Market makers vs. market takers: Key differences, explained

Understanding market makers and market takers in crypto trading

Market makers and market takers play a pivotal role in maintaining a smoothly functioning trading environment that impacts market liquidity, volatility and trading fees.

In cryptocurrency trading, there are two primary types of participants who play a crucial role in determining market dynamics: market makers and market takers. Every market participant on a cryptocurrency exchange, trading platform or marketplace falls into either of the two categories, or sometimes both.

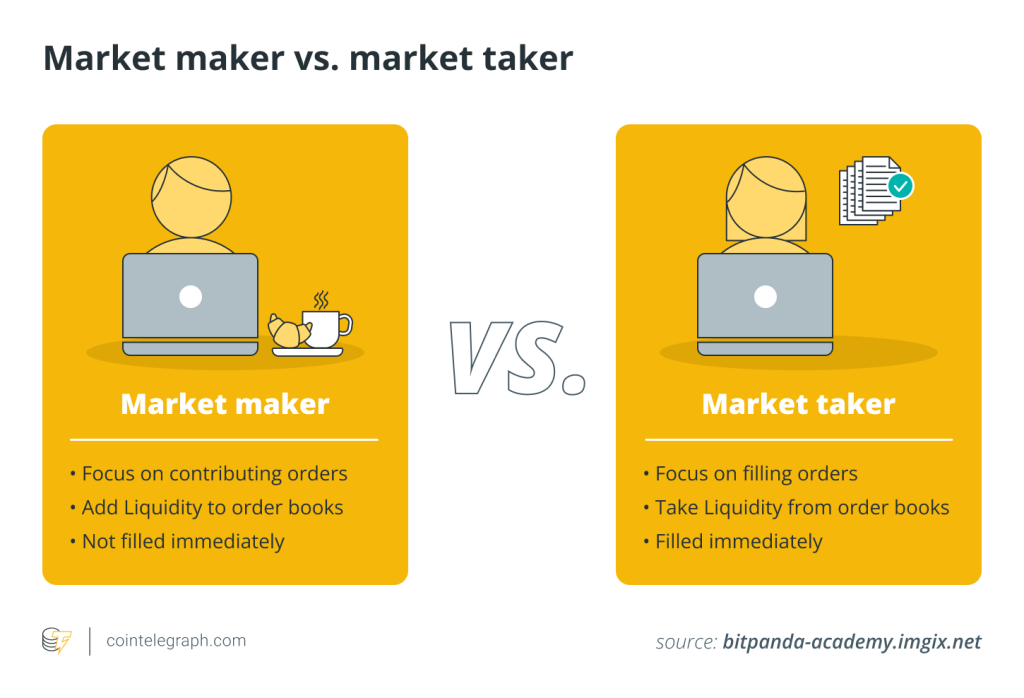

It is important to understand the distinction between the positions of market maker and market taker in terms of “liquidity” in the order book. Market makers add liquidity to the crypto order book, creating a market and making it easier for others to buy or sell when order conditions match. Market takers, on the other hand, accept the placed order and remove liquidity from the order book.

While both have different motivations, their symbiotic relationship adds to the health of the crypto market. The position a trader chooses to adopt also affects them, as there is a difference between maker fees and taker fees. Makers and takers employ a plethora of trading strategies to seek out profits and leverage those better suited to their roles.

Liquidity explained

Cryptocurrency liquidity refers to the ease with which a specific digital asset can be bought or sold in the cryptocurrency market without significantly impacting its price.

Market makers and market takers play pivotal roles in determining liquidity in crypto markets. Understanding liquidity is crucial for market makers and market takers for effective risk management, efficient trading strategies and profit maximization.

High liquidity means there are plenty of buyers and sellers actively trading the cryptocurrency, resulting in narrower bid-ask spreads and a stable market environment. In contrast, low liquidity implies fewer participants, wider spreads and a higher likelihood of significant price fluctuations when large orders are executed.

Factors influencing cryptocurrency liquidity

Trading volume: The more trading activity a cryptocurrency has, the higher its liquidity. A cryptocurrency with a high trading volume is typically considered more liquid.

Number of exchanges: Liquidity can vary from one cryptocurrency exchange to another. Major exchanges with many users tend to have higher liquidity for popular cryptocurrencies.

