What is Ethereum 2.0? The Merge and transition to PoS explained

As the world’s second most popular blockchain platform next to Bitcoin (BTC), Ethereum (ETH) aims to be everything its predecessor is not. Some of Bitcoin’s limitations are holding Ethereum back, such as the former’s insistence on a proof-of-work (PoW) consensus algorithm and overall lack of scalability.

Ethereum’s multi-phased upgrade, including the Beacon Chain, the Merge and Shard Chains, intends to improve the Ethereum network's scalability and security by making several infrastructure modifications. The most notable is the conversion from a proof-of-work (PoW) consensus method in favor of a proof-of-stake (PoS) model, both offering varying differences in the protocol.

In 2013, Ethereum creator Vitalik Buterin proposed a blockchain platform that supported apps and other benefits not necessarily centered around finance. Buterin saw a world where developers could harness the power of decentralization to build governance systems, lending platforms, databases, represent physical assets in a digital space and so much more.

Buterin posits Ethereum as a global supercomputer, but the network struggles to validate a few hundred transactions in a reasonable timeframe. Users transacting small amounts on Ethereum have to pay, at times, over 100% in fees and extra costs. For a platform looking to revolutionize the way the world interacts on a network, Ethereum is undoubtedly built on some questionable technology.

Fortunately, Buterin, various network developers and the Ethereum Foundation are aware of the project’s limitations. Ethereum’s team also understands that Ethereum’s blockchain limitations prevent institutional investors and otherwise interested parties from adopting Ethereum.

To solve Ethereum’s scalability problems, Buterin and the ETH crew have outlined a network upgrade called Ethereum 2.0, or Eth2. Ethereum 2.0 brings foundation-altering changes to how Ethereum works, but it will take years to implement. Since 2020, Ethereum developers have worked tirelessly on bringing the network’s upgrade to fruition, hoping to make Ethereum faster, more secure and more accessible than ever before.

What is Ethereum 2.0?

Ethereum 2.0 marks a significant shift in the network’s consensus algorithm. Instead of Ethereum running an energy-intensive proof-of-work algorithm, the Eth2 upgrade (now referred to as consensus layer upgrade) means switching to a proof-of-stake algorithm.

A PoS algorithm brings many benefits over a PoW one, adjusting various aspects of a network like scalability, security and accessibility.

