An overview of cryptocurrency regulations in Portugal

Is cryptocurrency legal in Portugal?

Blockchain and cryptocurrency innovation often raise legal questions, including whether standing legal frameworks offer answers for regulating new technological phenomena. Regulators from European political institutions and across most European countries are increasingly addressing concerns associated with cryptocurrencies. Some countries have fully embraced cryptocurrencies and merely created regulations to protect investors and promote innovation, while others have been more cautious.

As for cryptocurrency in Portugal, the government carried a relatively uninvolved viewpoint toward cryptocurrencies until recently. The Portuguese neither banned nor imposed any restrictions on the trading or holding of cryptocurrencies, meaning that crypto is allowed in Portugal. Portugal’s spirit as a relatively crypto-friendly country has made it a popular destination for investors, enthusiasts and businesses.

Fundamentally, cryptocurrency laws in Portugal do not prohibit cryptocurrencies, and investors can purchase, hold and sell them. Cryptocurrencies in Portugal are thus legal, and the government has acknowledged their potential as an alternative means of payment and investment.

That said, cryptocurrencies do not have legal tender status and thus do not qualify as fiat currently, nor are they considered “money.” The official treatment of cryptocurrency from 2016 was that cryptocurrency was to be treated precisely like any other currency in Portugal. Simply put, before 2022, the Portuguese state had yet to introduce specific legislation regulating cryptocurrencies per se.

Due to the lack of specific regulations, Portugal has become the place to be for its cryptocurrency space. Lisbon, for example, has become a hub for cryptocurrency and blockchain technology. Indeed, the country has several cryptocurrency exchanges and blockchain startups. Moreover, several businesses in Portugal have started accepting cryptocurrency payments.

An illustration of Portugal’s ambitions to spur the country’s growth through cryptocurrency is also reflected in its 2020 Digital Transitional Action Plan, which included the creation of “Free Zones” to test innovative technology.

That doesn’t mean cryptocurrency businesses enjoy a free haven in Portugal. Indeed, the government has implemented regulations to ensure that the use of cryptocurrencies complies with international Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) standards.

