Different types of ETFs, explained

Exchange-traded funds (ETFs) are a diverse and flexible investment tool that come in various forms. These financial instruments provide exposure to a variety of assets and strategies, catering to a broad range of investor preferences and objectives. Investors can select from a range of ETFs based on their risk tolerance and individual financial objectives.

The ETFs offer choices for risk reduction, income generation, sector-specific investing, diversification and much more. Investors can create a well-rounded and custom portfolio that fits their particular investment plan by picking the appropriate kind of ETF.

What are ETFs?

Investment vehicles known as exchange-traded funds are traded on stock exchanges. They give investors a way to own a variety of assets, like equities, bonds, commodities or digital currencies — all within a single fund. ETFs often contain a combination of assets, which helps to distribute risk across many investment categories.

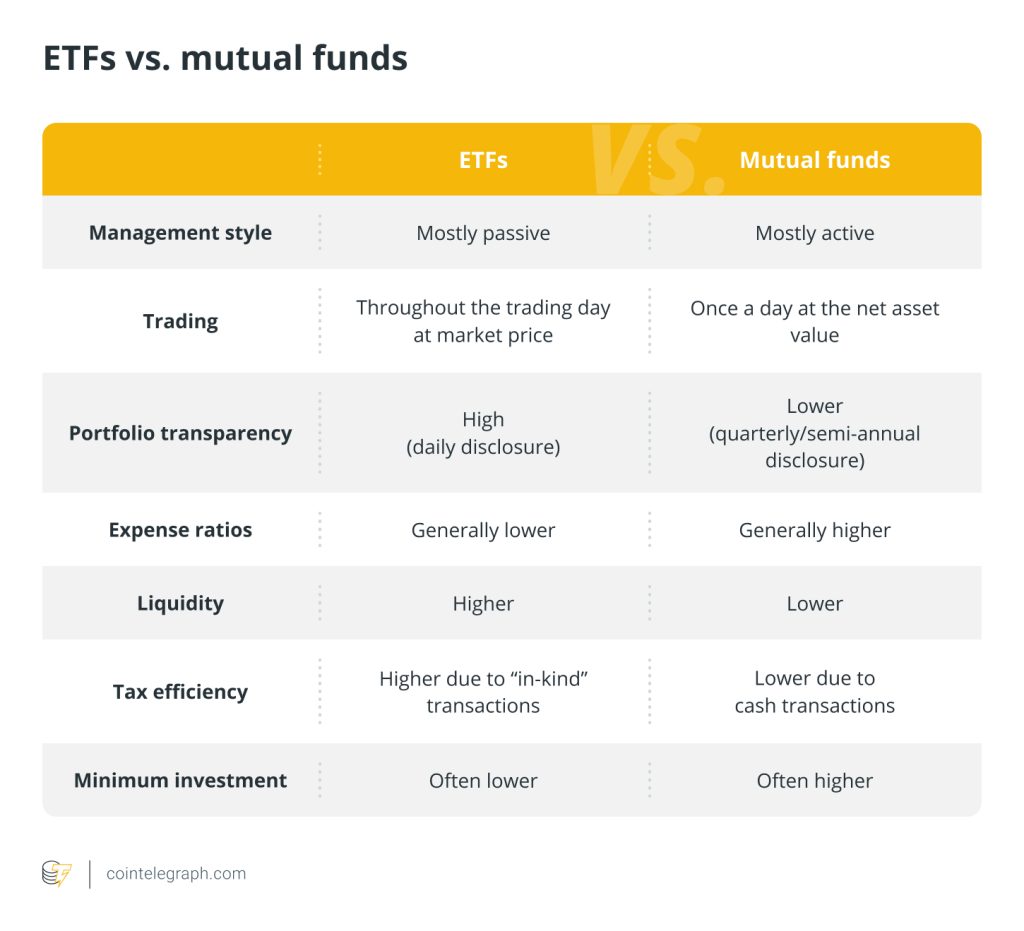

ETFs also provide liquidity in addition to diversification. At market pricing, they can be bought and sold at any time during the trading day, giving investors flexibility. One of the main characteristics that differentiates ETFs from conventional mutual funds is their liquidity.

A specific subclass of ETFs called “crypto ETFs” offers exposure to digital currencies. Investors can own shares in a fund with numerous digital assets rather than buying individual cryptocurrencies like Bitcoin (BTC) or Ether (ETH), which can help lower risk. However, the regulatory environment for cryptocurrency ETFs is complex and differs by jurisdiction.

