Who is Richard Teng? Profile, biography, Binance and more

Richard Teng took over as CEO of Binance, the largest cryptocurrency exchange by trade volume, after Changpeng “CZ” Zhao, the founder of Binance, stepped down after pleading guilty to the charges of violating Anti-Money Laundering (AML), rules, and other compliance requirements as a part of $4.3 billion settlement with the United States government.

Teng, who assumed the role of CEO of Binance Singapore in August 2021, brings over three decades of expertise in financial services and regulatory affairs, showcasing his seasoned leadership in the industry. Teng reached the helm of Binance as it confronts regulatory challenges globally, with uncertainty surrounding how it would perform financially after the colossal penalty — the largest in the history of the U.S. Treasury Department.

This article will explore the educational, family and professional background of Teng, a timeline of his association with Binance, his views on the post-CZ era at the exchange, the hurdles he will face, how he dispelled doubts, his plans to foster growth, his approach regarding the European market and awards he has achieved.

Teng’s educational and family background

Born in Singapore in 1971, Teng obtained a Bachelor’s Degree in Accountancy from the Nanyang Technological University of Singapore (1991 to 1994) with first-class honors. In 1998, he earned a Master’s Degree in Applied Finance with distinction from the University of Western Australia. In 2004, he completed an executive leadership program at the Wharton School.

Regarding Teng’s family background, little information is available in the public domain, except that his mother worked at an assisted living facility.

Teng’s professional background

Starting his career as an auditor at PricewaterhouseCoopers, Teng joined the Monetary Authority of Singapore (MAS) in 1997. He worked at MAS for over 13 years, holding senior roles such as director of corporate finance. His MAS regulatory experience spanned banking, insurance and capital market segments. In various capacities, he helped shape the transformation of Singapore’s financial services sector in the late 1990s, particularly the development of private banking and capital market sectors.

In 2007, Teng moved to the Singapore Exchange (SGX) as the chief regulatory officer. Working closely with the MAS, he helped formulate policy and framework in listing, trading and clearing. His job included approval regarding the admission of listing applicants and enforcing ongoing regulatory compliance.

Teng worked at SGX until February 2015 and then joined the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) in the United Arab Emirates as CEO. He was involved with the foundation and operation of FSRA, overseeing regulatory compliance in financial organizations.

He played a significant role in creating the contours of the regulatory framework at the ADGM, becoming one of the first regulators in the world to introduce a crypto framework, drawing from common law and global best practices. His tenure is noted for ADGM gaining recognition as a progressive financial regulator with expertise in fintech and crypto domains.

Teng’s personal interests

On a personal front, Teng loves his morning exercise, doing some weights, cardio and core daily. He is fond of reading books or catching up on movies on Netflix when he can.

