supply. However, Bitcoin is designed to be deflationary, and the halving plays a crucial role in its design.

Bitcoin’s inflation rate was 50% in 2011, plummeting to 12% after the 2012 halving and 4–5% in 2016. Currently, Bitcoin has a 1.74% inflation rate. In simple terms, after each halving, the value of Bitcoin increases. Every halving event has historically resulted in a bull run for Bitcoin. The price rises as supply decreases, causing demand to rise. This upward tendency, however, is usually not immediate.

Because of the high cost of electricity used to power the computers that solve the mathematical puzzles, the price of BTC would have to rise significantly for miners to receive half as many coins. Miners will find it challenging to stay competitive if the price does not rise in tandem with the decline in reward.

Miners will need to be as efficient as possible; therefore, a new technology that can generate more hashes per second while consuming less energy and lowering overheads will be in demand.

Furthermore, as countries get involved in Bitcoin, their economies may affect the price. More importantly, the price of Bitcoin is likely to rise due to the increased visibility it is now receiving. The volume of transactions will only increase as more stores, small businesses and institutions start using Bitcoin.

What would happen if a substantial number of miners suddenly quit Bitcoin mining?

The consequences of a significant number of miners abruptly quitting Bitcoin mining would directly impact the hash rate and several other aspects of the Bitcoin network. The hash rate represents the computational power dedicated to mining Bitcoin. The network’s overall hash rate would drop if many miners stopped mining, with block formation times taking longer and network security also degrading.

For instance, if many miners decide to depart simultaneously, the network may experience a bottleneck for a moment as users migrate to more rapid chains, making it easier for fraudulent users to take parts of the network.

However, historical evidence suggests that halving events do not cause this reaction. When the first halving occurred in 2012, Bitcoin’s hash rate dropped from December 2012 to mid-February 2013. Following that, both hash rate and mining profitability increased. This means that, once the dust settles, halving is advantageous to both miners and the network as a whole.

A similar scenario occurred during Bitcoin’s second halving, but the beneficial impacts took longer to manifest. The hash rate continued to rise steadily, but mining profitability did not recover for nearly a year after the halving date. If this pattern continues for the next event, mining profitability may suffer a long-term decline.

When is the next Bitcoin halving event?

Nearly 89% of the total 21 million Bitcoin that can ever exist have already been mined and are in circulation — over 19 million BTC. Approximately 900 new Bitcoin are mined and added to the digital supply daily.

As Bitcoin halvings continue, the rate of new Bitcoin supply will gradually decrease until all 21 million BTC have been mined, with the final fraction of Bitcoin expected to be mined by the year 2140.

While the exact date for the next halving is unknown, it will occur after mining the 840,000th block since the last halving. Since new Bitcoin are mined approximately every 10 minutes, the next halving is projected to occur around April 2024, reducing the mining reward for each block to 3.125 BTC.

As mining rewards are lowered, miners will need to adjust to the shifting dynamics of the Bitcoin mining environment as they face more competition for smaller rewards.

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Here you can find 64998 additional Info on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] There you will find 30403 more Information to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2786/ […]

… [Trackback]

[…] There you will find 77982 additional Information on that Topic: x.superex.com/academys/beginner/2786/ […]