For instance, Canada is notably ahead of the curve, as it has approved several Bitcoin and Ether ETFs. Also, the first Bitcoin futures ETFs were approved by the United States Securities and Exchange Commission (SEC) in October 2021, following years of intense anticipation and multiple denials of Bitcoin ETF applications. BlackRock’s spot Bitcoin ETF, however, is still awaiting a final decision from the SEC — along with several others.

Related: Bitcoin spot vs. futures ETFs: Key differences explained

How do ETFs work?

ETFs operate through a straightforward mechanism involving several key steps, including:

Creation of the fund

The process starts with a corporation, usually a financial institution or asset management firm, deciding to introduce an ETF. As the underlying holders of the ETF, they assemble a basket of assets that may consist of securities such as stocks, bonds, commodities or other financial instruments.

Getting regulatory approval

The sponsoring entity must get regulatory approval from the appropriate authorities, such as the SEC in the U.S. before an ETF can be sold to the public. Regulatory organizations make sure the ETF follows all applicable laws and regulations.

Creation and redemption

ETF shares are issued and redeemed via a method that involves authorized participants (APs). Large financial institutions or market makers that have been granted permission to take part in the formation and redemption process are those.

An AP gathers the necessary assets (which are often in-kind) and delivers them to the ETF issuer in order to establish fresh shares of the ETF. In exchange, they get a certain number of ETF shares. When an AP wants to redeem ETF shares, on the other hand, they give the shares back to the issuer and get the underlying assets.

Trading on stock exchanges

Shares of the ETF are traded on stock exchanges, much like individual equities, once they have been formed and are in the possession of investors. During regular trading hours, investors can buy and sell ETF shares at market rates. Investors benefit from the liquidity and flexibility this offers.

At the end of each trading day, ETFs determine their net asset value. This is calculated by dividing the fund’s total asset value by the number of outstanding shares. Due to the creation and redemption processes, the market price of the ETF shares is typically fairly close to the net asset value (NAV).

An arbitrage mechanism can be used to keep the market price of the ETF in line with its NAV through the process of issuing and redeeming ETF shares. Authorized participants may purchase or redeem shares when the ETF’s market price diverges from its NAV to profit from price discrepancies and keep the market price of the ETF around its NAV.

