An overview of the cryptocurrency regulations in India

A highlight of the 18th G20 Summit held in New Delhi on Sept. 9 and 10, 2023, was calling for the swift implementation of the Crypto-Asset Reporting Framework (CARF). Prime Minister Narendra Modi described cryptocurrencies as a burning issue influencing the world and sought the development of global standards to regulate the sector.

The Indian government clarified its stance on cryptocurrencies, confirming no plans for a ban. Instead, it emphasized the need for a global consensus on minimal cryptocurrency regulations, highlighting that localized rules would be insufficient without international cooperation.

Gita Gopinath, deputy managing director of the International Monetary Fund, opined that the collaboration shouldn’t be limited to regulatory aspects but also macro-financial aspects. Until the consensus evolves, India is likely to have the current regulations in place, implemented via The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021.

Here is an overview of the cryptocurrency regulations in India:

Categorization of cryptocurrencies

The bill categorized cryptocurrencies and nonfungible tokens (NFTs) as virtual digital assets (VDA). To define the term, Section 2(47A) was added to the Income Tax Act. The definition includes any information, number, token or code generated via cryptographic means, with the exception of gift cards or vouchers. In the income tax return (ITR), cryptocurrency gains need to be reported under Schedule VDA.

Cryptocurrency transactions liable for taxation in India include:

- Using virtual assets to purchase goods or services

- Swapping VDAs, which refers to the exchange of one cryptocurrency for another

- Trading cryptocurrencies using a fiat currency

- Receiving airdrops

- Receiving cryptocurrencies as payment for a service or as a gift

- Receiving a salary in a cryptocurrency

- Earning benefits from staking cryptocurrencies

- Mining cryptocurrency.

Taxation policy regarding crypto losses in India

The law requires all Indian citizens to report and pay taxes on cryptocurrency gains. If a company is dealing in cryptocurrencies, it needs to report the value of its virtual assets as on the balance sheet date. Changes made in Schedule III of the Companies Act regarding mandatory reporting of cryptocurrency assets came into effect on April 1, 2021.

According to Section 115BBH, all gains from trading of VDAs are taxed at a rate of 30% plus 4% cess, a tax levied on the tax by the government for spending on a specific purpose such as education or healthcare. From July 1, 2022, Section 194S has levied a 1% Tax Deducted at Source (TDS) on the transfer of VDAs if the transactions exceed 50,000 Indian rupees in the same financial year.

Unlike stock trading, the bill levies the same tax rate for short-term gains, long-term gains and business income. The tax rate applies to all types of income earned through VDAs. The law allows no deduction, except the cost of acquisition.

Crypto investors cannot offset losses from cryptocurrency transactions against any income, nor can they claim expenses except for the acquisition cost. Let’s understand this using an example.

Suppose Alice purchased Polkadot’s DOT (DOT) worth 50,000 rupees in June 2022 and later sold it for 70,000 rupees in the same financial year. A couple of months later, she purchased Algorand’s ALGO (ALGO) worth 20,000 rupees and sold it for 15,000 rupees for some reason. She also paid a fee of 800 rupees to the exchange for facilitating the transactions.

Alice made a profit of 20,000 rupees in the DOT transaction and a loss of 5,000 rupees in the ALGO transaction. Tax will be levied at the profit of 20,000 rupees at the rate of 30%. However, she won’t be allowed to deduct the loss from the ALGO trade or the exchange fee from the amount.

TDS on cryptocurrency transactions

Cryptocurrency regulations in India have levied Tax Deducted at Source (TDS), which requires cryptocurrency traders and investors to deduct a certain percentage at the source when carrying out a transaction and deposit it with the central government. Only after a deduction of TDS, the buyer is allowed to pay the balance amount to the seller for the transfer of cryptocurrencies or NFTs.