Proof-of-stake vs. proof-of-work

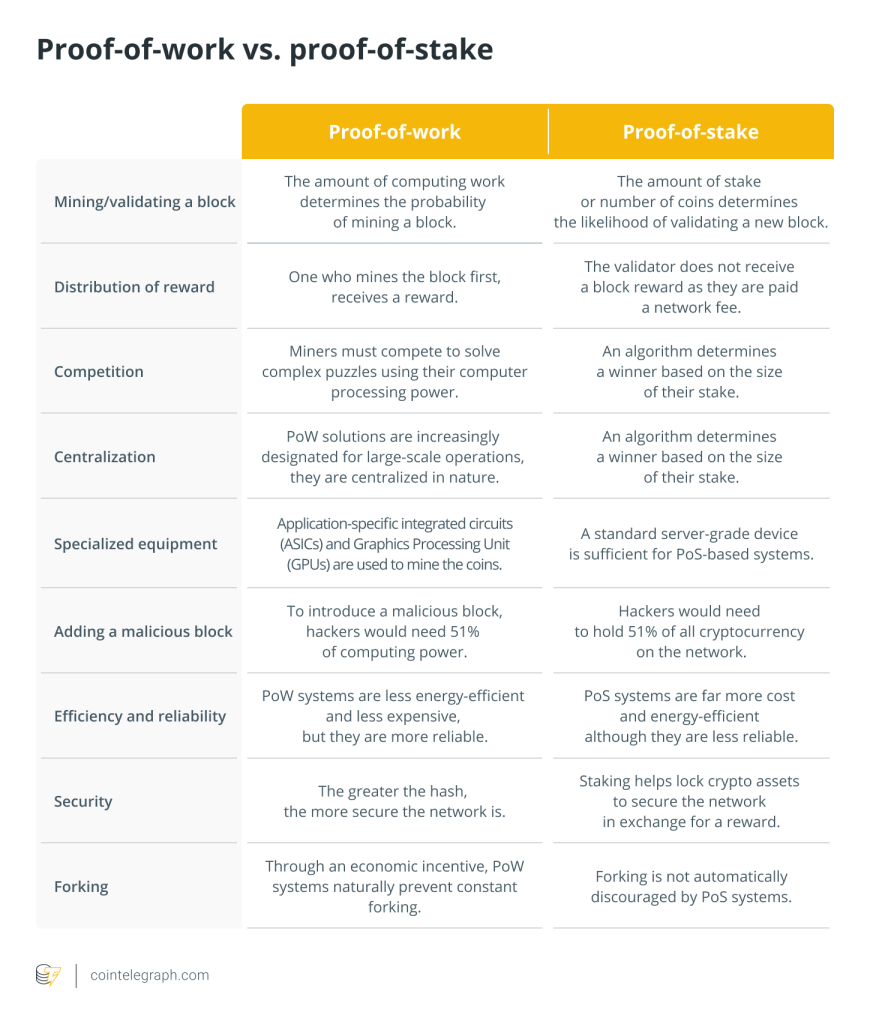

In terms of blockchain consensus, proof-of-work was the original method implemented by Bitcoin (the world’s first cryptocurrency). In PoW, miners, users who lend their computer power such as graphics processing units (GPUs) and central processing units (CPUs), solve complex algorithms and validate blocks. Blocks hold a certain amount of transactions within a blockchain network. When a block is full, it gets validated and logged on the blockchain by miners.

Essentially, every block of transactions must be proven unique to prevent double-spending or duplicate transactions. Each block has its own 64-digit hexadecimal code proving its uniqueness, but miners must find that code. The power lent by miner computers is used to solve the hexadecimal code, hence the proof-of-work moniker. A computer is utilizing real power to put in work and solve for a block.

Unfortunately, mining for blocks isn’t very environmentally friendly. It utilizes a ton of power and significantly raises a miner’s electricity bills. Plus, mining for cryptocurrency is a competition. Miners with just one graphics card are competing against operations with hundreds if not thousands of cards.

Only the first miner who finds the code gets a reward paid out in Bitcoin, limiting users without much money to invest in a proper mining rig. There are alternatives to mining alone, such as joining a mining pool, but the mining reward is split among dozens of participants.

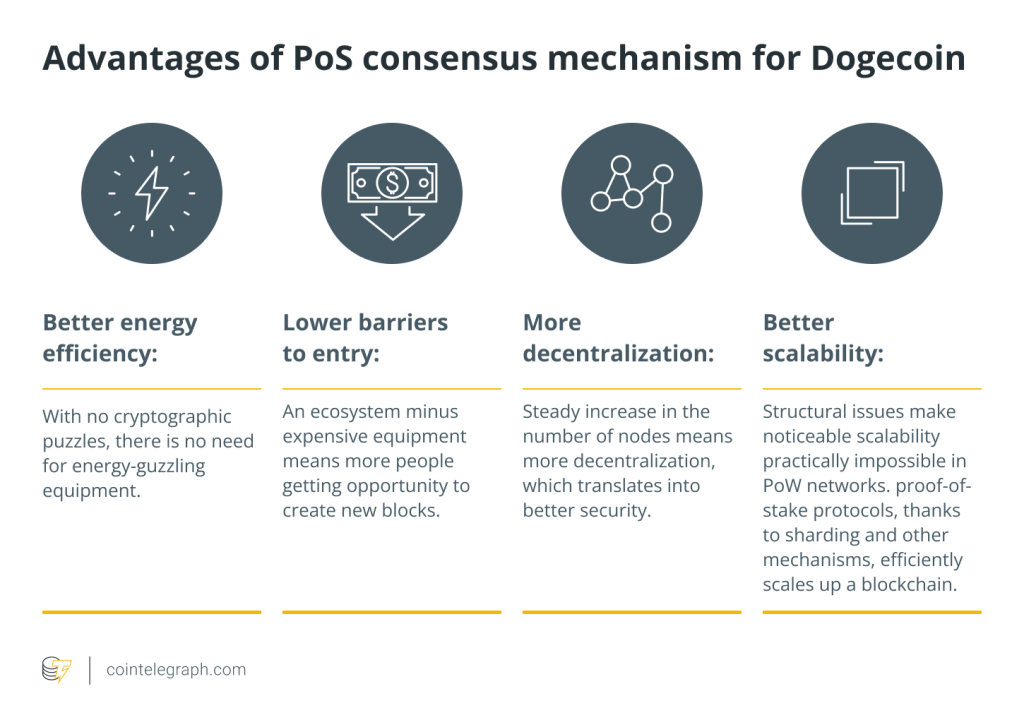

Proof-of-stake, however, solves a lot of the problems native to a PoW consensus algorithm. Proof-of-stake is similar to mining in that it requires users to validate transactions. However, participants in a PoS network are called validators. Validators are users who stake, or lock-in, an amount of cryptocurrency into the network. To lock in funds, these users signal to the network that they want to be validators, and the more funds staked by a validator, the more these users earn in rewards for their participation.

