How the Nakamoto consensus powers Bitcoin

Overview and significance of the Nakamoto consensus

The Nakamoto consensus has served as the backbone of the Bitcoin network and inspired the creation of a number of additional consensus techniques aimed at addressing energy consumption concerns.

Satoshi Nakamoto proposed the crucial concept of Nakamoto consensus, also known as proof-of-work (PoW), in the Bitcoin white paper in 2008. The word “Nakamoto” is used in the Nakamoto consensus as a tribute to the person who created the blockchain and the Bitcoin network. It is a way of crediting the consensus mechanism’s inventor, whose true identity remains unknown.

In decentralized networks, this consensus method is the cornerstone of security and trust. The first miner to successfully complete a challenging mathematical puzzle in the Nakamoto consensus adds a new block to the blockchain and receives rewards. By making it prohibitively expensive for attackers to influence the Bitcoin network, this technique supports decentralization, opposes centralized authority and ensures security.

Despite continuing debates around energy consumption and environmental effects, the relevance of the Nakamoto consensus lies in its capacity to solve the double-spending problem, provide trustless transactions and open the door for the expansion of blockchain technology into a variety of applications.

Background of the Nakamoto consensus

The Nakamoto consensus addresses the double-spending problem in digital currencies by utilizing PoW mining, ensuring authenticity and competitive validation, with the longest chain rule reinforcing consensus and security in decentralized blockchain networks.

Origin and conceptualization

The Nakamoto consensus was created as a fix for the issue of double-spending with digital currencies. Double-spending refers to the possibility of using the same digital currency unit more than once. Nakamoto’s revolutionary idea was a decentralized network with participants who could jointly decide on the order of transactions and uphold the security of the system through consensus.

Satoshi Nakamoto’s white paper on Bitcoin

In October 2008, Satoshi Nakamoto published a white paper outlining the fundamental ideas of the Bitcoin system. Without the need for a centralized authority, the paper offered the design for a peer-to-peer electronic cash system in which users, or nodes, keep an open ledger of every transaction. In order to reach consensus inside the network, it presented the idea of the Nakamoto consensus.

Role of nodes in the Bitcoin network

Participants, or the computers that maintain the blockchain, are known as nodes in the Bitcoin network. Nodes in the network can be divided into two categories:

Full nodes

These nodes obtain and keep an entire blockchain copy on them. They make sure that blocks and transactions follow the rules of the network by validating them. Complete nodes are essential to the integrity and security of the Bitcoin network.

Miner nodes

By resolving challenging mathematical riddles, these nodes are in charge of appending new transactions to the blockchain (proof-of-work). In exchange for their efforts, miners receive transaction fees and newly generated BTC.