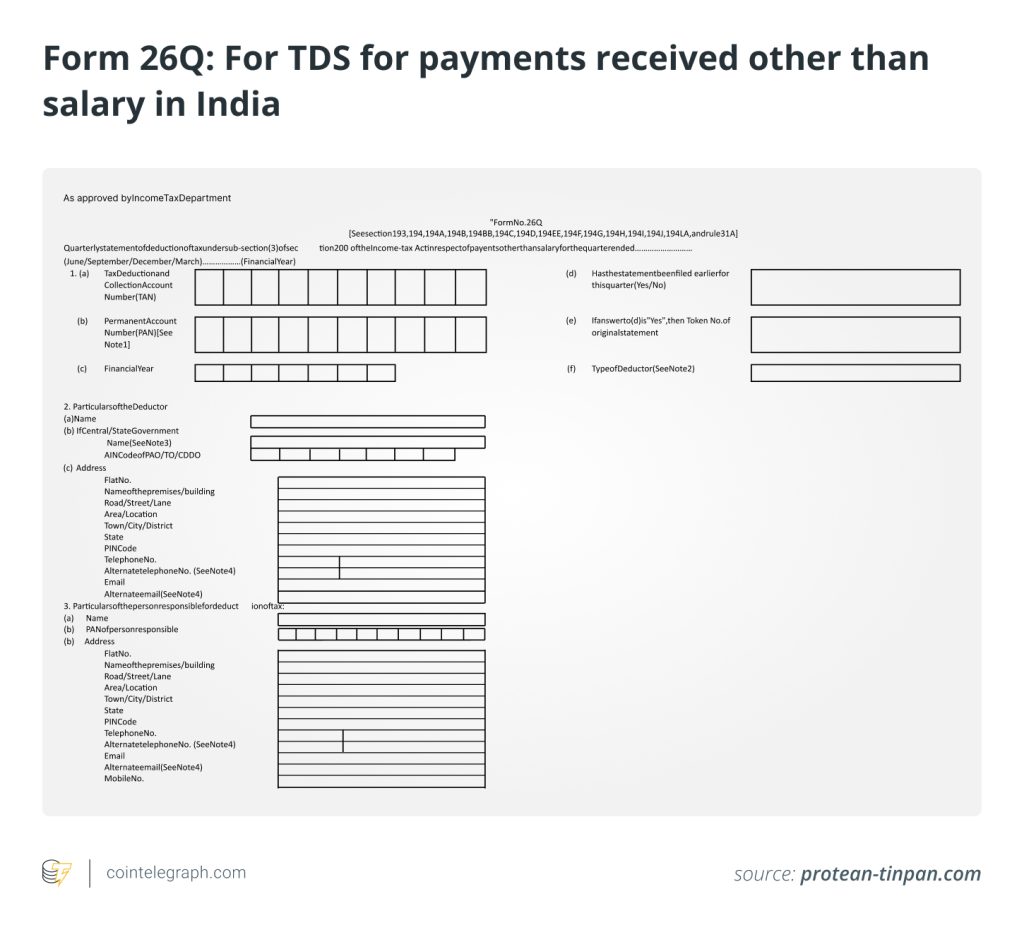

On July 1, 2022, the TDS went into effect. In case the transaction occurs on an exchange, the onus is on the exchange to deduct the TDS and forward the balance to the seller. If it is a peer-to-peer (P2P) transaction using a fiat currency, the buyer has to deduct TDS and fill out Form 26QE or 26Q, whichever is applicable.

For instance, if someone buys a cryptocurrency using fiat on a P2P platform or a cryptocurrency exchange, the buyer is responsible for deducting TDS and filing any of the forms.

However, if it is a crypto-to-crypto transaction, TDS is applicable to both buyer and seller at 1%. For example, if someone buys Ether (ETH) with stablecoins, the buyer as well as the seller will need to deduct TDS and fill out the suitable forms.

Form 26QE needs to be used for filing TDS on P2P trading. Serving as a challan-cum-statement of TDS as per Section 194S, the form acts as a receipt or statement for the TDS deducted.

Form 26Q needs to be submitted for TDS for all the payments received except salaries. The deductor needs to submit it on a quarterly basis under sections 200(3), 193 and 194 of the Income Tax Act of 1961.

Tax on airdrops in India

Airdrops involve sending small amounts of cryptocurrency to wallet addresses of a project’s community members for free or in return for small support such as reposting a post related to the project. The objective of airdrops is to raise awareness about projects.

In India, airdrops are taxed at 30%. Per Rule 11UA, airdrops are taxed at the market value of the tokens on the date of receipt. On the sale, swap or spending of the airdropped tokens later, one needs to pay a 30% tax on the gains paid.

