Cryptocurrency vs. quantum computing: A deep dive into the future of cryptocurrencies

Although blockchain technology is a relatively new innovation, digital assets like cryptocurrencies, nonfungible tokens (NFTs) and the entire ecosystem of decentralized applications (DApps) powered by it are now facing the challenge posed by quantum computing.

A technology that is developing at a rapid pace, quantum computing employs the laws of quantum mechanics to create computers that can solve problems considered too complex for classical or binary computers.

Touted as the next generation of computing that will supersede supercomputers (a class of classical computers with far superior performance as compared with general computers), they could challenge existing security standards due to their computational supremacy. Due to their ability to solve problems with a high degree of complexity, quantum computers could even upend the current assumption about blockchain technology’s immutability.

With the potential to sabotage digital security practices, quantum computing could help bad actors orchestrate attacks on cryptocurrencies and other blockchain applications, even though the technology is still in its nascent stages of development.

Therefore, it is important to understand what makes quantum computers so powerful and how they could undermine blockchain-powered applications in the future. With the global crypto ecosystem on the brink of reaching mainstream adoption, developers and entrepreneurs alike will have to delve into unexplored territories with respect to cryptographic algorithms and innovate to counter the threat posed by quantum computing.

What is a quantum computer, and how does it work?

The foremost distinction between quantum computers and classical or binary computers is how they use states to represent any number in a complex calculation. While binary computers use bits to encode information as either a 0 or 1, quantum computers use quantum bits or “qubits” and properties such as quantum superposition and entanglement to represent many things simultaneously.

Take for example the simple case of representing any number between 0 and 255. While eight bits are sufficient for classical computers to denote any number in this range, a quantum computer can concurrently represent all 256 numbers using eight qubits.

This allows quantum computers to take into account a large number of combinations and perform complex calculations much faster than the best supercomputers. Employing superconducting elements that offer very low resistance to electron flow when cooled to sub-zero temperatures, quantum computers are inherently sensitive to heat, electromagnetic waves and even exposure to air, making them vulnerable to computing losses in less-than-ideal environments.

As a result, the future of computing lies somewhere between existing classical computers and sophisticated quantum computers, unless large strides can be made in developing quantum computers for everyday use.

While IBM has created its Quantum System One integrated quantum computing system that supports a 127-qubit processor, breakneck advancements in quantum computing mean a 1,000-qubit quantum computer isn’t far away from reality.

In fact, IBM plans to release a 1,121-qubit quantum computer by 2023 that would make industrial-scale applications a reality and offer computational ability many multiples higher than the world’s most powerful supercomputer.

Are cryptocurrencies vulnerable to quantum computing attacks?

Before pure quantum computing devices hit the market, the next wave of computing will probably be led by quantum-centric supercomputers that integrate classical and quantum workflows.

These devices could boast of anywhere between 50 and 1,000 qubits of computing power, especially considering the introduction of the 433-qubit IBM Quantum Osprey on Nov. 9, 2022, less than a year after the launch of the 127-qubit Eagle processor.

Considering how powerful quantum computers are now and their limited availability, it would be easy to conclude that there is still much time before quantum computers become a threat to crypto.

Despite the immense potential on offer, the quantum advantage will not be possible unless advanced methods of suppressing errors are invented and computational speed increases without any associated concerns.