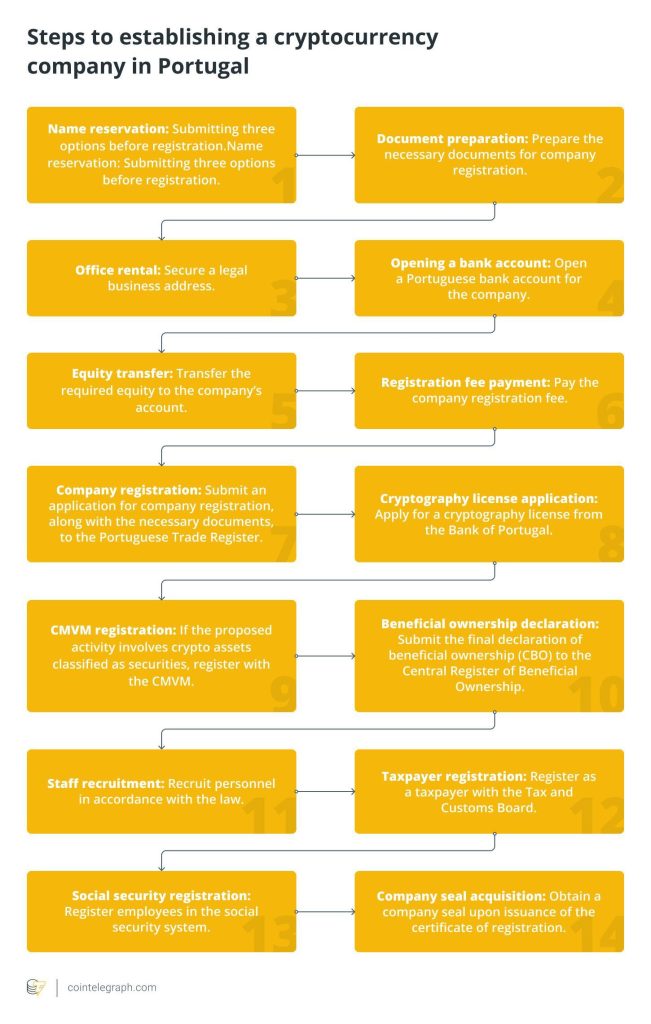

Note that a Portuguese limited liability company can be registered within two weeks. However, the licensing process may take several months. Each cryptocurrency company must be fully licensed by the Bank of Portugal as a virtual asset service provider (VASP) before commencing economic activities. Compliance with AML and CFT rules is crucial for successful licensing.

How is cryptocurrency regulated in Portugal?

The broader cryptocurrency ecosystem in Portugal is currently regulated according to a patchwork of laws and regulations. Considering the lack of comprehensive national legislation, the purchase and sale of cryptocurrencies are not explicitly regulated. Yet some specific digital asset regulation is readily in place and aligns with the international and European regulatory frameworks mentioned above.

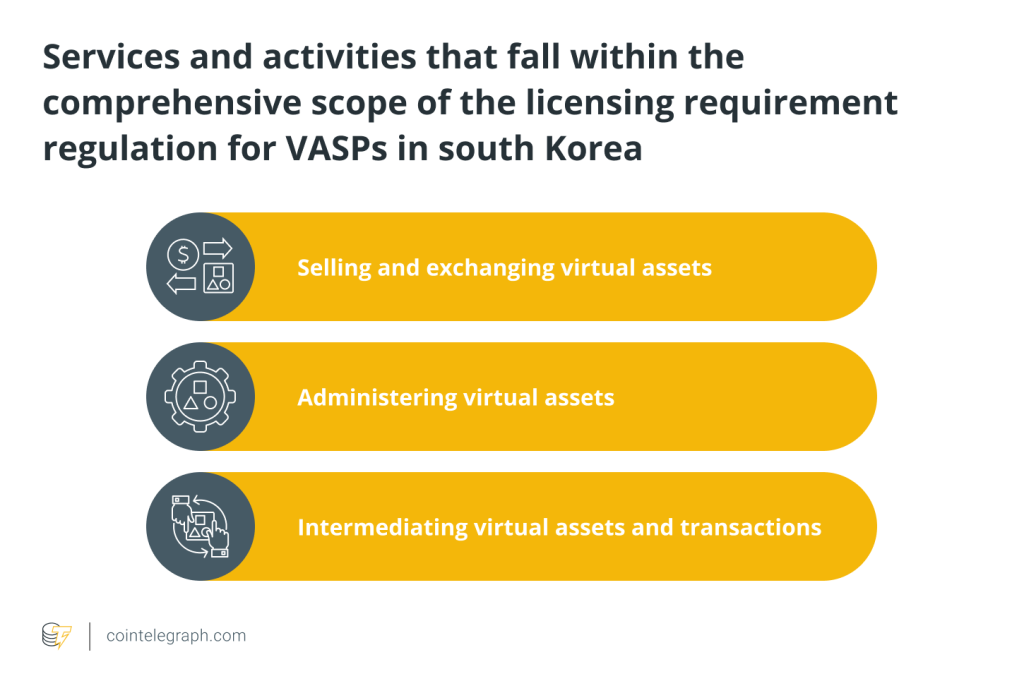

Standing cryptocurrency regulations in Portugal concern particular measures against money laundering and terrorist financing. The Bank of Portugal, in its capacity as both a central bank and competent national authority for the supervision of credit and payment institutions, is entrusted with the task of supervising and regulating cryptocurrency exchanges and wallet providers.

It also ensures compliance with AML and CFT standards. It involves creating and enforcing registration and licensing requirements for entities operating within the cryptocurrency ecosystem according to the implementation of EU Directive 2018/843 into Portuguese law in the form of Notice 3/2021.

