What is Lido (LDO): A beginner’s guide to liquidity for staked assets

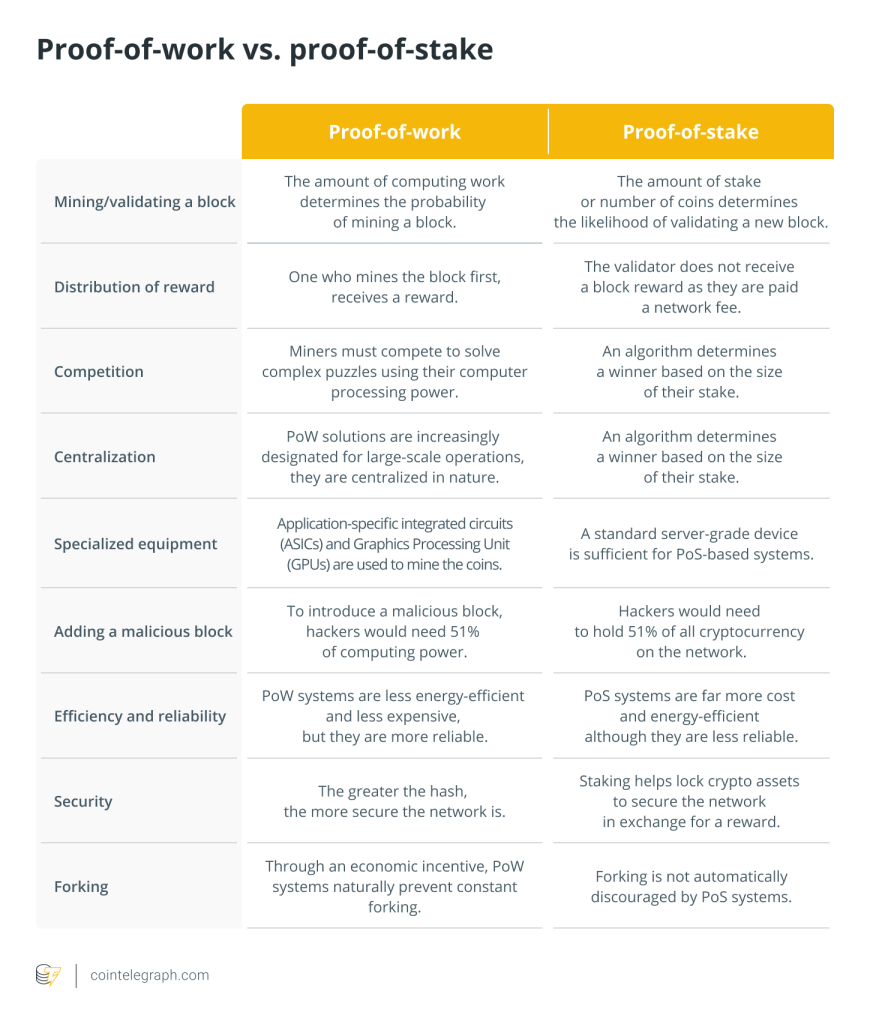

Illiquidity is one of the biggest challenges of staking on proof-of-stake (PoS) blockchains. Users cannot withdraw funds or access tokens once locked, thereby preventing them from earning additional yields from other decentralized finance (DeFi) protocols until the lock-up period is over.

