Bitcoin’s role in reshaping institutional investment strategies: Report

The report provides a detailed examination of Bitcoin’s growing influence in institutional investing, highlighting how it reshapes investment strategies and decision-making.

“The Case for Bitcoin in an Institutional Portfolio” report is a collaborative effort by Cointelegraph Research and the Crypto Research Report, which explores the transformative integration of Bitcoin (BTC) into traditional investment strategies for institutional investors. It provides a detailed analysis of Bitcoin’s historical performance, strategic significance, and the compelling factors driving institutional adoption while also addressing the challenges and opportunities of this digital asset.

Download a PDF of the Report for free from the Cointelegraph Research Terminal.

Navigating the Bitcoin landscape: A strategic imperative

The report delves into Bitcoin’s distinctive market behavior, focusing on the most effective allocation strategies and investment timeframes for Bitcoin. It offers a balanced analysis of Bitcoin’s volatility versus returns, underscoring its role in enhancing portfolio diversification. It also surveys the global regulatory environment, which is critical for institutions venturing into this novel domain.

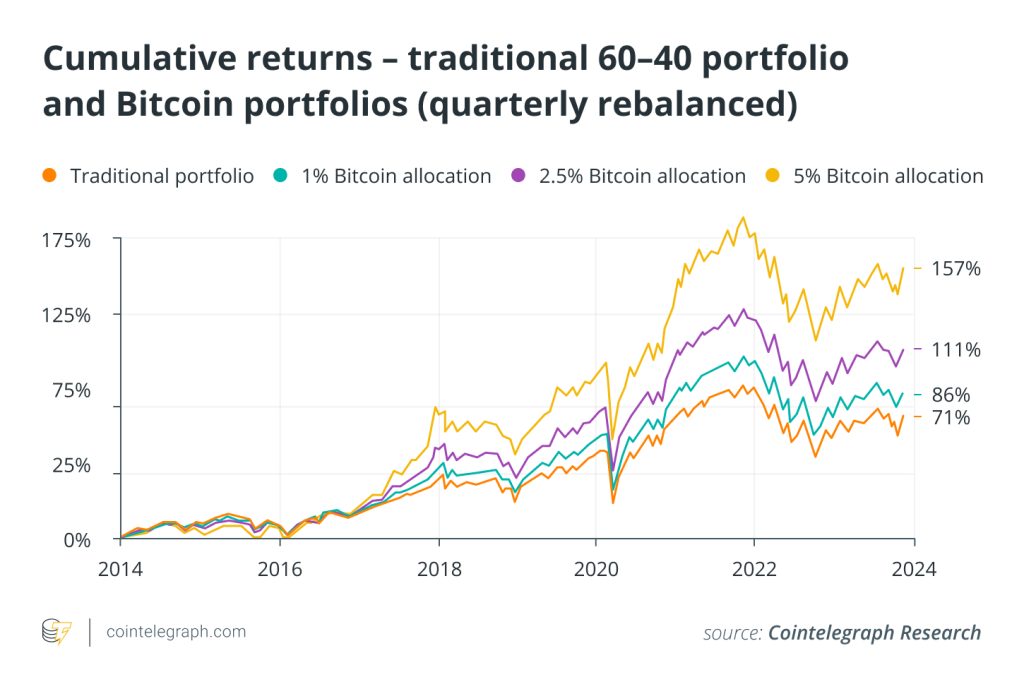

Between 2014 and 2023, a standard 60/40 asset allocation portfolio, rebalanced quarterly without Bitcoin, yielded a 71% cumulative return. However, adding a mere 5% allocation of Bitcoin to this portfolio would have boosted the return to 157%, illustrating Bitcoin’s remarkable effect in enhancing portfolio performance.

Forward-looking analysis

The report also delves into the infrastructural dimensions of institutional Bitcoin investment, highlighting crucial technological and operational factors for integrating Bitcoin into traditional portfolios. It underscores the significance of security measures and adherence to regulatory standards in this context.

This report represents the culmination of expert research, incorporating diverse insights from both the finance and technology sectors. It serves as a vital resource for institutional investors, offering an extensive understanding of Bitcoin’s place in the future of finance and delivering forward-looking perspectives on the evolving digital asset landscape.

Cointelegraph Research team

Cointelegraph’s Research department comprises some of the best talents in the blockchain industry. Bringing together academic rigor and filtered through practical, hard-won experience, the researchers on the team are committed to providing the most accurate, insightful content available on the market.

With decades of combined experience in traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to put its combined talents to proper use with the latest Investor Insights Report.

Download a PDF of the Report for free from the Cointelegraph Research Terminal.

The opinions expressed in this article are for general informational purposes only. They are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions.

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] There you can find 51896 additional Information to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] There you can find 52708 additional Information to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Here you can find 13378 additional Information to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Here you will find 2507 additional Information to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Here you will find 55944 more Information to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/news/bitcoin/2333/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/news/bitcoin/2333/ […]