An overview of crypto regulations in the Seychelles

Nestled in the vast cerulean expanse of the Indian Ocean, the Republic of Seychelles — a nation comprising an archipelago of 115 islands — is a globally acclaimed travel destination. Yet, beyond its travel hotspot allure, the Seychelles is fast emerging as a thriving center for crypto businesses.

The transformation into a crypto hub is largely fuelled by its favorable business-oriented policies, which encourage growth and innovation. Subsequently, it is estimated that approximately 20% of all crypto exchanges in the industry are incorporated in the country. Prominent crypto players registered in the country include HTX (formerly Huobi), BitMEX and KuCoin.

One major pro driving the influx of crypto companies to Seychelles is its remarkably attractive tax structure. Income tax in the country, for example, ranges from zero to 30% contingent on earnings, which is lower than the Organisation for Economic Co-operation and Development (OECD) average of 34.6% as of 2022.

On the other hand, corporate taxes range from 15% on the first 1 million Seychellois rupees ($75,415) to 25% for returns exceeding 1 million rupees. Notably, there are no capital gains or inheritance taxes. Such benefits have made Seychelles an appealing choice for companies seeking to take advantage of its tax-friendly policies.

This article discusses crypto regulations in Seychelles, including legal status, tax treatment, and the specific laws to be followed by cryptocurrency stakeholders.

Cryptocurrency rules and regulations in the Seychelles

If you’re wondering whether cryptocurrencies are allowed in Seychelles, the answer is yes. However, Seychelles is still in the nascent stages of regulating its crypto industry. Its government is working to create an effective legal framework covering crypto companies to protect investors.

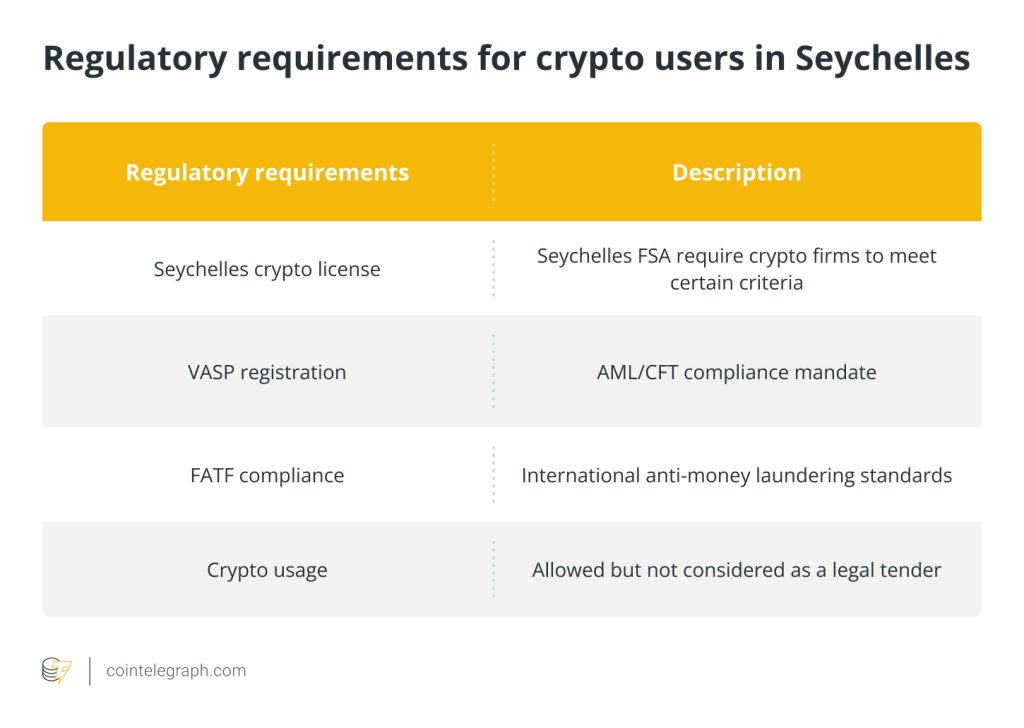

One notable milestone the country has reached in the regulation process is the introduction of the Seychelles Crypto License. The license, issued by the Seychelles Financial Services Authority (FSA) — the regulatory authority overseeing non-bank financial institutions in the country — allows crypto firms that meet certain criteria to operate in the island nation.