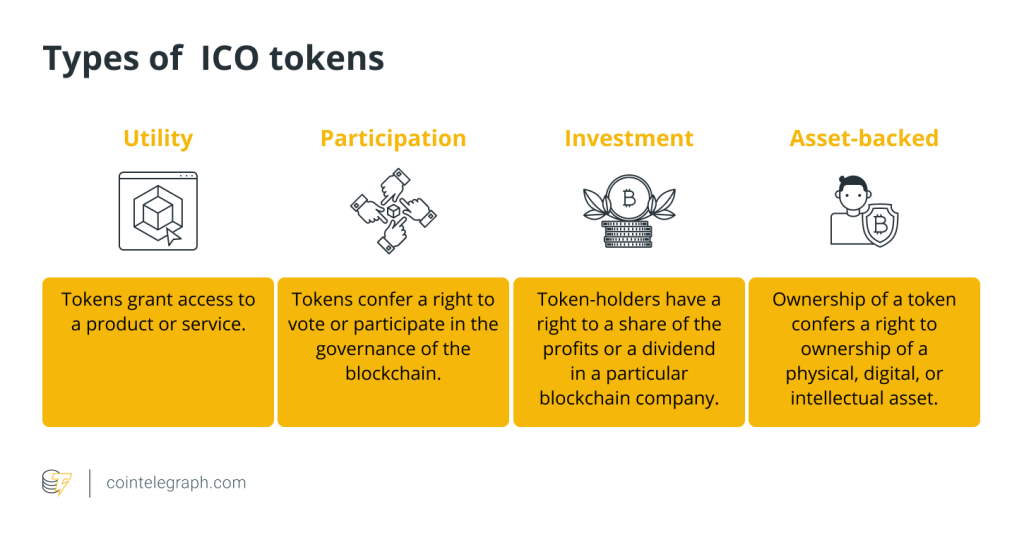

Moreover, the Portuguese Securities Market Commission (Comissão do Mercado de Valores Mobiliários, CMVM) focuses on regulating and supervising securities markets and investor protection. In the context of cryptocurrencies, the CMVM’s mandate extends to the oversight of the issuance and trading of digital assets classified as securities, such as specific types of tokens originating from initial coin offerings (ICOs) and security token offerings (STOs).

Cryptocurrency exchanges and wallet providers must adhere to specific registration and licensing requirements. These prerequisites are designed to ensure that the involved entities maintain transparency, security and compliance with said AML/CFT regulations, which encompasses conducting customer due diligence, monitoring transactions and reporting suspicious activities to the appropriate authorities. Both cryptocurrency exchanges and wallet providers must also employ robust security measures to protect user data and funds.

Until recently, no specific regime dealt with the taxation of cryptocurrencies apart from the rules flowing from the Portuguese Tax Authority’s (PTA) (official rulings on the matter). Indeed, the PTA held on to a paramount statement declaring that transactions involving the purchase or sale of cryptocurrency were exempt from capital gains tax and value-added tax (VAT) because the gains made on any currency’s sale used to be excluded from taxes.

In 2022, the government announced the reversal of the above-mentioned rule that excluded crypto gains based on the assumption that they were not legal tender. Yet rather than establishing a comprehensive regulatory scheme, the country adopted stricter cryptocurrency tax regulations to align with other European countries’ legislation.

Can you buy cryptocurrency in Portugal?

One of the questions on many people’s minds is how to buy Bitcoin (BTC) or other cryptocurrencies in Portugal. While cryptocurrency and crypto assets providers are implicitly and explicitly regulated in Portugal via national and European law, there are no explicit prohibitions against cryptocurrencies. Several cryptocurrency exchanges operate nationwide, providing individuals access to various digital assets.

While buying crypto is thus legal, it is essential to note that Portuguese cryptocurrency exchanges and international ones operating there are subject to several regulations to ensure their safe and secure operation, impacting investors.

