Is Bitcoin legal? A glimpse of BTC’s regulatory environment

The legal status of Bitcoin

Bitcoin’s (BTC) legality was always going to be a controversial conversation. How does a government approach a decentralized global digital asset that wasn’t meant to be controlled by a centralized party or an organization? A new form of currency that’s censorship-resistant and is community-focused? But, is Bitcoin regulated?

As such, the United States government has had a hard time regulating Bitcoin and not just for the above reasons. There are multiple layers to the world’s first cryptocurrency that go past traditional investments such as mining and trading. Each activity requires its own regulations, considering that most have a hard time finding out how Bitcoin works, how it is regulated and how the profits can be taxed. This governmental struggle stretches throughout all parts of the crypto industry.

For example, legal parties can’t allow unauthorized parties to manage crypto, much like they can’t allow just anyone to manage traditional fiat currencies. Regulators aim to establish new guidelines regarding businesses providing crypto custody or managing digital assets in other ways. This task is further complicated, as some assets are considered securities, while others are property. Then, there are also derivatives and other aspects of the investment process.

Should profiting off of an airdrop be taxed differently than an investment gain from cryptocurrency trading? Where do hard forks come into play? Do governments allow mining profits and if so, how are they taxed and how is the process monitored? And, where is Bitcoin accepted legally?

Regulations may vary based simply on how mining works for each network and if an entity is mining for personal or business reasons, even for their yearly income levels. Some companies might pay employees from earnings gained during mining as well, which would take various policies to regulate.

There are so many types of revenue in crypto — most of which the traditional citizen has no understanding. In some ways, the technology is developing faster than mainstream crypto knowledge and government regulations take time to understand and flesh out.

Ultimately, there are also the globalization and freedom of movement aspects to take into account. Citizens can hold and earn crypto anywhere in the world. So, how do the governments tackle that? It’s no wonder regulation is taking time, but is it safe to use and invest in Bitcoin? Here is an overview of how some of the countries around the world are looking to regulate cryptocurrencies like Bitcoin.

Is Bitcoin legal in the US?

It has never been “illegal” to buy and hold Bitcoin in the United States — at least, not at a federal level. So, the U.S. is among such countries where Bitcoin is legal but policies vary based on your state of residence.

However, the asset’s regulatory status on the national level has varied from time to time, with federal parties failing to decide on a single policy and approach. The United States Securities and Exchange Commission (SEC), the Financial Crimes Enforcement Network (FinCEN) and the Commodity Futures Trading Commission (CFTC) are just a few agencies looking to crack down on Bitcoin, and their views differ.

For instance, the SEC disclosed that BTC cannot be considered a security under the Howey test. Similarly, FinCen does not consider cryptocurrencies as legal tender, and CFTC considers crypto assets as binary options that are dependent on the price of an underlying like commodity swaps and options.

Securities and Exchange Commission

The SEC has been discussing Bitcoin since 2014 — a year in which it released an investor alert warning citizens of Bitcoin’s risks. Those risks included potential fraud, volatility and scams. In 2018, former head of the SEC Jay Clayton went on the record and classified Bitcoin as a property and not a security and that it should be taxed as such.

