What is Friend.tech? An Innovative Approach to Build Social Connections in Web3

Abstract

Friend.tech is a decentralized social platform built on the layer-2 Base network. This Web3 product tokenizes crypto personalities, enabling users to trade "Shares" (or "Keys") of themselves, with prices influenced by supply and demand.

To access the Friend.tech app, users are required to obtain an invitation code, bind their Twitter account, and deposit a minimum of 0.01 ETH into the Base network before gaining entry.

The main investment opportunities within Friend.tech include investing in "Keys" of groups with the potential for value appreciation, purchasing "Keys" of influencers and waiting for value appreciation, and gaining airdrop opportunities via the platform.

Friend.tech primarily targets on users with established, long-term connections, thereby lowering the expense of user migration. The platform employs ETH as tokens for purchasing shares, a widely accepted form of currency within the crypto communities.

Friend.tech faces the following potential risks and limitations: limited product functionality, exposed technical vulnerabilities, high costs of social migration, and intense competition from established centralized social platforms.

What is Friend.tech?

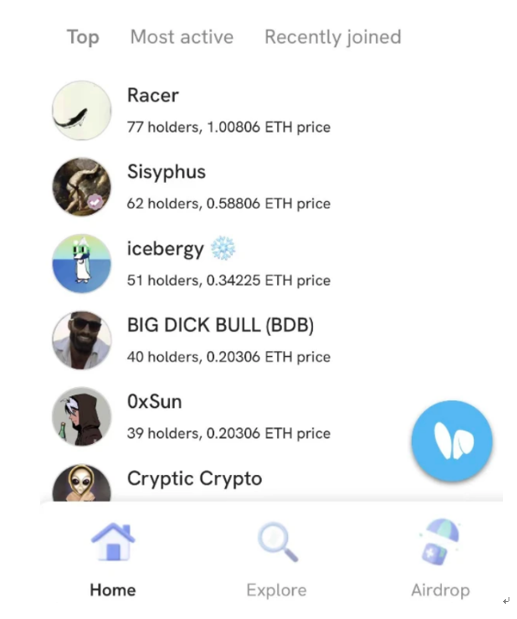

Friend.tech, a decentralized social platform, is built on the layer-2 Base network. It has been reported that this Web3 product was developed by Racer (@0xRacerAlt), the lead developer of TweetDAO and Stealcam. By establishing a connection to Twitter, the platform is able to acquire users' Web2 social identities. With Friend.tech, you can tokenize yourself, or perhaps more accurately, monetize your online identity.

Once you bind your Twitter account to Friend.tech, your Twitter influence (measured via metrics such as follower count) is converted into "Shares", which has now been renamed to "Keys". These "Keys" can be viewed as tokens representing either individual users or chat groups. On Friend.tech, you need to buy the "Keys" of an individual user to engage with them, resembling a pay-to-chat or pay-for-questions model. Likewise, you also have to buy the "Keys" to join a particular influencer group, similar to a paid membership or ticketing approach. Essentially, "Keys" function as social tokens. If a user or group enjoys high popularity, there's potential for the value of their tokens to increase. You can profit by buying these assets at a lower price and selling them at a higher one.

How to use Friend.tech?

Currently, users cannot directly access the Friend.tech via its official website. Only through mobile devices can you gain access to the platform. IOS users can easily access the official website on their phones and add it to their home screens without relying on any third-party downloads. To initiate engagement, you need to obtain an invitation code and link your Twitter account. After completing these initial steps, you must deposit a minimum of 0.01 Ethereum (ETH) into the Base network.

Upon entering the app, you can choose to engage in "one-on-one chats" or join group chats. On Friend.tech's homepage, you can browse a list of currently trending users, and you can also use the Explore button to search for and discover users you'd like to follow. Only after purchasing their "Keys" can you participate in one-on-one private chats. Here, "Keys" are used to unlock chat functionality, similar to paying for access to chat features. In order to prevent spam messages, Friend.tech has implemented a system in which each user can send up to three messages and must wait for a reply before the message limit is reset. Furthermore, you can pay a base price to join a specific chat group. If you choose to leave the group, you can sell the group "Keys" you hold.

