Bitcoin’s role in bridging the global wealth gap: Opportunities and challenges

The global wealth gap has widened over the last few decades. Statistics from the last quarter of 2022 revealed that the majority of the United States (90% of the population) only holds 30% of the country’s wealth. Meanwhile, nearly 70% of the wealth remains in the hands of the country’s top 10% — reflecting the reality that the rich get richer as the working class continues to struggle.

On a global scale, the richest of the rich possess 76% of wealth, while the middle and lower classes only hold 22% and 2%, respectively. The “World Inequality Report” likewise paints a picture of global income inequality in relation to class.

The middle class notably attempts to close the income gap by earning nearly 40% of global income, while the top earners take home 52% of the pie. The lower class, however, hovers at 8.5%. This once again underscores the stark reality that more than half of global wealth goes to the already affluent while lower-income classes continue to fall behind — with little to no means of catching up.

How is Bitcoin affecting the global economy?

The issue of global wealth-distribution inequality can be attributed, in part, to the general population’s lack of access to general banking and high-class financial services. The rich, however, can readily access resources and services that allow them to earn, invest, receive, send and store their money.

This is where cryptocurrency comes in. Bitcoin (BTC), in particular, was created with the intent to bridge the global wealth gap following the Great Recession in 2008. Bitcoin creator Satoshi Nakamoto purportedly developed the blockchain to subvert centralized currency manipulation — thus giving the general public better access to financial services.

Today, according to the World Economic Forum, financial inclusion is on the rise due to increasingly more accessible ways to open accounts and manage finances. The decentralized finance (DeFi) sector saw a “DeFi boom” in 2020, with more people accessing decentralized applications and looking for alternative ways to conduct financial transactions.

The Covid-19 pandemic reportedly catalyzed digital account adoption globally, with notable improvements in developing countries and emerging markets. The world’s unbanked population remains high at 1.4 billion in 2022, but this figure is a vast improvement from 2017’s 1.7 billion people. The World Bank directly attributes this improvement to increased access to digital financial services.

How does Bitcoin fix inequality?

Digital currencies, in general, provide a way for users to access financial tools that are more secure, affordable and user-friendly. Bitcoin is the top cryptocurrency globally, making it particularly helpful in providing ways for people in developing nations to send and receive money without the barrier of exorbitant transaction fees.