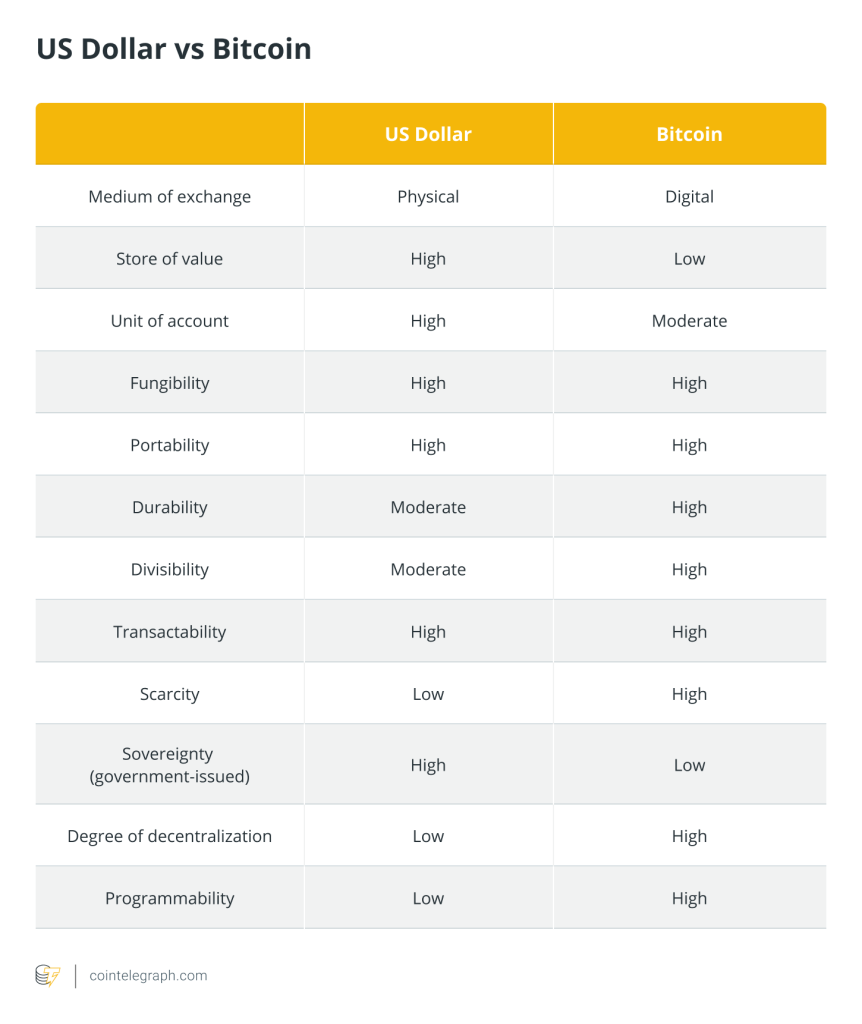

While most cryptocurrencies are considered securities, Bitcoin isn’t, as there’s no benefitting party behind the investment contract. Instead, the network is autonomous and Bitcoin is considered by the SEC as more of a traditional currency like the U.S. dollar. In fact, Clayton also claimed cryptocurrencies “are replacements for sovereign currencies, replace the dollar, the euro, the yen,” which contributes to his final decision.

Otherwise, the SEC’s regulation tends to focus on initial coin offerings (ICOs), as these are more similar to tech startups raising capital. As for regulation surrounding Bitcoin, other groups have more to say about it.

Internal Revenue Service

In 2014, the IRS released notice 2014-21, which classified Bitcoin as a property. This means that investors must pay capital gains tax on every cryptocurrency transaction and report it to the IRS in USD every year. Such a policy includes profits from Bitcoin mining and payments for goods and services, among other activities.

It wasn’t until 2020 that the IRS added an official ticker on Form 1040 that requires taxpayers to disclose any virtual currency activity. While many Bitcoin traders used the asset’s decentralized status to avoid taxes, the IRS formed a task force to hunt such evaders in 2018.

Commodity Futures Trading Commission

The CFTC views Bitcoin as a commodity similar to gold and other precious metals. In 2017, the commission released a Primer, defining their views for clarity’s sake. Moreover, the group’s power over derivatives will eventually cover insider trading, pump-and-dumps and similar activities as it learns about the industry.

Institutional investors waiting to get involved with cryptocurrency may find the CFTC quite appealing. After all, the commission released an official 2020-2024 Strategic Plan targeting Bitcoin and other cryptocurrencies. The plan focuses specifically on clear crypto regulation for all Americans while still encouraging innovation in the space. That said, it plans on “being tough” to those who “break the rules.”

The CFTC has honored its word as well, going after the BitMEX exchange stating that it failed to register the platform. Many crypto enthusiasts are excited, as regulation could mean an eventual Bitcoin exchange-traded fund (ETF) — something the SEC has been unwilling to implement for some time but has now passed Bitcoin futures ETFs.

Financial Crimes Enforcement Network

FinCEN established its guidance in 2013, stating that while the virtual currency is a medium of exchange it doesn’t have all the attributes of an actual currency, meaning it isn’t considered a legal tender. That said, they state that as long as a client is willing to accept it, anyone can use Bitcoin to buy goods and services.