Teng’s association with Binance

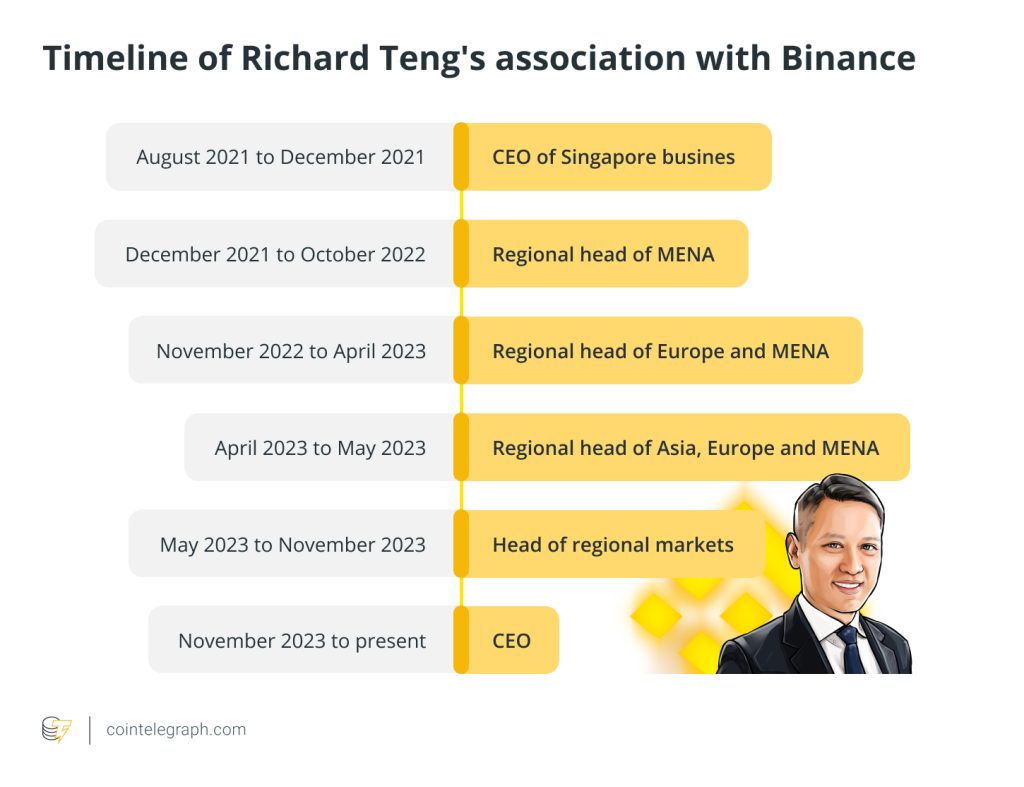

Richard Teng’s tenure at Binance evolved from CEO of Binance’s Singapore arm in August 2021 to CEO of Binance global as of November 2023, encompassing diverse regional leadership roles across the Middle East and North Africa (MENA), Europe and Asia.

Teng views post-CZ Binance as a new chapter

Teng holds that Binance made mistakes in the early days of crypto when the regulatory position wasn’t clear and the crypto ecosystem was still evolving. The exchange grew tremendously from a team of six people to a global company with approximately 166 million users in just six years, leaving gaps in regulatory compliance. However, Teng says that Binance has learned from its mistakes. Moreover, the regulatory take is much more straightforward and should help Binance start a new chapter as a corporation.

The appointment of Teng as CEO comes as no surprise. CZ himself had talked about a succession plan for Teng when he joined Binance. Teng has been working closely with CZ for the last couple of years, and now he will be navigating the crypto exchange through various regulatory landscapes worldwide.

As an executive with considerable experience as a regulator, Teng is expected to contribute positively to helping Binance deal with the regulatory hurdles it is facing. After taking over as CEO, he set the tone of the narrative that positions Binance as an enterprise that blends innovation with compliance in an interview with Cointelegraph. As an ex-regulator, Teng will look to build trust with authorities and an environment conducive to stable business.

Primary hurdles Teng will be facing apart from regulatory issues

While regulatory issues lie at the top of Teng’s priorities, there is a host of other issues he will be faced with:

Maintain innovative edge

In any technological domain, innovation is usually at loggerheads with regulation, which is always catching up. On the one hand, Teng has to embrace innovation; on the other, he has to stay on the right side of the law. Teng will need to walk a tightrope.

Retain market leadership

Binance has been a market leader in the crypto exchange landscape by a margin. In the post-CZ era, it will be challenging for Teng to find a sync with rapidly evolving market dynamics and keep competition at bay.

Expansion into new markets

In recent years, Binance had run-ins with regulators in several jurisdictions and was even forced to leave markets like the Philippines. To cover the base, it needs to find new markets. Teng must work strategically to find an equilibrium between growth and compliance.

Security

Cybersecurity is becoming increasingly complex every day, and hackers have been able to breach the security of many exchanges, including Binance. In this scenario, Teng will need to enhance platform security and be on top of security threats.

Teng’s commitment toward safe user funds and driving growth

Since its inception, CZ has been the leader of Binance, and his sudden exit from the center stage has triggered rumors about the future of the exchange. Teng has reassured the community that Binance is a safe custodial platform for user funds. He reiterated Binance’s commitment toward ease of use, which has always been the calling card of the cryptocurrency exchange. He stressed that user funds and platform security are sacrosanct at Binance.

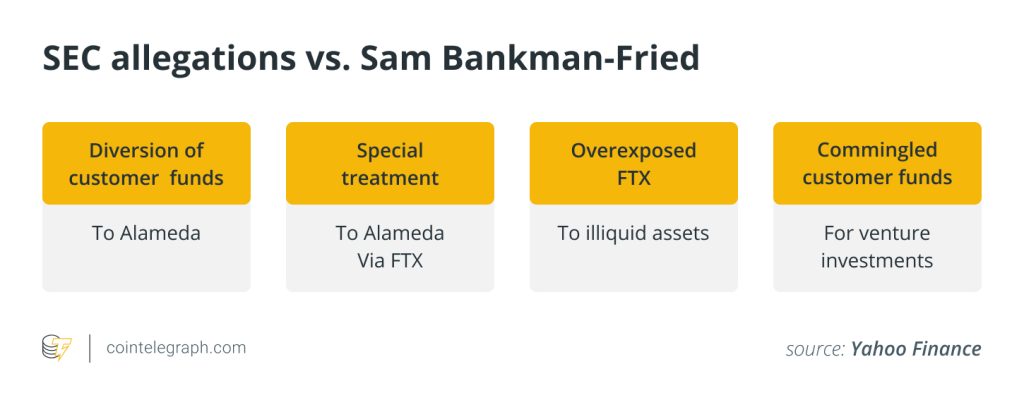

Teng stresses that the U.S. agencies scrutinized the documents with Binance diligently but didn’t find any misappropriation of funds. Under CZ, Binance was a user-focused company, and Teng intends to continue the policy.