A few large centralized exchanges (CEXs) operate in the Portuguese cryptocurrency market, with the two enforcement bodies closely monitoring them. Indeed, those seeking to buy cryptocurrency in Portugal via a CEX must note that said exchanges must comply with cryptocurrency exchange regulations, specifically, AML and CTF rules.

It is crucial to mention that in addition to cryptocurrency exchanges, cryptocurrency service providers operating in Portugal must adhere to the appropriate legal framework. These include digital wallets, payments processors and other companies that provide services related to cryptocurrency.

Individuals looking to buy cryptocurrencies in Portugal in ways beyond the paths mentioned above can consider decentralized exchanges (DEXs) or other means as provided by decentralized finance (DeFi). While these venues offer additional privacy and lower fees, DEXs may become subject to increased regulatory scrutiny due to the perceived potential for illicit activities.

For those interested in mining cryptocurrencies rather than buying them on CEXs or on the open market, it is paramount to note that there are no restrictions on mining cryptocurrencies. Nevertheless, Portugal’s 2023 Stage Budget tax law (discussed below) did create new tax rules for both crypto mining companies and individuals minting cryptocurrency alike.

Is cryptocurrency taxable in Portugal?

Cryptocurrency tax in Portugal has been portrayed as friendly. The lack of a specific tax regime for crypto assets led to different interpretations of the existing laws, making it an attractive destination for cryptocurrency investors. The absence of a comprehensive legal and fiscal regime was not necessarily an active regulatory choice. It derived from the state’s very omission of establishing a binding regulatory framework, de facto resulting in a friendly stance on cryptocurrencies.

The Portuguese State Budget for 2023 closed the tax loophole, and a new (yet non-exhaustive) tax framework was introduced. The new regime states that gains from the disposal of crypto assets will qualify as capital gains for personal income tax purposes. Notably, Portugal introduced a 28% taxation on capital gains from crypto assets (with the notable exception of assets held for longer than a year).

Related: A beginner’s guide to filing cryptocurrency taxes in the US, UK and Germany

According to the 2023 budget plan for Portuguese cryptocurrency taxation, gains on digital-asset holdings held for less than one year will be taxed at 28%, as it is seen as DeFi passive income. The standard flat rate will apply to a positive balance of capital gains and losses arising from the disposal of these assets, except for crypto assets held for more than 365 days (although aggregation is a viable option).

For example, negative balances gained in a specific year can be carried forward to the following five years if the taxpayer opts for aggregation. Cryptocurrency transactions would also be taxed, and a 4% rate would apply to commissions charged by intermediaries.

Cryptocurrencies’ underlying blockchain technology is, in principle, anonymous but also traceable due to its transparent character. Both individuals and businesses must thus always be mindful of the tax implications of holding and trading these assets. Importantly, authorities also regard income derived from the issuance of cryptocurrencies, validation and mining operations as taxable income (which is treated as an income obtained in the scope of professional or business activity). The tax rate for cryptocurrency gains in Portugal depends on the individual’s income tax bracket.

Income derived from operations with crypto assets is expressly qualified as professional and commercial activities taxed as business income if taxpayers have not exceeded 200,000 euros of gross business income in the previous fiscal year. In such cases, 15% of the gross income from most crypto assets operations carried out under a business activity will be taxable at progressive rates, (14.5%–53%) with the effective tax rate not exceeding 8% of gross proceeds.

The new regime includes a 28% exit tax provision for crypto asset holders, which supposes a change of residency, except when the taxpayer is a resident in a member state of the European Union or the European Economic Area (or in another country having an agreement with Portugal that provides for the exchange of information for tax objectives).

VAT remains not imposed on cryptocurrencies, and gifts and inheritances in the form of crypto assets are not taxed, provided they are received by spouses and direct descendants. Finally, nonfungible tokens (NFTs) are expressly excluded in the tax regime alongside the sale of crypto assets that constitute securities for the purpose of the law.