Also, it’s important to note that those who use cryptocurrencies to buy goods and services are not considered a money services business, meaning they fall under different regulatory policies than a traditional business.

Federal Reserve

In March 2021, Federal Reserve Chairman Jerome Powell stated that Bitcoin is more of a “speculative asset” closer to gold than a currency or store of value. Powell also claimed that Bitcoin isn’t a particularly useful store of value due to its volatility, hence the speculative moniker.

In fact, the Federal Reserve has often gone on record declaring the risks of Bitcoin and other digital assets, recommending that citizens do not invest in them. Randal K Quarles, a key chair on the Federal Reserve’s Board of Governors, has gone as far as to exclaim that Bitcoin will never be a “revolutionary means of payment.”

However and somewhat ironically, the Federal Reserve plans to continue developing its own digital currency, which will likely resemble more of a stablecoin.

Financial Industry Regulatory Authority

FINRA requires cryptocurrency brokers to have certification to deal with such securities like Bitcoin. If, say, a so-called cryptocurrency broker provides some wrong information, FINRA can provide a lawyer to help. If that broker is unlicensed, they’re going to have a hard time continuing their practice and will probably have to go out of business.

Otherwise, FINRA does its best to educate citizens on the risks of cryptocurrencies, providing informative podcasts and guides regarding digital assets.

Office of the Controller of the Currency

The OCC has been one of the most progressive government groups in terms of Bitcoin and cryptocurrency legislation. As the regulator of major banks, the office allowed national banks to legally begin offering crypto custody services and work with stablecoins in 2020 before nominating the United States’ first “digital asset bank” the next year.

Since then, acting comptroller of the OCC Michael Hsu outlined plans to review its crypto guidance to foster “responsible innovation.” He wants crypto startups to feel welcome in the United States, assuming they keep citizens safe as well.

The history of Bitcoin regulation in the United States

It’s safe to say that governments did not care for Bitcoin at its launch in 2009 — assuming they even knew about it. That said, once word picked up of citizens using it on the dark web, regulators began to take notice. The situation really took a turn once the FBI took down The Silk Road in 2013, a leading dark web platform that only accepted Bitcoin.

In just two years, The Silk Road had made over $1.3 billion in Bitcoin. The FBI feared much of that revenue was the result of money laundering, starting the anonymity of the Bitcoin debate. That same year, FinCEN declared that Bitcoin wasn’t legal tender. The U.S. Senate also sent out letters warning law enforcement of the threats of digital assets.

It wasn’t until 2015, though, when a state approached regulating cryptocurrency use. This state was New York, which had been publicly looking into the sector for two years. Then came BitLicense — a required mandate a business must pass to mediate the buying and selling of crypto, store or offer crypto custody, operate a crypto exchange and more.

