What Are USD Stablecoins? What Makes PayPal's PYUSD Different?

Key takeaways

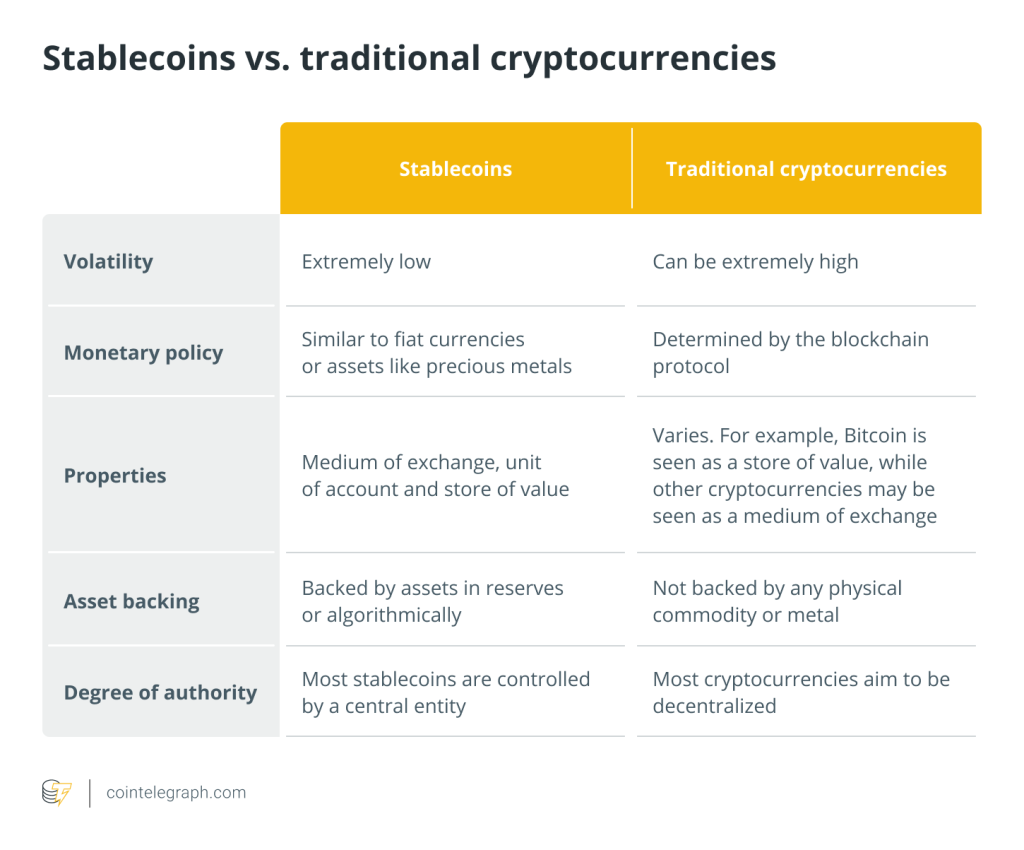

Stablecoins are a type of cryptocurrency designed to maintain a stable value, typically pegged to real-world asset classes or external indicators like a fiat currency, gold, or other commodities.

Stablecoins were initially issued on Bitcoin. As Ethereum matures, stablecoins have shifted their focus from Bitcoin to Ethereum. MakerDAO adopted an over-collateralization mechanism to issue decentralized stablecoins.

Fully uncollateralized algorithmic stablecoins represent an aggressive attempt in the crypto market. However, the catastrophic depegging of UST almost marked the failure of algorithmic stablecoins. On the other hand, regulated stablecoins like USDC are gaining mainstream acceptance with increasing regulatory scrutiny.

Traditional financial payment institution PayPal is making moves into the stablecoin market, indicating the integration of stablecoin and traditional finance. Notably, PayPal USD (PYUSD) features "Freeze" and "wipeFrozeAddress" and exhibits more centralized attributes than other stablecoins.

What are USD stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value, typically pegged to real-world asset classes or external indicators like a fiat currency, gold, or other commodities. Unlike other cryptocurrencies such as Bitcoin and Ethereum, stablecoins experience less price volatility, making them more suitable for payment, trading, and storage.

Stablecoins are classified into various types based on the underlying asset or mechanism to which they are pegged. These types include USD stablecoins like USDT, USDC, and TUSD, stablecoins tied to other commodities such as gold and bank deposits, as well as algorithmic stablecoins, among others. Fiat-backed stablecoins, tied to traditional currencies, are better aligned with regulatory requirements than other cryptocurrencies. As an example, PayPal announced on August 7 its launch of PayPal USD (PYUSD), a USD stablecoin designed for transfers and payments. It is issued by Paxos, a stablecoin issuer regulated by the New York State Department of Financial Services (NYDFS).

Stablecoin Development Over Time

As a cryptocurrency aimed to address dramatic price volatility, stablecoins can be traced back to the early days of the crypto market. In fact, the idea of stabilizing value transfer in the digital economy emerged shortly after the birth of Bitcoin in 2009.