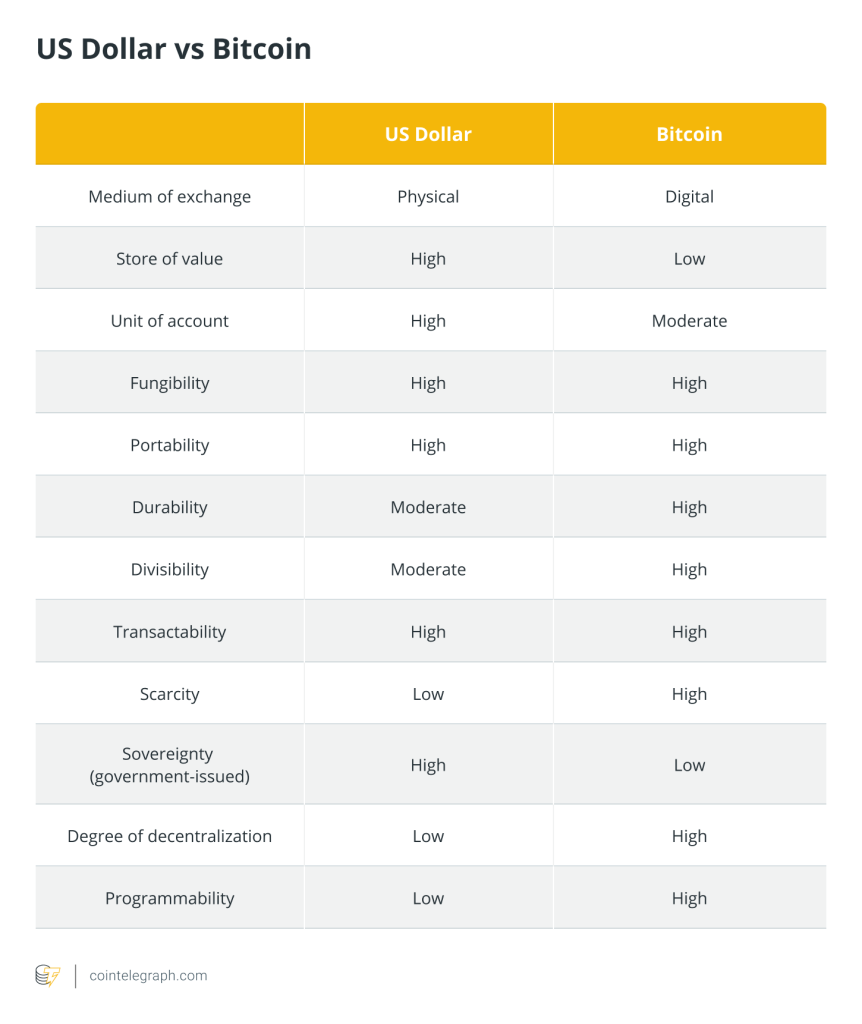

It is worth noting that Bitcoin itself does not directly solve the problem of economic inequality. After all, Bitcoin remains a highly decentralized digital currency and technology. Its proponents, however, argue that it holds the potential to address various aspects of inequality precisely because of its unique characteristics — such as decentralization and transparency.

Bitcoin, for example, generally allows for better accessibility than traditional banking systems. This is because access to digital currency systems like Bitcoin isn’t dependent on social standing, gender or economic stability — factors often heavily considered in traditional banking setups.

Bitcoin is decentralized

Governments regulate traditional financial institutions in centralized systems. All transactions are thus regulated and limited via central banks. This can be a good thing in areas with completely trustworthy governments.

However, centralized finance may not offer access to people living in underprivileged areas where financial control can easily foster corruption and extortion. Bitcoin provides an alternative system that is entirely decentralized, which means that the government has no control over people’s transactions.

Bitcoin is inflation-resistant

Although not wholly impervious to inflation, Bitcoin can act as a hedge against inflation. As the largest and most well-established cryptocurrency, Bitcoin offers long-term growth prospects.

First, Bitcoin’s limited and fixed supply of 21 million eliminates inflation risk because new coins cannot enter circulation. Increased printing of fiat currency is one of the hallmarks of inflation. Second, Bitcoin is independent of any economy or currency. It generally remains impervious to economic changes that bring about inflation.

And because Bitcoin does not have to deal with the economic risks associated with stock markets, it can also be considered a more viable option than equities. It is also easily transferable due to its decentralized nature.

Bitcoin facilitates access to payment systems

Global payment and remittance systems like PayPal and Wise require users to have their account linked to a bank before they can cash out. This presents a challenge to unbanked people looking to work remotely or receive payments online. On the other hand, Bitcoin allows users to receive payments free of intermediaries.

