5 Exchanges’ Earn Yields Compared: Who’s the “Dark Horse” of Crypto Wealth Management? — An Analysis of Yield Landscapes from Binance and OKX to SuperEx

#OKX #Binance #Exchange

Wealth management isn’t new. The most common example is when you deposit money at a bank and the staff recommend wealth products — plus the classic cold-call pitches. In traditional finance, wealth management has long been a standard tool for capital allocation.

By 2025, wealth products in crypto stand out just as much. Why? Imagine this: between trades you notice there’s always a small chunk of “idle cash” sitting in your account. It’s too small to deploy into a position, but leaving it untouched feels wasteful. Many users run into this, so more and more are focusing on how to “put idle funds to work.”

On this basis, major exchanges have rolled out their own earn sections — each with pros and cons. What’s the same is that virtually all crypto exchanges are investing heavily in their earn offerings:

- On one hand, crypto asset prices are highly volatile, and holders often need a “stable return” channel to hedge risk;

- On the other, an exchange’s earn service has become a key tool for attracting and retaining users.

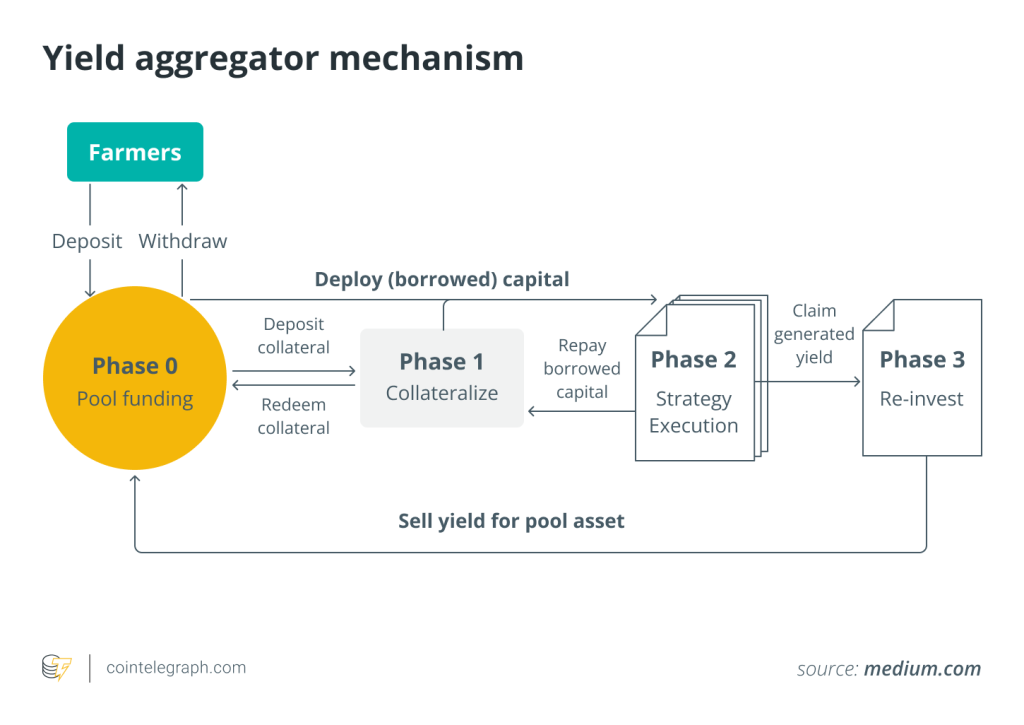

In essence, the logic of crypto earn is simple: you hand funds to the platform; the platform uses them for liquidity provision, lending, or staking; it earns a return and pays users according to the stated rate. In essence, wealth products have become part of an exchange’s core ecosystem, shaping user stickiness and fund retention.

Starting with the earn sections of five popular exchanges — Binance, OKX, Bybit, Huobi, and SuperEx — we’ll make a comprehensive comparison.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

