Stablecoin regulations in the US: A beginner’s guide

What are stablecoins?

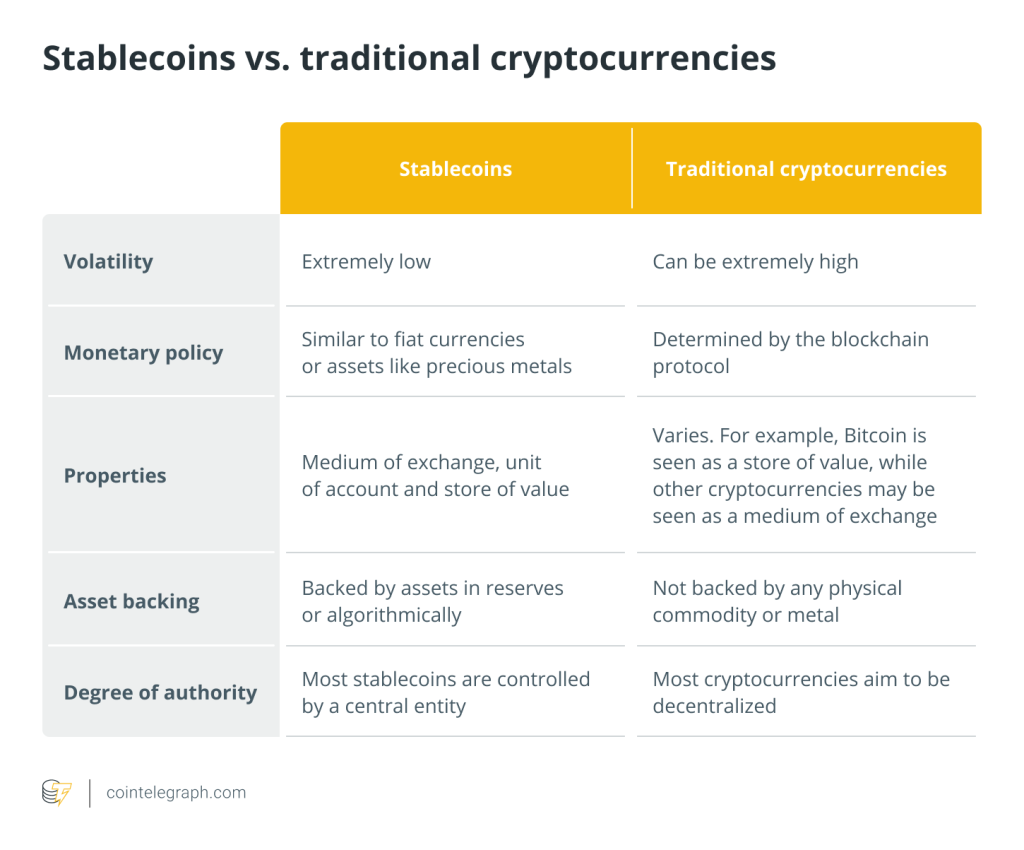

Stablecoins are a class of cryptocurrencies created primarily as a medium of exchange and are used to facilitate crypto transactions today. An alternative to extremely volatile and popular cryptocurrencies, stablecoins have their value tied to a commodity, fiat currency or financial instrument and maintain price stability by locking reserves of the underlying pegged asset as collateral or by some algorithm to control the token supply.

In all, there are three types of stablecoins: fiat-collateralized stablecoins, crypto-backed stablecoins and algorithmic stablecoins. Linked to the price of the underlying fiat currency, popular fiat-collateralized stablecoins like USD Coin (USDC), Tether (USDT) and Binance USD (BUSD) are pegged to the United States dollar and backed by U.S dollar reserves equivalent to the number of stablecoins issued.

Crypto-backed stablecoins like MakerDAO’s Dai (DAI) and Wrapper Bitcoin (WBTC), on the other hand, are linked to popular cryptocurrencies like Ether (ETH) and Bitcoin (BTC), respectively.

Since the price of these cryptocurrencies displays significant volatility, crypto-backed stablecoins are overcollateralized in order to ensure sufficient reserves even if the base cryptocurrency’s price falls significantly.

In contrast to these two types, algorithmic stablecoins hold their value steady by controlling token supply through an algorithm, similar to how central banks across the world regulate the price of their native fiat currencies.

While algorithmic stablecoin issuers do not enjoy the same level of confidence as per the U.S Federal Reserve, spectacular failures of stablecoins such as Basis Cash (BAC), Iron Finance’s stablecoin (IRON), and TerraUSD Classic (USTC) have led to calls for regulation in this niche space.

What are the risks with stablecoins?

In an ideal scenario, fiat currency and crypto-backed stablecoin issuers allocate enough reserves of the pegged asset to guarantee their stablecoin’s price stability and thus the value of token holdings held by investors over the short term.

