An Overview of USD Stablecoins and Mainstream Stablecoin Projects

Key takeaways

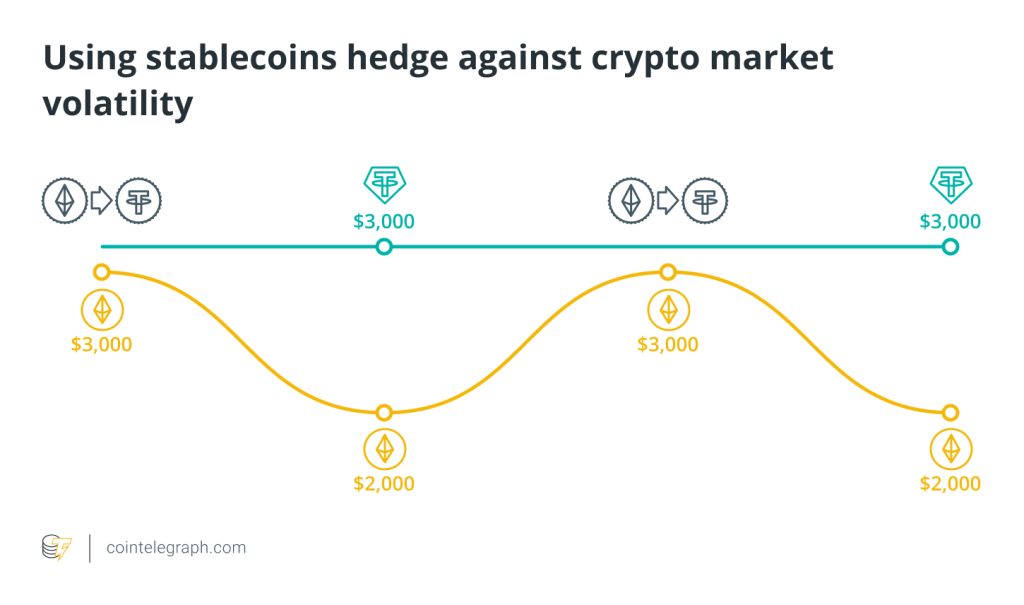

Based on how stablecoins are collateralized, they can be divided into centralized fiat-backed stablecoins and algorithmic stablecoins.

Centralized fiat-backed stablecoins are guaranteed by centralized organizations to maintain a 1:1 peg to the US dollar and are subject to regulatory oversight.

Algorithmic stablecoins can be classified into three types: over-collateralized, hybrid algorithmic, and algorithmic pegged.

Fiat-backed stablecoins primarily include USDT. Over-collaterialized algorithmic stablecoins are exemplified by DAI. FRAX and USDD are among hybrid algorithmic stablecoins. USDC, USDP, and GUSD are notable examples of regulated and compliant stablecoins.