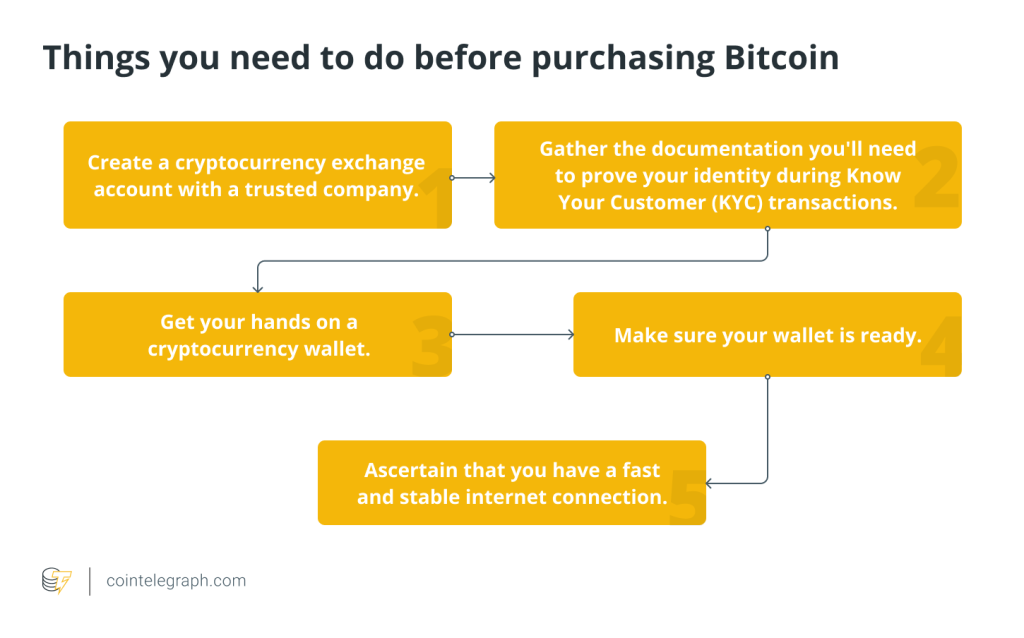

BitLicense approval necessitates implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, among other requirements. Many states followed suit in regulating Bitcoin, but none of them have anything similar to a BitLicense.

The regulation was further streamlined in 2020, thanks to the Conference of State Bank Supervisors. This made it easier for PayPal and similar payments groups to offer digital assets.

Wyoming is a very crypto-friendly state — one that legally recognizes cryptocurrencies as money. The state allows crypto companies to become Special Purpose Depository Institutions, a sort of bank that can lend out digital assets, provide crypto custody, and offer other types of services.

The state of Texas is similar to Wyoming in that it recognizes cryptocurrencies as a medium of exchange. It’s also one of the friendliest states when it comes to crypto mining. Texas plans to become a major cryptocurrency mining hub.

Finally, Miami’s mayor spent 2021 establishing progressive crypto laws within the state of Florida. The city is attempting to allow citizens to pay taxes in Bitcoin, for instance, among other significant developments that recognize cryptocurrencies as a transfer of value.

Is Bitcoin legal in China?

China is among such countries where Bitcoin is banned. In May 2021, China banned crypto and restricted financial groups from providing any Bitcoin-related services. While the country had already banned cryptocurrency exchanges and crypto-related fundraising methods, this ban went after traditional businesses involved with crypto services, like banks and other financial institutions. The country quoted crypto volatility as its reasoning behind the cryptocurrency ban.

Though, after Bitcoin got banned, citizens who already hold cryptocurrency are legally allowed to keep it.

The history of Bitcoin regulation in China

Overall, China is not looking to proactively regulate cryptocurrency, but it wasn’t always that way. Until late 2017, Chinese citizens enjoyed crypto without much governmental intervention. Eventually, the government learned enough about crypto and cracked down on high-risk enterprises.

As a result, the People’s Bank of China banned ICOs, meaning projects couldn’t conduct fundraising in the country. This shouldn’t come as too much of a surprise, however, as the Chinese government has been after all sorts of international transactions — crypto and otherwise. These regulations took a toll on cryptocurrency trading in China and many companies had to move away from the mainland.

The Chinese government issues further crackdowns on mining in Summer 2021 and it is among the countries where Bitcoin is illegal. Considering the country held a significant portion of the world’s miners — an estimated 50% to 70% — Bitcoin’s price fell hard as a result. China blamed Bitcoin miners for missing its climate goals. In the same year, China banned financial groups from providing crypto services and forbade big groups like Alipay from doing the same.

On the other side of China’s big crackdown is the government’s interest in blockchain tech and central bank digital currencies (CBDC). The country is known to be working on its own CBDC, which is a stablecoin cryptocurrency that is tied to the price of the yen at a one-to-one ratio. Ultimately, once released, the technology would enable China to digitize the yen.

Bitcoin regulation in the rest of the world

As one can probably infer, there’s no global state of regulation when it comes to cryptocurrencies. Almost every country has rules that differ from one another. Let’s get into the most prominent.

Asia

Russia

For a while, Bitcoin went unregulated in Russia. In 2020, however, the country passed a bill stating that no federal employees nor their families can hold crypto in any form. The Russian government also legitimized Bitcoin trading, though it prevented using Bitcoin and other cryptocurrencies in exchange for goods and services.

Some officials have attempted to argue this crypto legislation and there’s even a group of lobbyists claiming the Russian government is standing in the way of the crypto industry. There are also rumblings of a new bill that would require citizens to declare their holdings.

