An overview of the cryptocurrency regulations in Australia

Over 1 million Australians — 5% of the country’s population — own cryptocurrency, according to Roy Morgan’s Research Institute. Some surveys even stretch the statistics to 20% of the Australian population holding cryptocurrencies. Certainly, the amount of people involved in the country’s industry keeps rising. Still, only as little as 20% of cryptocurrency owners appear to be aware of the risks of investing in digital assets.

The crypto market has always been vulnerable to hacks, scams, rug pulls or bankruptcy, causing investors to lose part or all of their funds. The events of 2022 have revealed that even the most popular and trusted platforms like FTX or Celsius or crypto investment businesses — like the Three Arrows Capital (3AC) — are risky to use and could collapse, bringing down their customers with them.

The 2022 dramatic scenario has prompted governments and digital asset market regulators worldwide to take action to enhance legislation to protect customers, and Australia has taken a similar approach by considering tighter measures.

Is cryptocurrency legal in Australia?

Bitcoin (BTC) and other cryptocurrencies are legal in Australia and are treated as property. It is legal to trade, spend, receive and store cryptocurrency, and they are an accepted means of payment for personal and business transactions, although merchants are not obliged to accept it.

Blockchain and cryptocurrency in Australia have always enjoyed neutral and stable market incentives, encouraging technological innovation in payments, crypto assets, lending, investment and custodial services.

Cryptocurrency and cryptocurrency exchanges achieved full legal status in 2017. Since then, Australian laws have never interfered much with the industry and have embraced the innovation that comes with the technology.

However, in 2018, crypto laws in Australia have factored in Anti-Money Laundering (AML) and counter-terrorism financing (CTF) measures because transferring value in digital currencies involves procedures that could facilitate such illicit activities. As a consequence, the Financing Act 2006 started including digital currencies in the AML and CFT regime.

How is cryptocurrency regulated in Australia?

The Australian government has historically employed a mild approach to crypto asset regulation. However, in light of the recent dramatic events in the crypto space, there have been calls for developing a more effective digital currency regulation focused on consumer protection and market integrity.

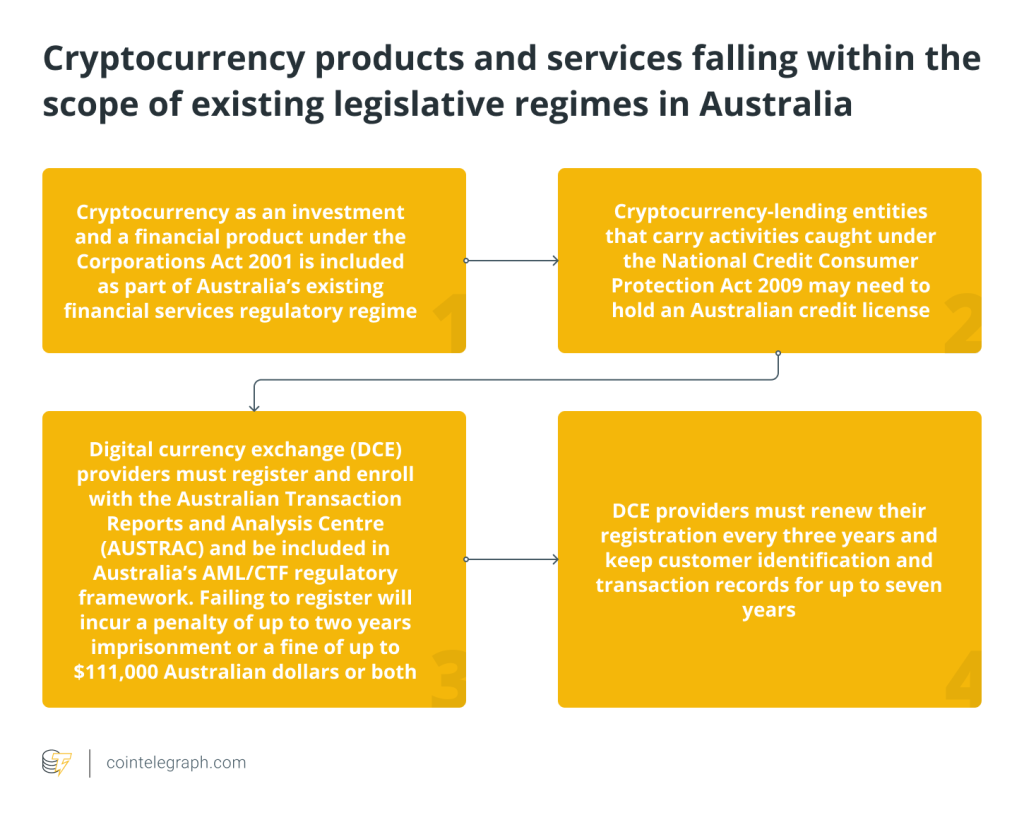

While cryptocurrencies are not treated as a specific area of law by the local jurisdiction, they can still be captured in existing regulatory frameworks under Australian law. Below are a few instances of cryptocurrency products and services that fall within the scope of existing legislative regimes:

Australia’s regulatory stance on blockchain and cryptocurrency

Australia’s primary financial services regulator for the corporate, markets and consumer credit fields is the Australian Securities and Investments Commission (ASIC). It has specified that crypto assets form part of exchange-traded products (ETPs) — which are regularly priced securities that trade during the day on a national stock exchange — and other investment products.

Crypto as an investment

Being treated as investments, cryptocurrencies in Australia are generally under scrutiny from a transactional relationship perspective, such as the issuing and exchanging process. The Australian legislation focuses on activities involving cryptocurrencies rather than the cryptocurrency assets themselves.