Categories of mainstream stablecoins

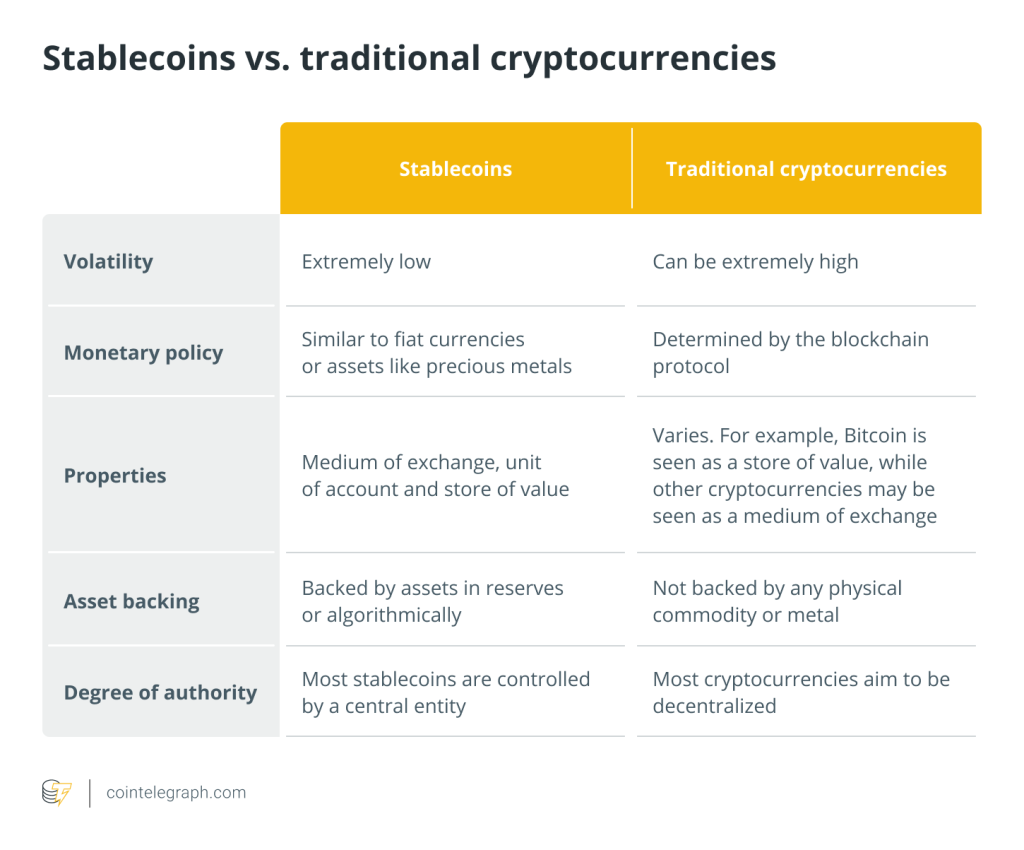

Based on how stablecoins are collateralized, they can be divided into centralized fiat-backed stablecoins and algorithmic stablecoins.

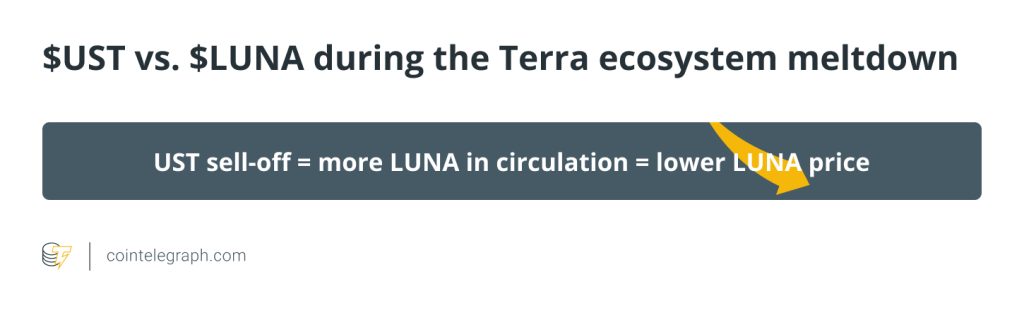

Centralized fiat-backed stablecoins are guaranteed by centralized organizations to maintain a 1:1 peg to the US dollar and are subject to regulatory oversight. Common examples of such stablecoins include USDT and USDC. Algorithmic stablecoins can be classified into three types: over-collateralized, hybrid algorithmic, and algorithmic pegged. Over-collateralized stablecoins are minted by over-collateralizing with other cryptocurrencies. Examples include DAI and MIM. Hybrid algorithmic stablecoins use a combination of other cryptocurrencies, typically stablecoins, as collateral and ecosystem coins for pegging. Examples include FRAX and USN. Algorithmic pegged stablecoins maintain their stability solely based on algorithmic mechanisms such as burning and minting. Examples include UST, USDN, and USDX.

Mainstream stablecoin projects

Fiat-backed stablecoins

USDT

USDT, also known as Tether, is a cryptocurrency introduced by Tether Ltd. in 2014, pegged to the US dollar at a 1:1 ratio. Tether's reserves have been controversial – only a portion are held in cash, while the rest consist of other assets like commercial paper, trust deposits, and treasury bills. USDT is currently issued on various mainstream blockchains, including Ethereum, Binance Smart Chain, Tron, and Solana.

Over-collaterliazed algorithmic stablecoins

The development of stablecoins has given rise to crypto-collateralized stablecoins that maintain stability through smart contracts. A prominent example is MakerDAO's DAI.

DAI

DAI is a decentralized cryptocurrency backed by other crypto assets, pegged to the US dollar at a 1:1 ratio. Maker, a smart contract platform built on Ethereum, supports and stabilizes the price of DAI through collateralized debt positions (CDP), automated feedback mechanisms, and external incentives. It allows anyone to utilize their Ethereum assets to generate DAI as a leverage. Once created, DAI can be used like any other cryptocurrencies – It can be sent to others, used as a payment tool, or held for a long term.

