Gold on steroids? Bitcoin, gold correlation surges in 2023 — Fidelity

Bitcoin and gold have recorded strong performance in 2023 amid geopolitical uncertainties and rising interest rates.

The correlation between Bitcoin (BTC) and gold has increased over 2023, as indicated by a recent report from asset manager Fidelity.

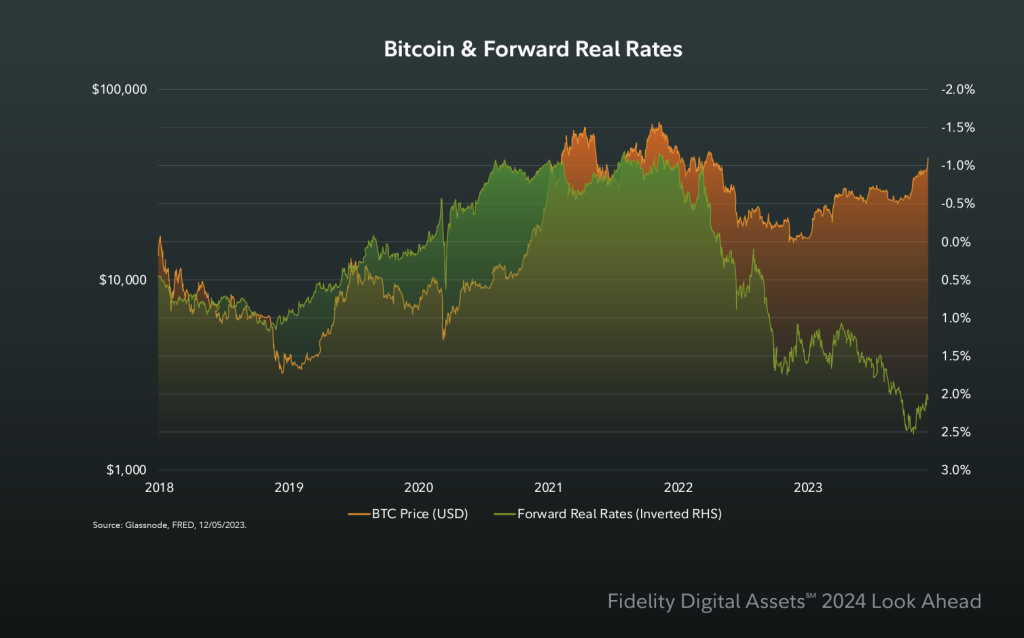

According to Fidelity’s analysis, Bitcoin’s price decoupled from its previously inverse relationship with interest rates and even rallied despite global rates increasing across the world — high interest rates tend to lower the demand for risk assets. Over the past twelve months, gold prices have followed the same pattern:

“But this past year, we saw a complete decoupling of this relationship as real rates continued to rise (with inflation subsiding and treasury yields screaming higher at one of the fastest paces in history), with bitcoin not only holding steady, but then rallying! Could this be due to an idiosyncratic event, such as the anticipation of a spot ETP? Perhaps. But we do not think so, because gold has also been showing similar behaviors recently.”

In 2023, gold experienced significant fluctuations, but overall showed strong performance against a number of currencies. Over the year, gold’s performance in U.S. dollars grew to 14.6%, with notable variations among different currency pairs. The asset performance was primarily driven by geopolitical risks and central banks’ demand. Bitcoin, meanwhile, gained 156% in 2023.

“Historically, bitcoin has been relatively noncorrelated to gold over the longer term, but recently has shown an increase in correlation as both have rallied,” noted Fidelity.

The investment company speculated on the reasons for the increased correlation between the commodities, stating that investors might be watching the United States’ growing fiscal deficit or even anticipating a change in interest rates.

“We can only speculate as to what these real asset markets may be saying, but one possible explanation is that both Bitcoin and gold are saying that the bond market may be wrong or that both assets are sniffing something else out, such as the United States’ increasingly large and structural fiscal deficits. Perhaps the bitcoin market may be anticipating more debt monetization by the Federal Reserve in the future, or anticipating rate cuts, given that our research shows that Bitcoin’s price is highly correlated not to consumer price inflation, but rather inflation in the money supply itself and various liquidity metrics.”

Fidelity’s analysis also points to a tighter supply environment for Bitcoin, as the amount of long-term holders has reached another all-time high of 70%. “It appears to us that the last few years of the bear market have forged some very strong hands in terms of holding period. Even in the face of a 160%+ rally in Bitcoin (at the time of writing in mid-December), we have not observed these long-term and illiquid coins moving in response to the price to take profit.”

Magazine: Lawmakers’ fear and doubt drives proposed crypto regulations in US

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Here you can find 95042 additional Info on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Here you can find 95512 more Information on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Here you can find 30223 more Information to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Here you can find 89676 additional Information on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Here you can find 8258 additional Info on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2517/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2517/ […]