Role of proof-of-work concept in the Nakamoto consensus

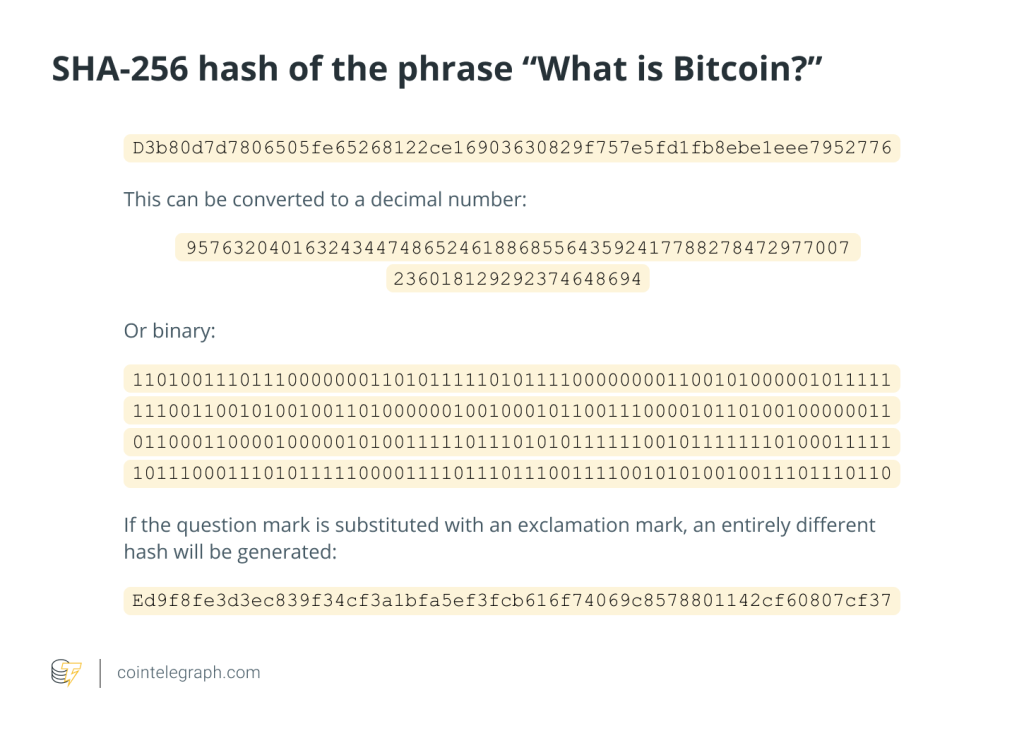

The fundamental concept behind reaching consensus in a Bitcoin network is PoW, a technique used by miners to approve transactions and add new blocks to the network. They accomplish this by working through challenging cryptography riddles, which entail locating a nonce that, when hashed with the block’s contents, yields a hash with particular properties.

This competition among miners keeps any one party from obtaining disproportionate influence over the system because it would take more computing power than the network as a whole to carry out such an attack. PoW, therefore, strengthens the blockchain’s immutability and security, making it much more resilient to manipulation and attacks.

Longest chain rule

A key component of the Nakamoto consensus and the underlying technology of Bitcoin and other blockchain networks is the longest chain rule. In these networks, miners compete to solve computational puzzles and validate transactions, which results in the creation of new blocks.

Competing chains can occur in a network when several miners work on problems at the same time. This is resolved via the longest chain rule, which declares the chain with the highest total computing effort to be the legitimate blockchain. By making any bad actor exert more processing power than the network as a whole, this method ensures consensus. It maintains security and decentralization while promoting trust and consensus in a decentralized system.