Hybrid algorithmic stablecoins

Hybrid algorithmic stablecoins have also gained mainstream acceptance. Notable examples include FRAX and USDD. For fully uncollateralized stablecoins, there are very few users left following the UST crash.

FRAX

FRAX is a new scalable, trustless stable on-chain currency created by combining the principles of fully collateralized stablecoins (like MakerDAO's DAI) and purely algorithmic stablecoins. Pegged 1:1 to the US dollar, FRAX maintains stability through smart contracts and other mechanisms. The Frax protocol enables a dual-token system: the stablecoin FRAX and the governance token FXS. Such a system allows FRAX to be backed by both collateral and algorithm (which governs the burning and redemption of FXS). When collateral and FXS are deposited into the Frax protocol, FRAX is minted at a specific collateral rate. This rate determines the proportion between the collateral and algorithm backing $1 worth of FRAX.

USDD

USDD is an algorithmic stablecoin launched on the TRON blockchain. It provides the Peg Stability Module (PSM), an open-source software that allows users to swap USDD with other stablecoins like USDT and USDC at a 1:1 ratio. The PSM serves as an additional mechanism to enhance the stability of USDD. USDD's primary goal is to achieve financial freedom for all users through mathematics and algorithms. It works similarly to TerraUSD (UST) and Frax Finance (FRAX).

Regulated and compliant stablecoins

With growing regulatory scrutiny in the crypto market, regulated and compliant stablecoins have garnered increasing attention. The prominent examples include USDC, GUSD, USDP, and BUSD.

USDC

USD Coin (USDC) is an ERC-20 token on the Ethereum blockchain, designed to maintain a 1:1 peg to the US dollar. Here's how it works:

USDC is issued by Centre, a consortium consisting of Coinbase and the payment processing company Circle. When users want to buy USDC, they send their US dollars to a licensed financial institution partnered with Centre, and the institution will issue an equivalent amount of USDC to their Ethereum wallets. The reserves for each USDC token are held in separate accounts at regulated financial institutions. Centre collaborates with the accounting firm Grant Thornton LLP to provide monthly verification reports on USDC reserves. Through partner financial institutions, users can redeem USDC for US dollars at a 1:1 ratio. When USDC is redeemed, the tokens are burned, and the corresponding US dollars are released from the reserve account.

USDP

Pax Dollar (USDP), a stablecoin minted by Paxos, maintains a 1:1 value ratio with the US dollar through a collateral mechanism. To buy USDP, users send their US dollars to Paxos' bank account, and Paxos will issue an equivalent amount of USDP to their wallets. When users want to convert USDP into US dollars, they can send USDP back to Paxos, and Paxos will send the equivalent US dollars to their bank accounts. This process is called redemption. Notably, users must complete identity verification and anti-money laundering (AML) requirements as mandated by regulatory bodies before they can redeem USDP. Once these requirements are met, users can submit redemption requests to Paxos.

GUSD

Gemini Dollar (GUSD) is the first cryptocurrency issued by Gemini Trust Company and the world's first stablecoin overseen by US regulators. Issued on the Ethereum blockchain, GUSD is backed by and pegged to the US dollar at a 1:1 ratio. GUSD is created when withdrawn from Gemini and redeemed or burned when deposited to the platform.

Summary

Currently, USDT still dominates the market share of stablecoins. However, its lack of regulation and reserve transparency makes it a potential risk for the market. USDC, as the second-largest regulated stablecoin, exhibits strong centralization like PYUSD. However, such a nature has spurred doubts, albeit making it safer. Among algorithmic stablecoins, the over-collateralized DAI has demonstrated resilience. Nevertheless, given its costly governance, its earning prospects are concerning unless substantial investment is made in RWA this year. FRAX furthers decentralization through smart contracts and has lower governance costs, making it a market favorite in the short term. That said, this young stablecoin still needs time to prove its long-term stability.

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Here you will find 11366 more Information on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Here you can find 8199 more Information to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Here you can find 82403 more Info on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/1985/ […]

… [Trackback]

[…] There you will find 47921 additional Info on that Topic: x.superex.com/academys/deeplearning/1985/ […]