As a validator, users are responsible for validating transactions made on the network they’re participating in. Once a validator validates a transaction, it is sent to the blockchain, and the validator earns a reward. Compared with a PoW system, PoS is more accessible, as anyone can participate if they have the funds rather than requiring expensive hardware.

Network accessibility leads to better scalability, as more users are connected to the network, validating transactions. More users validating a network also leads to better security and decentralization. There are more and more points of stability on a PoS network rather than one central point for bad actors to attack. The environment also suffers less from a PoS network, as PoS requires less power than mining on a PoW network.

More decentralization on a network also helps prevent what’s called a 51% attack, an attack that is standard on PoW networks involving a bad actor that takes control of 51% of nodes and validates ill-intended transactions. In a way, proof-of-stake prevents a 51% attack because attempting one requires holding 51% of all tokens on the network. Holding 51% of all tokens on a PoS network sounds almost impossible, as doing so would require stealing from potentially hundreds of Ethereum wallets at once.

Upon the upgrade’s completion, Ethereum will experience all of the proof-of-stake benefits. PoS will bring Ethereum better scalability, accessibility and security, making it more environmentally friendly. But Ethereum moving to a 2.0 network is no easy task, requiring a ton of input from users and quite a lot of time for changes to take effect.

Ethereum vs Ethereum 2.0: Difference explained

The primary distinction between Ethereum PoW and Ethereum PoS is that proof-of-stake is significantly more energy-efficient than proof-of-work since it decouples the consensus mechanism from power-hungry computer computation. It also implies that less CPU power is required to secure the blockchain.

Moreover, Ethereum 2.0 is far more efficient than the original Ethereum, which could only manage 15 transactions per second. It can now handle up to 100,000 transactions per second. It is also important to note that a proof-of-work version of Ethereum called ETHPoW also became live after The Merge, which still uses PoW consensus mechanism to validate blocks.

Related: What are the risks of the Ethereum Merge?

Transitioning to Ethereum 2.0

Ethereum’s transition into 2.0 is broken down into various stages.

Phase 0

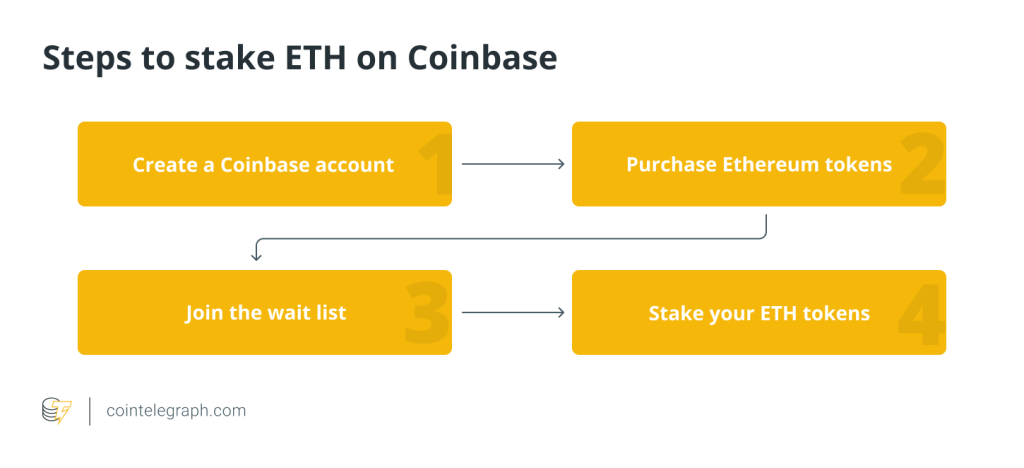

Phase 0 of the Ethereum 2.0 upgrade introduces what’s called the Beacon Chain. Launched on December 1, 2020, the Beacon Chain marks the shift to PoS, enabling users to stake (lock away) their Ethereum and become validators. That said, Phase 0 does not affect the main Ethereum blockchain, the Beacon Chain exists alongside Ethereum’s mainnet. However, both the Beacon chain and mainnet will eventually be linked. The objective is to “merge” Mainnet into the Beacon Chain-controlled and coordinated proof-of-stake system.

Moreover, potential validators can still register their interest in the Beacon Chain by staking 32 ETH. Asking users to stake 32 ETH is a tall order, considering 32 ETH is tens of thousands of dollars worth of Ethereum. Staked funds will also be held for two years or more only to be released when Ethereum 2.0 is fully ready to launch. Early validators are expected to be very committed to the project’s future, hence the high entry requirements.

