An overview of crypto regulations in Scandinavian countries

The still arguably novel and nascent cryptocurrency sector has yet to be broadly and consistently regulated, and this is true for Denmark, Norway and Sweden. Cryptocurrency laws and regulations in Scandinavian countries follow a similar trend to many other parts of the world; they’re still inconsistent and largely nonexistent, varying from country to country.

This article gives an overview of cryptocurrency regulations in the Scandinavian countries of Denmark, Norway and Sweden. It answers questions such as: Is cryptocurrency legal in Scandinavia? Can cryptocurrency be bought in Denmark? Is crypto taxable in Sweden? and other prudent questions for crypto users and operators in the region.

Cryptocurrency regulations in Denmark

Denmark is the most southern of Scandinavian countries, bordering Germany to the south and linked to Sweden by the Öresund bridge. It has a population of 6 million and is a developed economy with a high gross domestic product per capita and a reputation for scientific and technological development and nurturing startups. Denmark is home to OpenLedger and the Nordic Blockchain Alliance.

Are cryptocurrencies regulated in Denmark?

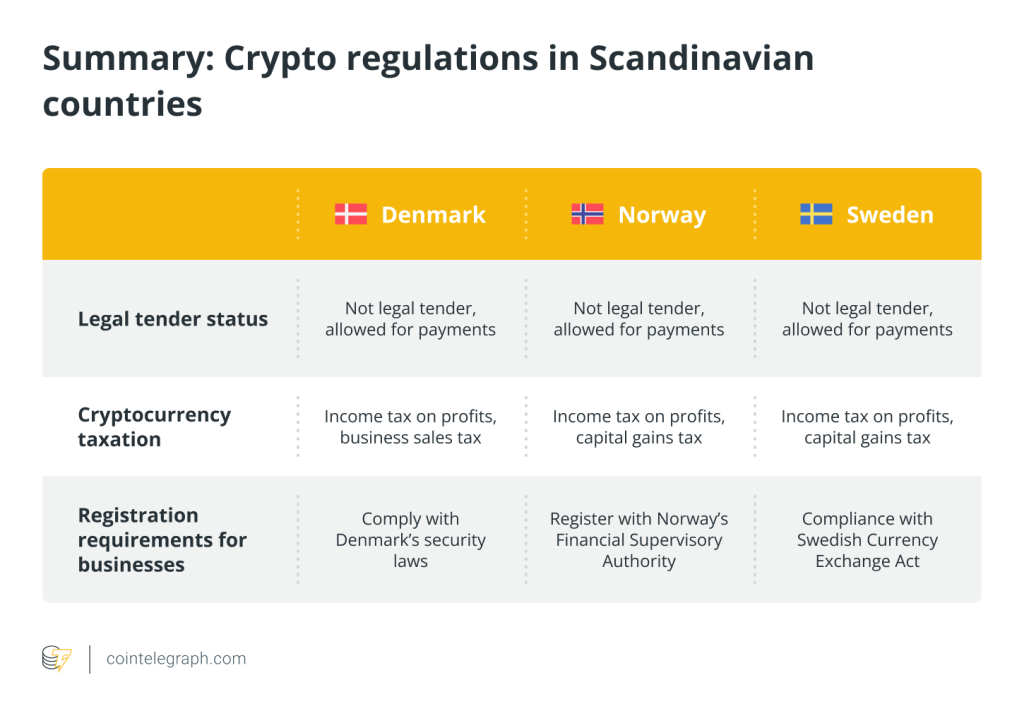

Cryptocurrency is not regulated in Denmark and is not considered a legal currency, but Danish authorities allow cryptocurrency payments. In 2021, Denmark’s largest bank, Danske Bank, noted that it would not offer cryptocurrency services but would not interfere with transactions from cryptocurrency platforms.

The Danish Financial Supervisory Authority says cryptocurrencies used for payments are generally not regulated by the body. However, Denmark’s security laws may apply to initial coin offerings (ICOs), often in cases where ICOs are similar to initial public offerings (IPOs). Denmark also amended its Anti-Money Laundering AML Act in 2020 to encompass digital currencies.

Are cryptocurrencies subject to capital gains tax in Denmark?

Cryptocurrency in this Scandinavian country is considered a personal asset and, as such, is subject to income tax rather than capital gains tax. The average Danish resident is estimated to pay an effective income tax rate marginally above 35%, but this can vary by location and personal circumstances.

In March 2023, Denmark’s supreme court passed a verdict on two cases concerning whether Bitcoin (BTC) sales qualified as a taxable event. The first related to Bitcoin investments intended for sale later, and the second to proceeds from mining.

In both cases, the verdict was that they were business sales rather than private assets and, therefore, taxable in such a manner. The Danish Tax Authority mandates that cryptocurrency losses cannot be declared as business losses and that cryptocurrency businesses may not deduct losses as their entire operations revolve around cryptocurrencies.

Cryptocurrency regulations in Norway

Mountainous Norway has a population of just over 5 million and is one of the richest countries by per-capita income. Again, like Denmark, cryptocurrencies are classified as assets and are legal to use for payments.

Norway has also welcomed numerous blockchain startups, including IdeaSoft and BitSpace. Is cryptocurrency regulated in Norway? It’s not, and below is what’s known about the crypto-friendly country to date.