However, in the event that these reserves fall short or are backed by a cryptocurrency whose price continues to plummet, there is a real risk of the stablecoin losing its peg. This could trigger a chain reaction, resulting in the stablecoin being dumped by panic-stricken investors and losing most or all of its value.

With algorithmic stablecoins, this risk is even higher, as their protocol designs rely on an intricate relationship between the stablecoin and the collateral cryptocurrency to maintain the former’s price.

As was demonstrated by the Terra crash, the stablecoin’s issuers designed the peg such that USTC’s market capitalization had reached levels far higher than what the collateralized Luna Classic (LUNC) token reserves should have allowed.

While flaws in how USTC was pegged are now evident, few investors or market experts could have guessed the speed with which USTC would crash in May 2022.

Additionally, there are the usual security risks associated with stablecoins as they are held in digital or hot wallets or with an exchange. These platforms could be impacted by a malicious attack and any theft of stablecoins or the reserve funds could jeopardize the entire peg.

A lot also depends on how issuers self-regulate their operations, with severe counterparty risks arising in case of any fraud committed by them or any of the related parties involved in maintaining the stablecoin.

Why do stablecoins need to be regulated?

As more issuers began to flood the market with new stablecoins and an increasing number of them failed for a number of reasons, legislators and experts alike were vocalizing the need for legislating stablecoins.

Concerned about the systemic failure of some top stablecoins, U.S. Treasury Department’s Secretary Janet Yellen even alluded to the rising uncertainty that stablecoin issuers would be able to back their stablecoins with traditional assets in times of stress.

While these comments have surfaced in the aftermath of the Terra debacle, the Securities and Exchange Commission (SEC) has been critical of stablecoins and other crypto assets since 2018.

Even top stablecoin firms like Tether have surprised ardent stablecoin fans with their disclosures. In its reserve report compiled up till March 31, 2021, the company clarified that it held no more than 76% of its reserves in cash or cash equivalents, while the rest were in the form of corporate debt, funds, precious metals or secured loans.

While these non-cash assets do behave like actual cash in normal scenarios, they do not enjoy the same liquidity and are also subject to valuation fluctuations that can wreak havoc on the overall valuation of the company’s reserves. Not surprisingly, the Commodity Futures Trading Commission (CFTC) penalized Tether Holdings Limited and its affiliates, Tether Limited, Tether Operations Limited and Tether International Limited, on October 15, 2021, with a fine of $41 million for falsely claiming that USDT was 100% backed by cash.

The CFTC order stated that Tether had violated Section 6(c)(1) of the Commodity Exchange Act (CEA) and Regulation 180.1(a)(2), which prohibits manipulative and deceptive statements from being made in relation to the underlying commodity. The latter section deals specifically with Tether’s actual backing of USDT, which was a far cry from the 100% fiat currency collateralization that was claimed by the company.

Despite the path-breaking innovations introduced by blockchain technology and several crypto firms, there is a critical need to integrate digital assets like stablecoins into existing law and address the associated risks without hampering innovation.

In order to protect investor interests and curb the menace caused by lax or fraudulent actors, U.S President Joe Biden signed an executive order in March 2022 directing multiple government agencies to formulate a regulatory framework for digital currencies.

Are stablecoins FDIC insured and what happens if stablecoins are deemed as securities?

When the broader crypto market was scaling new heights in November 2021, the U.S President’s Working Group (PWG) on financial markets issued a blistering report on the risks posed by stablecoins and their negative impact on the stability of financial markets.

Recognizing the fact that payment stablecoins pose systemic risks that can defeat their very purpose as a widely accepted form of payment, the PWG report referred to issuers of stablecoins as the new “shadow banks” and implored U.S. regulators to subject them to continuous and comprehensive oversight. Detailing how stablecoins risk losing value in the event of a crypto run, the report also highlighted how such events could disrupt tokenholders’ ability to make payments while also leading to a wider contagion effect that could disrupt allied markets as well.

What’s more, the report insisted that stablecoin issuers should be insured by the Federal Deposit Insurance Corporation (FDIC), an independent agency created by Congress to examine financial institutions for safety, soundness and consumer protection. However, stablecoin issuers are not required to comply with federal banking laws and hence are not even FDIC insured.

With stablecoin providers increasingly becoming a source of ‘private money’ comparable to money market funds, the risks arising out of a failure can potentially wipe out investor wealth, as these issuers do not enjoy the explicit government backing provided to firms regulated by the FDIC.

To do this, stablecoins would have to be categorized as securities and come under the strict regulatory oversight provided by the SEC today. Moreover, stablecoin issuers would be subjected to complete disclosures that can help investors but also weigh down stablecoin firms with time-consuming paperwork.

A glimpse at U.S state-level regulations on stablecoins

While many complimented the White House for taking a significant step toward regulating digital assets, few states like Wyoming had already gone to great lengths to introduce digital asset regulations back in 2018.

