Grayscale Bitcoin Trust ETF moves $41M in BTC to exchange during price crash — Arkham

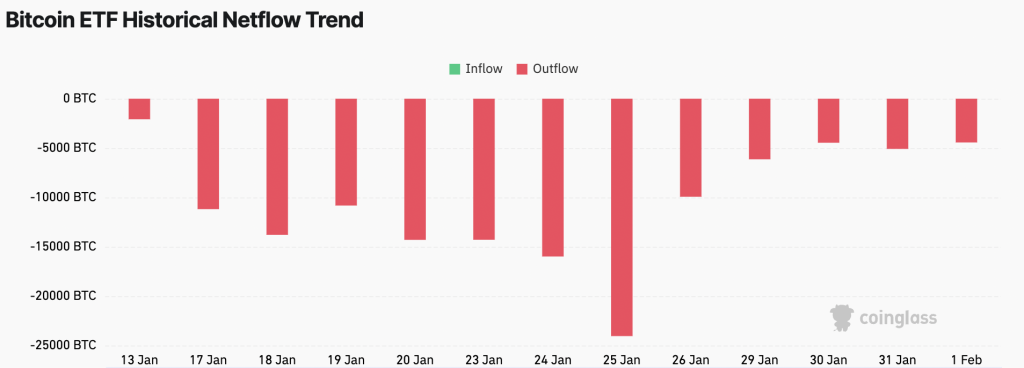

Some X accounts theorized that the Bitcoin crash was caused by GBTC redemptions, but Arkham data shows only $41 million in outflows.

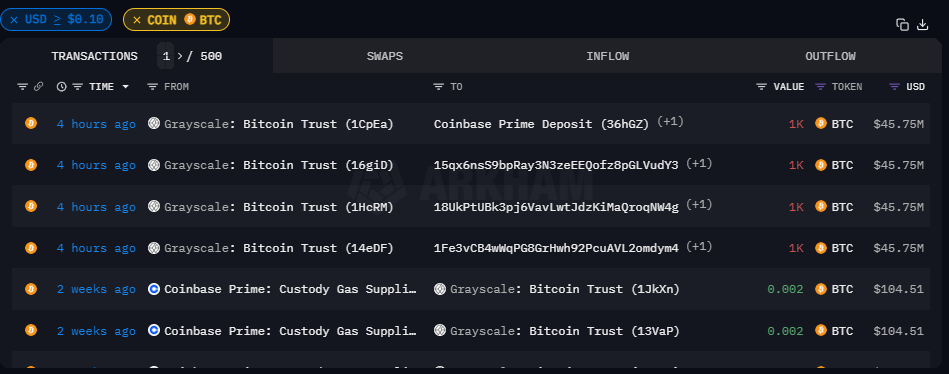

The Grayscale Bitcoin Trust (GBTC) moved 894 Bitcoin (BTC) (worth $41 million at the time of the transfer) to a Coinbase Prime deposit wallet on Jan. 12, according to data from blockchain analytics platform Arkham Intelligence. The movement comes the day after the trust started to allow authorized participants to redeem Bitcoin. Some X (formerly Twitter) accounts speculated that GBTC redemptions were responsible for the downturn in Bitcoin’s price, although the withdrawals have been small as a percentage of Grayscale’s total assets so far.

In addition to the $41 million in outflows to Coinbase, another $119 million was sent to wallets with no previous history.