Types of ETFs

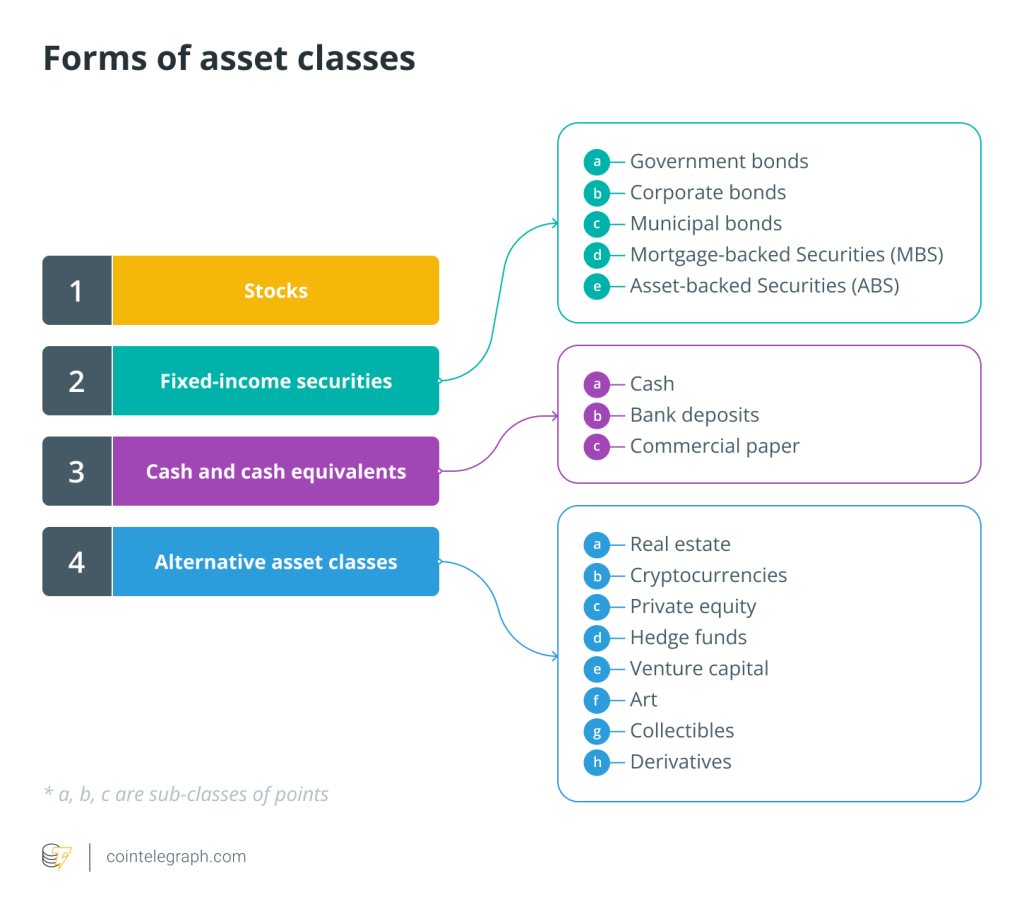

ETFs can be divided into traditional and crypto ETFs. Exchange-traded funds that offer exposure to different asset classes, such as equities, bonds and commodities, are called traditional or conventional ETFs. These ETFs track and offer exposure to traditional financial products and markets in accordance with the traditional model.

On the other hand, crypto ETFs are a relatively new phenomenon, consisting of a specific category of exchange-traded funds that offer exposure to digital currencies like Bitcoin or a basket of cryptocurrencies. Conventional ETFs are more established and offer a broader selection of conventional asset classes and investment methods.

Traditional ETFs

Equity ETFs

The most popular kind of exchange-traded funds are equity ETFs, which offer exposure to individual stocks, stock indexes or particular industrial sectors. Investing in an ETF that tracks the S&P 500 or a sector-specific ETF that focuses on technology businesses are two available investment options under this category.

Fixed-income ETFs

Bonds and other fixed-income securities are invested in by fixed-income exchange-traded funds. They provide diversified exposure to many bond categories, including high-yield bonds, corporate bonds, municipal bonds and government bonds.

Commodity ETFs

ETFs that offer exposure to physical commodities like gold, silver, oil or agricultural products are known as commodity ETFs. Some of these ETFs hold the real physical assets or futures contracts, while others monitor the commodity’s price.

Currency ETFs

With currency ETFs, investors can trade foreign exchange rates or have exposure to a particular currency. To replicate the swings of a currency pair, these ETFs frequently use currency futures contracts.

Environmental, Social and Governance (ESG) ETFs

ESG ETFs integrate environmental, social and governance factors into their investment criteria. They focus on companies with strong sustainability and ethical practices.

Real estate ETFs

ETFs that specialize in investing in real estate include real estate investment trusts (REITs) and real estate corporations. They offer exposure to the real estate market without actually owning any real estate.

Inverse ETFs

These funds seek to make money when the value of the underlying asset or index declines. To get inverse returns, they use derivatives as well as other strategies.

Leveraged ETFs

By using financial derivatives to boost returns, these exchange-traded funds offer twice or three times the exposure to the underlying index. They are riskier and intended for short-term trading.

Thematic ETFs

ETFs categorized as “thematic” are those that concentrate on particular investment themes or trends instead of broad market indexes or asset classes. These exchange-traded funds aim to expose investors to businesses, sectors or patterns associated with a specific subject, such as renewable energy, AI, robots, cybersecurity, e-commerce and cannabis.

Crypto ETFs

Crypto index ETFs

These exchange-traded funds seek to mimic the performance of a particular cryptocurrency index, like the Bloomberg Galaxy Crypto Index. They provide a range of exposure to different cryptocurrencies included in the index.

Altcoin ETFs

ETFs that track a variety of cryptocurrencies other than Bitcoin are known as altcoin ETFs. The purpose of altcoin ETFs is to offer investors diversification across a range of cryptocurrencies, given that several cryptocurrencies may have disparate price movements and fundamentals.

Bitcoin ETFs

The most well-known cryptocurrency, Bitcoin, is the only focus of these exchange-traded funds. Such ETFs give investors access to Bitcoin’s price fluctuations without requiring them to hold the cryptocurrency outright.