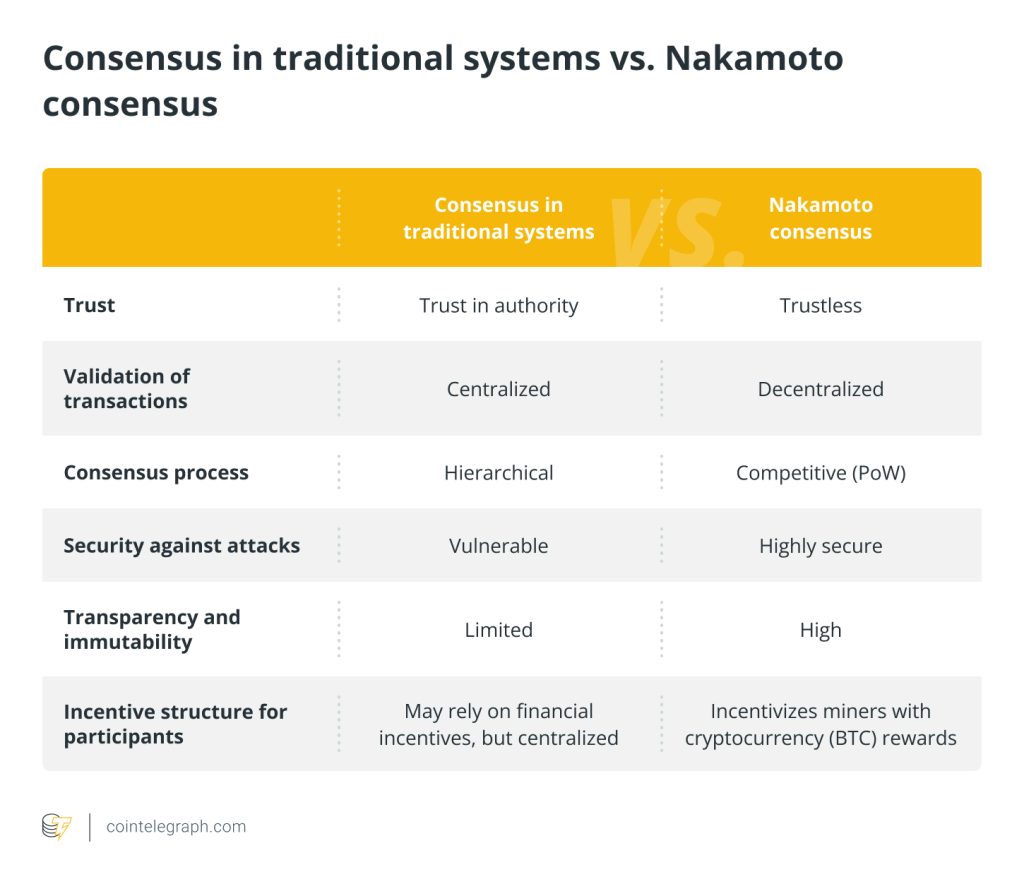

Consensus in traditional systems vs. Nakamoto consensus

Consensus procedures are essential to ensure distributed systems can consistently agree on the state of their data.

Although reaching consensus is the goal of both the Nakamoto consensus in blockchain networks like Bitcoin and conventional centralized systems, they approach it very differently. Below is a comparison between these two methods:

These differences underscore the contrasting philosophies and mechanisms at play in traditional systems and the Nakamoto Consensus.

How the Nakamoto consensus powers Bitcoin

The foundation of Bitcoin’s success as a safe and transparent digital currency is the Nakamoto Consensus, which combines decentralization, trustlessness and the competitive consensus mechanism driven by PoW.

It can be seen as a specific implementation of Byzantine fault tolerance (BFT). It is nevertheless based on the assumption that most of the network’s computational power is honest, often comparable to probabilistic BFT.

In the Nakamoto consensus, consensus is reached through a competitive process in which miners solve computational puzzles to validate transactions and create blocks. Although this method does not offer instantaneous finality, it was designed to withstand Byzantine failures.

Nakamoto consensus is essential to the sequencing and validation of transactions. A Bitcoin (BTC) transaction is broadcast to the network and goes through a decentralized validation process. Several nodes or miners independently confirm the authenticity of the transaction.

The transaction is added to the blockchain and included in a block once verified. Through the PoW process, miners compete to create these blocks by resolving challenging mathematical puzzles. By preventing a single party from controlling the network, this competitive process improves system security and reliability.