According to the latest Seychelles Crypto License rules, prospective crypto companies seeking the license must be incorporated in the country and maintain a physical presence within its borders. Additionally, they have to be in compliance with current Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations and have robust transaction monitoring systems.

Other requirements include meeting specified technical security standards to safeguard customer assets and data, along with having sufficient insurance coverage, including general liability and cyber liability insurance.

Besides the requirements mentioned above, obtaining the Seychelles Crypto License also requires registering as a Virtual Asset Service Provider (VASP) with the FSA. The VASP license mandates crypto service providers adhere to established AML/CFT guidelines, which are developed in collaboration with the Financial Action Task Force (FATF).

The FATF, an international watchdog established in 1989 by G7 nations, is dedicated to combating money laundering and terrorist financing. The agency sets universal benchmarks known as the FATF Recommendations and evaluates countries’ compliance with these standards through mutual evaluations.

A VASP, according to the Financial Action Task Force (FATF), is a business engaged in digital asset activities such as converting virtual assets into fiat currency, trading different virtual assets, or providing financial services linked to the buying and selling of virtual assets.

The introduction of these and other licensing requirements has compelled many crypto companies registered in the Seychelles to adopt the new rules. Consequently, a collective of crypto exchanges based in the Seychelles have announced the implementation of new KYC procedures that align with the regulations.

So, is the Seychelles crypto-friendly? Absolutely, it is! The usage of cryptocurrencies in the Seychelles is permitted. However, it is important to note that cryptocurrencies are still not recognized as legal tender by the Seychelles’ central bank. Therefore, individuals who engage in cryptocurrency trading through entities registered in the country do so at their own risk.

Seychelles’ efforts toward transparency and accountability

Seychelles has previously faced scrutiny for its relaxed stance in dealing with crypto companies. Nevertheless, the country is currently taking steps to tighten its grip on the industry, spurred partly by a growing number of complaints about crypto firms registered there. The grievances have included accusations of fraudulent practices and concerns regarding the security of crypto trading platforms based in the nation.

The gravity of the complaints has in the past drawn the attention of notable regulatory agencies such as the U.S. Commodity Futures Trading Commission (CFTC), prompting it to start investigations into certain crypto firms operating in the Seychelles. Such levels of scrutiny have increased the pressure on the Seychelles government to clean up the local crypto sector and align it with global regulatory standards.

Consequently, the Seychelles government has demonstrated its commitment to ensuring transparency and accountability in the crypto industry by adopting pertinent financial principles designed to combat fraud, money laundering and terrorist financing.

Before implementing current regulatory procedures, Seychelles grappled with myriad issues related to crypto regulation, such as the classification of crypto firms registered as International Business Companies (IBCs). The IBCs, often operating outside the country’s borders, posed a significant regulatory challenge due to their opaque nature and difficulty monitoring their activities.

The introduction of mandatory licensing requirements for crypto entities has marked a turning point in Seychelles’ approach to crypto regulation by addressing many of the regulatory shortcomings that previously plagued the country.

Why crypto regulation is important for the Seychelles

The cryptocurrency industry is rapidly evolving, attracting the attention of institutional investors worldwide. Notably, Seychelles attracted approximately 43% of all blockchain funds raised in Africa in 2022.

According to the 2023 Global Crypto Hedge Fund Report by PricewaterhouseCoopers, which included a survey of industry participants, many institutional investors already invested in the crypto industry plan to expand their crypto holdings in the medium term despite the market’s inherent volatility.

However, the report also highlighted regulatory hurdles as a significant barrier for institutional investors seeking to venture into the industry. By effectively tackling such regulatory concerns, countries like Seychelles will be strategically positioned to reap the benefits of increased investments from this category of investors.

Is there capital gains tax on crypto in Seychelles?