Phase 1

Phase 1 was meant to launch in mid-2021 but was delayed to early 2022 with developers citing unfinished work and code auditing as big reasons for Ethereum 2.0’s delay. This next stage will merge the Beacon Chain with the mainnet, officially switching to a PoS consensus algorithm. From Phase 1 onward, Eth2 will house Ethereum’s entire history of transactions and support smart contracts on the PoS network. Stakers and validators will officially step into action, as Ethereum 2.0 will take mining out of the network. It is expected that many miners will take their holdings and stake them to become validators.

At its inception, developers meant Phase 1 of the Ethereum 2.0 upgrade to introduce sharding. Sharding is the act of dividing up a database, or in this case, the blockchain, into various smaller chains known as shards. Eth2 will have 64 shards i.e., spreading the network's load across 64 new chains. Shards make running a node easier by lowering the hardware requirements. This upgrade will occur after the mainnet and the Beacon Chain have merged.

With Ethereum 2.0, validators and other users can run their own shards, validating transactions and keeping the mainchain from seeing too much congestion. A proof-of-stake consensus method is required for shard networks to enter the Ethereum ecosystem safely. Staking will be introduced on the Beacon Chain, preparing the stage for the shard chain update to come later.

Phase 2

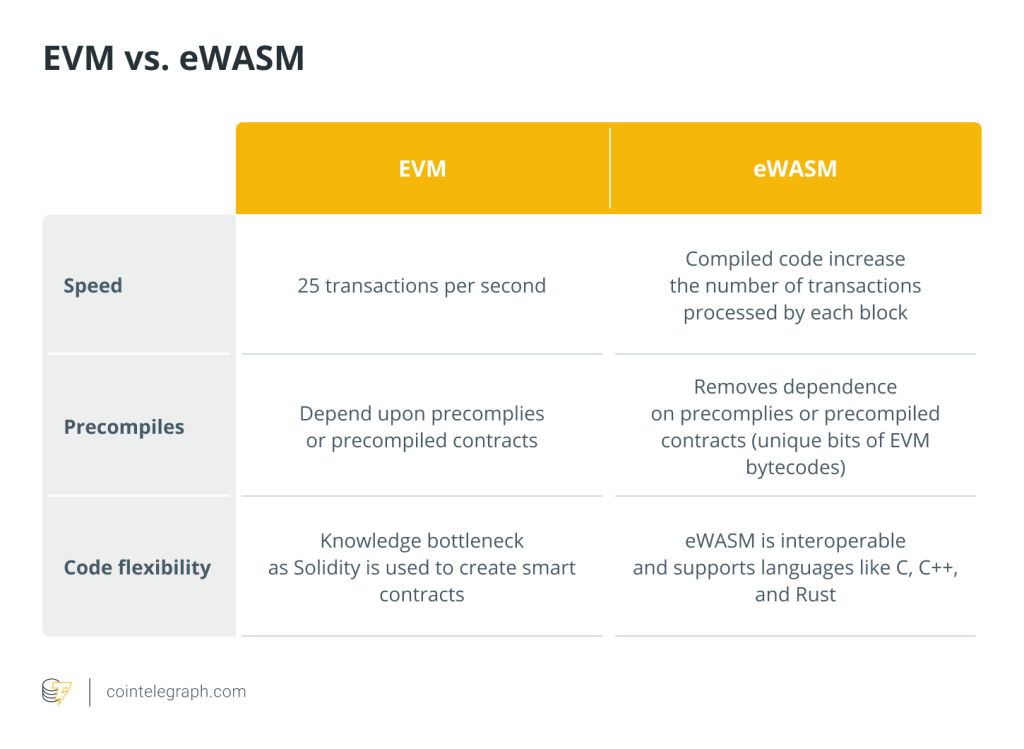

Finally, Phase 2 will see the introduction of Ethereum WebAssembly or eWASM. WebAssembly was created by the World Wide Web Consortium and is designed to make Ethereum significantly more efficient than it currently stands. Ethereum WebAssembly is a proposed deterministic subset of WebAssembly for the Ethereum smart contract execution layer.

Ethereum currently has what’s called an Ethereum Virtual Machine, or an EVM. An EVM enables Ethereum to run as a global supercomputer. Users access this computer worldwide, running smart contracts and interacting with decentralized applications (DApps). The EVM stores all of the code necessary to execute commands on Ethereum while also facilitating wallet addresses for transactions and calculating transaction (gas) fees for every transaction.