As CEO, Teng accepted the regulatory problems Binance faced but underlined that the company had taken on board staff with expertise in handling regulatory matters. It has specifically hired people who have worked in compliance matters in financial institutions and regulatory agencies. He was looking forward to working with regulators worldwide and meeting global standards.

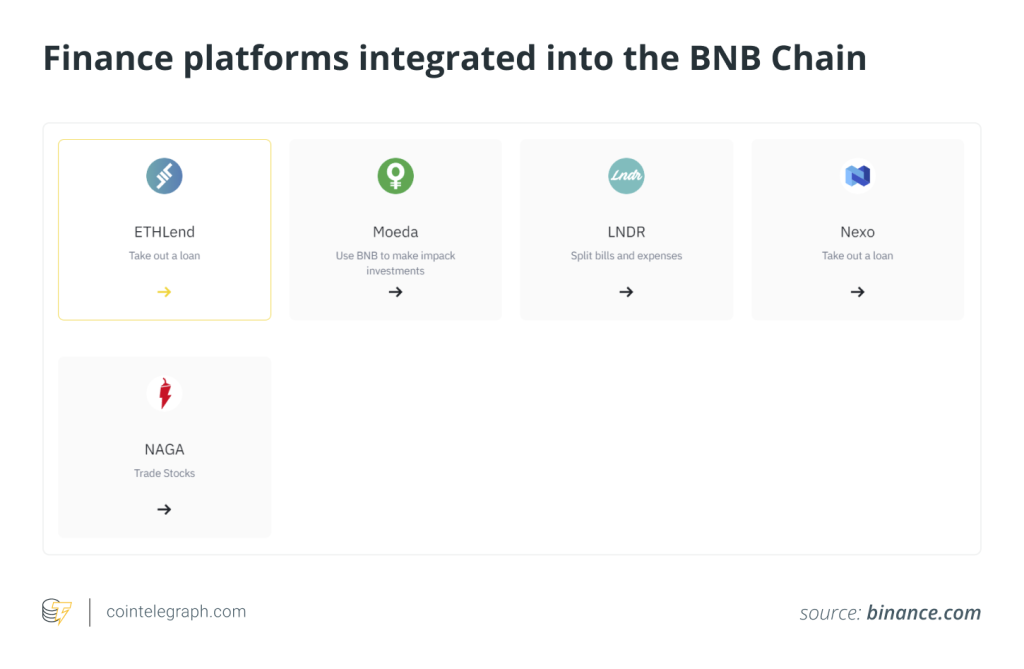

As a market leader, Teng will seek global and local partners to drive Web3’s growth and augment crypto adoption. Teng feels that there is a viable atmosphere for the rapid growth of crypto. Top companies have their plans for Web3, and new projects are upcoming. This would lead to a vibrant growth atmosphere and plenty of liquidity. BlackRock’s spot Bitcoin exchange-traded fund indicates what is in the offing. If approved, it will provide institutional investors a window to invest in crypto indirectly.

Teng’s approach to the European market

The European Union’s Markets in Crypto-Assets Regulation (MiCA) will come into effect in 2024, and an enterprise licensed in any member nation will be able to conduct business in all countries of the union. However, some countries, such as France and Germany, are more prepared to implement MiCA than others, and Binance will need to carefully choose the EU countries it wants to function in. This becomes important in light of the regulatory problems Binance has faced in several European countries.

The exchange had to stop operations in Belgium, was forced to renounce registration with a Cyprus regulator, failed to get a license in the Netherlands, and voluntarily withdrew applications for regulatory approval in major European countries like Germany and Austria.

As the new top executive of Binance, Teng recognizes the opportunity that MiCA offers, enabling companies to operate in all 27 countries in one go. Under CZ, Binance was forced to abandon most of Europe. However, the new regulatory framework will open another window for Binance to jump in and try its luck.

Awards and recognitions earned by Teng

- With Teng at the helm, the ADGM was named Financial Centre of the Year (MENA) by Euromoney’s Global Investors Group in 2016 and 2017.

- Teng is a frequent public speaker, particularly on fintech regulations.

The road ahead

Teng’s forward-thinking approach emphasizes leaving regulatory challenges behind to foster a mutually beneficial environment for investors, users and regulatory bodies. This approach aligns with a vision of sustainable growth, enabling Binance to navigate complexities while remaining compliant and innovative.

With a strategic focus on collaboration and compliance, Teng aims to steer Binance toward continued success by balancing innovation with regulatory adherence, ensuring the platform’s longevity and stability in the evolving market landscape.

Written by Dilip Kumar Patairya

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] There you will find 60817 additional Information to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Here you can find 12914 additional Information on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1941/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1941/ […]