Why Are Privacy Coins Surging? Why ZEC and DASH Stood Out Against the Trend

#PrivacyCoins #ZEC #DASH

Introduction

The crypto market has been notably sluggish lately: BTC briefly dipped below $100,000, and ETH has fallen for nearly a month, breaking $3,400. Against this broad market weakness, the privacy-coin segment stood out as a clear outlier. Led by Zcash (ZEC) and Dash (DASH), privacy coins have rallied sharply: ZEC’s 7-day gains have been relatively moderate yet steady, while DASH was dramatic — over seven days it ran from $41 to nearly $140 at the Nov 4 intraday high (roughly 3×), barely flinching even during the Nov 3 sell-off.

Behind the spike isn’t just a burst of short-term sentiment; it also hides multi-factor drivers: technical iteration, regulatory shifts, market-structure changes, and ecosystem traction. Starting from the question of “why the sudden rise,” this article examines the drivers behind the latest privacy-coin rally, whether it can persist, and what it means for the broader crypto-asset ecosystem.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Starting with DASH’s Counter-Trend Strength

DASH’s recent performance has stolen the spotlight: while majors wobbled, DASH delivered a “3× in 7 days” move. Even DASH’s official channels summarized five core pillars behind the move: consumer payment expansion (DashSpend), bill-pay progress, privacy upgrades, DEX integrations, and smart-contract evolution.

Let’s unpack these five pillars:

1) Consumer Payment Expansion — DashSpend

DASH positions itself as “privacy + payments,” not just an anonymity coin. DashSpend has rolled out with multiple merchants, letting holders spend Dash directly in everyday scenarios. Marketing materials note the feature’s revival and frame it as key to shifting crypto beyond “pure speculation.”

This repositioning — from “exchange coin” to “spendable currency” — is one leg of the bull case: when users can actually use a token, the value narrative extends beyond “number go up” into daily utility.

2) Bill-Pay Beachhead — Project Three Billion

More compellingly, DASH cites a long-term target: enabling 3 billion people to pay at least part of their bills with Dash. Bill pay is viewed as the next breakthrough scenario for crypto, especially across developing regions with thin banking coverage. DASH is working with BillPay-type services to push bill and everyday expense payments via crypto.

This strategy reframes privacy coins from “anonymous transfers” into “privacy + daily payments,” drawing renewed market attention.

3) Privacy Upgrades

On the technical side, DASH is advancing its privacy stack, including a proposal for Confidential Transactions (CT), which hides transaction amounts and strengthens anonymity. Compared with older designs that only hide addresses or paths, this marks a new stage in capability.

With privacy and compliance back in focus, projects investing here may capture the upside from renewed privacy demand.

4) DEX Integrations & Smart-Contract Push

DASH is integrating with decentralized exchanges — for example, inclusion in cross-chain AMM Maya Protocol. Meanwhile, it has announced the “Dash Evolution” smart-contract rollout for 2026, signaling a step from “privacy payment coin” toward a “privacy smart chain.”

This blend of future potential + current scaffolding has supported a value re-rating in the market.

5) The Real Potential of Smart-Contract Evolution — Dash Evolution

If payments, privacy, and bill pay bring DASH back to crypto’s original vision, then Dash Evolution marks the step into “next-gen Web3 platform.”

Historically known for fast payments and a masternode network — but lacking Ethereum-style programmability — DASH aims to fix that. Dash Evolution introduces a new application-layer protocol so developers can build DApps, DAOs, and private payment systems on Dash. The core is Dash Platform, combining decentralized storage (Drive) and an identity layer (DPNS, Dash Platform Name Service), enabling on-chain identity registration and data interactions while preserving privacy.

In short, Dash Evolution brings smart-contract capability and a balance between privacy protection and compliant identity. That opens room for private DeFi, anonymous NFT trading, and enterprise bill-pay, evolving DASH from “privacy payment coin” to “privacy smart chain.” This trajectory is a deep reason the market has repriced DASH.

Why Did Privacy Coins Rally as a Group?

Zooming out from DASH, the privacy-coin rally is not isolated — it’s a structural recovery driven by regulation, flows, tech, and psychology. Privacy is being re-priced from “an ideal” to “part of market consensus.”

