xUSD Depeg Explained: What Happened and What It Means for the USDe Family

#xUSD #USDe

The xUSD depeg is likely something you’ve already heard about — there’s been a flood of news over the past few days, causing a sizable stir. Markets increasingly view Stream xUSD as a “tokenized hedge fund” disguised as a DeFi stablecoin. The team behind it, Stream Finance, announced that an external manager caused approximately $93 million in losses and subsequently suspended deposits and withdrawals.

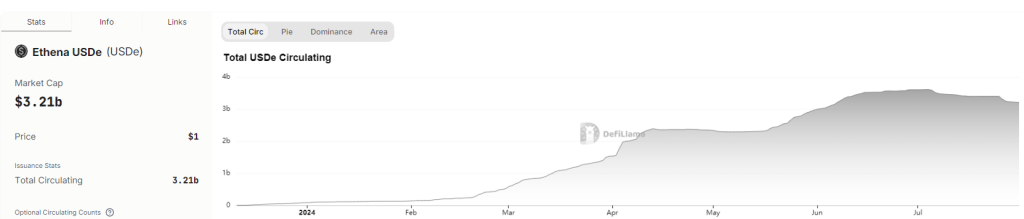

Looking back to October 11, the world’s third-largest stablecoin, USDe (a “yield-bearing stablecoin” issued by Ethena Labs), suffered a severe de-peg, with its price plunging to around $0.65, briefly losing the peg functionality expected of any stablecoin. Less than a month later, memories were still fresh. Taken together, these events have impacted similar “delta-neutral” stablecoin architectures — especially those used by issuers/designers like USDX and USDe.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

xUSD Depeg: Timeline and Key Symptoms

1) Depeg behavior

xUSD was designed to maintain a $1 peg, but after disclosures, the price rapidly fell from roughly $1 to ~$0.18, a drop of more than 80%. At the same time, lending pools that accepted xUSD (or its derivative sUSDX) as collateral were drained: assets such as USDT, USDC, USD1 were borrowed out en masse.

2) Project response

Stream Finance stated that a third-party external fund manager incurred major losses while handling assets. The project retained a law firm to investigate and paused all in- and outflows. Although it said it would “proactively liquidate remaining liquid assets,” it did not initially provide sufficient transparency or a full breakdown of losses.

3) Preliminary causes

On-chain data and third-party research indicated:

- A sharp mismatch between the stated TVL and traceable on-chain assets;

- A recursive leverage / rehypothecation strategy — collateralizing, borrowing, and re-collateralizing in loops to amplify risk;

- In extreme conditions, ADL/auto-deleveraging and liquidation triggers kicked in, collateral values plunged, and the structure buckled;

- With very low transparency, team/affiliated addresses were suspected of moving funds out to exchanges ahead of the crowd.

Mechanism Under the Microscope: Why Did xUSD “Lose the Peg”?

1) Misconceptions about delta-neutral strategies

“Delta neutral” means, in theory, that the long collateral and short hedge offset, reducing directional risk. In practice, Stream packaged this as a stablecoin business but ran it on multi-layered leverage and off-chain strategies. When volatility spikes, liquidity dries up, and an external manager loses money, the very strategy becomes a liability.

2) Recursive leverage & rehypothecation risks

Rehypothecation refers to re-using pledged assets repeatedly across borrowing loops. If collateral value drops or liquidations lag, the entire structure can fracture. As ChainCatcher highlighted, xUSD’s collateral and borrowing scale reached multiple turns of leverage. In addition, certain key addresses were tracked borrowing large amounts of stables in a short window and sending them to CEXs, worsening the liquidity and confidence shock.

3) Lack of transparency around third-party/off-chain asset management

Stream claimed about $500M TVL, while on-chain verifiable assets were closer to $150M. Many key transactions occurred off-chain, with external managers and assets that were hard to verify — sharply eroding trust.

4) Liquidation mechanics failed, confidence collapsed

When some lending pools couldn’t be repaid, collateral slumped, borrow rates spiked (some pools > 800%), and loans were drained, conventional liquidation processes broke down. Under this multi-layer negative feedback loop, the xUSD ecosystem rapidly entered a full-blown confidence spiral.