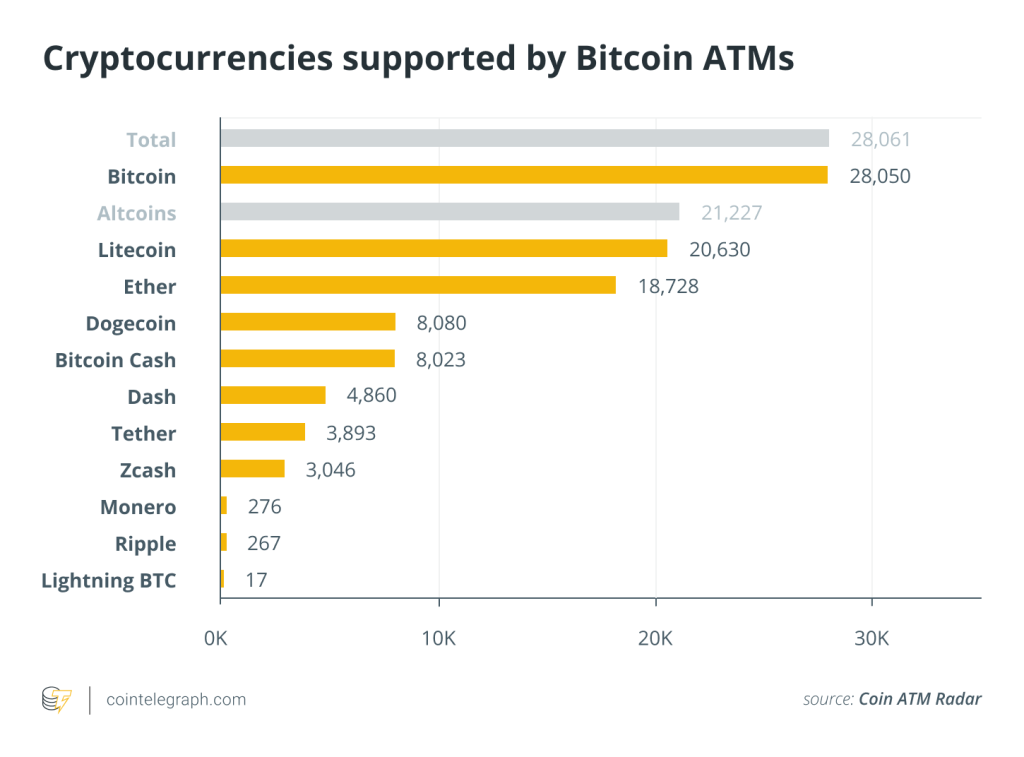

Blockchain technology facilitates peer-to-peer transactions in a secure environment, allowing users to receive funds directly from another user. All they need is a compatible cryptocurrency wallet and they can safely send and receive cryptocurrency. They can also withdraw their Bitcoin in the form of fiat money through Bitcoin ATMs, which are now widely available globally.

Bitcoin fosters innovation

The very technology of Bitcoin hinges on innovation. As mentioned, Nakamoto originally intended for it to be a “great equalizer” to help close the global wealth gap. To this day, Bitcoin remains decentralized and uncontrolled by any single entity.

It has also paved the way for many technological innovations in the cryptocurrency space. Since its inception, various platforms have been created to facilitate the further use of cryptocurrencies. These include cryptocurrency exchanges and platforms for mining, lending and staking digital currencies.

Bitcoin remains a technical basis for many new and innovative cryptocurrency projects, meaning that developers continue to build on Bitcoin’s code and technology to come up with increasingly innovative blockchain solutions. Its scaling problem, for instance, has inspired developers to keep finding ways to support the network and improve scalability.

For example, Rootstock brings smart contracts to the Bitcoin ecosystem via a two-way peg. These smart contracts are expected to make faster payments and scale up to 100 transactions every second.

The challenges associated with a crypto-based economy

In 2021, the International Monetary Fund (IMF) pointed out the challenges and risks that cryptocurrencies pose in the larger financial ecosystem. These include consumer protection risks, which remain a considerable threat due to oversight and inadequate disclosure.

In some cases, cryptocurrency tokens listed in exchanges may have no liquidity or may be abandoned by their developers. Some may even be created for purely fraudulent purposes or just for speculation.

The lack of regulation also remains an area of contention. The entire cryptocurrency ecosystem falls under different regulatory frameworks spanning multiple countries, making it difficult to enforce any common set of rules.

The IMF has also expressed concern regarding the increasing “cryptoization” of the economy, which refers to increasing cryptocurrency adoption rates to the detriment of local currency use. Analysts warn that cryptoization could reduce central banks’ ability to enforce monetary policy effectively and could create financial stability risks.

Finally, there is the challenge of interoperability and cross-border payments. While Bitcoin facilitates financial freedom, its scaling limitations make it hard to use as a payment method in everyday transactions such as buying food or paying bills.

How has Bitcoin impacted society?

Data reveals that millennials are the top Bitcoin users, with most cryptocurrency owners falling between 25 and 44 years old. Millennials regard Bitcoin as both a valuable investment tool and a store of value — often preferring it over stocks, real estate, government bonds and gold.

Bitcoin’s technical nature also holds a certain appeal among tech-savvy millennials and developers. Bitcoin fits millennials’ digital habits and lifestyles, as their generation is generally at ease with online shopping and the digital economy. This explains why Bitcoin’s market capitalization continues to grow despite its high volatility, with new investors entering the market regularly.

Experts also suggest that Bitcoin functions as an investment vehicle and storage medium for newly acquired generational wealth. Society is undergoing a “Great Wealth Transfer” from baby boomers to millennials — and Bitcoin is among the top beneficiaries of this shift. Bitcoin is expected to capture 3% of the gold market alongside the emergence of the millennial generation’s “Bitcoin millionaires.”

Bitcoin isn’t reserved for the affluent, though. Reports reveal that although most Bitcoin users fall within the same age bracket, they come from varying economic backgrounds. This remains consistent with Nakamoto’s original design, which sought to promote financial freedom for all, regardless of identity or economic status.