Japan

Japan’s government has declared Bitcoin a legal tender as of 2016 and requires crypto exchanges to abide by AML and KYC policies. This decision is a result of years of government research after the Mt. Gox incident.

Further hacks affected Japanese cryptocurrency exchanges, resulting in authorities demanding better protection policies and putting new exchanges on hold for the time being. In 2019, however, Japan started allowing new crypto exchanges and pointing regulations toward improving the security token offering (STO) and ICO markets.

India

The Reserve Bank of India (RBI) banned local businesses from servicing cryptocurrencies in 2018, stating that they were not legal tender and no entity can have a “relationship” with it. This ban lasted for two years until March 2020, when the RBI walked back on it and India became one of the crypto-friendly countries in the world. So, Bitcoin and cryptocurrency trading are now legal, but initial coin offerings and asset funds are still illegal.

Europe

Countries are relatively progressive in Europe, though the European Union is still struggling to find a regulatory consensus. In 2015, the European Court of Justice ruled that cryptocurrency trading is a supply of service. This declaration means digital assets are not subject to value-added tax. Of course, individual countries can still decide their own regulations, much as states in the U.S. can decide.

That said, European countries signed a 5th Anti-Money Laundering Directive, which affects all countries. This directive will create a record of all cryptocurrency traders and holders in an attempt to fight terrorism and money laundering.

France

France regulated ICOs and groups providing crypto services in 2019. Since then, the country has severely tightened all KYC and AML requirements for French exchanges and required them to register with the federal government. As of 2021, however, the country is still looking to create an overall regulatory framework. Bank of France governor Francois Villeroy de Galhau claimed that the EU only has one or two years to do so before digital assets affect its financial sovereignty.

Germany

In 2021, the German Federal Financial Supervisory Authority (BaFin) provided Coinbase with an official license required to keep serving customers in the country. Coinbase marks the first crypto-related group to receive this license – a requirement that came into effect in November 2019. BaFin plans to assign the license to many other groups.

United Kingdom

The United Kingdom’s Financial Conduct Authority (FCA) is positive toward Bitcoin even though the asset is not considered legal tender. As of 2020, the asset is considered property in the U.K., meaning they’re subject to capital gains tax. However, because cryptocurrencies are different from a traditional asset class, that tax can vary based on the involved parties.

In 2021, the FCA banned Binance from participating in regulated activity in the U.K. due to an operations review. The country also made a point to ban cryptocurrency derivatives, as they cannot be “reliably valued” by customers.

Bitcoin regulation in South and Central America

El Salvador

El Salvador marks the world’s first country to make Bitcoin legal tender. As of Summer 2021, a law came into place requiring businesses to accept Bitcoin for goods and services. Citizens can also pay for housing with the digital asset, which has no capital gains tax when spent. El Salvador’s president airdropped $30 worth of Bitcoin to the personal wallet of every adult resident that wished to adopt the new form of payment.

Paraguay

Shortly after the El Salvador regulation, many believed Paraguay would be next. On July 14, 2021, Congress in Paraguay released a bill set to “regulate the activities of production and commercialization of virtual or crypto-active assets.” Essentially, there will be three governmental parties that control aspects of crypto, attempting to prevent money laundering and managing all electricity usage.

Otherwise, the country will establish crypto transaction monitoring that all must abide by, and miners must acquire a Virtual Asset Mining License to continue the activity. It’s important to note, however, that virtual assets are not considered legal tender in Paraguay. Rather, they’re considered to be security tokens that the public has a right to profit from.

Panama

Finally, lawmakers in Panama planned to introduce Bitcoin regulation in July 2021. The country will present a bill bringing clear rules and access to digital currencies. Congressman Gabriel Silva claims this support will make Panama an incubator for financial technology and entrepreneurial developments. Later, he proposed legislation that would allow cryptocurrencies to be used as a form of payment for civil and commercial transactions in September 2021.

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] There you will find 92660 more Info to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Here you can find 68516 additional Info to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Here you will find 28705 additional Information to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Here you will find 42335 additional Information to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Here you can find 63115 additional Info to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Here you can find 76167 more Information on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2499/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2499/ […]