Are cryptocurrencies regulated in Norway?

Norway does not have specific cryptocurrency regulations, making buying, selling or trading cryptocurrency legal in this Scandinavian country. Cryptocurrencies are not recognized as legal tender but can be used to make payments. Norway defines cryptocurrencies as a type of asset, not money.

In 2018, Norway’s Ministry of Finance issued its Regulation on Money Laundering, which covers cryptocurrency businesses. The law requires exchanges and crypto custody providers to register with Norway’s Financial Supervisory Authority “Finanstilsynet” and comply with Anti-Money Laundering (AML) rules.

In May 2023, Norway’s central bank, Norges Bank, recommended that Norwegian authorities consider their own strategy for regulating cryptocurrencies, as the European Union’s upcoming Markets in Crypto-Assets (MiCA) regulation may not be adequate.

Norway is, however, crypto-friendly; it was one of the first countries to begin work on a Central Bank Digital Currency (CBDC) in 2016, and Norges Bank is still, in 2023, testing a government-backed blockchain-based digital currency.

Is crypto taxable in Norway?

Norway’s tax authorities view cryptocurrency as a capital asset, so profits from sales are capital gains. However, Norway lacks a dedicated capital gains tax, which means that individuals profiting from cryptocurrency sales are subject to applicable income tax rules.

At the lower income range in Norway, capital gains taxed as income are subject to a flat rate of 22%, but there are progressive brackets for higher earners.

Cryptocurrency regulations in Sweden

Beautiful Sweden borders Norway, Finland and Denmark by bridge and has the ninth-largest population in the European Union at over 10 million. It is also the seventh-most prosperous country globally, with a well-established IT sector and an economy renowned for engineering and telecommunications. Sweden is home to companies such as Safello, OpenGeeksLab, ChromaWay and the Nordic Fund Ledger initiative.

Are cryptocurrencies regulated in Sweden?

Again, in Sweden, there is no specific regulation pertaining to cryptocurrency. Cryptocurrency is not considered legal tender, but cryptocurrency payments are allowed, as is buying, selling or trading cryptocurrency.

Sweden’s Financial Supervisory Authority and its central bank have clearly and publicly stated that Bitcoin is legal but not an official form of payment or legal tender. The key supervisory bodies in the country are the Swedish Financial Supervisory Authority and the Swedish Data Protection Agency.

There are some registration requirements for crypto businesses in Sweden. Crypto custodians, wallets and exchanges must comply with the Swedish Currency Exchange Act, which requires certain types of financial institutions to comply with AML rules.

When MiCA, discussed below, comes into force in full in 2024, its rules to protect consumers and cryptocurrency businesses will apply to Sweden. It’s worth noting that Bitcoin mining in Sweden has received some scrutiny for its high energy consumption. In June 2022, Sweden’s central bank, the Sveriges Riksbank, made a case to ban Bitcoin mining completely in the country.

That said, the Riksbank is also a global leader in developing a CBDC, and the Swedish e-krona technically became ready for further integration into financial systems in 2022.

Is crypto taxable in Sweden?

Taxes are applied differently to distinct types of cryptocurrency transactions in Sweden, and capital gains, income tax and interest income tax may apply. Selling cryptocurrency balances at a profit is subject to a 30% capital gains tax, but 70% of crypto losses can be deducted from gains.

Income from cryptocurrencies is subject to income tax rates of about 30%.

Interest income tax in Sweden applies to earning cryptocurrency through staking or lending rewards; the tax rate is 30%, and 70% of losses can be deducted.

Is it possible to buy cryptocurrency in Denmark, Norway and Sweden?

It is absolutely legal to buy, sell and trade cryptocurrency in Denmark, Norway and Sweden. Although cryptocurrency is not strictly regulated, its use is not restricted. Popular cryptocurrency exchanges in Scandinavia include eToro, Bybit, Bitpanda and Binance.

Crypto investors in Denmark, Norway and Sweden can simply:

- Find a cryptocurrency exchange that offers the coin required

- Register with the exchange or use an existing account

- Fund the purchase

- Make the trade to purchase the desired crypto

- Ensure cryptocurrency balances are stored safely.

Will Denmark, Sweden and Norway be affected by MiCA when it is implemented in 2024?

The future of cryptocurrency in Scandinavia will be affected by the EU’s Markets in Crypto-Assets regulation when it comes into effect in 2024. MiCA is based on EU rules for securities trading and will regulate companies offering new cryptocurrencies and cryptocurrency services.

The regulation includes guidelines for issuing white papers and the launch of coins and stablecoins with the goal of protecting consumers. It also contains provisions to protect against cryptocurrency market abuse and insider dealing. MiCA has been broadly welcomed in the cryptocurrency space for its potential to add legal certainty to the sector, something that may bolster wider adoption and use.

Furthermore, the Financial Action Task Force recommends that G7 countries and around 30 more of its participating nations adopt the crypto Travel Rule. If a government adopts the Travel Rule, cryptocurrency exchanges and other crypto service providers are required to collect identifying information about the senders and receivers of cryptocurrency transfers that exceed $1,000.

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] There you will find 29385 additional Information on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] There you can find 8045 additional Info on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Here you will find 19484 additional Info to that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2206/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2206/ […]