Hardware vs. software wallets: Key differences

In the cryptosphere, a wallet is as much needed as a regular one for holding bank notes. However, it isn’t a leather wallet where one keeps fiat or plastic money; it is a wallet where one can store digital assets. The wallet acts as an interface, enabling one to access their digital currency.

The security and convenience of one’s digital assets depend on the wallet they choose. Somewhere, one needs to balance between the two, which requires considering a plethora of factors.

Two major cryptocurrency wallets are software and hardware, both with their own design philosophies. This article includes what hardware and software wallets are, some selected examples and key differences, including many parameters.

What are hardware and software wallets?

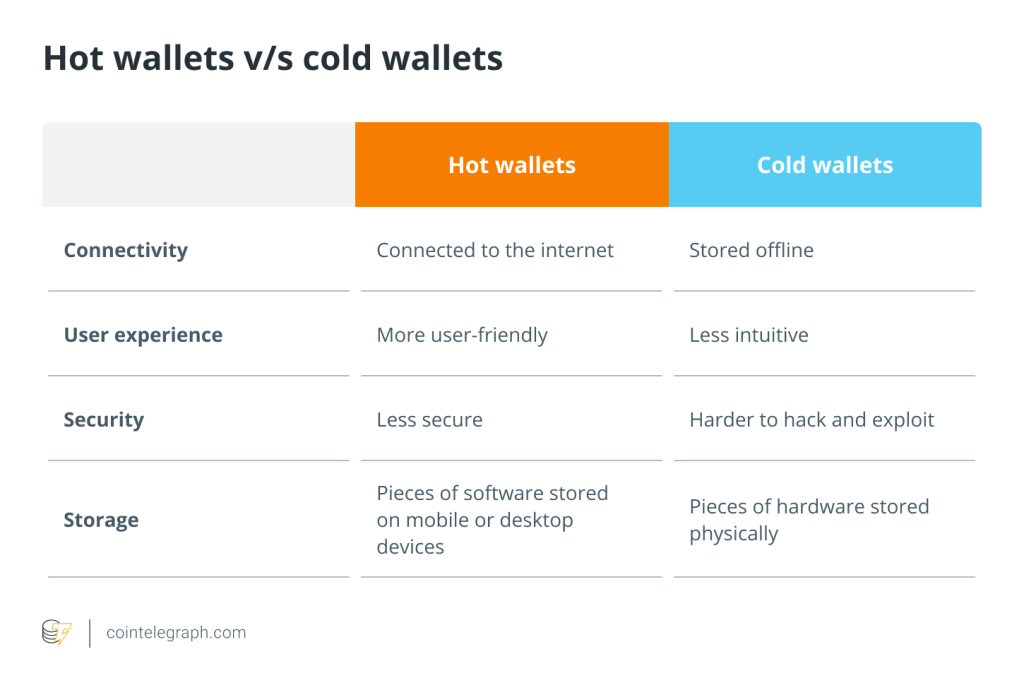

A hardware crypto wallet, or cold wallet, is tangible equipment for storing private keys required for accessing and transacting with digital assets. Resembling USB drives, hardware crypto wallets can save digital assets offline, taking them outside the reach of hackers, though they must be stored in a safe place to avoid any physical damage.

Most renowned hardware wallets can be integrated with software wallets, converting hot storage into cold storage. Exodus wallet, for instance, facilitates integration with the Trezor cold wallet. The desktop app of Crypto.com can integrate with Ledger hardware wallets.

On the other hand, a software crypto wallet, or hot wallet, is a software program used on a desktop, laptop, tablet, smartphone or any other digital device. Depending on the digital device they are being used on, they are classified into desktop, mobile and web wallets. The primary difference between various software wallets is how they store and manage cryptographic keys.

There is another way of categorizing software wallets: custodial and noncustodial. In custodial wallets, a third party manages the cryptocurrencies for the users, while in noncustodial wallets, the user has complete control of their digital assets. The downside is that if the user of a noncustodial wallet forgets their keys or passwords, they also lose their digital assets.