The Seychelles does not impose specific capital gains taxes on cryptocurrency transactions. However, it is important to remember that tax rules and regulations are subject to change as governments worldwide are continuously adapting their tax frameworks to encompass digital assets.

Even in cases where there isn’t clear taxation on cryptocurrencies, people involved in the space should keep track of their transactions and activities. Maintaining thorough records can be beneficial if tax laws change in the future or more information is required regarding tax obligations.

The future of cryptocurrency regulation in the Seychelles

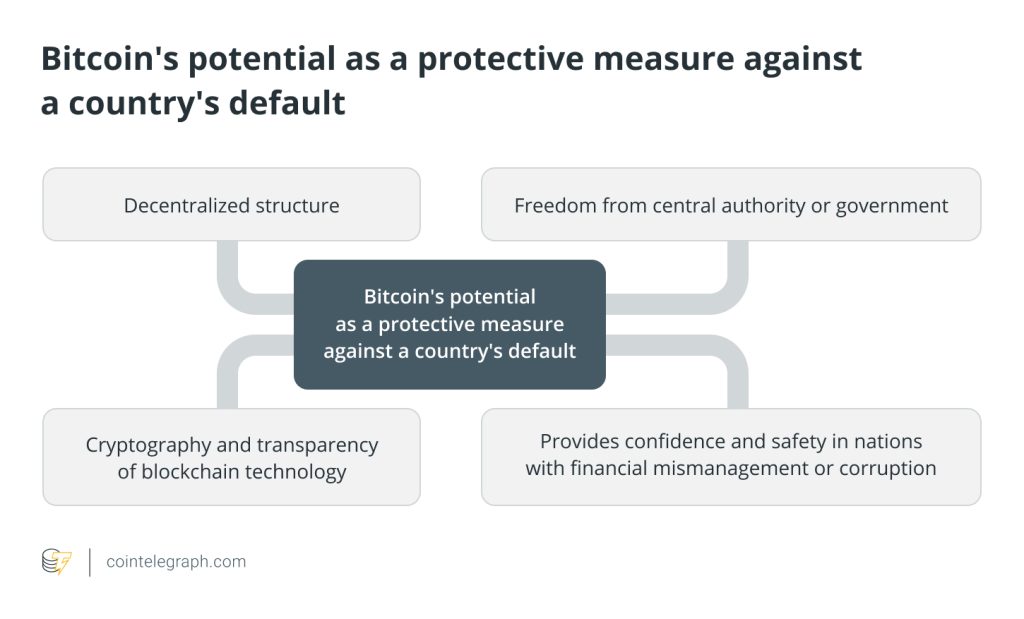

Seychelles joins a growing list of nations that are taking steps to regulate the cryptocurrency sector. While regulation may help alleviate many of the risks associated with cryptocurrencies, it also raises concerns about its impact on key cryptocurrency principles, such as decentralization.

By introducing stringent regulatory requirements, governments may inadvertently undermine those principles and blur the distinction between cryptocurrencies and traditional financial instruments. Existing licensing requirements, like those implemented by Seychelles, could centralize control and restrict the ability of the cryptocurrency sector to operate independently of traditional financial institutions.

The limitations have the potential to impede innovation within the cryptocurrency space and hinder the development of decentralized applications and systems.

While Seychelles’ current crypto statutes are a significant step forward, the journey is likely to encounter some obstacles. For example, the continuous emergence of novel digital asset classes, such as tokenized assets, is likely to pose formidable challenges for its regulatory authorities, particularly when it comes to their classification.

Moreover, when it comes to recognizing cryptocurrencies as legal tender, Seychelles, like other nations, is likely to remain cautious about taking this step due to the regulatory intricacies of preventing their utilization for illegal activities such as tax evasion and fraud.

Written by Elizabeth Gail

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] There you will find 47624 additional Information to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Here you will find 70058 additional Info on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Here you can find 95654 additional Info on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Here you will find 98231 additional Information to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Here you can find 5023 more Information on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] There you will find 70495 more Info on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Here you will find 70639 more Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Here you can find 94185 additional Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Here you can find 99023 additional Info to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] There you can find 88797 additional Info on that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1923/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/1923/ […]