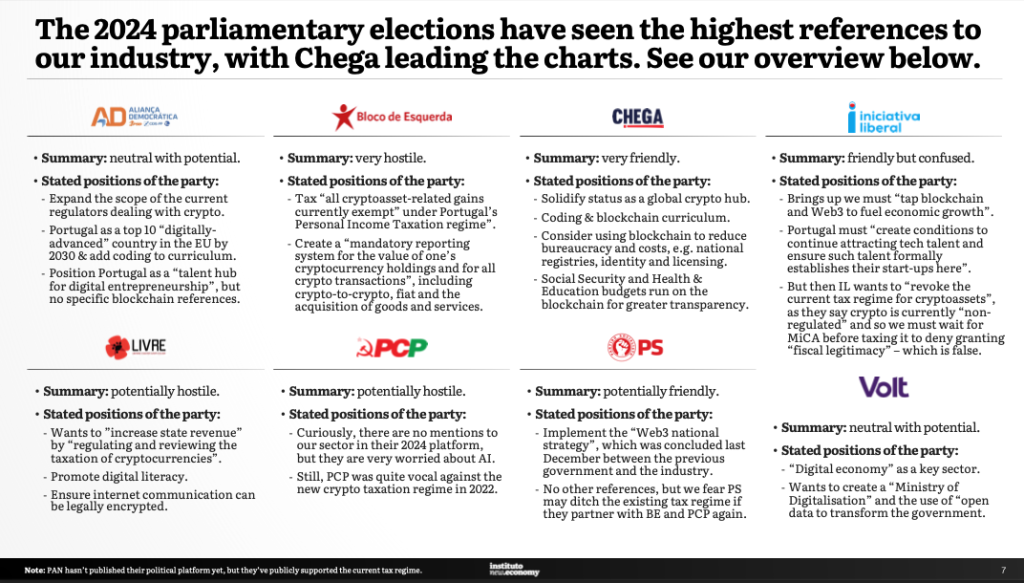

The future of cryptocurrency in Portugal

In recent years, Portugal has been viewed as a cryptocurrency tax haven. The Golden Visa program, which grants special tax exemptions and a path to citizenship, has attracted foreign investors and entrepreneurs alike. Portugal has also proactively created a supportive environment for blockchain and cryptocurrency startups, evidenced by the Portuguese government introducing the blockchain Panorama platform in 2019 to encourage cooperation among blockchain business participants. This initiative has attracted cryptocurrency enthusiasts to the region, who have appreciated the opportunity to use cryptocurrencies to pay bills, real estate and taxes.

Crucially, the country has started adopting more stringent regulations on cryptocurrency taxes to align with the legislation of other European countries. In 2022, the government announced the replacement of the long-standing tax practice by a regime embracing new rules for taxing crypto assets. Its rationale was to eliminate previously existing uncertainty and gaps and to follow principles of fairness and effectiveness so that the imposed taxation is not only more straightforward but also proportionate.

Finally, it is crucial to grasp that the standing regulatory oversight and the new tax regime are somewhat narrow in scope and do not offer a comprehensive approach or exhaustive taxonomy for all digital assets. The reality remains that cryptocurrencies are a much more complex reality than capital gains taxation and VASP’s rules only.

However, some overarching rules set at the EU and supranational levels have steered policymaking at the national level. Yet they are not sweeping enough to have created a cryptocurrency-level playing field across all EU member states.

Until the Markets in Crypto-Assets (MiCA) regulation comes into force, the current policy landscape remains a patchwork across the EU, with Portugal being no exception. The future of cryptocurrency in Portugal depends on finding an appropriate balance between national and European regulation on the one hand and innovation on the other. The country could thus remain a crypto-friendly homeland for the foreseeable future, providing a supportive climate for disruption and growth in the digital asset sector remains in place.

Author: Alexandra Overgaag

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] There you will find 10538 additional Info to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Here you can find 60250 more Information to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] There you will find 31273 more Info to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Here you will find 78281 more Information to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] There you can find 64684 more Information to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] There you will find 4129 additional Information to that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Here you will find 17053 additional Info on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2357/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2357/ […]