Implications for the USDe Family and Similar Models

1) Structural similarities & systemic risk

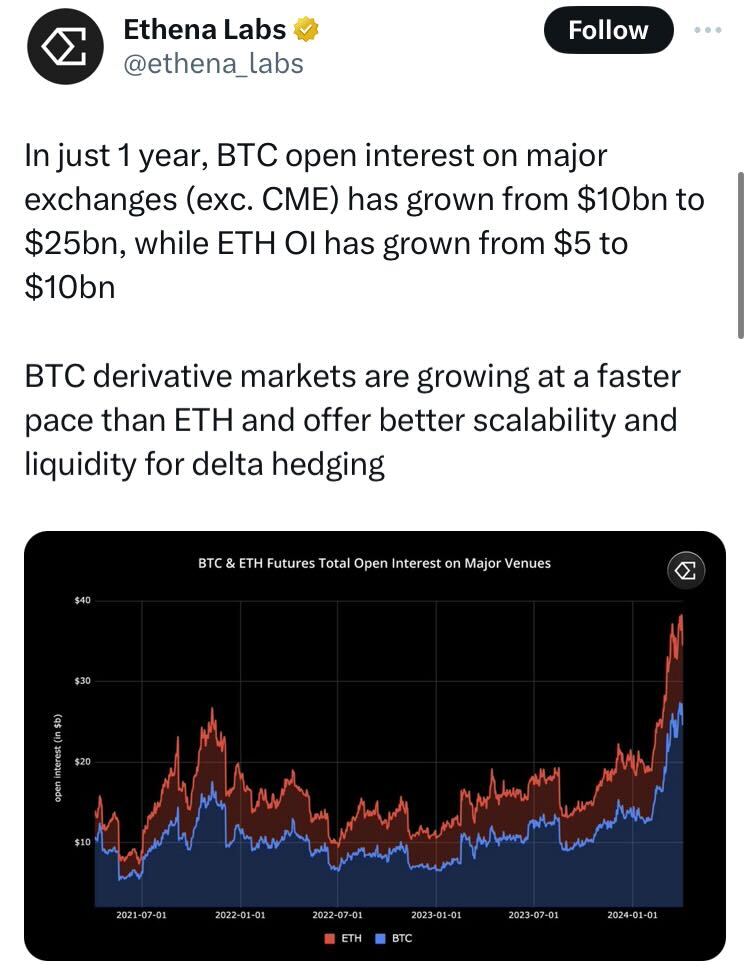

The xUSD depeg exposes a deeper issue — are these “innovative” stablecoin structures just another flavor of leverage loops? xUSD and USDe share a key trait: rather than being backed 1:1 by fiat reserves or fully transparent on-chain collateral, they rely on delta-neutral hedging (e.g., shorting in derivatives markets) to counter price volatility and manufacture “risk-free yield.”

The theory works only if:

- Derivatives markets have ample liquidity, including in stress;

- Liquidation/collateral/treasury ops are fully transparent and responsive.

xUSD’s failure hinged on inability to rebalance hedges quickly amid turbulence. The “delta-neutral” stack turned into delta amplification — risk wasn’t neutralized; it accumulated. This is not an isolated incident; it’s a systemic warning for structured stablecoins. When stability depends on financial engineering rather than verifiable assets, the balance between stability and trust is fragile.

2) Credibility & transparency, revisited

xUSD’s collapse directly damaged trust in similar designs, and the USDe family now sits squarely under the spotlight. If USDe continues to lean on off-chain management, leverage, and collateral loops, it must answer two questions:

First, can assets be fully verified on-chain?

If funds reside with centralized custodians or hedges are executed off-chain, outside users cannot verify positions. Without on-chain proofs, transparency falls and trust can’t compound.

Second, are liquidation mechanics robust?

In stress, can the system rapidly close hedges? Are there moments of hedging delay or liquidity vacuums? xUSD faced both — those were the fuses.