Bitcoin’s demand rose exponentially during the Covid-19 pandemic, with Reuters reporting a 300% advance in 2020. Analysts noted that the surprising resilience of cryptocurrencies, especially Bitcoin, amid economic instability and deep societal unrest was instrumental in the wider acceptance of digital currencies.

What made Bitcoin successful wasn’t the hype, though. It’s been around since 2009. Its robust technology and flawless code, however, have gained the confidence and trust of its users.

Today, many countries are actively exploring the potential of blockchain technology for various applications, from digital identification and healthcare services to data management and voting systems. Other countries are also looking to follow in the footsteps of El Salvador and the Central African Republic in officially declaring Bitcoin as legal tender.

Can Bitcoin help with economic problems?

Given Bitcoin’s ability to democratize financial services, economists believe it can help with economic issues and fuel economic growth. In Africa, for instance, Bitcoin reportedly helps many people gain access to basic banking services or remittance payments. This is especially helpful in countries where the traditional banking system remains inaccessible due to geopolitical constraints.

Bitcoin has also been touted as a potential tool for developing countries in the fight against poverty and rampant corruption. Bitcoin offers fast, transparent and affordable money transfer services, allowing more people to participate in the global economy without relying on financial institutions.

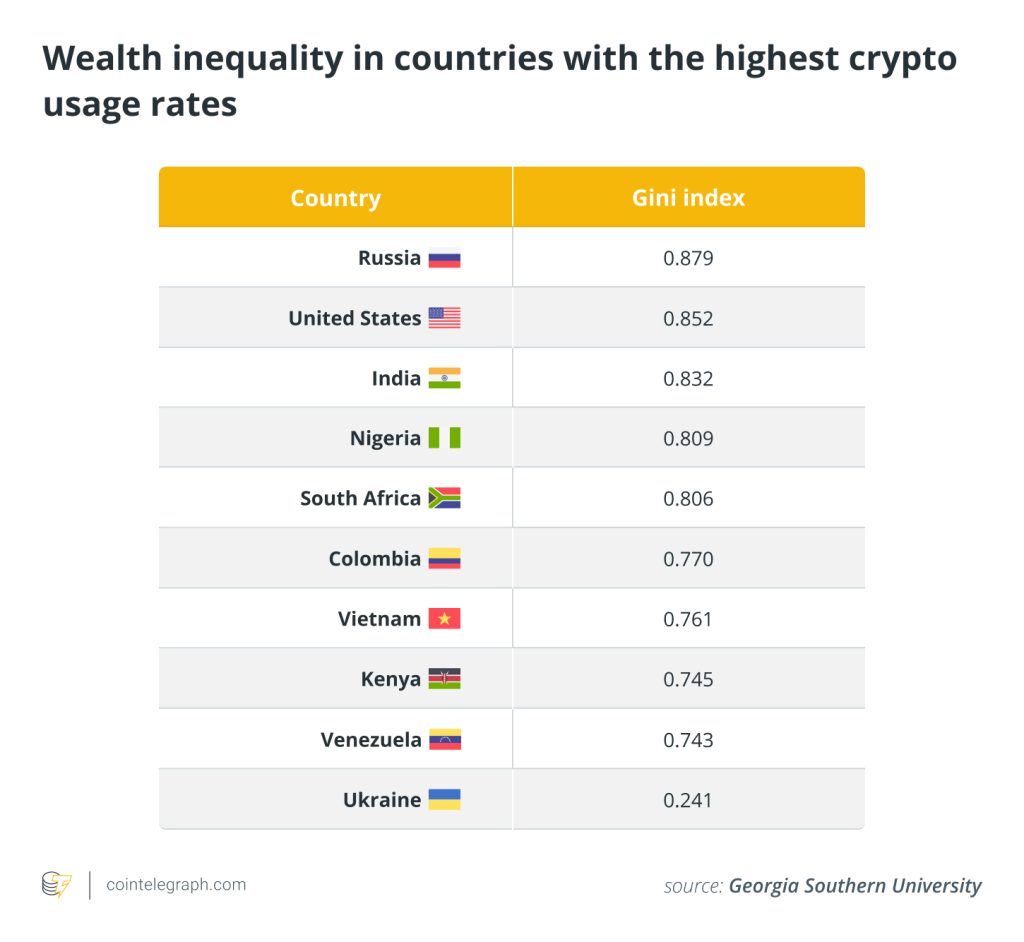

Income inequality is statistically measured by examining wealth distribution via the Gini index, a metric developed by Italian statistician Corrado Gini. The Gini index ranges from 0 to 1, with 0 indicating perfect equality and 1 indicating perfect inequality.