Arguably the most crypto-friendly state in the United States, Wyoming had set the legal foundation for smart contracts, clarified how digital assets are to be treated in commercial law and even made it easier for entrepreneurs to set up limited liability companies to help investors from other states store their digital assets.

In April 2021, the state even passed legislation that granted legal status to decentralized autonomous organizations (DAOs) and allowed Wyoming banks to serve as custodians for digital assets without refraining institutional investors from retaining the direct ownership of these holdings.

Even before Wyoming, however, New York’s Department of Financial Services (NYDFS) had issued its digital currency regulation under the New York Financial Services Law in 2015. The state permitted entities to either apply for a BitLicense or a charter under the New York Banking Law in order to conduct digital currency business activity within its geographical limits. Ever since, the NYDFS has granted numerous digital currency licenses and charters to ensure that its dwellers can access well-regulated digital currency marketplaces.

This has, in turn, established New York as one of the important hubs of technological innovation in the blockchain and crypto space. Other states such as Colorado, Texas, California and Ohio, too, have adopted a crypto-friendly approach and introduced regulations covering various aspects such as crypto mining, consumer protection, crypto businesses and even taxes.

Understanding the proposed stablecoin regulation

Highlighting the importance of providing investor protection and fostering innovation in the crypto ecosystem, the US House Financial Services Committee member Josh Gottheimer introduced the draft “Stablecoin Innovation and Protection Act, 2022” on February 15, 2022.

Describing “qualified” stablecoins as those which are issued by insured depository institutions and certain non-banking entities, the bill proposed the introduction of a qualified stablecoin insurance fund to safeguard tokenholders’ interest and allow them to exchange these qualified stablecoins for U.S. dollars whenever needed.

Providing the Office of the Comptroller of the Currency (OCC) with oversight powers over these qualified stablecoins, the bill proposed that the SEC and CFTC could examine the non-qualified stablecoins and cryptocurrencies.

While this draft bill aimed to distinguish accredited stablecoins from the broader market, it didn’t state how existing stablecoins could fall into the regulatory framework. With the SEC stating that cryptocurrencies ought to be categorized as commodities rather than securities, the bipartisan pair of Republican Senator Cynthia Lummis and Democratic Senator Kirsten Gillibrand took charge of formulating a more comprehensive crypto framework that built upon this premise.

In June 2022, the duo unveiled the Responsible Financial Innovation Act (RFIA), which aims to bring all crypto products under the regulation of the Commodity Futures Trading Commission.

The RFIA bill proposes that the CFTC maintain exclusive jurisdiction over all matters pertaining to crypto products and addresses many questions about how investor interests can be protected. It also introduces the term ‘ancillary asset’ and includes any digital asset that is provided or sold to investors in relation to the purchase or sale of a security that is executed as part of an arrangement in an investment contract.

By definition, stablecoins perfectly fit into this description of an “ancillary asset” and would be treated similar to other commodities if the bill is approved in its present form. This would also put stablecoins out of the SEC’s legal purview and bodes well for stablecoin firms that have been awaiting clarity from federal regulators for a while now.

From an investor’s perspective, the RFIA bill provides for an exclusion of $200 from an individual’s gross income to be exchanged in lieu of virtual currency for payment of goods and services.

Additionally, the bill proposes that digital assets received through mining or staking should not be added to a taxpayer’s gross income and directs the Government Accountability Officer (GAO) to study the opportunities and risks of retirement investing in digital assets.

For both investors and innovators, this draft bill offers much-needed relief and is indicative of the supportive stance being adopted by U.S regulators. It details important regulatory aspects involving payments, consumer protection, and how collateralized assets are to be treated when insolvency proceedings are initiated.

When it comes to passing, the RFIA will not only serve as a framework for the U.S market but also spur other nations to introduce legislation that will accelerate crypto innovation even further.

The regulatory road ahead

While the RFIA bill is unlikely to be passed in 2022, on account of the midterm elections due in November 2022, it provides a comprehensive base on which further deliberations can take place. The most likely scenario is that the bill will be tabled in the 118th United States Congress, with U.S Congressman Patrick Henry expected to advance this draft bill into legislation as the next in line chairperson of the Financial Services Committee.

This hinges on whether the Republicans take charge of the House of Representatives in the midterm elections, especially considering the fact that Republican members have been staunch supporters of crypto assets and have called for a more pragmatic approach toward regulating digital assets. Either way, the RFIA bill details many provisions that could find their way into the final legislation and hence warrants a closer examination by crypto industry members, budding crypto entrepreneurs, and investors alike.

Purchase a licence for this article. Powered by SharpShark.

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Here you will find 68615 more Information on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] There you can find 45247 more Info to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] There you will find 36936 additional Info to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] There you can find 531 additional Info on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Here you will find 71202 more Information on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2383/ […]

… [Trackback]

[…] Here you will find 14945 more Info to that Topic: x.superex.com/academys/beginner/2383/ […]