Even though El Salvador adopted Bitcoin as a legal tender, the Australian government confirmed it would keep treating Bitcoin and other cryptocurrencies as investment assets, not as foreign currency or any type of money. As investments, cryptocurrencies are subject to capital gains tax (CGT) — a tax on profits realized on the sale of an asset — which means that traders and investors must keep track of all transactions in detail to assess if CGT is due or not.

Cryptocurrency exchanges

Australia’s cryptocurrency exchanges are required to register with the AUSTRAC, identify and verify their users, maintain records, and comply with the government AML/CTF reporting obligations. A Digital Currency Exchange Register is managed and safeguarded by AUSTRAC, while unregistered exchanges may face criminal charges and financial penalties if they do not comply with registration requirements.

Blockchain and DLT

Currently, no specific legislation is applied to blockchain or other distributed ledger technologies (DLT) in Australia. ASIC provides publicly available guidelines related to potential issues that may arise with the implementation of such technologies.

Businesses that operate their market infrastructure and provide financial or consumer credit services using DLT are subject to regulations existing under the relevant licensing regime. Companies operating within the cryptocurrency, blockchain and DLT technology frameworks must observe general guidelines and obligations. Such policies and responsibilities are related explicitly to planning organizational competence, provision of adequate technological resources and risk management.

One of the main features of some cryptocurrency networks is the implementation of smart contracts, also identified as self-executed contracts. Australia recognizes the validity of smart contracts from a legal standpoint, provided they meet all the requirements and obligations of a traditional legal contract.

Central bank digital currency

Despite global attention to the development of central bank digital currencies (CBDCs), the Reserve Bank of Australia — Australia’s central bank — has not indicated any immediate plans to issue such a centralized digital currency. The government recognizes that a CBDC is a potential new form of digital money that would be the responsibility of the central bank and the digital version of cash, widely accepted via smartphone wallets or smart cards.

However, the Reserve Bank of Australia has anticipated that there is currently no strong policy case and has adopted a more skeptical approach toward a real use case for a retail CBDC — a digital central bank liability offered to the general public for retail payments. The main reason for such a position is that Australia already has an efficient electronic payment system that provides retailers and businesses with a wide range of safe, convenient and low-cost payment services.

Do you pay tax on crypto in Australia?

The Australian Taxation Office (ATO) is the authority that regulates crypto tax in Australia and considers cryptocurrency an asset. More specifically, crypto assets are considered property for tax purposes and subject to capital gains tax. If the cryptocurrency is held for at least 12 months before it is sold, then capital gains tax may be discounted.

Sale and exchange of cryptocurrency

Australia’s existing financial services regulatory regime regulates the sale or exchange of cryptocurrencies and other digital assets. If the sale or exchange of cryptocurrency is the ordinary course of a holder’s trading activity, the digital asset will be treated in the same way as trading stock.

Gains coming from the sale of cryptocurrency — in a trading or mining business, for example — will be quantifiable, while the losses will be deductible.

Staking cryptocurrency

Staking cryptocurrency and being rewarded with crypto tokens is an activity that is treated as ordinary income and will be a taxable event.

Good and services tax (GST)

Since July 2017, digital currency supplies and acquisitions have not been subject to GST, provided they are input-taxed financial supplies. Input-taxed sales are goods and services that don’t include GST in the price, and GST credits cannot be claimed for the GST included in the price of “inputs.”

However, because digital currency can be a payment method, the usual GST rules apply to the payment or receipt of digital currency for goods and services.

Mining

A cryptocurrency miner is required to register for GST if the annual GST turnover of their business is $75,000 AUS or more. However, a miner who does not reach such a GST threshold may still want to register for GST to claim from the ATO full input tax credits for the GST cost of its business acquisitions.

Enforcement of cryptocurrency tax evasion

The ATO is committed to tackling cryptocurrency tax evasion and, with this intent, has created a specialist task force. The tax office requires Australian cryptocurrency exchanges and service providers to keep and provide customer records. The aim is to conduct data matching and ensure that cryptocurrency traders and investors pay the right amount of tax.

Future plans for digital assets regulation in Australia

In August 2022, the Australian government announced that it would be taking all steps necessary to initiate a series of consultations with industry players, investors and stakeholders to start drafting a regulatory framework for the cryptocurrency sector.

In regulating the crypto industry, Australia will have to face the hurdles of dealing with a relatively new market, understanding it and establishing crypto restrictions without suppressing innovation.

Here are the regulatory authorities’ primary areas of focus:

- The treasury is expected to prioritize a token-mapping exercise to provide regulatory bodies with the tools to identify the relevant characteristics and regulated status of crypto assets since crypto tokens and NFTs have a broad and different range of applications.

Authorities will have to recognize significant gaps in the regulatory framework, assess progress on the licensing regimen, determine custody obligations for third-party custodians of crypto assets, and produce additional consumer protection guidelines.

- The Australian government is committed to introducing custodial and exchange regulations to protect customers in situations like the FTX crypto exchange collapse, which caused the platform’s users to lose funds. The ASIC also anticipates the introduction of good practices concerning how asset holders should keep custody of their crypto assets and ensure that adequate risk management systems are in place.

- The government pledges to introduce exchange regulations and custody arrangements as early as 2023 to signal the urgency of safeguarding customers’ funds. In particular, legislation will require registered exchanges to adopt Know Your Customer (KYC) processes for customers’ identification and verification, comply with annual reporting obligations, and monitor and report large suspicious transactions.

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Here you can find 52206 additional Info to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] There you will find 57281 more Information on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] There you can find 42104 additional Information on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] There you will find 56340 more Info to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Here you will find 15326 additional Info to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Here you can find 39385 more Information on that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2371/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2371/ […]