Rollups, corporate demand, and Bitcoin-tied solutions among 2024’s crypto business trends

After enduring a lengthy winter, the crypto industry shows signs of recovery, fueled by increasing institutional interest and Bitcoin’s widening popularity.

Crypto businesses are looking forward to less turbulent times after a long crypto winter, with institutional demand and growing Bitcoin adoption helping to drive innovation in the crypto space. Trends to look for this year include scalability and compliance solutions, industry participants told Cointelegraph.

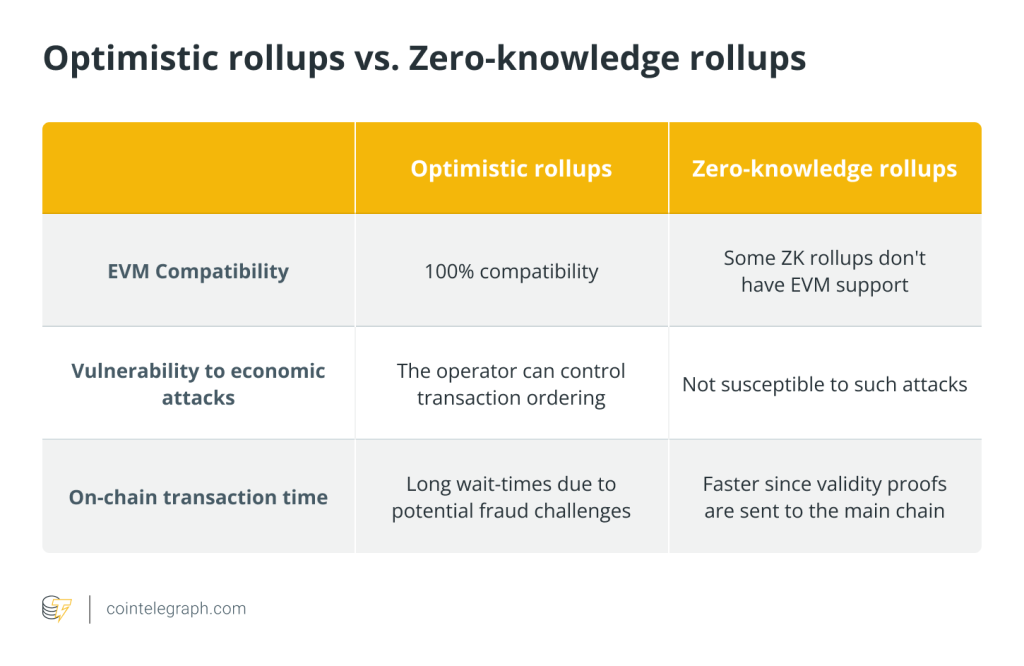

Transaction speeds and costs are challenges for both the Ethereum and the Bitcoin networks. Not by chance, rollup projects are expected to be in high demand in 2024, said Axelar’s CEO Sergey Gorbunov. He believes rollup development kits are “something to watch in 2024.”

“We’re beginning to see abstraction for the Web3 developer that is similar to what consumer-facing developers in SaaS enjoy,” explained Gorbunov about the growing offer of tools for developers working on blockchain scaling solutions.

Rollups are a type of layer-2 blockchain designed to improve scalability. They combine multiple transactions into a single batch outside the main blockchain (off-chain). This significantly reduces the amount of data that needs to be processed and stored on the main chain (on-chain), resulting in faster and cheaper transactions.

According to Gorbunov, projects currently “moving to scale across this landscape include DeFi innovators like Frax and Lido – and leading DEXs like dYdX, PancakeSwap and Uniswap.”

Decentralized infrastructure is another area expected to grow over the next few months. “Decentralizing frontends and backends is a critical issue, including when it comes to decentralized web-hosting and cloud-storage systems,” said Frank Hu, chief operating officer of ByteTrade Lab.

