Spot Bitcoin ETFs record notable volume on day 1 — BTC price nearly hits $49K

Markets react positively to the first trading day for spot BTC ETFs, with Bitcoin rallying to nearly $49,000 and ETH hitting a 12-month high.

After eagerly waiting for nearly 10 years, traders finally saw the first-ever spot Bitcoin (BTC) exchange-traded fund (ETF) approved by the United States Securities and Exchange Commission on Jan. 10, and ETF trading began at the opening bell, less than 24 hours later.

BlackRock’s iShares Bitcoin Trust (IBIT), Grayscale Bitcoin Trust (GBTC), Valkyrie Bitcoin Fund (BRRR), Bitwise (BITB) and ARK 21Shares Bitcoin ETF, among others, have begun trading.

The first few hours of trading saw high trading volume coming in. Bloomberg Bitcoin ETF analyst Eric Balchunas made a similar observation, saying:

“Wow, only 20 min into trading and the volume is big with HALF A BILLION traded for the group (ex GBTC too) (outpacing $BITO by a lot) led by $IBIT (which is near lock to pass $1b) and $FBTC. Imp to note almost all the volume in the first few days will convert to inflows.”

In early trading, the Grayscale Bitcoin Trust rose nearly 6%, while the iShares Bitcoin Trust jumped more than 4%.

At the time of writing, GBTC was the biggest of the group, accounting for “40% of the total volume,” which crossed the $1 billion mark within the first two hours of trading.

UPDATE: $1.44bn total ETF spot volume now

GBTC at 40% of the total volume https://t.co/iW4CqTop0F pic.twitter.com/fns5yIzL3K

— BitMEX Research (@BitMEXResearch) January 11, 2024

The Grayscale fund was converted from an over-the-counter trust that already had more than $28 billion in assets.

The Hashdex fund is a strategy change from an existing Bitcoin futures ETF. However, the change had not yet taken effect as of the time of writing, as per SEC filings.

The regulator approved 11 spot Bitcoin ETFs, paving the way for investments in the world’s biggest cryptocurrency by market capitalization without the risk of holding the digital token directly.

JIM CRAMER ON BITCOIN ETF APPROVAL‼️:

“It’s a WIN, because THE PEOPLE want it…

People didn’t want to be in a situation where they had their money in some ‘bank’ that just disappeared overnight…

The customer is right Jamie Dimon.”#Bitcoin pic.twitter.com/reGH5PFjpR

— Swan Media (@Swan) January 11, 2024

Meanwhile, charting platform TradingView has added support for the spot Bitcoin ETFs using price tickers of the issuers, making it possible for traders to easily follow and analyze their performance.

Bitcoin ETFs now available on TradingView

IBIT – iShares Bitcoin

BITB – Bitwise Bitcoin

DEFI – Tidal Bitcoin

ARKB – ARK Bitcoin

GBTC – Grayscale Bitcoin

FBTC – Fidelity Bitcoin

BTCW – WisdomTree Bitcoin

BTCO – Invesco Bitcoin

BRRR – Valkyrie Bitcoin

HODL – VanEck Bitcoin

EZBC -… pic.twitter.com/hquXWG43uh— TradingView (@tradingview) January 11, 2024

The wider crypto market surges alongside Bitcoin ETF trading volumes

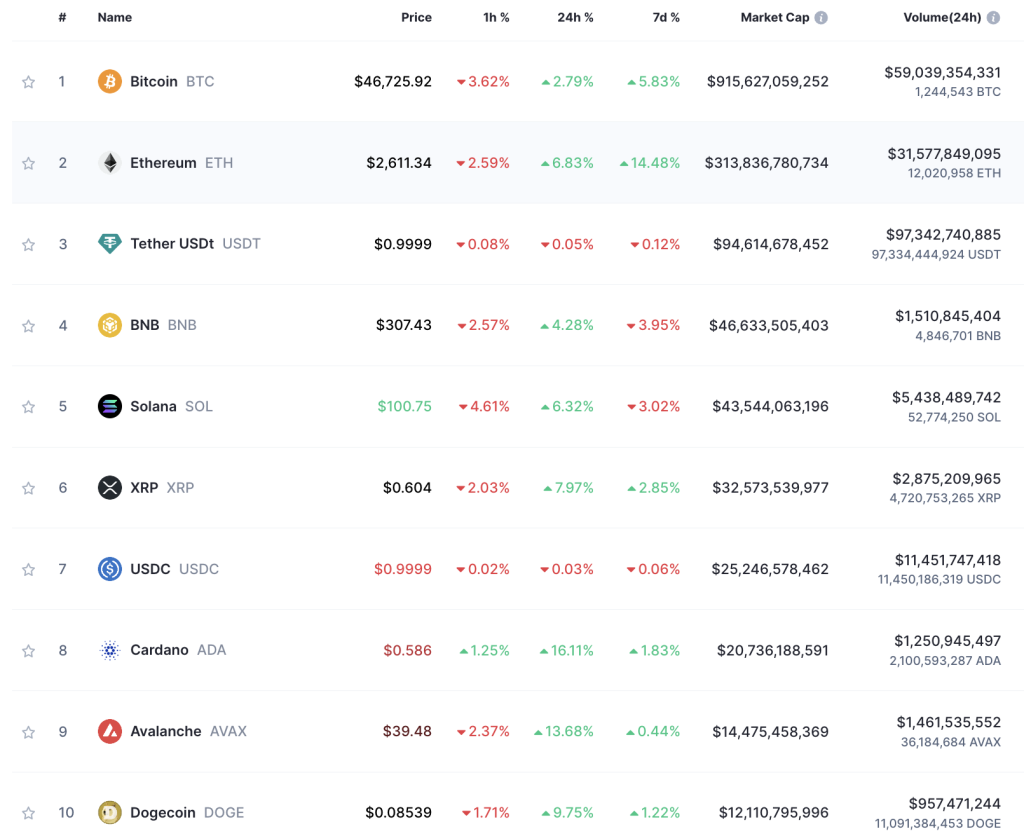

As the spot Bitcoin ETFs began trading, crypto prices started turning up, with Bitcoin (BTC) soaring more than 2.7% on the day, according to data from CoinMarketCap. At some point, the cryptocurrency rose above $49,000 before correcting to the current price.

The total crypto market capitalization is at $1.76 trillion, up 3.57% over the last 24 hours.

Market participants will continue watching Bitcoin ETFs closely to see how they perform but also how well they correlate with BTC price.

A negative correlation between the price of a fund and the price of the underlying assets that lasts for several days could be a sign of thin trading or structural issues with an ETF. This might intimidate potential buyers, even if the fund is temporarily outperforming spot Bitcoin.

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Here you can find 40522 more Info on that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Here you can find 74823 more Info to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Here you can find 46457 more Information to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Here you will find 72648 additional Info to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Here you will find 60554 additional Info on that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/news/bitcoin/2341/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2341/ […]