Stablecoins were initially issued on Bitcoin. In 2012, the first stablecoin, Mastercoin (now Omni), was developed to introduce additional features, including the concept of stablecoins, to the Bitcoin blockchain. Mastercoin planned to create tokens on the Bitcoin blockchain to support price stability. In 2014, BitShares launched BitUSD, a BTC-backed stablecoin. Pegged to the US dollar, BitUSD was designed to achieve stability through smart contracts and collateralization.

As Ethereum matures, stablecoins have shifted their focus from Bitcoin to Ethereum. In 2014, Tether introduced USDT, a stablecoin pegged at a 1:1 ratio to the US dollar. First issued on Bitcoin, USDT was later expanded to other blockchains like Ethereum. Nevertheless, USDT has faced lingering controversy due to concerns about the transparency and stability of its reserve assets.

MakerDAO adopted an over-collateralization mechanism to make a big step toward the decentralized issuance of stablecoins. In 2017, MakerDAO launched DAI, a decentralized stablecoin. DAI maintains stability through collateralization and smart contracts, with its value pegged to the US dollar. Notably, its issuance does not rely on centralized reserve assets.

With increasing regulatory scrutiny in the crypto market, regulated stablecoins like USDC are gaining mainstream acceptance. In May 2018, Circle announced the launch of the stablecoin USDC, which was officially released four months later. Circle, the issuer of USDC, holds the most crypto licenses worldwide, including payment licenses in the US (including the New York BitLicense), the UK, and the EU. Therefore, it provides compliant venues for converting major fiat currencies, including USD, GBP, and EUR, into crypto assets.

Facebook's failure in global stablecoin issuance led to stagnation in stablecoin development. In 2019, Facebook (now Meta) announced its plans to launch Libra, a cryptocurrency backed by stable assets, aiming to provide financial services to the global population. However, the project was abandoned due to regulatory and legal issues.

The catastrophic depegging of UST marked a setback for fully algorithmic decentralized stablecoins. In April 2019, Terra launched LUNA on the Cosmos blockchain, before introducing the algorithmic stablecoin UST. As UST was pegged to the US dollar, users must burn an equivalent value of LUNA to mint UST (i.e., a $1:$1 ratio). Likewise, to redeem LUNA, they had to burn an equivalent value of UST. This meant that UST maintained stability depending on market incentives without the backing of external collateral assets. In 2022, LUNA collapsed and UST was depegged from the US dollar, resulting in a continued decline in stablecoins solely relying on algorithms.

Traditional financial payment institution PayPal is making moves into the stablecoin market, indicating the integration of stablecoin and traditional finance. On August 7, 2023, PayPal launched PayPal USD (PYUSD), a USD stablecoin designed for transfers and payments. It is issued by Paxos Trust Co. and backed by the US dollar, short-term government bonds, and cash equivalents.

What makes PayPal's PYUSD different?

PayPal's expansion into the stablecoin space marks that stablecoins are entering a mature stage. That said, PayPal's stablecoin, PYUSD, differs from others like USDT. Compared to stablecoins issued by crypto agencies, PYUSD is better aligned with regulations and compliance.

PYUSD is an ERC-20 token, exchangeable with the US dollar at a 1:1 ratio. It is backed by short-term US treasuries, cash, and equivalents, and will publish audited reserve reports on a monthly basis. Notably, PayPal USD features "Freeze" and "wipeFrozeAddress." This means that PayPal, through centralized control, can freeze or unfreeze malicious wallet addresses and wipe all assets from such addresses. Although blockchains are immutable, PayPal can effectively ban transactions or freeze assets through specific codes. Compared to other stablecoins like USDT, USDC, and USDD, which can also impose freezing, PayPal has much greater control over PYUSD and its platform in a more centralized manner.

PYUSD is primarily tailored for PayPal and Venmo, while USDC is designed for Circle. This suggests that PYUSD could be more appealing to PayPal and Venmo users. Additionally, PYUSD distinguishes itself from other stablecoins like USDT and USDC with several advantages. First, it leverages the PayPal ecosystem to access bilateral networks. Second, it can serve as an alternative payment solution for e-commerce websites and PayPal-accepted merchants. Third, it boasts interconnectivity with fiat currencies.

Summary

Stablecoins play a crucial role in bridging traditional finance and crypto finance. As the crypto market grows, stablecoins have evolved from a niche product to a mainstream market segment. During this process, two major paths have emerged. Some stablecoins are moving toward decentralization, giving rise to various algorithmic stablecoins. Others aim to attract traditional financial institutions and integrate with traditional finance, advancing toward compliance.

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Here you will find 25779 more Info to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Here you can find 57696 more Info to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Here you will find 23450 more Information on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] There you can find 3984 additional Information to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] There you can find 98977 additional Information to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/deeplearning/1987/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/deeplearning/1987/ […]