The following example will help us understand better how tax is levied on airdrops in India. Suppose Bob receives 10,000 XYZ tokens on an exchange via airdrop on May 5, 2022, but no trading of these tokens happens. If the price of these tokens on the exchange is 5 rupees per token (10,000 XYZ * 5 rupees), he will be taxed 30% of 50,000 rupees — i.e., 15,000 rupees.

However, if Bob sells, swaps or spends all 10,000 tokens a month later at the price of 10 rupees per token, the gains garnered will be (10,000 rupees * 10 – 50,000 rupees) = 50,000 rupees. He will have to pay 30% of 50,000 rupees as tax — i.e., 15,000 rupees. The accumulated tax he will be paying in both instances is 30,000 rupees.

Tax on staking in India

Staking is a way to achieve proof-of-stake (PoS) consensus on a blockchain that functions by selecting validators in tune with their quantity of associated cryptocurrency holdings. The blockchain rewards stakers with a certain amount of cryptocurrency.

Anyone who stakes a cryptocurrency needs to pay a tax of 30% on their earnings. The amount a validator earns is in sync with the annual percentage rate (APR) offered. If one has staked 500 coins with a 15% APR, they will earn 15% interest every year.

This income of 75 coins a year will attract taxation of 30%. Moreover, when selling these coins, a 30% tax will be levied again. Transferring cryptocurrencies stored in one’s wallet to another wallet or staking does not incur taxes.

Tax on crypto mining in India

Mining is a process that enables the verification and recording of transactions on blockchains. A group of nodes or computers, termed “miners,” compete to solve complex cryptographic puzzles. The node or a group of nodes that solves the puzzle first is paid a predetermined amount of cryptocurrency.

A miner gaining crypto from mining is taxed at a flat 30%. Though mining requires expenses such as infrastructure and electricity costs, miners cannot include them in the cost of acquisition. Therefore, to calculate the gains regarding mining, the cost of acquisition is considered zero.

The value of a crypto asset received as a reward for mining is its fair market value on the date of receipt. For instance, if Bob received 500 XYZ tokens as a crypto mining reward on June 1, 2022, and the token had a value of 10 rupees that day, the value of the asset received will be 5,000 rupees.

The tax levied on this amount will be 30% of 5,000 rupees — i.e., 1,500 rupees. If Bob sells, swaps or spends the cryptocurrency later, a 30% tax will be levied on gains as well.

Tax on cryptocurrency gifts in India

Budget 2022 included VDAs within the scope of movable properties as gifts. Therefore, if the total value of cryptocurrency gifts from non-relatives is more than 50,000 rupees, these will be taxed as “income from other sources” at regular slab rates.

Cryptocurrency gifted by relatives is tax-exempt. Gifts received through inheritance or a will, in contemplation of death, or on special occasions are also exempt from tax. Cryptocurrency gifts can be received as tokens, crypto paper wallets or gift cards.

How to report cryptocurrencies when filing a tax return in India

Anyone filing a tax return for the financial year 2022–2023 needs to declare their transactions in cryptocurrencies using either the ITR-2 form (reporting as capital gains) or the ITR-3 form (reporting as business income). The updated ITR forms have a specific section “Schedule VDA” for reporting cryptocurrency transactions.

Depending on the nature of cryptocurrency transactions and investors’ intentions, the gains would qualify as capital gains or business income for taxation. If the investor holds the cryptocurrency long term to gain from appreciation in value, the gains qualify as capital gains. However, if high-volume trades are done frequently, the gains get categorized as business income.

The road ahead

While cryptocurrency taxation comes across as unrelenting and harsh for the community, there is a silver lining. As G20 discussions suggest, current regulations might be a precursor of more balanced regulations later when the clouds of doubt regarding cryptocurrencies retreat.

As the crypto regulatory framework evolves worldwide and countries in the European Union agree on a minimum regulatory framework with Markets in Crypto-Assets regulation (MiCA), crypto regulations in India are likely to enter the next phase.

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] There you can find 65082 additional Info to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] There you can find 9342 more Info to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Here you can find 39780 additional Info on that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Here you will find 68540 additional Info to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Here you can find 12889 additional Information to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Here you will find 67847 more Information to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1933/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1933/ […]