Bitcoin miner Core Scientific to exit bankruptcy, relist shares in ‘coming days’

Crypto mining firm Core Scientific is putting an end to its 13-month restructuring journey, with an emergence targeted for Jan. 23.

Crypto mining firm Core Scientific has been given court approval to emerge from bankruptcy and relist its “CORZ” shares on the Nasdaq — putting an end to a 13-month restructuring process.

In a Jan. 16 statement, Core Scientific said its plan of reorganization had been confirmed by the bankruptcy court for the Southern District of Texas. The firm is targeting an emergence date of Jan. 23 and anticipates being relisted on the Nasdaq the following day.

The Bankruptcy Court has confirmed our Chapter 11 plan of reorganization. The Bankruptcy Court’s approval of our plan clears the way for Core Scientific to emerge and re-list on Nasdaq by the end of January 2024!

Read the full press release here: https://t.co/9pvy6hKOrP pic.twitter.com/3rnKjG1TBv

— Core Scientific (@Core_Scientific) January 16, 2024

Under the terms of the Chapter 11 plan, existing shareholders will retain around 60% of the company’s shares. The restructuring plan would also trim millions in debt from its balance sheet and provide “full recovery” to all classes of creditors.

U.S. Bankruptcy Judge Christopher Lopez reportedly said in a hearing that the plan “provides a tremendous recovery for both unsecured creditors and also equity holders.”

The plan is also expected to preserve more than 240 jobs at the company.

A U.S. #BTC mining company, @Core_Scientific has gained approval from a bankruptcy judge for its Chapter 11 restructuring.

This move allows the firm to eliminate $400 million in debt and aims to emerge from bankruptcy by the end of January.

The judge praised the plan for…

— Anthony P⭕️wer (@cazenove_uk) January 16, 2024

“Today’s plan confirmation is a defining moment in our reorganization; we’re poised to emerge by the end of this month as an even stronger company, with a highly motivated team that is aligned for success,” said Core Scientific CEO Adam Sullivan.

“With demand for Bitcoin and high-value compute continuing to rise, we look forward to creating value for our shareholders as we execute our growth plan, de-lever our balance sheet and deliver superior efficiency at scale.”

Related: Bitcoin miner Core Scientific completes $55M equity offering

Core Scientific is one of the United States’ largest crypto miners, producing over 13,700 self-mined Bitcoin (BTC) and 5,500 BTC from co-located miners in 2023.

However, a combination of a prolonged bear market, rising energy prices, increased mining difficulty, and bad debt lent to crypto firm Celsius saw the firm file for bankruptcy in December 2022. It had previously traded on the Nasdaq Global Select Market under the symbol “CORZ” but was delisted after bankruptcy proceedings began.

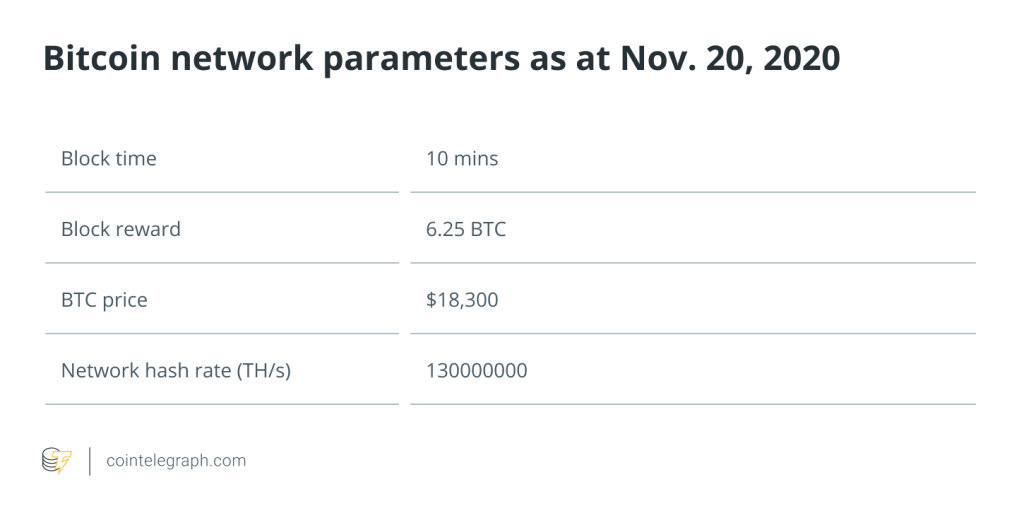

Core Scientific said the restructuring plan has been possible due in part to a “substantial increase” in the price of Bitcoin and hash prices in the time since it filed bankruptcy in December 2022.

Magazine: MakerDAO’s plan to bring back ‘DeFi summer’ — Rune Christensen

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Here you will find 93149 additional Information to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] There you will find 19118 additional Information on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Here you can find 67070 additional Information on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] There you will find 21913 additional Info to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2726/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/news/bitcoin/2726/ […]