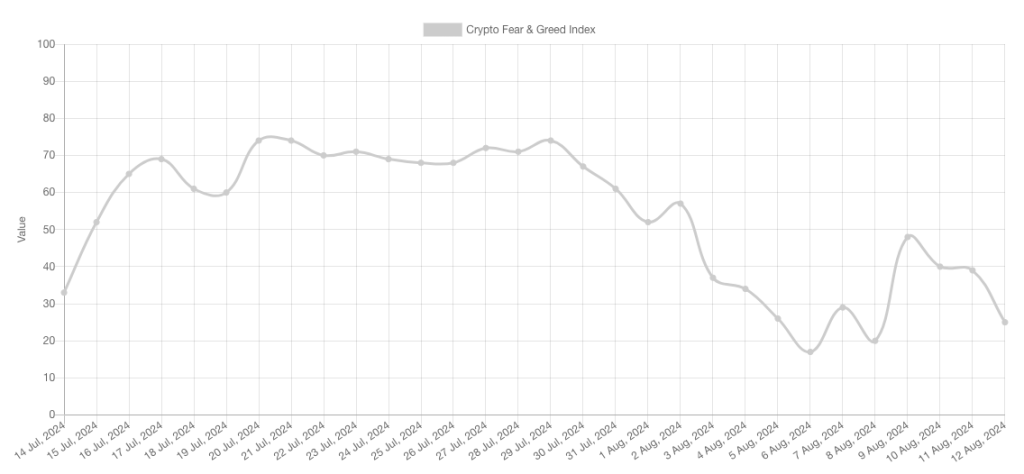

Bitcoin daily RSI hits 4-month lows, with BTC price still up 70%

BTC price action was at $25,000 the last time that daily RSI was as low as this week.

Bitcoin (BTC) is rapidly headed for oversold territory despite still trading above $40,000, the latest data shows.

As noted by analyst Matthew Hyland on Jan. 14, Bitcoin’s relative strength index (RSI) hit its lowest levels since September this week.

BTC price RSI echoes $25,000 levels

BTC price performance suffered a 15% drop after the launch of the United States’ first spot Bitcoin exchange-traded funds (ETFs) — and has so far struggled to bounce back.

As traders warn of the risk of further downside, the RSI is showing that a reversal may already be near.

On daily timeframes, the classic momentum oscillator dipped to 42.7/100 on Jan. 14 — lower than at any point in the last four months, as confirmed by data from Cointelegraph Markets Pro and TradingView.

At the time, BTC/USD traded at around $25,000.

The move was not lost on Hyland, who uploaded a chart to X (formerly Twitter), which suggested a hidden bearish divergence playing out, with RSI making lower lows while Bitcoin makes higher lows.

#BTC Daily RSI lower that October lows and at lowest levels since September: pic.twitter.com/lwPnkrhkUh

— Matthew Hyland (@MatthewHyland_) January 16, 2024

Daily RSI is nonetheless not strictly indicative of an imminent return to form for BTC price strength.

Having sunk below the midpoint of 50/100, the metric’s next major test could be the barrier to its “oversold” area at 30/100.

“I would like to see the Daily RSI go down to Oversold for Bitcoin,” popular trader and social media commentator Seth wrote in part of a recent X post.

On hourly timeframes, RSI pierced the 30/100 line in the sand twice this week, both times recovering and making higher lows in the process.

Bollinger Bands reflect return of volatility

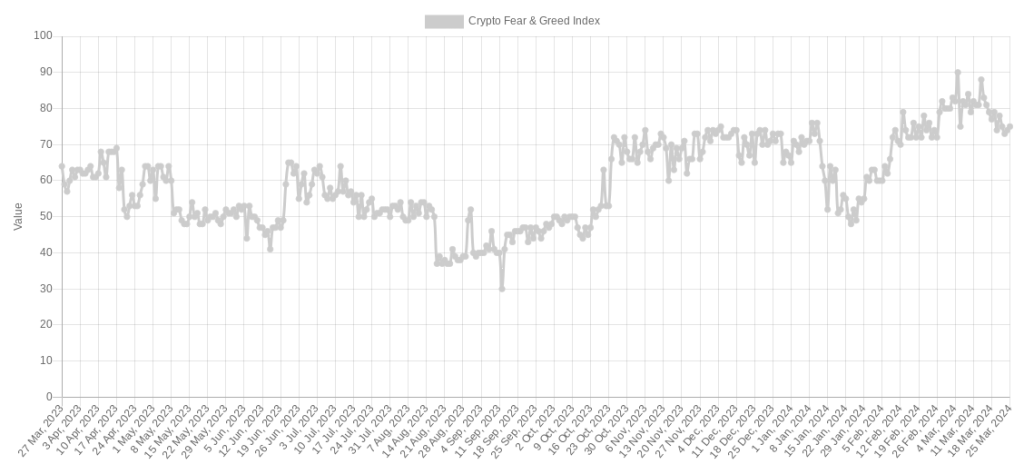

Last week, meanwhile, fellow trader Jelle meanwhile noted that by contrast, a trip back to “overbought” levels above 70 can often mark the start of the steepest upside on BTC/USD.

Related: BTC speculators dump $5B — 5 things to know in Bitcoin this week

When #Bitcoin's RSI enters the overbought territory, the real fun happens.

Just look at what happened in the past: pic.twitter.com/IAdXyOE3nU

— Jelle (@CryptoJelleNL) January 9, 2024

As Cointelegraph reported in December 2023, RSI is just one of several key metrics currently on the radar of market participants.

Another is the Bollinger Bands volatility indicator, the daily chart for which now shows BTC/USD back in volatile mode after a period of constriction.

Current prices mark a trip to near the bottom of the expanding channel, which has likewise not been truly challenged since mid-September.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Here you will find 87502 more Info to that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Here you will find 25457 additional Information on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] There you can find 82883 more Information on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] There you will find 36107 more Information on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Here you will find 25701 additional Info to that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2699/ […]

… [Trackback]

[…] Here you can find 70135 more Info to that Topic: x.superex.com/news/bitcoin/2699/ […]