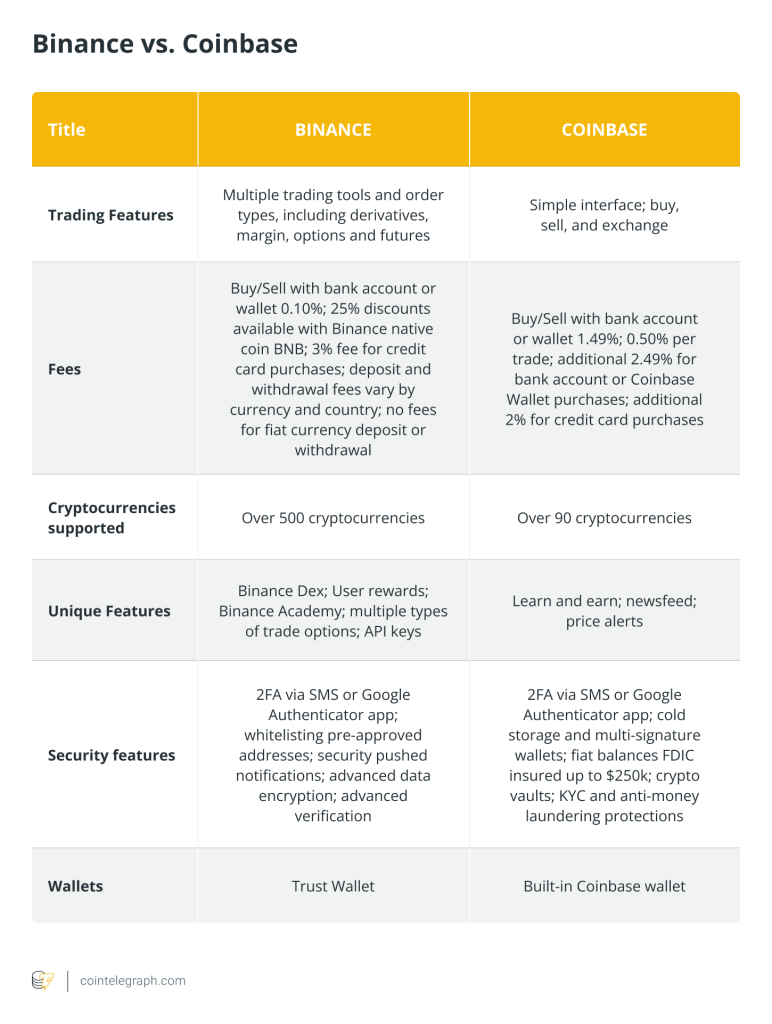

Binance: A Long-Standing Giant Playing the “Steady” Style

Binance Earn is among the earliest crypto earn modules, covering flexible, fixed terms, locked products, Launchpool, and more.

Key traits:

- Yield types: Flexible APY ~0.15%–12.7%; fixed-term lockups ~2.62%–10.3%

- Supported assets: 300+ major tokens

- Flexibility: Flexible products allow anytime subscribe/redeem; some fixed terms support early redemption

- Security: As an industry leader, Binance’s reserves and risk controls are comparatively robust

- Dual Investment: A high-volatility, non-principal-protected product with no guaranteed minimum return

However, while Binance’s earn products are stable, they’re increasingly “bank-like” — numerous categories, complex operations, and on some popular assets, lower yields with high subscription thresholds.

In one line: Binance Earn feels like “institutional-grade, steady wealth management,” suitable for larger portfolios and safety-first veterans.

OKX: Plenty of Yield Flavors, But Higher Operating Threshold

OKX Earn is practically the “department store” of crypto earn. Beyond flexible earn, it integrates DeFi access, BTC Accumulator/Save-to-Stack, Dual Investment, ETH staking, and more derivative plays.

Core figures:

- Flexible APY: Up to ~1.49%–19.5%

- BTC Save-to-Stack: Historical APY ~1.26%, with principal protection

- Dual Investment: Similar to Binance’s concept — highly volatile, no minimum return. OKX offers 5 tenors: 1–7 days, 10, 17, 24, 30 days, among which:

1-day pays the highest, theoretical APY up to 525%;

30-day lowest, theoretical APY ~2%–37%

- ETH staking: Up to ~1.49%–25.55%

OKX currently has no fixed-term earn track. Its flexible yields — both floor and ceiling — tend to edge past Binance, but the complex interface and mixed yield models put many newcomers off.

In one line: OKX Earn is like a “financial lab for pros” — returns can be solid, but it’s not for everyone.

Huobi: Traditionally Strong, But Losing Steam

Huobi Earn used to be a pioneer, but in recent years, due to compliance and geography, the user experience has clearly declined.

Core figures:

- Flexible earn: ~3%–20%, most commonly stabilizing around 10%

- Fixed-term: ~1.5%–20.5%

- Shark Fin: ~4%–29.5%, same track as Dual Investment — volatile returns, though relatively steadier than Binance and OKX

Issues: Slow product updates, some yield cuts, fewer campaigns, and a smaller product ecosystem than Binance/OKX. Overall competitiveness is trending down. While it still retains a user base, innovation has clearly lagged.