Examples of hardware and software wallets

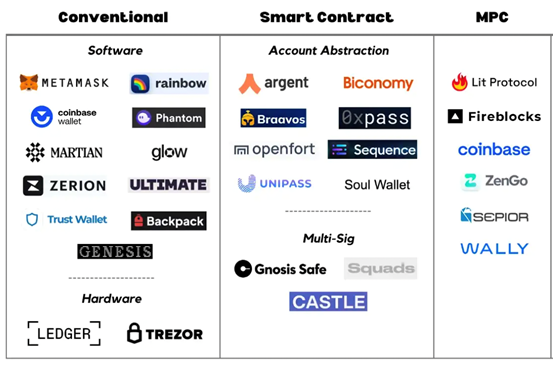

Common hardware wallets

Ledger

While Ledger is known for hardware wallets, it also has a highly rated mobile app and a dedicated desktop app. The advantages of the Ledger Nano X include smart card encryption, backup data, paperless remote login, PIN entry and remote password protection. As for negative aspects, one can have limited interaction with decentralized applications (DApps) on Ledger wallets despite their exemplary storage capabilities.

Trezor

It offers high-end hardware along with a desktop offering. Though it doesn’t offer a mobile app, it has an app for smartwatches. Pros of Trezor wallets include impressive seed phrase functionality and open-source wallets. Cons include limited support for iOS devices and various browsers and the lack of a smartphone app.

Common software wallets

MetaMask

It is the most popular DeFi wallet, available as a browser extension or mobile app on iOS and Android devices. It supports ERC-20 tokens and nonfungible tokens (NFTs). MetaMask presents users with a user-friendly wallet interface, granting comprehensive control over their local funds.

Trust Wallet

Trust Wallet, a noncustodial wallet, is known for its user-friendly interface, which enables users to perform a gamut of actions through a single platform. Supporting more than 100 fiat currencies for buying crypto, the wallet has an in-built staking mechanism that enables one to stake their crypto to earn interest. In terms of drawbacks, there’s an absence of direct customer support, although users can submit a ticket for more specific issues they encounter.

Electrum

Electrum is a Bitcoin (BTC)-only desktop wallet compatible with hardware wallets like Ledger, Trezor and KeepKey. Moreover, it is an open-source application, which means one can modify code to build features that suit their requirements.

Despite its limited altcoin support, Electrum compensates with its emphasis on security and transparency. However, the absence of direct customer support necessitates reliance on documentation.