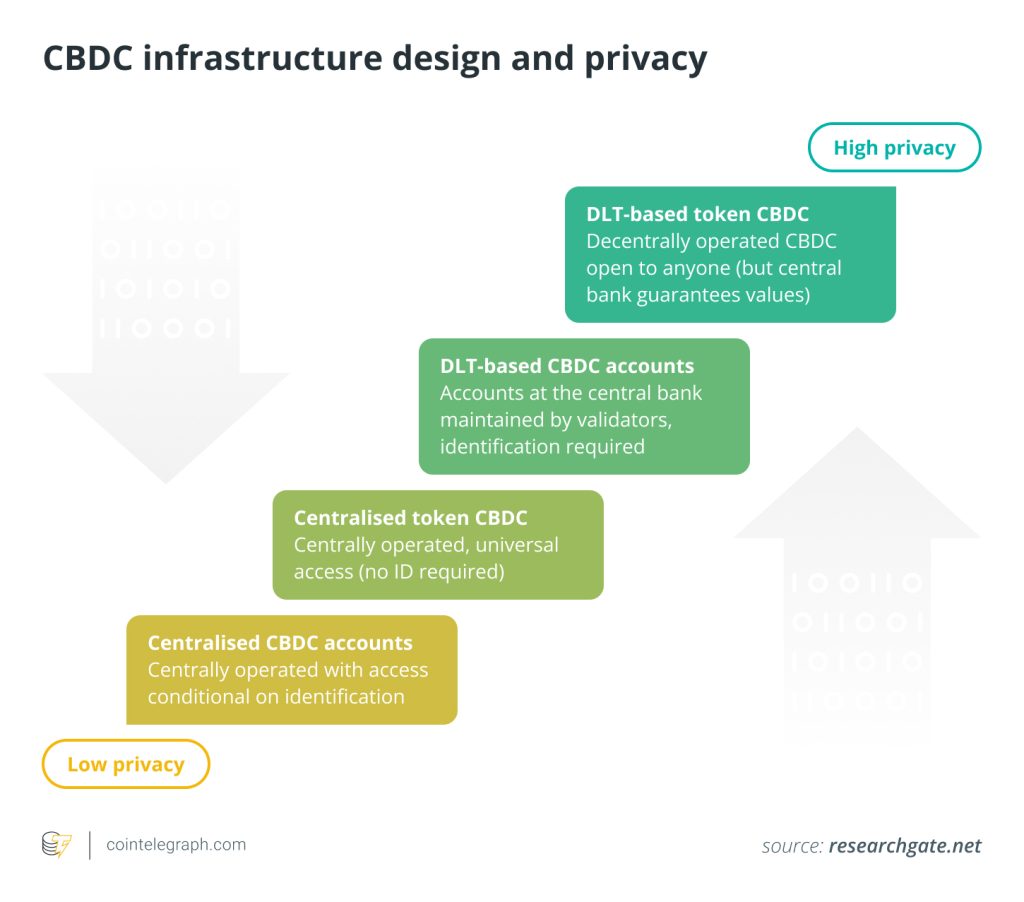

1) Regulatory Pressure is Forcing Privacy Demand

Global crypto regulation has intensified over the past two years: MiCA in the EU, the U.S. Travel Rule, real-name rules in China and Hong Kong, etc. The result: more transparency, less room for anonymity.

On the surface this adds safety and compliance, but for individuals and institutions it also creates new risks. Corporate treasury moves, institutional repositioning, and personal wallet activity can be tracked in real time by analytics firms (Chainalysis, Nansen, Arkham Intelligence). In other words, financial privacy risks becoming public information.

Naturally, the market looks for hedges. Privacy assets (Monero, Zcash, Dash) become a safe harbor under high regulatory scrutiny.

- CoinDesk analysis notes that tighter regimes often spur short-term flight-to-privacy flows.

- Decrypt adds the trend isn’t only retail; funds and market makers also allocate to privacy assets to diversify traceability risk.

When “transparency” turns into a burden, privacy gets re-valued.

2) Liquidity & New Capital Flows

On-chain data corroborate it: active addresses and volumes in privacy coins have risen noticeably over the past three months. ZEC, XMR, DASH show 30%–50% YoY gains in on-chain activity, with pairs on mid-tier exchanges (Gate, MEXC, Bitrue) seeing volume spikes.

It’s not just “heat,” it’s real capital reallocation. According to Binance Research, privacy-segment market cap broke $25B in Oct 2025, emerging as a hotspot after AI and RWA. Meanwhile, majors (BTC/ETH) chopped sideways.

Behaviorally, when core assets stall with ample liquidity but no new story, capital hunts fresh narratives. Privacy coins check three boxes: undervalued, higher certainty, policy hedge.

Hence many institutional notes now argue: “Privacy assets are being re-rated with both safe-haven and growth premia.”