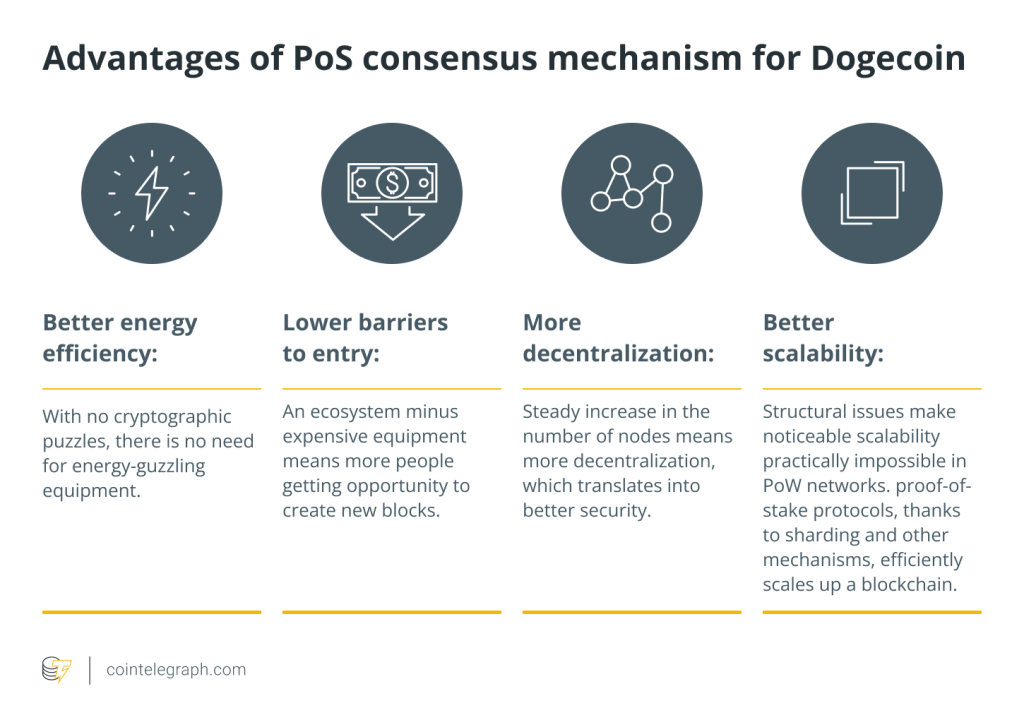

In addition, high barriers to entry, such as steep costs to run a node and an overall complex validator setup, deter many general retail users from participating in PoS staking. Lido provides an alternative to traditional PoS staking through its liquid staking solution, effectively enhancing the liquidity of staked tokens and making staking more accessible to its users.

What is liquid staking?

Whereas staking is the process of locking one’s crypto assets for a fixed period in exchange for yields, liquid staking for digital assets addresses the main drawback of locking tokens.

Users receive a tokenized version of their deposited funds (stAsset tokens) on a 1:1 basis. In addition to the staking yield a user earns, additional yield can be earned by using the stAsset tokens on other DeFi protocols as collateral for loans and yield farming.

For instance, if a user stakes two Ether (ETH) tokens, they will be issued two stETH. Likewise, if the user stakes two Polygon (MATIC) tokens, they receive two stMATIC tokens.

What is Lido (LDO)?

Launched in 2020, Lido (LDO) is a liquid staking solution for proof-of-stake cryptocurrencies. It supports post-Ethereum Merge consensus layer (formerly Ethereum 2.0) staking, as well as other layer-1 PoS blockchains like Polygon, Kusama, Solana and Polkadot.

So, who is behind Lido? To facilitate decentralized protocol governance, the network launched a decentralized autonomous organization (DAO) that makes all key decisions on the protocol’s operations. Such a framework allows the protocol to remain aligned with its stakeholders’ best interests and maintain decentralization and transparency.

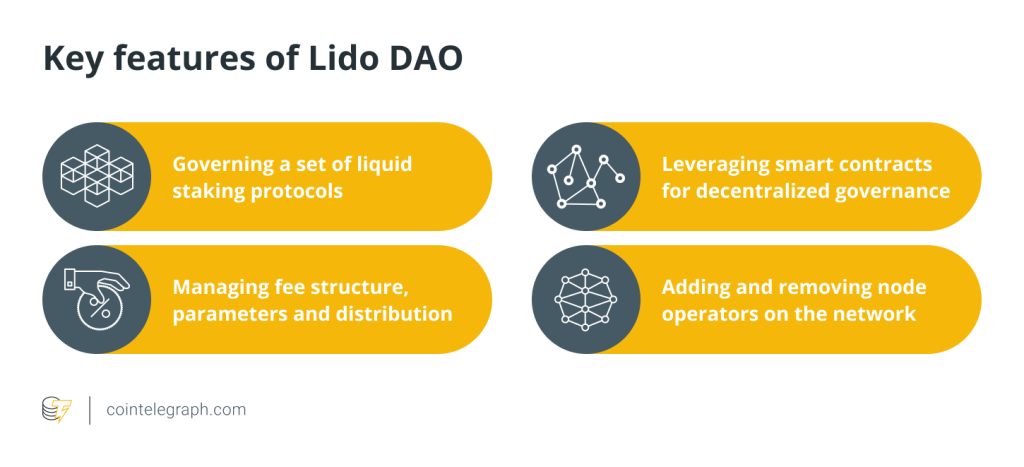

Some of the key features of Lido DAO are:

The Lido DAO distributes governing rights through the protocol’s native crypto asset, LDO. Each LDO token grants its holder the weight of one vote, with voting power proportional to each tokenholder’s stake in the network.

However, a key differentiator between Lido and other protocols is that Lido’s voting mechanism is upgradable and adjustable while remaining independent of other adaptable protocols on the blockchain. This means that the Lido DAO can implement changes to its governance structure while keeping the platform’s other functions intact.

How does Lido (LDO) work?

Liquid staking services like Lido get new users to participate in securing PoS networks such as theirs by allowing users to stake any amount of proof-of-stake assets in exchange for block rewards. Lido provides an innovative solution to the hurdles presented by traditional PoS staking by effectively lowering barriers to entry and the costs associated with locking up one’s assets in a single protocol.

When a user deposits their assets to Lido, the tokens are staked on the Lido blockchain via the protocol. Thus, Lido is effectively a staking pool smart contract with the following functions:

- Managing users’ withdrawals and deposits

- Delegating the protocol’s pooled funds to node operators

- Determining staking reward fees

- Minting and burning tokens

- Possessing a full list of node operators, validation keys and records of reward distribution

Since Ethereum’s transition to PoS, users interested in becoming staking validators can do so by depositing at least 32 ETH — quite a steep “minimum” requirement — to stake on the network.

