SuperEx Educational Series: The Cross-Chain Bridge - The Most Dangerous, Yet Most Indispensable Crypto Infrastructure

#CrossChainBridge #SuperEx

In the crypto community, there’s a consensus: cross-chain bridges are both the most dangerous and the most indispensable infrastructure in the crypto world.

They are dangerous because most major on-chain exploits have targeted bridges. They are indispensable because bridges are the very interaction hubs of the crypto world.

Before cross-chain bridges existed, it was widely accepted that assets existed only on their native chain. For example:

- BTC on Bitcoin

- ETH on Ethereum

- Applications, liquidity, and users were tightly bound to their respective ecosystems.

But as the multi-chain era truly began — with Layer 2s, sidechains, appchains, and modular chains developing in parallel — users faced a new reality: assets are on one chain, but the application is on another.

Thus, cross-chain bridges were born. They are both the “transportation systems” of the multi-chain world and — so far — one of its most attacked and most devastatingly vulnerable infrastructures.

To understand cross-chain bridges is to grapple with one fundamental question:Can blockchains really trust one another?

What Is a Cross-Chain Bridge Really Solving?

From the user’s perspective, a cross-chain bridge looks simple: move assets from Chain A to Chain B, and a few minutes later, see the equivalent on another chain.

But from a systems perspective, this is highly counterintuitive.

Because at the heart of blockchain is one foundational principle: each chain only trusts itself.

- Ethereum won’t actively verify Solana

- Bitcoin doesn’t read the state of Arbitrum

- Blockchains don’t natively talk to one another

So cross-chain bridges don’t literally “move” assets, but instead simulate this movement through alternative mechanisms.

Most cross-chain bridges are essentially doing three things:

- Locking or burning assets on the source chain

- Minting a representative asset of equal value on the destination chain

- Maintaining a system that upholds state consistency

Which leads to a fundamental fact: a cross-chain bridge can never be as secure as the native security of a single chain.

The Three Main Design Patterns of Cross-Chain Bridges

Despite the vast range of implementations, most bridges today fall into three broad categories:

1. Lock & Mint

This is the earliest and most common bridge model. The process is straightforward:

- Users lock assets on Chain A

- The bridge mints an equivalent wrapped asset on Chain B

- The reverse process happens on withdrawal

Examples:

- WBTC (BTC → Ethereum)

- Most early EVM-based bridges

Pros:

- Simple to implement

- Clear liquidity management

- Clear asset mapping

Fatal flaw:

- All risk is concentrated in the locking contract

- Once breached, the assets are almost always irrecoverable

Most of the largest bridge hacks in history occurred under this model.

2. Liquidity Network

To avoid lock-up risk, some projects take a different route: instead of minting new assets, they use existing liquidity to swap across chains.

For example, a user deposits funds on Chain A, and the bridge pays out from its liquidity pool on Chain B — akin to a cross-chain market-making system.

Pros:

- No massive asset lock-up

- Faster cross-chain speeds

- User experience resembles a swap

Cons:

- Highly dependent on liquidity depth

- Slippage and pricing risk

- High cost for large transfers

This model is more market-driven, but also more prone to volatility and liquidity fragmentation.

3. Message Passing / Light Clients

This is the most technically ideal — but also most complex — cross-chain design.

The core idea: allow one chain to directly verify the state of another chain using light clients or cryptographic proofs. For example:

- Chain B verifies blocks or states from Chain A

- No need for centralized relayers

- Security is theoretically on par with native chains

Examples:

- IBC (Cosmos)

- Some ZK-based bridges

- Next-gen modular cross-chain solutions

Challenges:

- Extremely complex to implement

- High cost

- High demands on underlying chains

This model is not yet ready for mass adoption, but remains the long-term ideal.

Why Are Cross-Chain Bridges Always Getting Hacked?

Look back at the largest security breaches in crypto, and you’ll find one harsh truth: the biggest exploits almost always involve bridges.

Here’s why:

1. Artificially Expanded Trust Boundaries

A bridge builds trust between systems that do not natively trust each other. This introduces:

- More assumptions

- More permissions

- More attack surfaces

Any weak link can cause a systemic failure.

2. Centralized Permissions, Massive Payouts

Compared to a single DeFi protocol, a bridge is the gateway to full-chain assets.One breach can yield hundreds of millions.High risk × high reward = perfect target for attackers.

3. Off-Chain Components Are Inevitable

Even in decentralized designs, there are still:

- Observers

- Relayers

- Signing nodes

These off-chain parts are inherently weaker in terms of security guarantees.

Deep Dive: Six Major Types of Bridge Attacks

Each of the following attack types has been exploited repeatedly, causing hundreds of millions in losses.

1. Multisig Key Theft / Threshold Signature Breach

How it works:Many bridges use multisig to confirm messages like:“Lock 100 ETH → Mint 100 wrapped ETH.”If a hacker gains enough private keys, they can:

- Forge a lock message

- Mint unauthorized assets

- Withdraw funds freely

Case: Ronin Bridge ($600M)

The attacker controlled 5 of 9 validator keys managed by Sky Mavis and forged withdrawals — the largest attack in crypto history.

Key risks:

- Centralized control

- Poor key storage

- Lack of permission separation

Solutions:

- Decentralized validation (PoS, light clients)

- MPC key management

- Decentralized multisig

- Daily withdrawal caps

2. Smart Contract Verification Bugs

How it works:Some bridges verify “proofs” of events from other chains.

If the verification logic is flawed, attackers can forge those proofs.

