An overview of the Liechtenstein Blockchain Act

Liechtenstein legislation for blockchain

The use cases of blockchain technology beyond Bitcoin (BTC) led to legal uncertainty regarding blockchain-based business models that carry activities that are financial but are uncovered by financial market legislation. As a result, governments worldwide are trying to regulate distributed ledger technologies to protect consumer trust.

Liechtenstein is the first nation to specifically regulate the token economy by passing the Token and Trustworthy Technology Service Providers Act (also known as the Blockchain Act or the Liechtenstein Blockchain Act). In terms of client and asset protection, the law governs civil law matters and there will be enough oversight of the many service providers in the token economy.

As subjecting service providers to the Anti-Money Laundering (AML) and Countering the Financing of Terrorism regulations is another way to prevent financial crime, the bill further clarifies the situation concerning digital securities. In this context, this article will discuss the Liechtenstein Blockchain Act and the status of cryptocurrency in Liechtenstein.

What is the Liechtenstein Blockchain Act?

The Liechtenstein Blockchain Act passed its second hearing in October 2019 and took effect on January 1, 2020. The new blockchain law in Liechtenstein enables tokenization of all types of assets and rights without the need to circumvent the law and improves the country’s capacity to host digital tokens legally. As a result, blockchain entrepreneurs and digital technology enthusiasts get attracted to set up businesses in Liechtenstein.

It is important to note that the Financial Action Task Force (FATF) uses different terminology than the Liechtenstein regulator. For example, the term TT service provider is used in place of virtual asset service providers (VASPs). TT stands for Trustworthy Technologies (TT), which are technologies that guarantee the availability and integrity of tokens.

The Token Container Model (TCM) and the role of the physical validator

The objectives of the Liechtenstein Blockchain Act include combating financial crime by enforcing due diligence duties on blockchain-based businesses or service providers. The physical validator acts as a service provider and identifies tokenholders, and ensures that the represented rights and duties are contractually enforced, for example, by securing the real world's assets (or rights) in a vault.

If assets are damaged or lost, and the physical validator cannot solve such issues, he may lose his license. With this tactic, the Liechtenstein Blockchain Act assigns the physical validator the responsibility of ensuring that the physical and digital worlds are entirely synchronized.

In addition, the new model expands the token's use beyond securities to cover music rights, patents, utility coins, software rights, etc. The foundation of the Liechtenstein Blockchain Act is the Token Container Model, in which a token functions as a container that can hold any right. A right that represents a real asset, such as stocks, bonds, real estate, commodities, or fiat money, can be “loaded” into the container. The container could, however, be empty, for instance, the digital code of the Bitcoin blockchain.

With the help of this model, one can better understand the process and effects of tokenization as law and technology are separately treated by the Liechtenstein Blockchain Act. However, because some specific rights are digitally encoded as tokens, they are altered even while everything else that defines the right and the asset remains the same. For instance, the TCM views security tokens built on blockchain as comparable to traditional securities, except that security is loaded or “packed” inside the token, which acts as a container.

As mentioned, the rights and assets inside the container remain the same even if the token is maintained in a portfolio, transferred to new owners or safely stored by a custody service. A token virtually kept in a container on the blockchain represents a right, such as the ownership right of gold. The gold is owned by the token owner, according to TCM, and can be transferred to other owners without having to change its physical location.

This forward-thinking concept offers legal certainty for tokenized pre-existing rights and data held on blockchain-based systems. It should be noted that Liechtenstein changed its civil code to permit the token world to take precedence over the real world in situations where tokens exist for rights and property.

Additionally, the Liechtenstein Blockchain Act requires new service providers to be regulated, meaning they should register with the Liechtenstein Financial Market Authority (FMA) and obtain a license.Furthermore, the newly defined job of the physical validator is essential to enable the token economy to tokenize existing rights and correctly transfer them onto a blockchain system.

Tokenizing any right or asset

A token can represent any right or asset under the Token Container Model. The European E-Money framework, which service providers can use, enables the packaging of conventional currencies like the euro or Swedish Krona into a token. These tokens are called payment tokens, digital euro or money on the ledger, etc.

Moreover, utility tokens such as software license rights can be put into the token container and sold before a product launch through an initial coin offering (ICO). Intellectual property rights will be applicable if any party wishes to obtain software usage rights. The token may eventually represent a security, and all securities laws are applied to token sales through a security token offering (STO) process.

After the tokens have been generated, they are sold to investors via ICO or STO processes. Then, the tokens can be exchanged for other tokens, and they need to be kept safe. Different actors, such as token generators, token issuers and token depositaries, play a crucial role in the token's life cycle. However, legal consequences of token transfer and its legitimate owner and possessor are treated separately.

As per blockchain laws in Liechtenstein, the FMA requires companies to register and obtain a license before operating. In addition, the applicants need to meet the minimum capital requirement and pay supervisory fees. However, the costs for tokenizing any asset will eventually decrease once registrations are well defined, as they are in Liechtenstein.

The legal status of cryptocurrency in Liechtenstein

If you wonder if cryptocurrency is legal in Liechtenstein, the answer is yes. One can own and transact using cryptocurrencies in Liechtenstein. The FMA oversees participants in the financial markets, including those involved in the cryptocurrency industry, and establishes the framework for legal and regulatory purposes.