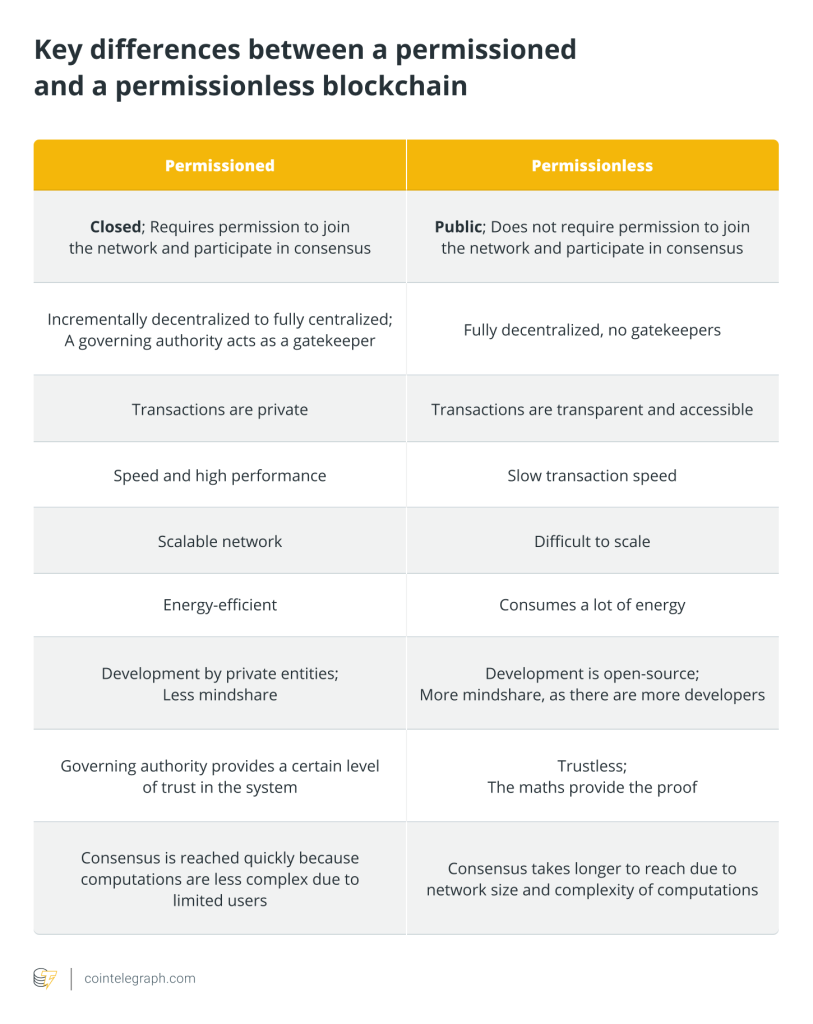

On the other hand, traditional BFT systems need a predetermined set of validators and are built for permissioned networks. Their objective is to attain agreement in a more deterministic manner, making them ideal for crucial applications that require instantaneous finality. However, they may be less decentralized than the Nakamoto consensus.

Limitations of the Nakamoto consensus

The Nakamoto consensus offers many benefits, but it also has certain drawbacks that may restrict its usefulness and applicability. The most crucial problem is scalability. Both the volume of transactions and the computational power needed for mining increase as the number of participants in the network rises.

This may cause scalability issues, which would increase transaction costs and cause confirmation times to lag. The applicability of the Nakamoto consensus for applications requiring high throughput may be restricted by these problems.

An important constraint to consider is the substantial energy usage linked to the Nakamoto consensus process. The proof-of-work method uses a lot of energy since it takes a lot of processing power. Concerns over the long-term viability of blockchain systems utilizing this consensus process have been raised by its potential environmental impact.

A 51% attack, in which a single person or organization seizes control of more than 50% of the network’s processing capacity, can undermine the Nakamoto consensus. Such an assault may jeopardize network security; however, decentralization and high computational costs typically serve as disincentives.

The Nakamoto consensus suffers from a practical constraint in the form of lengthy confirmation times. A transaction might need to be confirmed more than once before it is deemed final. This delay may hamper applications that need quick transaction processing.

Finally, there is always a chance of network bifurcation. Community disagreements can potentially cause hard forks, which split the blockchain into two distinct chains. These splits have the potential to confuse people and upset the ecosystem’s balance.

The future of the Nakamoto consensus

The future of the Nakamoto consensus is marked by ongoing evolution and adaptation. It has demonstrated its decentralization and security over time, yet it still confronts obstacles that are determining its future.

Its energy usage has prompted a search for increased efficiency, with projects concentrating on the development of energy-efficient hardware and the use of renewable energy sources. Research and innovation remain vital, ensuring that the Nakamoto consensus remains a robust and relevant component of blockchain technology while addressing pressing issues to meet the demands of an evolving landscape.

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] There you can find 75500 additional Information to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Here you will find 15487 more Info on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Here you can find 32493 more Information on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] There you can find 34714 more Information on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Here you will find 42266 additional Information to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] There you will find 72516 more Information to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] There you can find 98792 additional Information to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2208/ […]

… [Trackback]

[…] There you will find 66060 additional Information on that Topic: x.superex.com/academys/beginner/2208/ […]