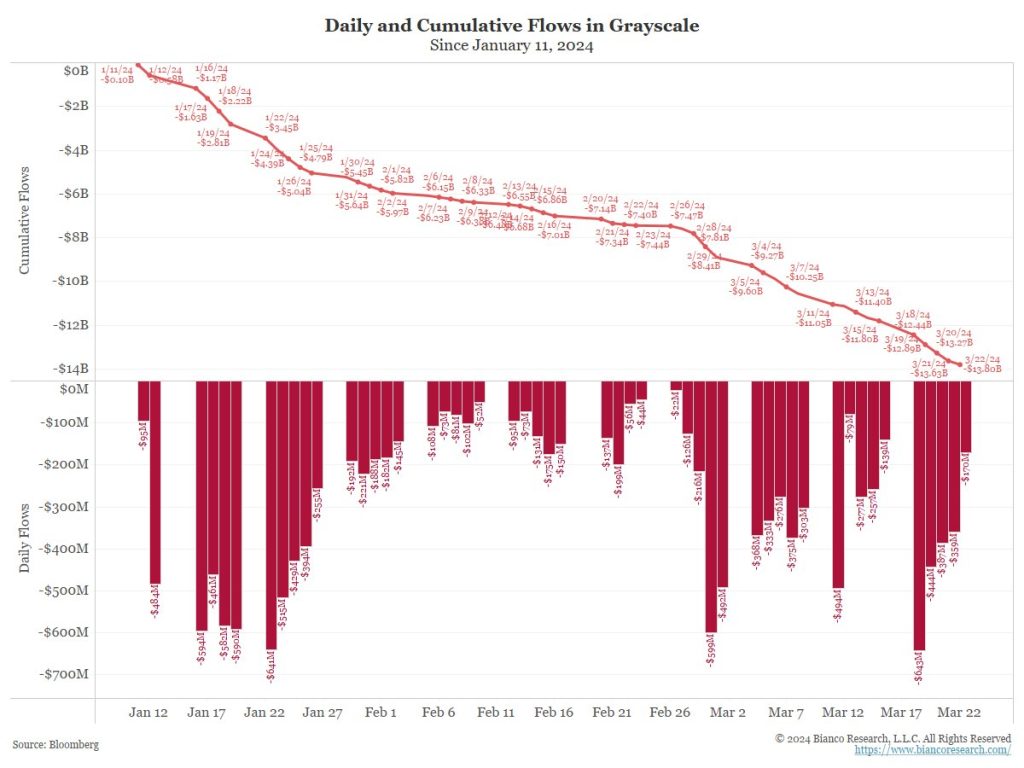

The Grayscale Bitcoin Trust is often believed to be one of the largest single holders of Bitcoin in the world. In a Sept. 6 social media post, Arkham claimed that the trust held over $16 billion worth of the cryptocurrency. Current Arkham data estimates the trust’s holdings at $27 billion, as the price of Bitcoin has risen over the past few months.

Shares of GBTC have been traded since 2013 but were not redeemable for Bitcoin until Jan. 11. Because of the irredeemability of the shares, they have often traded at a steep discount to their net asset value, or the value of the Bitcoin they represent. For example, in October, each share of the trust was worth 16% less than the amount of Bitcoin it represented.

On Jan. 12, the day after multiple Bitcoin ETFs began trading, Arkham Intelligence data showed that the trust sent 894 BTC to Coinbase in one transaction and another 2,607 BTC to other wallets in three other separate transactions. The amount sent to Coinbase represents $41 million in outflows, or approximately 0.15% of the Grayscale trust’s total holdings, while the remaining outflows to other wallets represent an additional $119 million, or 0.44%.

Related: Grayscale court decision was key to Bitcoin ETF approval, says Gary Gensler

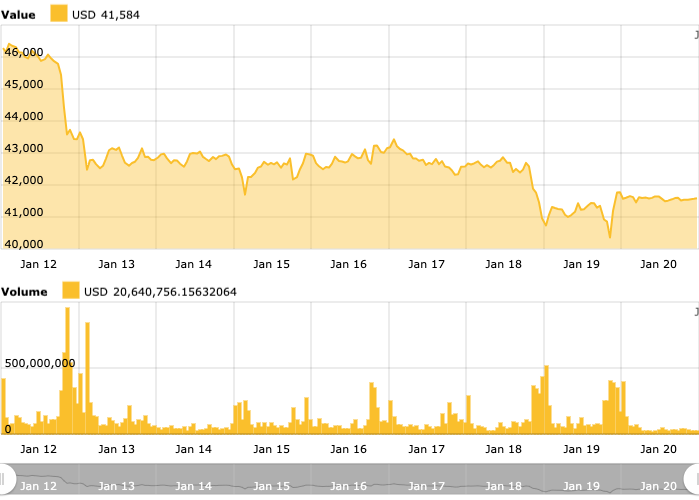

On the same day that these outflows occurred, Bitcoin’s price went into a sudden downturn, falling from approximately $46,000 to slightly above $43,000 by 6:47 pm UTC. The fall resulted in the break of a strong line of support at $44,740.

Despite the small amount of outflows shown by Arkham, some X users theorized that the downturn may have been caused by redemptions of GBTC shares, as holders of these shares finally got the chance to cash out. Pseudonymous crypto trader Fomocap posted an image of the falling Bitcoin price and remarked: “People are selling $25b worth of GBTC, welcome to ETF.”

People are selling $25b worth of GBTC, welcome to ETF https://t.co/ojKOGxrfrr pic.twitter.com/TQjZH3fXzs

— Fomocap (@fomocapdao) January 12, 2024

Napatradamus made a similar claim, stating, “Less than $1b out of $28b has been sent out so far gents,” adding, “Loooong way down.” As evidence for their theory, Napatradamus posted a link to Arkham’s page for the Grayscale Bitcoin Trust.

Ran Neuner, host of CNBC’s Crypto Trader, agreed with the theory, posting to X that “Bitcoin Price is dumping as people are dumping their GBTC shares.”

Bitcoin Price is dumping as people are dumping their GBTC shares.

GBTC held $25bn+ worth of Bitcoin that has been locked up for years with no option to be sold. As soon as the redemption option opened, for the first time people are starting to exit – as they exit the Bitcoin… pic.twitter.com/EqHgpHyVdd

— Ran Neuner (@cryptomanran) January 12, 2024

In his post, Neuner warned that Bitcoin “could see some selling pressure for a while,” as “$25bn is a serious number and even if just 20% are redeemed, that is $5bn in sales on the market.”

Grayscale has never publicly stated its wallet addresses, so Arkham could be mistaken about which wallets belong to the trust, in which case the outflows could be larger or smaller than Arkham’s data shows.

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2457/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2457/ […]