Market depth: Market depth represents the order book’s size, indicating the volume of buy and sell orders at various price levels. Deeper order books generally mean higher liquidity.

Asset popularity: Popular cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) tend to be more liquid due to their widespread adoption and use.

The distinction between market makers and market takers

Market makers play the role of liquidity providers for a cryptocurrency exchange, while market takers play the role of executors and take advantage of the liquidity provided by the makers.

Crypto exchanges typically record trades using an order book. An order book serves as a real-time, dynamic ledger that displays all the buy (bids) and sell (asks) orders for a particular asset, such as a cryptocurrency, at various price levels. Both market makers and takers have a distinct role here.

Market makers

Market makers place buy and sell orders at a specified price. They provide a two-sided market. For example, assuming the current price of ETH is $2,100, a market maker is looking to buy when the price drops and may place a buy order for 5 ETH at $2,000 per ETH. For this, they may place a limit order.

A limit order is an instruction to buy or sell a specific amount of a cryptocurrency at a predefined price or a better price. Limit orders allow traders to specify the exact price at which they want to trade. This is added to the order book, and it will be filled when the ETH price is at $2,000.

Thus, the market maker in the above example has announced intentions beforehand by adding to the order book and has “made” the market. They have essentially provided liquidity to markets. Market makers also place sell orders on the ask side. For example, another market maker may place a sell order for 3 ETH at $2,100 per ETH.

Market takers

A market taker verifies the order and executes the buying or selling at the specified price. Takers engage in the two-sided market spread created by market makers. For example, a market taker wants to buy ETH immediately at the current market price. For this, they submit a market order, which matches the orders in the order book.

A market order is an instruction to buy or sell a specific amount of a cryptocurrency at the current market price. Market orders are used by traders who prioritize immediate execution over the price at which the trade is executed.

The market taker’s buy order for 3 ETH at $2,100 per ETH matches the market maker’s sell order for 3 ETH at $2,100 per ETH. The market taker’s order is executed, and they buy 3 ETH at $2,100 per ETH. The taker takes advantage of the liquidity provided by market makers and removes a part of the liquidity from the market.

Makers and takers fees

Market maker and market taker fees are levied by the crypto exchange or trading platform and affect the costs and incentives for participants in the market. Cryptocurrency exchanges typically charge a fee for executing orders, which are split between market makers and traders. The fee amount differs from one exchange to another and usually also varies depending on the trading volume and role.

While each platform has its own policies and fee structure, all exchanges are incentivized to attract traders to their platforms. This is why market makers usually enjoy reduced fees from exchanges owing to their pivotal role in supplying liquidity. On the contrary, market takers encounter escalated fees due to their actions impacting liquidity.

It is important to note that fee structures can vary significantly from one cryptocurrency exchange to another. Some exchanges may offer tiered fee structures based on trading volume, providing reduced fees for high-volume traders, whether they are market makers or takers. Additionally, certain exchanges may have unique fee models or fee discounts for specific trading pairs.

Risks and challenges for market makers and takers

Market makers deal with significant risks due to market volatility and unforeseen price increases, while takers face execution pressure. For market makers, maintaining an orderly market involves the risk of being exposed to sudden price fluctuations and market volatility.

Fluctuations can result in unexpected losses, especially if market conditions change rapidly. Furthermore, market makers might face challenges in managing inventory, as holding significant amounts of assets while providing liquidity might make them vulnerable to sudden price shifts, impacting their profitability.

On the other hand, market takers face risks associated with immediate execution and liquidity removal. Their trades can influence short-term price movements, potentially causing slippage or executing orders at less favorable prices than expected, particularly in markets with low liquidity.

Market takers also face higher costs due to fees associated with immediate order execution, which can eat into their profits, especially when executing large orders in less liquid markets.

Both market makers and takers need to assess and manage these risks carefully to ensure efficient trading, maintain profitability, and navigate the complexities of the dynamic cryptocurrency market. Adjusting strategies, implementing risk management protocols and staying informed about market conditions are vital for minimizing these inherent challenges.

Written by Shailey Singh

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Here you can find 62279 additional Information on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] There you will find 18927 more Info on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Here you will find 56631 more Info to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Here you will find 92543 additional Information to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] There you will find 86938 additional Info on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1913/ […]

… [Trackback]

[…] Here you can find 92431 additional Information on that Topic: x.superex.com/academys/beginner/1913/ […]