Investment Opportunities Presented by Friend.tech

Invest in "Keys" of groups with the potential for value appreciation

In Friend.tech, "Keys" for a particular group start at zero value and increase incrementally. The sole factor influencing the price is the total number of "Keys" issued. The price in ETH is calculated using the formula: Price in ETH = (total supply^2) / 16000. This formula means that the price per share (in ETH) is determined by dividing the square of the total supply by 16000. Currently, Friend.tech charges a 10% transaction fee, with 5% distributed to group shareholders and the remaining 5% going to the Friend.tech treasury.

As more users join a specific group, the number of "Keys" for that group increases, leading to a higher base price per share. This highlights that joining a group fulfills both social and investment needs. From an investment perspective, joining a group constitutes an investment in both the group itself and the group owner. Consequently, speculative users often choose to purchase more "Keys" of the groups they believe have potential, or "Keys" of their own groups, at an early stage.

Purchase "Keys" of influencers and waiting for value appreciation

The base price of each user's "Keys" is determined by their Twitter data. As transaction volume increases, the price per share also rises. If you believe that a specific influencer will become more popular in the future, you can purchase that influencer's "Keys" and hold onto them until their value increases. You can then sell the "Keys" at a suitable time to make a profit. From an investor's angle, it allows users to invest in the influencers they admire.

Gain airdrop opportunities through Friend.tech

Friend.tech employs a point-based incentive system as its primary strategy to convert Twitter users into its core user base. Additionally, to foster active engagement, the platform introduces token airdrops and offers tangible rewards to users. Friend.tech plans to distribute a total of 100 million points over the upcoming 6-month testing period, with distributions occurring every Friday. It's worth noting that the point records will not be stored on the blockchain.

Advantages of Friend.tech

Friend.tech generated an impressive 2,953 ETH (approximately $5 million) in fees in just 11 days, sparking considerable anticipation in the market. Friend.tech's advantages are prominently demonstrated in the following four key areas:

1) The acquisition of a large range of individual users is not Friend.tech's primary focus. Instead, it aims to attract users with enduring relationships, thereby creating favorable conditions for success within private group chat scenarios.

2) Friend.tech has effectively lowered user migration barriers by linking users' Twitter accounts and providing a user-friendly application without the need for third-party downloads.