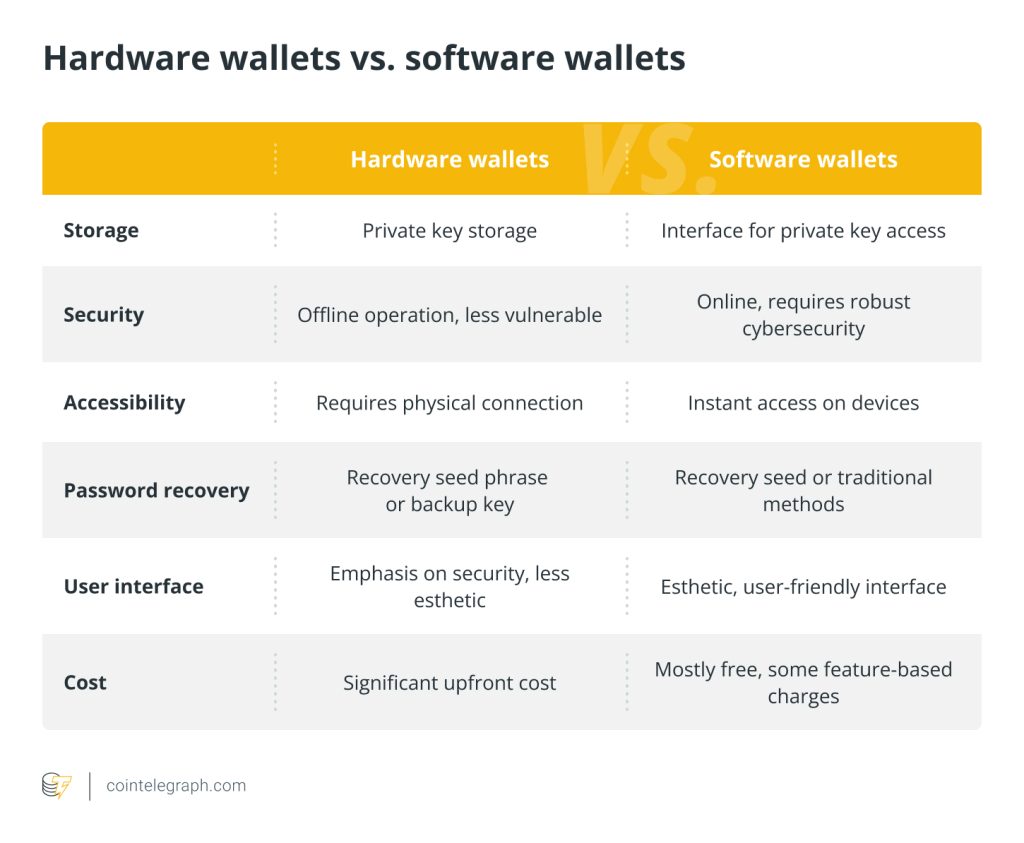

Key differences between hardware and software wallets

Hardware and software wallets differ in several ways. Here are the key differences between them:

Storage

There is a misconception that hardware wallets store digital assets offline, while software wallets hold the coins on the computer. Digital assets do not get stored within the hardware wallet, but on the blockchain. All a hardware wallet does is store the private keys of the user.

One uses the private key on the hard wallet to open the lock to the blockchain address where the assets actually reside. As the blockchain is accessible from anywhere, provided there’s an internet connection, one just requires the physical wallet to transact with the tokens.

Even the software wallets work as an interface between the user and the blockchain. So, contrary to the general opinion, both wallets are the same in terms of storage!

Security

When it comes to holding digital assets securely, there is no better option than hardware wallets. As they can operate offline, they are outside the purview of hackers. Only when they are connected to an internet-enabled device do they become a bit vulnerable.

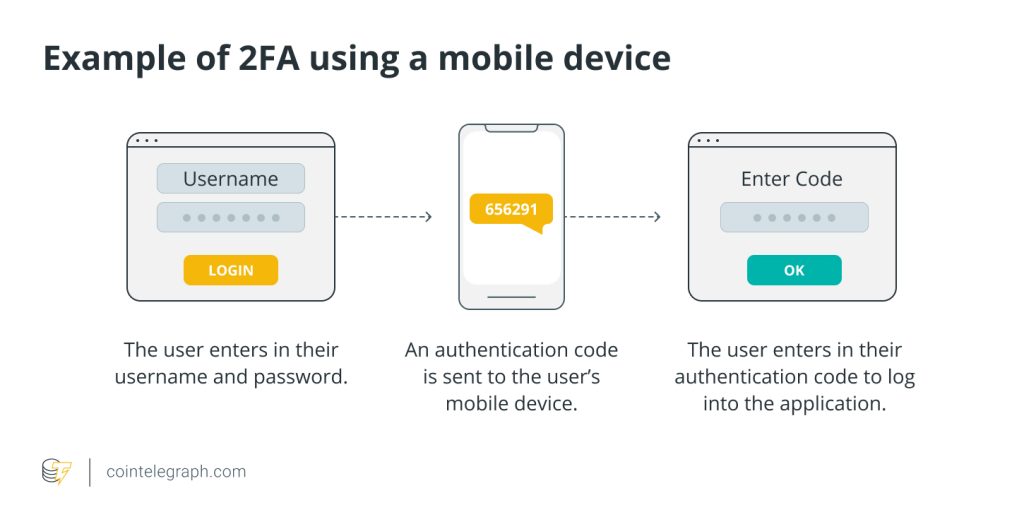

However, if one has updated software and adequate security layers, such as a firewall and two-factor authentication (2FA), even that vulnerability can be overcome.