The EVM can support various actions at once, such as knowing if a smart contract needs terminating (it uses too much gas), if a DApp is deterministic (if it will always execute the same inputs and outputs), or if a smart contract is isolated (if something goes wrong, that contract’s error won’t affect the wider Ethereum network). However, the Ethereum network has gotten a little too crowded. Due to many transactions occurring at once, the EVM is much slower than originally intended. Ethereum’s EVM is also difficult to upgrade considering it was written in a specific, difficult-to-understand code, Solidity. The eWASM was specifically designed to replace the EVM, which would see implementation in Phase 2.

The eWASM compiles code much faster than the EVM, speeding up processes within the network. Gas works more efficiently via the eWASM, and the eWASM is compatible with various traditional coding languages like C and C++. Basically, the eWASM is meant to make Ethereum development much more accessible.

Unfortunately, the launch of stage two has been significantly delayed due to struggles implementing the previous stages. Developers are unsure when the eWASM will come into effect.

What comes next?

Ethereum 2.0 is an upgrade necessary for Ethereum’s future. In its current state, users pay ridiculously high gas fees, experience long transaction validation times and are using up a fair amount of energy during the process.

Basic transactions on Ethereum aren’t the only factors affected by the network’s lack of scalability. Ethereum’s problems affect nonfungible tokens (NFTs) and aspects of decentralized finance (DeFi) like loaning and borrowing. For example, building and trading NFTs on Ethereum can cost hundreds of dollars in gas fees due to network congestion.

Upon Ethereum 2.0’s launch, the network will immediately experience benefits in every aspect. Trading and minting NFTs on Ethereum will be cheaper due to sharding and the proof-of-stake consensus algorithm. Ethereum developers will have an easier time building DApps and compiling smart contracts thanks to eWASM implementation. Because eWASM is designed according to the World Wide Web standards, getting in-browser support for Ethereum lite clients will be easier. Finally, Ethereum’s switch to proof-of-stake will make the network more accessible than ever before while having a minimal impact on the environment.

The long-term effects of Eth2 are more left to speculation. It’s worth noting that Ether (the native currency of the Ethereum network) isn’t necessarily meant to be an asset of high value like Bitcoin. Instead, Ether is used more to move value from one area to another. For example, a user might invest in Ether to convert it to DAI, which they can then lend out to earn interest. While many crypto experts hope Ethereum 2.0 will boost Ether’s price to the five-digit mark, the upgrade very well may stabilize Ether’s price instead.

Related: Will the Ethereum 2.0 update reduce high gas fees?

After all, expanding the Ethereum ecosystem simply makes room for more ERC-20 assets. ERC-20 is the technical standard for all Ethereum-based assets. Every ERC-20 token follows the same set of rules, ensuring all ERC-20 assets are interoperable. As users flock to the Ethereum network, they’ll invest in Ether and convert it to other ERC-20 tokens before interacting with various DApps. In Bitcoin’s ecosystem, invested value is meant to stay for long periods of time, slowly increasing the asset’s price. With Ethereum, the better the network gets, the more value is exchanging hands at all times.

Of course, we can expect Ether to rise significantly before the asset stabilizes. The question is, how high will Ethereum’s price behave as the network expands and diversifies? Outside the Ethereum ecosystem itself, Ethereum 2.0’s expanded usability could positively affect the crypto industry.

For instance, as DApp developers take advantage of Ethereum 2.0’s proof-of-stake functionality, other blockchain networks are sure to take note. Ethereum competitors will need to offer similar scalability features to retain development or even a user base. Moreover, Bitcoin may be pressured to shift from its limiting PoW consensus method.

As Ethereum 2.0 features like staking make an impact, individuals and corporations not into crypto will start to understand its financial benefits. Interested parties might join Eth2 if they learn of high staking interest rates compared with traditional banking.

More users will become validators than ever before, participating in the Ethereum network and educating themselves on blockchain as a whole. The knowledge learned on Eth2 could then expand to other networks, resulting in more participation across the crypto industry. Investors may move to higher interest rates offered by DeFi lending platforms, leaving banks behind. Citizens could potentially move all of their funds out of banks and into the widespread Ethereum network. Moving money to Ethereum provides the user with complete control over their funds without requiring a bank to charge fees and limit money movements, among other control issues.

Undoubtedly, Ethereum 2.0 will affect how the world understands Ether’s value. If Ethereum 2.0 works as intended, Ether could go from an oft-valued commodity to a necessary asset. Corporations and individuals everywhere may utilize Ether in their everyday activities, building databases and apps within the network. A widespread shift in the world’s view on Ethereum is an invaluable change indeed.

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Here you can find 94426 additional Info on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] There you can find 19100 more Info on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Here you can find 93441 more Information on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2547/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2547/ […]