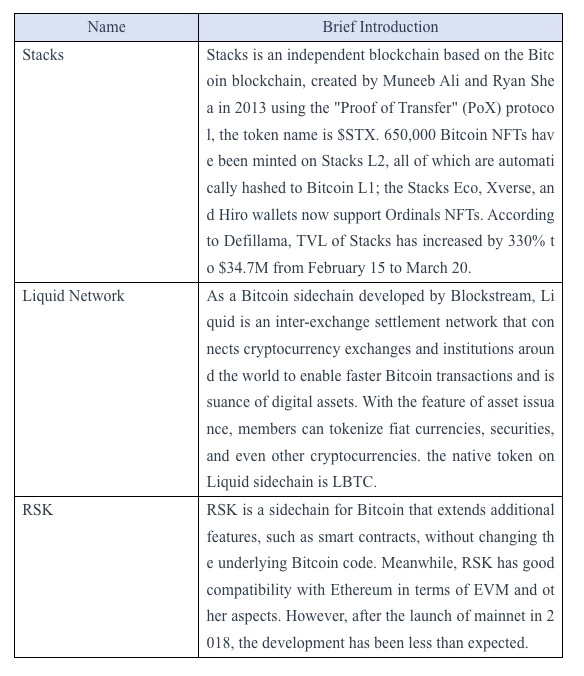

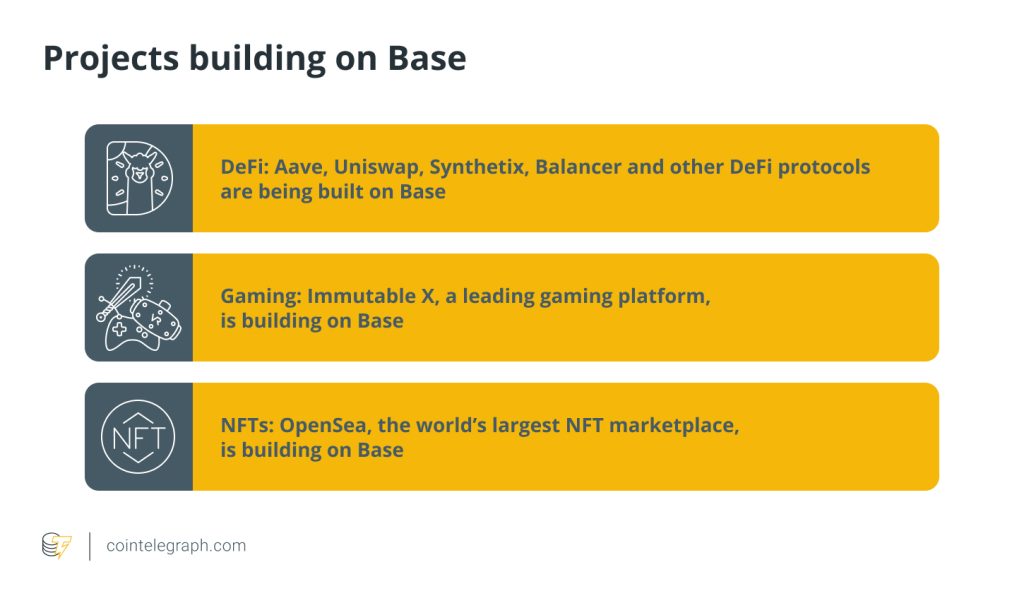

3) Friend.tech takes a different approach from BitClout, a decentralized social product that initially used a share-based mechanism (later integrated into DeSo). Instead of Bitcoin, Friend.tech uses Ethereum for transactions, a cryptocurrency with broader community acceptance. Additionally, Friend.tech is built on the Base network, which will facilitate acquiring new users.

4) To boost user participation and engagement, Friend.tech implements an invitation code mechanism, tokenizing users' personalities based on their Twitter influence, and reshaping the fan economy. As the platfrom continues to evolve, it has the potential to transform the decentralized social media landscape.

Risks and Limitations of Friend.tech

While Friend.tech possesses many advantages and shows potential for success, users should remain aware of its inherent risks and limitations.

Friend.tech lags behind established social platforms due to its limited feature set. Taking into account user characteristics, Friend.tech has the potential to attract users from the Discord community, potentially offering higher-quality users compared to acquiring customers directly from Twitter. However, in comparison to Discord's comprehensive feature set and robust plugin system, Friend.tech's features remain somewhat constrained. In more intricate scenarios, it faces difficulties in ensuring effective user communication.

Concerns regarding technical risks associated with Friend.tech have emerged. Despite the current market fascination with the speculation and hype surrounding Friend Tech, the platform has recently disclosed certain technical vulnerabilities. These vulnerabilities encompass instances of data leakage through APIs and users' ability to trade shares on the platform without requiring an invitation code.

Besides, the cost of social migration is high, and centralized social platforms have a significant first-mover advantage. Further observation is needed to assess the subsequent development of Friend.tech. In the cryptocurrency industry, invitation code-based registration was found in some earlier social products, such as Monaco in 2021. However, many of these platforms experienced a surge in popularity followed by a subsequent decline in user activity. On August 10th, the social app Friend.tech on the Base network saw its popularity skyrocket. Initially, users were eager to acquire invitation codes to join the platform. However, this enthusiasm lasted for less than three days, and activity on Friend.tech subsequently experienced a sharp decline. Currently, Friend Tech sustains its high level of popularity, largely thanks to its successful seed funding from Paradigm.

Summary

Friend.tech is a browser-based application launched on the Base network, an Ethereum scaling network provided by Coinbase. It employs an invitation mechanism and strategically unveils Paradigm's seed funding news at the right moment, driving itself to the forefront of the industry. Friend.tech has forged a strong integration with Twitter, mandating users to link their Twitter accounts. By tokenizing users' personalities and offering airdrop incentives, the platform has attempted to reshape the fan economy and has already demonstrated initial success in private group chat scenarios. However, social migration comes with high costs, and centralized social platforms have a significant advantage due to their early establishment. Meanwhile, Friend.tech is still grappling with difficulties stemming from its somewhat restricted product feature set and underlying technical risks. Despite experiencing a short-term surge in popularity, it still has a long journey ahead to secure lasting success.

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] There you will find 87099 additional Information to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Here you can find 23894 additional Info to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Here you can find 41355 additional Info to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Here you will find 2957 more Information to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Here you can find 95410 additional Info to that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Here you will find 87834 more Information on that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Here you will find 97049 more Info on that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/deeplearning/1993/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1993/ […]