3) Halving Expectations & Supply-Side Shifts

Supply also matters. Zcash (ZEC) is expected to enter a new halving around late-2025, cutting block rewards from 3.125 to 1.5625 ZEC. Anticipated supply contraction prompts early positioning.

Historically, Bitcoin halvings often lift “mineable/PoW — privacy — store-of-value” cohorts together. Given privacy coins carry both scarcity and functional value (privacy), their price elasticity can be stronger.

Among miners, many privacy coins remain PoW (Monero, Zcash), giving hashrate participants incentives to pre-secure resources, adding to tight supply dynamics.

4) Tech Iteration & Real-World Traction

If privacy coins were mostly “anonymous pay” pre-2021, by 2025 they’re evolving into privacy-computing infrastructure:

- Zcash’s Zashi wallet supports shielded transactions, private cross-chain transfers, and mobile zero-knowledge verification.

- Dash is advancing Dash Evolution / Dash Platform, fusing privacy payments with smart contracts.

- Monero is developing the Seraphis protocol to improve privacy efficiency and scalability.

Privacy tech is landing — from base protocols into user experience. With DeFi, GameFi, and RWA needing privacy, privacy tech is being modularized into broader Web3 stacks.

For example, zk-privacy frameworks like Aztec Network, Railgun, Noir support private lending, NFT transfers, and privacy DEX trading. This cross-ecosystem maturity highlights the malleability of privacy coins. Data show ZEC’s shielded pool exceeds 4.9M ZEC (≈30% of supply), suggesting actual usage — not just talk.

5) From Concept to Consensus: Privacy = Freedom

Ultimately, the rally reflects a reframing of freedom. Privacy is no longer read as “concealment,” but as the infrastructure of choice.

The recovery also hints at a shift from regulatory panic to coexistence. As Zcash founder Zooko Wilcox says: “Privacy isn’t anti-regulation; it makes regulation more precise.”

Going forward, privacy ecosystems may bifurcate:

- Fully anonymous, anti-censorship networks (e.g., Monero);

- Verifiable privacy chains (e.g., Zcash, Railgun, Aztec).

The former defends the frontier of freedom; the latter explores compliance–privacy balance. Both answer the question: “In a world of ubiquitous data, do we still have the right not to be seen?” That’s why privacy is being re-valued and the segment is rallying.

Can This Rally Last? Key Variables & Risks

Despite the heat, sustained upside hinges on fundamentals and ecosystem depth. Watch these:

1) Will demand persist? Is privacy a mainstream need?

Privacy is trending, but do mass users have durable demand? If privacy coins remain a hedge narrative without usage conversion, the rally may fade. For example, DASH’s bill-pay at scale still needs execution proof; if progress lags, the market may cool quickly.

2) Will regulation tighten?

Privacy coins sit in a sensitive zone. If major exchanges or jurisdictions restrict services for privacy coins or mixing, they face risks in liquidity, listings, and legality. Several countries have limited anonymity coins or mixers in the past. The future direction of policy will define whether privacy coins survive under compliance.

3) Will tech upgrades and ecosystem depth materialize?

Privacy tech is maturing but not yet plug-and-play. For instance, Zcash offers zk-SNARKs, but shielded usage is only part of total activity. Without wallets/exchanges/devs pushing shielded features, market may question the practical privacy utility. If privacy coins don’t extend into DeFi, smart-contract apps, and payments, value may remain defensive rather than expansive.

4) Will market sentiment and rotation shift?

There’s sentiment in this leg: rotation into undervalued sectors + narrative revival. If leadership rotates elsewhere next, privacy coins could retrace. Most privacy coins are mid-cap, with weaker shock absorption, and can be hit by single negatives (delistings, protocol incidents). Before chasing “1000×,” weigh the drawdown risk.

Conclusion: Fireworks or First Light?

In sum, the privacy-coin surge has multiple engines — regulatory change, capital rotation, tech upgrades, and ecosystem strategy. But sustained appreciation isn’t guaranteed; it depends on whether privacy coins can deliver real value through tech landing, scenario expansion, and compliant frameworks.

If privacy coins shed the “hype” label and become a core allocation for users and institutions, this move could be dawn, not dusk. If it’s only sentiment without substance, it may be short-lived.

For investors and builders, the question isn’t “how high can price go,” but: along which path (tech, policy, use cases) can privacy coins truly open up — and is that growth structurally supported?

In the coming years, privacy may become a new moat in crypto. Positioning here requires watching both trend and execution.

Responses