Bitcoin price rallies past $47K as spot BTC ETF deadline approaches

Bitcoin price hits a new multiyear high above $47,000 as market participants show their excitement over institutional investors’ deepening involvement with BTC.

Bitcoin price has broken through $47,000 for the first time since April 2022 as the deadline for the United States Securities and Exchange Commission’s approval of spot Bitcoin ETFs draws near.

Bitcoin (BTC) climbed rapidly from a price of $44,000 on Jan. 8, surging more than 6.5% in the last 24 hours and 177% over the last 12 months, to hit a year-to-date high at $47,284, according to data from CoinMarketCap.

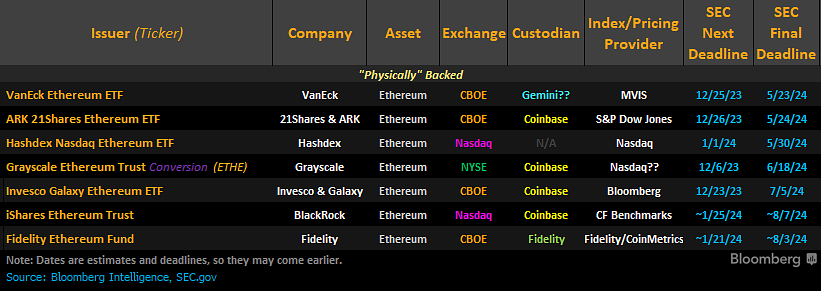

Bitcoin’s price performance comes as the market readies for the SEC’s potential approval of one or several of the 14 outstanding applications for a spot Bitcoin ETF product, with Bloomberg analysts predicting a decision as early as Jan. 10.

People asking me if we changed odds. No, we still holding line at 90% odds of approval by Jan 10 (aka this cycle), the same odds we’ve had for months (before it was cool/safe). What we watching for now: more amended/final filings to roll in and clarity on in-kind vs cash creates https://t.co/uiWgfxOfzz

— Eric Balchunas (@EricBalchunas) November 29, 2023

The last time Bitcoin traded above $47,000 was nearly 20 months ago, on April 3, 2022, when it reached a high of $47,458 before descending into an enduring bear market that saw it fall as low as $15,600.

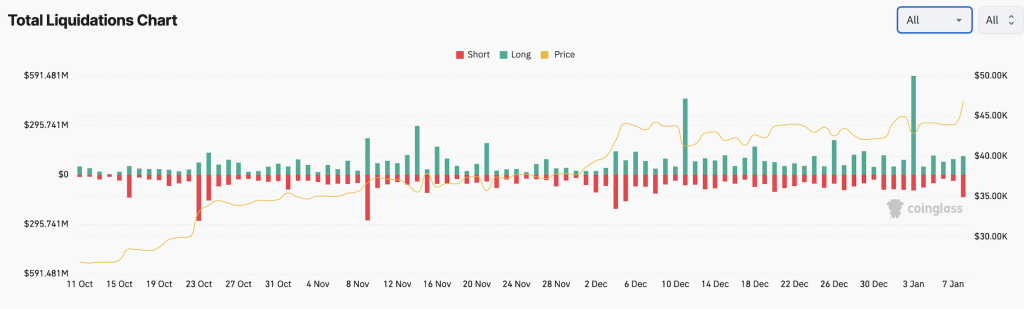

Trader and analyst Jin flagged BTC flipping the “21 EMA” into support, adding that the flagship cryptocurrency was headed to $48,000, while popular X user Byzantine General noted that “a lot of shorts just got liquidated” by the rapid price move to $47,000.

48k comming https://t.co/qf1YSWLwDq

— Jin (@trader1jin) January 8, 2024

Related: 100 days to the halving — 5 things to know in Bitcoin this week

Data from Coinglass shows short-position liquidations for Bitcoin topping $76 million on the day, with the tally still increasing at the time of writing. Cross-crypto short liquidations amounted to more than $112 million.

Many market participants expect the fresh round of bullish price action to continue amid any news surrounding a spot Bitcoin ETF approval. This point was demonstrated by BTC’s price action response to the top BTC ETF contenders entering into a fee war, as illustrated by the latest S-1 amendments, in a bid to lure clients once the approval comes.

$BTC Touched $47000

Super Hype All Around Regarding #BitcoinCNBC Talking About ETF Approval & News Coming That Billions Of Dollars Ready To Be Invested In $BTC After Approval ⚠️

Don’t You Guys Think Whales Gonna Dump On Retailers Soon ? #CryptoNews #CryptoInsights pic.twitter.com/rXC2in0ZXJ

— Karan Singh Arora (@thisisksa) January 8, 2024

Meanwhile, the SEC reissued a warning about FOMO (fear of missing out) crypto investing just days ahead of the anticipated approval of spot Bitcoin ETF. However, the products are ultimately expected to attract trillions of dollars worth of inflows over the next few years.

… [Trackback]

[…] Here you will find 75140 additional Information on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Here you can find 46075 additional Information on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Here you can find 24258 more Info to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Here you can find 84458 additional Information to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] There you can find 20584 more Information on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Here you can find 33528 more Information on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/1806/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1806/ […]