In Liechtenstein, the Travel Rule applies to all TT transactions, including the transfers of virtual assets. The Travel Rule ensures that cryptocurrency businesses follow the law and makes it simpler for regulators to demand transaction data. It is the first crypto rule to be applied globally and may pave the way for more consistent crypto industry regulation.

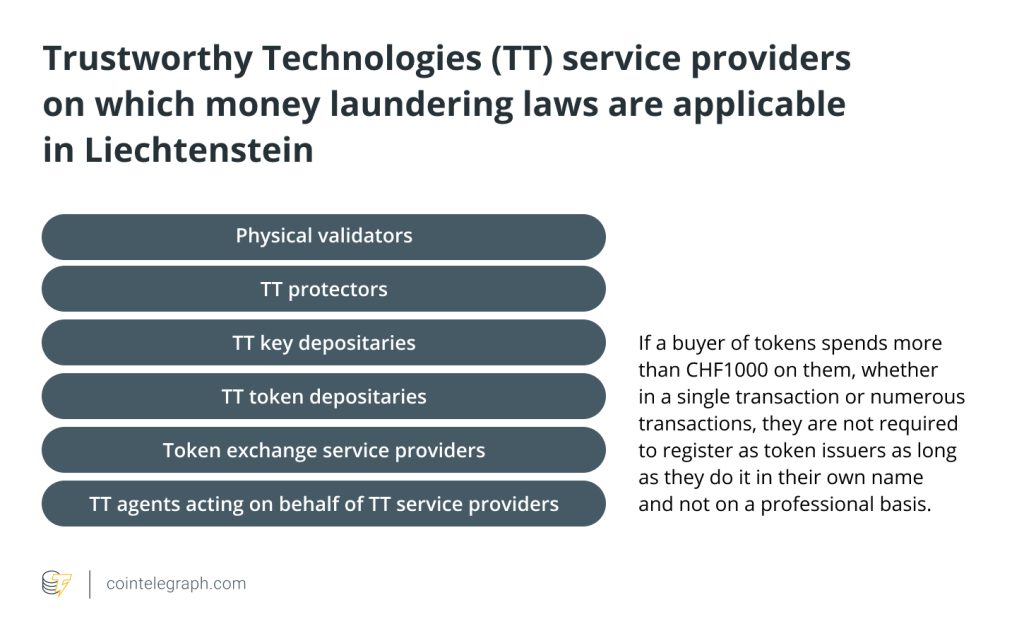

Additionally, money laundering laws apply to all TT service providers, such as VASPs, who work with tokens or digital currency on the behalf of third parties:

Please note that the traders of goods are also subject to due diligence requirements if they receive payment in virtual currencies equal to or greater than CHF 10,000. Moreover, the peer-to-peer trading of tokens outside of a regulated trading environment is not prohibited by Liechtenstein legislation. Other restrictions, however, might be imposed by the token's smart contract regulations.

The legal classification of a token as a security or utility token determines whether and where investors or tokenholders are permitted to exchange specific tokens in a controlled secondary market setting. For instance, utility tokens can be traded via centralized crypto exchanges like Binance. However, suppose a cryptocurrency exchange offers its services in Liechtenstein. In that case, the Blockchain Act's registration requirements for TT exchange service providers and other services, as well as the KYC and AML standards, may apply.

Regardless, such cryptocurrency exchanges must prohibit the listing and trading of tokens that the Markets in Financial Instruments Directive (MiFID II) considers financial instruments like derivatives or shares. Depending on the specific services and business model, further authorization under the Banking Act may be necessary if the token held for a third party is deemed a financial instrument under MiFID II.

Similarly, decentralized exchanges (DEXs) are recognized by Liechtenstein legislation. However, the legitimacy of a DEX is based on the legality of the tokens that will be listed and sold there. That said, if the tokens are utility tokens, the Blockchain Act's rules will apply to the DEX, and it may be necessary for the DEX to register as a service provider as a TT exchange service provider.

On the other hand, if the coins are deemed financial instruments, the Banking Act's investment business license will also be necessary. The Due Diligence Act's Know Your Customer and AML requirements would typically have to be followed in both situations. But are cryptocurrencies taxable in Liechtenstein?

Under Liechtenstein’s tax legislation, cryptocurrency trade is subject to a material approach. Different tax regulations apply depending on the rights of the particular token and whether it qualifies as a utility or payment token. Profits from trading such tokens are tax-free because Liechtenstein law does not impose a capital gains tax on gains from trading with participations. The participation rate is a gauge of trading activity concerning the amount of liquidity present in the market.

Utility tokens are considered to be conventional commodities, and any trading profits would be considered taxable trading income following standard tax laws, i.e., 12.5% for legal entities, subject to further deductions. On the contrary, payment tokens are regarded as currencies, and trading earnings are considered to be taxable trade income according to standard tax laws.

Written by Jagjit Singh.

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Here you can find 29434 more Info on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Here you can find 87580 additional Information to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Here you can find 26404 additional Info to that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2288/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2288/ […]