Blockchain ETFs

These ETFs invest in businesses involved in blockchain technology, although they are not exclusively cryptocurrency ETFs. Without holding any cryptocurrency, they provide a tangential exposure to the blockchain space.

Related: BlackRock’s Bitcoin ETF: How it works, its benefits and opportunities

How to invest in ETFs

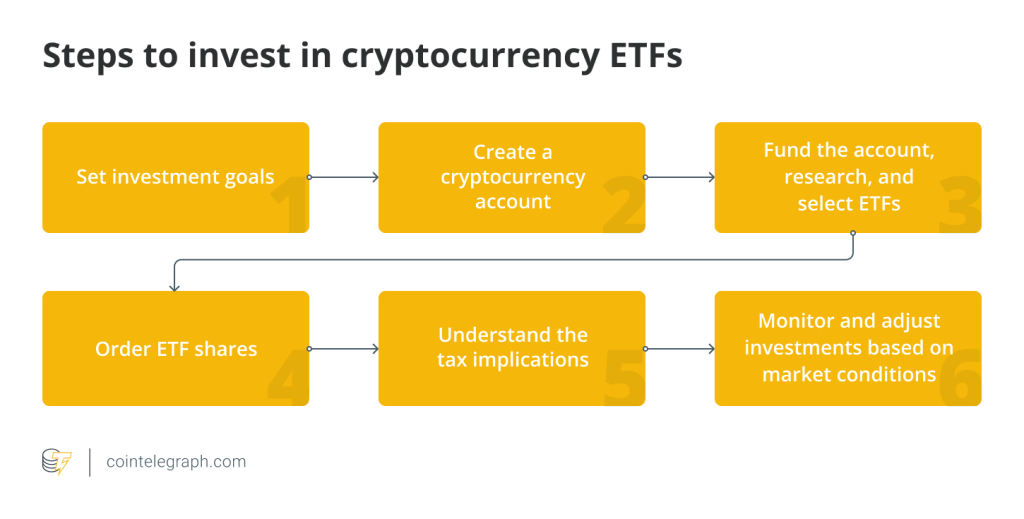

Investing in ETFs involves a structured process that can be applied to both traditional and cryptocurrency ETFs. Setting financial objectives, creating a brokerage account, funding the account, conducting research, choosing ETFs, placing orders, keeping track of investments, remaining informed, and reevaluating and adjusting the investment strategy on a regular basis are the steps involved in investing in traditional exchange-traded funds.

Similar steps are involved in investing in cryptocurrency ETFs, such as setting investment goals, creating a cryptocurrency-specific brokerage account, funding the account, researching and selecting cryptocurrency ETFs, ordering cryptocurrency ETF shares, monitoring and adjusting investments, understanding tax ramifications, taking security precautions and staying informed about the volatile cryptocurrency market.

Advantages and disadvantages of ETFs

ETFs offer a host of advantages. They lower risk by enabling investors to distribute their funds among a variety of assets, which offers diversification. Because ETFs are highly liquid, investors can purchase or sell shares with ease and speed. One noteworthy advantage of ETFs is their transparency; they reveal their holdings every day, making it possible to make well-informed investment decisions.

Their cost-effectiveness stems from generally low fees, reducing the financial burden on investors. Furthermore, because of the way they are structured, exchange-traded funds reduce capital gains distributions and, in turn, reduce tax obligations. Due to these benefits, exchange-traded funds are a desirable option for investors looking for a diversified, affordable and tax-efficient portfolio.

Conversely, ETFs have their drawbacks. Investors are subject to market risks because of the potential for value fluctuations. The performance of an ETF may differ from the index it’s designed to reflect due to tracking problems, which could affect returns. Profits can be reduced by trading costs such as charges and bid-ask spreads, especially for regular traders.

Some ETFs, particularly those related to cryptocurrencies, can be complicated and difficult to comprehend. Counterparty risk arises when it comes to cryptocurrency exchange-traded funds, as the firm offering the derivative may default, potentially resulting in losses. Despite these disadvantages, the versatility of ETFs has solidified their presence in both traditional and emerging markets.

… [Trackback]

[…] Here you can find 30745 additional Information on that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Here you can find 69690 additional Info to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Here you will find 87027 additional Info to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Here you will find 48278 more Info to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Here you will find 76603 more Info on that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Here you can find 44996 additional Information to that Topic: x.superex.com/academys/beginner/2202/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2202/ […]