Solutions like Lido make staking on Ethereum more accessible by allowing users to stake fractions of Ether to earn block rewards. As mentioned earlier, these users will then receive stETH, a token that is ERC-20 compatible. The stETH tokens are minted as soon as funds are deposited into Lido’s staking pool smart contract and burned as soon as users withdraw their ETH tokens.

ETH staked on the protocol will then be distributed to the Lido network’s validators (node operators) and deposited to Ethereum’s mainnet — the Ethereum Beacon Chain — for validation. The funds are then effectively locked and secured in a smart contract where validators cannot access them.

The ETH that users have deposited via Lido staking is then divided into sets of 32 ETH among active node operators on the Lido network. These operators will use a public validation key to validate transactions involving users’ staked assets.

Through such a mechanism, the network can distribute users’ staked assets across multiple validators, effectively eliminating risks associated with a single point of failure and single validator staking.

How to buy Lido (LDO) tokens?

LDO tokens can be purchased on most cryptocurrency exchanges. On Binance, for example, purchasing LDO tokens can be as straightforward as searching “LDO” to reveal available trading pairs and proceeding with the LDO purchase as follows:

- Go to your Binance account and click “Trade” and “Spot”

- Search “LDO” to see the available trading pairs, including LDO/BUSD, LDO/USDT and LDO/BTC.

- Go to the “Spot” box and enter the amount of LDO you want to buy. Click “Buy LDO” and the purchased tokens will be credited to your spot wallet.

The specific steps may vary, but they are similar across most exchanges like Kraken, Uphold and Coinbase.

Does Lido work on other blockchains?

Yes, users can stake LDO tokens on various PoS blockchains, as explained below:

Ethereum

Lido adheres to the Ethereum network’s staking requirements by pooling ETH staked from multiple Lido users. Unlike other platforms, however, Lido does not require nodes to deposit collateral equivalent to the staking position before becoming a validator.

The Lido DAO selects nodes with proven track records of staking assets, effectively requiring only one asset deposit in the protocol’s contract. Chosen node operators also do not have access to users’ funds, although the DAO does. This model is what the Lido network refers to as “capital efficiency.”

Solana

Staking on Solana is similar to staking on Ethereum in terms of benefits. These include liquid staking, simplified staking for end-users, DeFi integrations and instant liquidity. Solana (SOL) tokens can be staked in exchange for stSOL, allowing users to trade the issued stSOL tokens or use them as collateral on other DeFi protocols.

Polygon

Lido for Polygon allows participants to stake MATIC tokens on Ethereum in return for stMATIC to represent their staking pool share. Stakers can also receive staking rewards and utilize their stMATIC holdings on other DeFi protocols. Such a staking model contributes to the Polygon network’s security and decentralization and increases the utility of stMATIC tokens.

Polkadot

Lido for Polkadot, or “Lido DOT,” allows users to earn rewards and utilize stDOT tokens while their staked Polkadot (DOT) tokens are locked on the protocol. An asset-growing mechanism is in place wherein collected tokens are distributed to selected node operators, effectively increasing the network’s pooled assets.

Kusama

Staking Kusama (KSM) on Lido grants stakers with stKSM, which gives participants daily staking rewards and utilization across the Kusama and Moonriver ecosystems. Kusama users simply need to link their wallets to Lido and deposit the required tokens to start staking KSM.

What are the possible risks when staking on Lido?

Lido may be one of the top liquidity staking protocols in the cryptocurrency space, but it is not without its own set of risks. Security threats and technical risks are inherent to the virtual space, so it’s always worth staying alert when dealing with service providers — even comparatively secure ones like Lido.

Some of the most significant risks that Lido users should be aware of are:

Technical risks related to the Beacon Chain

Ethereum’s PoS layer is relatively new and is still in its early days, during which all sorts of issues may become apparent. Even well-established networks may fall prey to technical risks given certain operational circumstances, and Ethereum’s development roadmap still has a long way to go. This opens it up to future technical risks that may affect its staking mechanism.

Smart contract bugs

This is not new information, but it bears repeating. All code-based platforms carry a bug-related risk that may compromise a network’s operations. Lido is assuredly open-sourced and regularly audited, though, plus it has a bounty program geared toward bug minimization.

DAO-related risks

Early on, Lido held collective assets of 600,000 ETH from multiple accounts. The protocol utilized multisignature thresholds, effectively reducing the risk of custody. Even with this security measure in place, there’s still a considerable danger that signatories get hacked or lose their keys. This can potentially lead to Lido’s funds being locked away indefinitely.

The future of Lido

Lido continues to dominate the DeFi scene as its total value of assets locked continues to increase, overtaking equally robust protocols like MakerDAO. This is in line with Ethereum’s shift to PoS and the network’s upcoming “Shanghai” upgrade.

Lido, alongside other liquid staking protocols, is expected to increase in strength as Ethereum pushes to open ETH withdrawals.

Author: Marcel Deer

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Here you can find 14133 additional Info to that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2501/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2501/ […]