SuperEx: Up to 365-Day Fixed Terms — The “Stable-Yield Dark Horse” of Earn

SuperEx launched “SuperEx Earn” in 2023. In product design and yield structure, it’s virtually a king in the stable earn lane.

A clear two-engine system: Flexible + Fixed

- Flexible Earn (liquid, variable return): Deposit/withdraw anytime; base rate 2%, bonus rate (consult support at www.superex.com).

- Fixed Earn (steady lock): 7 / 60 / 180 / 365 days and other terms; APY up to 10%.

“High return = high volatility” is a timeless market law. Compared with Binance, OKX, and Huobi, SuperEx doesn’t chase extreme headline APYs, but it shows notable advantages in stability and tenor selection.

SuperEx offers one of the most mature fixed-term frameworks in the industry, with diverse tenors up to 365 days — well beyond the common 90-day cap elsewhere. That means users can lock in stable returns over longer periods, avoiding frequent rollovers and the uncertainty brought by market swings.

For users seeking steady appreciation and long-term holding, SuperEx fixed-term earn is a safer, more worry-free choice. In a highly volatile crypto market, SuperEx’s “long-term stability + predictable returns” philosophy has truly become a harbor for conservative investors.

Other differentiators at SuperEx:

1. Lightweight structure, UX-first

Unlike multi-layered earn pages on traditional exchanges, SuperEx displays all products in one place — new users can subscribe in under a minute.

2. Sensible yield design, higher effective rates

A “base rate + bonus rate” model balances risk while keeping user returns among the industry’s front-runners.

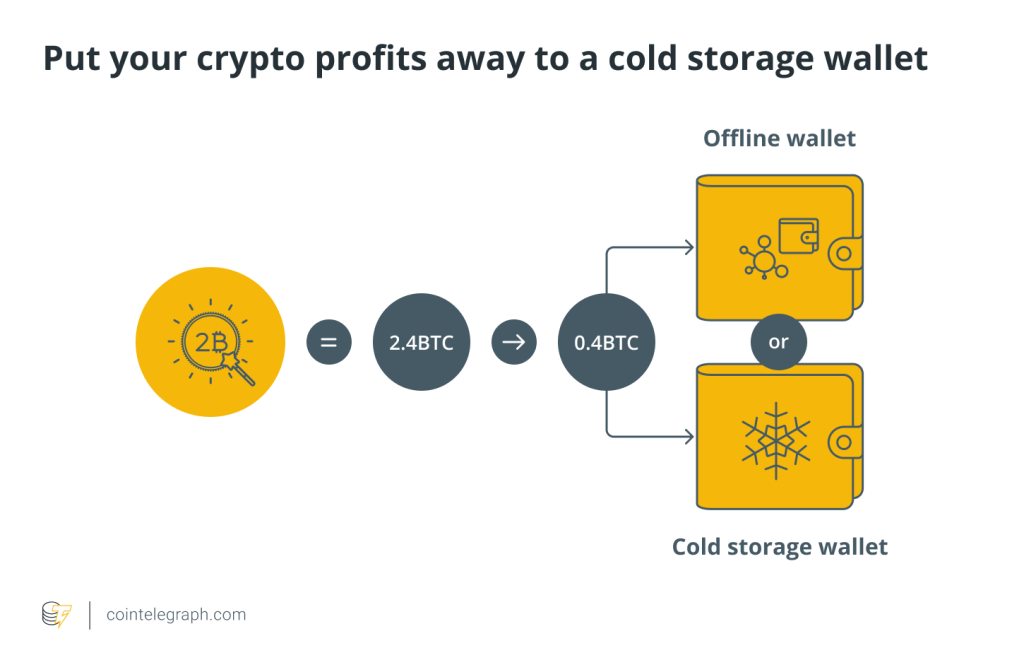

3. High transparency & flexible redemption

Interest accrues T+1 minute; funds available within 1 hour, ensuring real-time control.

4. Friendly early redemption

No penalty on principal for early redemption (already-paid interest is clawed back — user-friendly but know the detail).

Market Takeaway

Today’s crypto earn market has shifted from “who pays higher” to “who’s steadier and more transparent.” Binance represents the steady route of the traditional giant; OKX wins on diverse innovation; while SuperEx, with its “longer tenors + higher flexibility + stronger safety” tri-high model, is rapidly attracting a new generation of users — especially the stability-minded.

Looking ahead, as users care less about “who lets me speculate” and more about “who keeps me steady,” SuperEx Earn may well be the true wealth channel that rides through bull and bear.

Responses