Software wallets, in comparison, are more susceptible to cyberattacks because they are online. The security of cold wallets hinges on the security standards of the computer or smartphone they are installed on, whether they are desktop, mobile or web wallets. If one leaves their digital assets with a centralized exchange, they reside in the custody of the exchange, and their security depends on the security steps taken by the exchange.

When transacting on decentralized exchanges (DEXs), users require a wallet compatible with the smart contract. Some wallet extensions enable users to access funds directly in their browsers. Users can install these wallets, import an existing one via a private key or a seed phrase, or create a new one. They need to keep their private key and seed phrase secure to prevent any security risk. As DEXs are noncustodial, users have full control over their funds.

Accessibility

Hardware wallets, however, are physical devices that need to be carried around. Before one can use them, they have to be connected to an internet-enabled device. This makes them a bit less accessible compared to software wallets.

Where the software wallets score over their hardware counterparts is the accessibility factor. As the wallets are present right on the device, one can quickly execute transactions or check balances. If someone regularly transacts cryptocurrencies or does day trading, convenience becomes particularly important.

Password recovery

Both hardware wallets and software wallets have backup options, though the process is a bit different. When users begin working with hot wallets, they receive a recovery seed phrase or backup key that they can use to access their funds on any other similar wallet, in case their wallet gets destroyed or lost.

A seed phrase is a string of words that needs to be put in the same order to recover a wallet and its funds. The seed phrase can also be used to recreate the password and 2FA process.

Care must be taken when keeping the seed phrase, as whoever knows it has access to funds. If the seed phrase is lost, funds become inaccessible.

In the case of decentralized software wallets, too, users can also use a backup key to retrieve funds and recreate passwords. When using wallets with centralized exchanges (CEXs), they can use the traditional process of getting a passcode or password recovery link in their email or mobile phone.

User interface

The design philosophy behind hardware and software wallets means their user interfaces are also different. Software wallets tend to have a more esthetic interface and user experience, as the focus is on enhancing the layout for accessibility and comfort.

On the contrary, hardware wallets are designed to be as safe as possible, so they might be lacking when it comes to an appealing design.

Support for digital assets

Support of hardware wallets for digital assets isn’t as extensive as support for software wallets. Though support of hot wallets for digital assets has increased over the years, it isn’t as inclusive as software wallets. Particularly, the compatibility range of wallets attached to large crypto ecosystems is much greater compared to hardware wallets.

Trust Wallet, which is the official wallet of Binance, supports more than 10 million types of digital assets. The Guarda software wallet supports more than 400,000 digital assets. On the other hand, Ledger’s support is limited to around 5,500. Trezor, another renowned maker of hardware wallets, supports more than 1,200 assets.

Cost

Cost is a key factor in users determining the crypto wallet they will be using to store their digital assets. Hardware wallets carry a significant cost, as they are physical devices with robust security features. Software wallets, on the other hand, are usually free, though some might charge for specific features. One can simply download a software wallet on their smartphone or computer or add them as an extension to their browser and park their digital assets there.

Users balance the cost with other important factors, such as accessibility and security. More often, they might use both kinds simultaneously. They would leave some funds in a software wallet to do day trading or make small payments while keeping large funds in hardware wallets.

Striking the balance: Choosing the ideal wallet for your digital assets

Selecting the ideal wallet involves a delicate equilibrium. It necessitates a thorough assessment of individual needs, weighing the advantages and disadvantages of different wallets to determine the best fit.

If one is looking toward holding digital assets for the long term, cold wallets may suit them better. However, if they need a wallet for day trading and regular transactions, accessibility becomes important, so a hot wallet may be a better bet.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Here you will find 70975 additional Info to that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1955/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1955/ […]