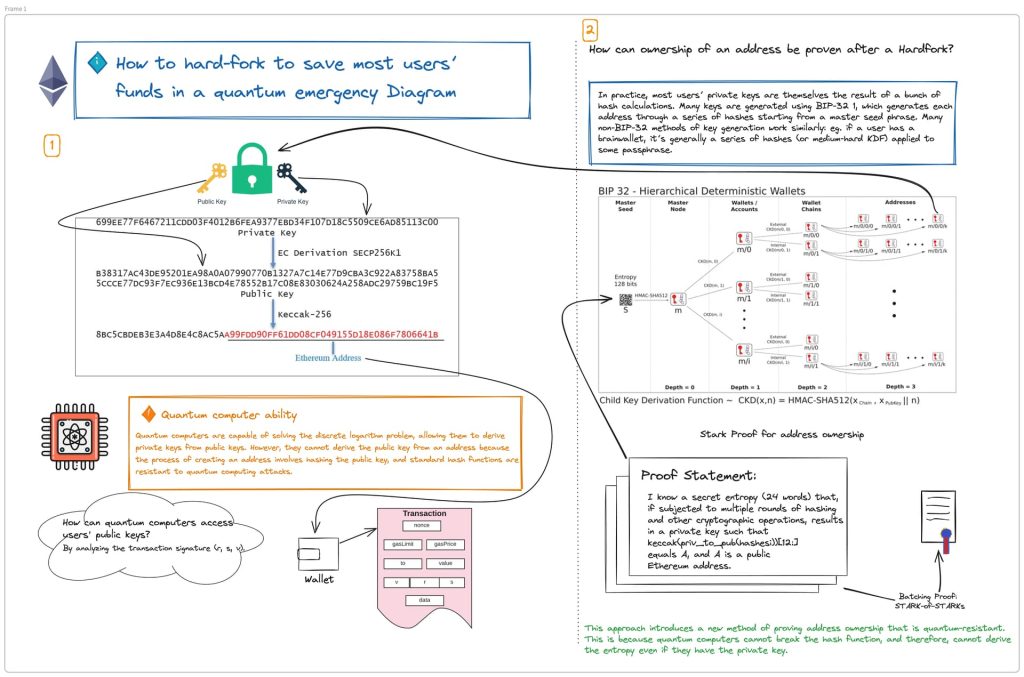

Even if we consider the possibility of quantum computing defeating the cryptography used in cryptocurrencies, it would need inordinate levels of computing power to launch a storage attack, in which wallet addresses with a public key are targeted to steal funds residing in them. For a blockchain like the Ethereum Network, it would require in excess of 10 million qubits of computing power to conduct such a storage attack.

For a transit attack, in which a bad actor would deploy massive amounts of quantum computing power to seize control over transactions within the block time, the scope is much larger, as it would involve attacking all nodes. However, since it is crucial to execute the attack before a new block is added to the blockchain network, malicious entities are left with a few minutes for Bitcoin and tens of seconds for Ethereum to complete a transit attack.

With billions of qubits of quantum computing power needed to successfully execute such an attack, blockchain developers have sufficient time to innovate new cryptographic signing algorithms that are resistant to quantum attacks.

Can quantum computers steal Bitcoin?

Cracking the encryption that safeguards Bitcoin would require inordinate amounts of quantum computing power to be deployed together and controlled by a single entity that orchestrates the attack.

According to researchers at the University of Sussex, a quantum computer with 1.9 billion qubits of processing power would be needed to break into the Bitcoin network within 10 minutes. This would require hackers to deploy millions of quantum computers, a scenario that is highly unlikely for the foreseeable future.

With any lower computing power, it would take an exponentially longer time to conduct an attack, allowing enough time to deactivate the compromised nodes and restore the network. With a storage attack seemingly more plausible, cryptocurrencies like Bitcoin (BTC) will have to at least adopt changes to the underlying blockchain protocol to counter such possibilities.

While this approach still leaves Bitcoin wallets at risk of an attack in the long run, they are much easier to implement than introducing a new cryptographic algorithm. The current Elliptic Curve Digital Signature Algorithm, or ECDSA, used by Bitcoin is a cryptographic algorithm that has separate signing and verification algorithms that utilize a user’s private key, public key and signature to ensure funds can only be spent by them.

However, with public blockchains requiring a consensus by significant users to approve any changes to their protocols, even making changes to Bitcoin’s protocol may take longer than anticipated. Recognizing the need for quantum-resistant software and cryptographic solutions, there are numerous projects within the crypto space that are devoted to this cause.

The future of Bitcoin post-quantum computing becoming mainstream will probably mean having to graduate to a more sophisticated and quantum-resistant ledger system, all powered by a revolutionary cryptographic algorithm.

Will quantum computing destroy cryptocurrency?

Applications of quantum computers will undoubtedly help in simulating molecular behavior, assist in developing new energy-efficient materials and more effective medicines, and even improve catalysts that could positively impact many manufacturing industries.

While the real premise behind the development of quantum computers is to gain the ability to solve the world’s most complex problems, they could be used to wreak havoc on public blockchains and cryptocurrency networks by bad actors.

To answer if blockchain will survive quantum computing, the technology will have to evolve into a quantum-resistant ledger system over the next decade. This is primarily because quantum computers could become powerful enough to attack cryptocurrencies in the next 10–15 years.

Scaling up key sizes could be one solution to this problem, although it remains to be seen if it is feasible to keep doubling the number of keys against quantum computers that will get more powerful with time.

New cryptography concepts such as lattice-based cryptography, in which mathematical noise is added to the encryption to confuse a quantum computer, and quantum-resistant algorithms that rely on math problems are the way forward.

The latter approach is designed such that both classical and quantum computers will have difficulty solving, thereby ensuring relevance and security in both computing systems. Irrespective of whether cryptocurrencies implement structured lattices or hash-based algorithms, the key will remain in staying ahead of the capabilities of quantum computers.

So, while quantum computing won’t challenge cryptocurrencies in their present form, it will require a concerted effort to introduce a raft of changes that will preserve decentralized governance structures against the future threat of quantum supercomputers.

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] There you can find 36896 additional Information on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2493/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2493/ […]