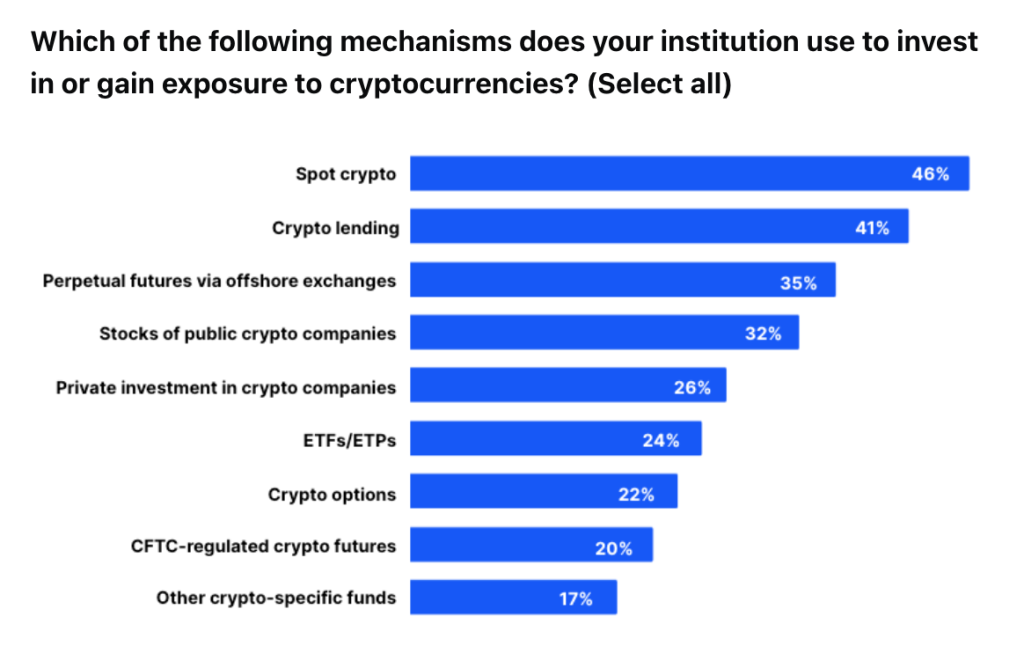

Behind these trends is the increasing involvement of institutional investors and traditional corporations within the crypto space. According to a November survey by Coinbase, 64% of current institutional crypto investors expected to increase their allocations in the next three years, and 45% of investors without crypto allocations planned to start investing within the same period.

Sandra Carter, chief operating officer of Unstoppable Domains, sees projects offering interoperability between Web2 and Web3 as a potential growth area. “There are so many people, brands, and organizations in Web2 that are yet to move over to Web3 or even know about it. They need to take those first steps, and [crypto] businesses will make that easier and more accessible because they know that there is so much value locked up in Web2 that Web3 can unleash,” she noted.

The approval of spot Bitcoin exchange-traded funds (ETFs) will also serve as a business driver in 2024. According to Mauricio di Bartolomeo from lending protocol Ledn, variations of Bitcoin ETF, such as leveraged and short ETFs, are expected to flood the market over the next few months. The hype surrounding the cryptocurrency is also predicted to boost its use as collateral on crypto loans.

Furthermore, one of the crypto industry’s foundations is also being disrupted — social media platforms. “Crypto has always been driven by social media,” said the co-founder of DSCVR, Juan Bruce, who believes it is only a matter of time before decentralized social media platforms find the product-market fit that will replace the traditional ones.

“Teams, including ours, are building social platforms that aren’t just on chain but enable crypto transactions in a social context for users and projects,” Bruce told Cointelegraph.

Growth prospects, however, are not immune to challenges. Carter believes the regulatory landscape will still play a significant risk for crypto businesses in 2024.

“There are so many variables when it comes to regulations, and while there are victories and signs of hope [such as Ripple’s and Grayscale’s court victories], there are specific individuals who are dead-set on stopping crypto from entering the mainstream. The U.S. wants to be competitive in blockchain technology, but regulators are doing their utmost to prevent or control that as best they can.”

Magazine: MakerDAO’s plan to bring back ‘DeFi summer’ — Rune Christensen

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Here you will find 60132 more Information to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Here you can find 84783 additional Information to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2568/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/2568/ […]