According to a study by Georgia Southern University, the Gini index in countries with the highest cryptocurrency ownership indicates high economic inequality. This signals high crypto usage across varying income levels (not just the upper class), indicating that Bitcoin may be helping to reduce economic disparities in certain countries.

In addition, Bitcoin has helped promote financial literacy since its inception and continues to do so today. The now-iconic “Bitcoin Pizza Day,” during which Laszlo Hanyecz was the first person to use BTC in a commercial transaction (two pizzas for 10,000 BTC), showcased how Bitcoin could be used as a viable medium of exchange. Since then, people started to explore various uses for Bitcoin, thus continually improving financial literacy.

How Bitcoin could change the world economy

U.S. federal data revealed the statistical proof of a shrinking middle class. Amid record-high inflation and fears of recession, experts say that Bitcoin could help fight income inequality. Bitcoin’s transparency is among the top qualities that make it a formidable tool for strengthening the middle class.

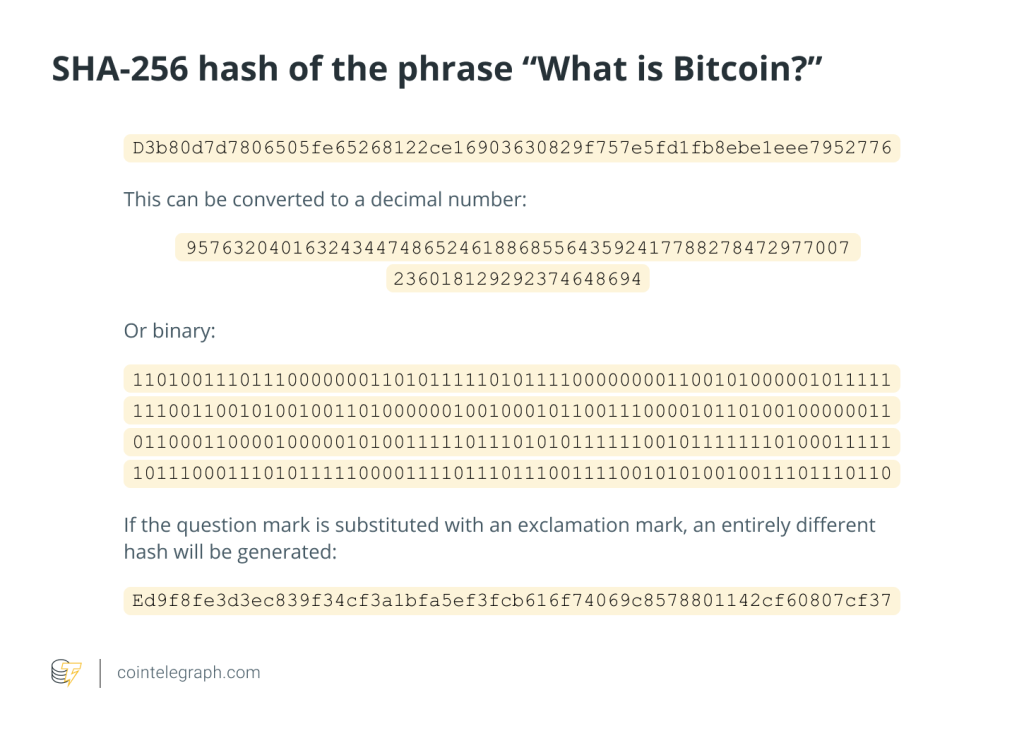

Because the Bitcoin network functions independent of central authorities and owing to the technological underpinnings of blockchain technology, all transactions are recorded on a public ledger and are, therefore, tamper-proof and unalterable.

This feature allows the public to “opt-out” of the fiat system, protecting people from central authority oversight and unfair inflationary policies. With Bitcoin, anyone can store value outside the traditional banking system, enabling individuals to take their finances into their own hands (i.e., financial sovereignty).

Furthermore, the widespread adoption of Bitcoin could help kickstart a new era of global economic sovereignty. With blockchain-powered digital currencies like Bitcoin, people are no longer limited to their national currency and can easily transact across borders.

Written by Marcel Deer

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] There you will find 93265 additional Info to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] There you will find 51054 more Information to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2413/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2413/ […]