Notably, while USDe emphasizes “decentralized hedging and on-chain verification,” current hedges still depend on centralized derivatives venues. If an exchange fails, APIs break, or liquidations lag, the mechanism can still be dragged down. In other words, the innovation hasn’t eliminated trust intermediaries; it has renamed them.

3) Lending-protocol exposure test

Another knock-on effect is a sector-wide re-rating of DeFi lending risk. In this episode, many lenders (especially those taking sUSDX/xUSD collateral) lacked real-time liquidation and absorbed losses. When a “stablecoin” de-pegs, collateral value collapses, triggering cascading liquidations that can wipe out a protocol.

As USDe expands across money markets, it must square with this. In ecosystems like EigenLayer, Pendle, etc., structured stables are often packaged into yield-enhanced wrappers (“hold a stable and earn extra”). That draws funds in bull phases, but when the market turns, negative feedback loops get magnified.

Put simply, “stable” here isn’t no-risk; it’s risk deferred and concentrated.

Hence, USDe and peers must adopt stricter risk and collateral controls, e.g.:

- Dynamic collateral ratios;

- Real-time monitoring of hedges and leverage;

- Periodic on-/off-chain attestation of assets/positions;

- Callable liquidation APIs and risk alerts for integrated lending markets.

These will be make-or-break for survival under tighter oversight and skeptical markets.

4) Regulatory evolution & industry logic

xUSD’s collapse brings regulators back to the definition question. Traditional stables (USDT/USDC) are fiat-reserve-backed, auditable under regulatory frameworks. Structured stables rely on derivatives hedging, so stability is contingent on execution and market conditions — harder to classify: stablecoin, structured note, or covert fund? (Recall Columbia Business School’s Austin Campbell argued in 2023 that Ethena’s USDe is not a stablecoin but shares in Ethena’s structured product.)

Meanwhile, recent statements in the U.S. and Hong Kong suggest intensified scrutiny of “non-traditional stablecoins,” focusing on:

- Transparency/verifiability of backing;

- Sustainability of hedging;

- Risks from leverage amplification and cross-collateralization;

- Misleading users into treating high-risk notes as “stablecoins.”

This means USDe-like models must self-align with compliance early. Persisting with semi-black-box approaches risks delistings and trust flight as rules harden.

From an industry-logic lens, xUSD is not a one-off failure but a stress test for the entire structured-stable segment — forcing a redefinition of “stable”: not unchanging yield, but controllable, transparent, predictable risk.

Three Lessons & the Road Ahead

Lesson 1: Transparency is the real “collateral.”

No matter how intricate the strategy — labeled “neutral,” “capital-efficient,” etc. — if collateral, processes, and liquidations lack transparency, risk is amplified. xUSD’s issue wasn’t a single loss; it was non-verifiability at the model’s core.

Lesson 2: Off-chain ops = a naked trust test.

DeFi promised trustlessness, but when key asset management moves off-chain or to third parties, that promise weakens. The right questions aren’t “how many layers?” but “who operates?” and “is it auditable?”

Lesson 3: Structured products must respect liquidity cycles.

Even if a model claims “risk hedged,” when volatility spikes, liquidation thresholds trip, and lending pools are drained, the very strategy can become an accelerant. In stress, xUSD triggered looped liquidations and liquidity vacuum, accelerating the crash.

The path forward

- Issuers should prioritize on-chain proof-of-reserves, periodic audits, diversified collateral, and public leverage policies.

- Lending protocols must vet novel collateral carefully and avoid high exposure to complex, leveraged assets.

- Regulators may draft structured-stablecoin guidelines mandating disclosure of collateral pools, lending chains, and recovery processes.

Conclusion

The xUSD depeg isn’t just one project’s failure; it’s a wake-up call for today’s DeFi stablecoin architectures. When structures get complex, collateral opaque, and leverage layered, the deeper the risk is hidden, the harder the collapse.

For the USDe family and similar designs, this is both an ordeal and an opportunity. Issuers must trade transparency, auditability, and compliance for user trust; protocols must trade mechanism design for system stability. And we should remember: a stablecoin is first and foremost a promise of stability. Once the promise breaks, the timeline no longer matters.

Responses