Case: Wormhole hack ($320M)

The contract failed to check signature integrity.Attackers submitted a fake proof and minted 120k ETH on Solana.

Weak points:

- Incomplete verification

- No secondary signature checks

- Lack of timestamps or chain IDs in messages

Solutions:

- zk-SNARKs

- Multi-layer proof verification

- Dual confirmation

- Replay protection

3. Reentrancy Exploits

Occurs when external calls happen before internal state updates, allowing repeated withdrawals.

Solutions:

- Use OpenZeppelin’s ReentrancyGuard

- Adjust execution order: state update → fund transfer

- Mark executed messages

4. Oracle Manipulation

Bridges relying on price oracles for minting/burn can be exploited if price feeds are manipulated.

Solutions:

- Use TWAP

- Aggregate multiple oracles

- Avoid minting based on a single feed

5. Hash Replay Attacks

Even if a proof is valid, reusing it on another chain can cause duplicate minting.

Solutions:

- Use nonce

- Embed chain ID

- Ensure message uniqueness

6. Forged Cross-Chain Messages

If relayers are compromised, they can submit fake “locked” messages to the destination chain.

Solutions:

- Multi-relayer consensus

- zk-based light clients

- Trustless relaying mechanisms

Cross-Chain Security Guidelines for Regular Users

Bridges will get safer in the future — but not today.

Until then, your best protection is not technical knowledge, but knowing how to avoid common traps.

Rule 1: Never Bridge Large Amounts

Bridges are not banks — they are top hacker targets.

Never bridge more than you can afford to lose.

Rule 2: Avoid New, Small, or Unaudited Bridges

Especially when:

- Bridging between obscure chains

- The project just launched

- TVL < $50M

- No audits

- No reputable team

Any of these is a red flag.

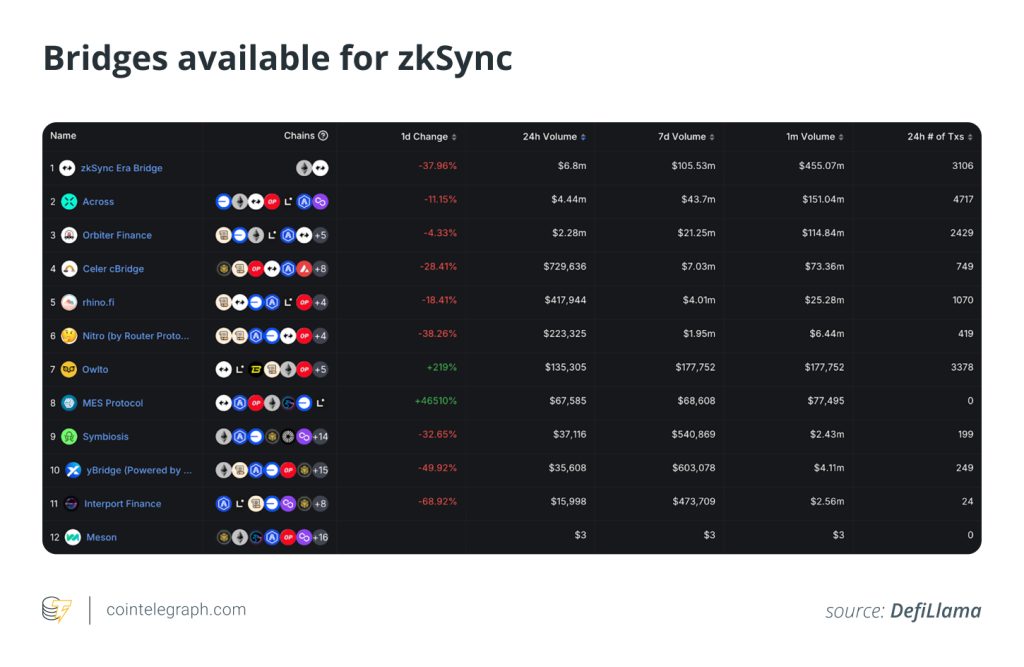

Rule 3: Choose Battle-Tested Bridges with Reputation

Some of the safest options today include:

- LayerZero

- Wormhole 2.0

- Cosmos IBC

- Axelar

- Chainlink CCIP

Not risk-free, but far safer than the average bridge.

Rule 4: Use Official Bridges Whenever Possible

For example:

- Arbitrum Bridge

- Optimism Bridge

- zkSync Bridge

- Polygon PoS Bridge

These are often natively integrated and more secure.

Rule 5: Move Assets to Cold Wallet or L1 ASAP

Don’t leave funds idle on the bridge.

Rule 6: Never Interact with Tokens You Didn’t Request

Scammers airdrop tokens and lure you into connecting to fake bridges.

Bridging = Contract interaction = High risk.

Rule 7: Monitor Bridge TVL and Message Latency

If you see:

- Sudden TVL drops

- Unusual delays

- Withdrawals stuck across chains

Stop everything immediately — these are signs a bridge is about to fail.

Final Thoughts: Bridges Aren’t Infrastructure — They’re a Work of Compromise

In a perfect world:

- All chains would talk natively

- Security would be inherited

- No trust trade-offs required

But the multi-chain world is itself a compromise on the single-chain security model.And bridges are the very embodiment of that compromise.

They unlock liquidity, expand composability, and break ecosystem silos.But they also constantly remind us: every bridge transaction is a trade-off in trust.

To understand bridges is not to blindly trust them — but to understand exactly who you’re trusting.

Responses